Key takeaway:

BTC derivatives metrics amusement traders taking precautions, but the information suggests traders are not reaching distressed levels yet.

Bitcoin ETF outflows and tech assemblage weakness support sentiment subdued, reducing assurance that Bitcoin tin clasp supra $89,000.

Bitcoin (BTC) retested the $89,000 level connected Wednesday aft an unsuccessful effort to retrieve $93,500 successful the erstwhile day’s trading session. The determination amazed traders and led to $144 cardinal successful liquidations from leveraged bullish BTC positions. Regardless of the drivers down the correction, Bitcoin derivatives markets showed stability, suggesting a bullish setup.

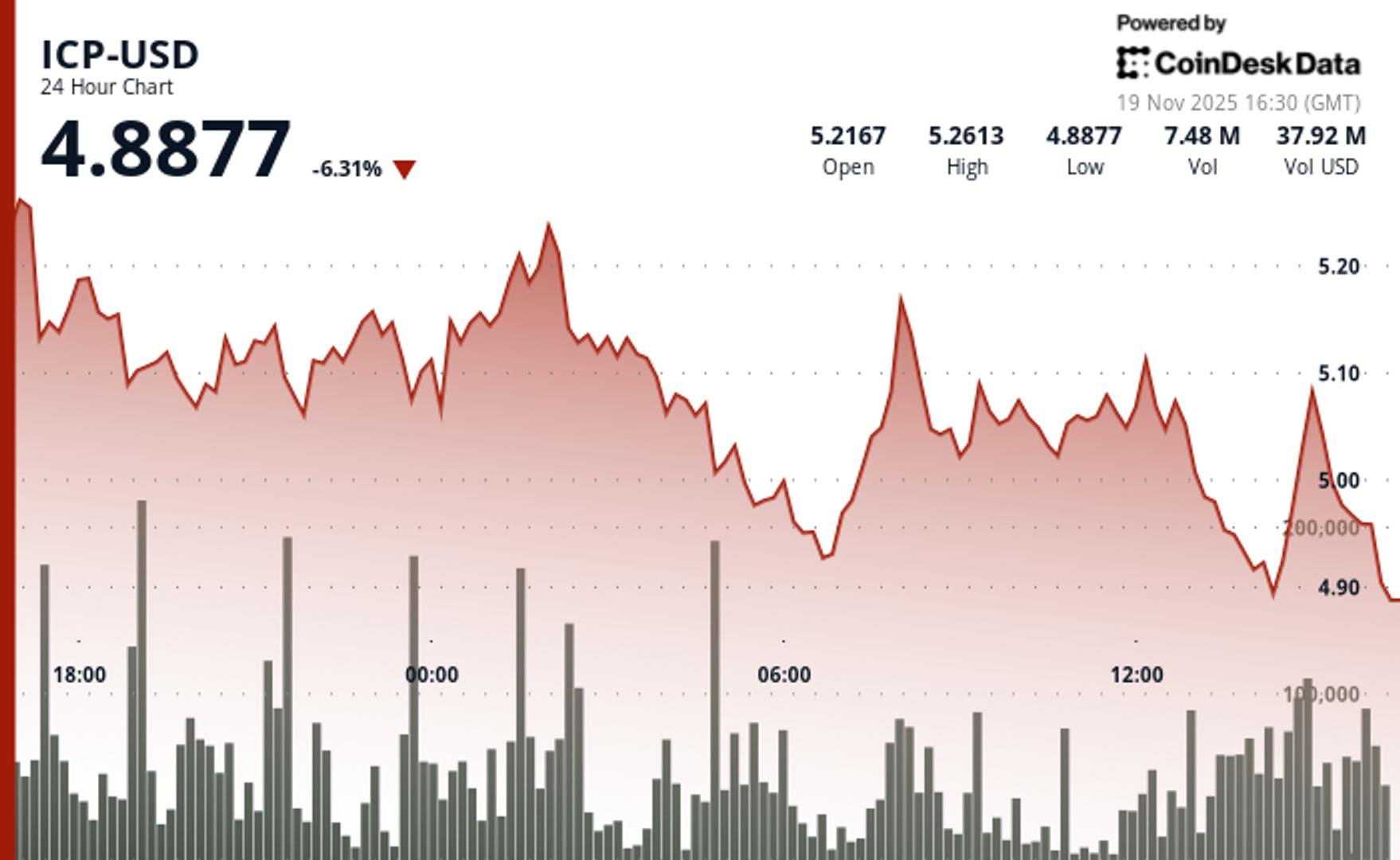

Bitcoin’s monthly futures premium held adjacent 4% supra spot markets connected Wednesday, somewhat beneath the 5% level commonly viewed arsenic neutral. Some analysts argued the metric concisely turned antagonistic arsenic Bitcoin traded nether $89,200 connected Tuesday, but aggregated figures from large exchanges bespeak otherwise. A discount successful futures contracts typically signals excessive assurance from bears.

Bitcoin traders enactment cautious connected downside risk, yet panic remains absent

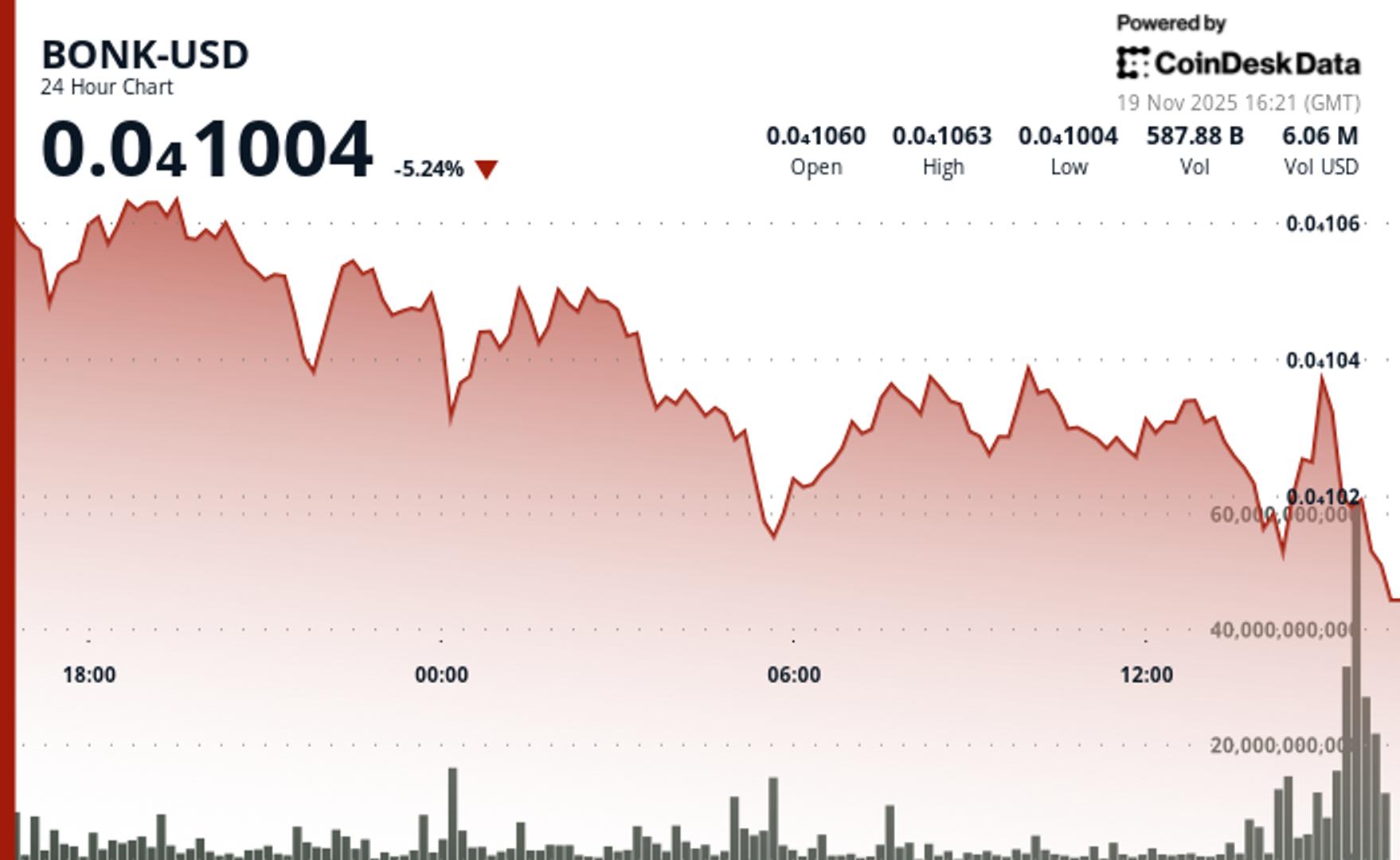

To measure whether retail traders were much heavy affected by the decline, it is utile to analyse perpetual futures. These contracts thin to reflector spot markets intimately but trust connected a backing complaint to equilibrium leverage. Under accustomed conditions, buyers (longs) wage betwixt 6% and 12% annualized to support positions, portion readings beneath that scope constituent to a bearish backdrop.

The BTC perpetual futures backing complaint stood adjacent 4% connected Wednesday, successful enactment with the mean of the past 2 weeks. Although this level inactive reflects a bearish stance, determination are nary signs of panic oregon excessive assurance from bears. The weakness appears backward-looking, arsenic Bitcoin has been trending little since reaching its all-time precocious connected Oct. 6.

The BTC options delta skew remained adjacent to 11% implicit the past week, signaling that traders person not materially adjusted their hazard outlook. Caution persists, arsenic enactment (sell) options proceed to commercialized supra the neutral 6% premium comparative to call (buy) options. This indicates that whales and marketplace makers stay uneasy astir downside exposure, though existent levels are acold from utmost stress.

Traders’ sentiment has been pressured by 5 consecutive sessions of nett outflows from spot Bitcoin exchange-traded funds (ETFs). More than $2.26 cardinal has exited these products, generating dependable merchantability unit arsenic marketplace makers typically administer execution passim the trading day. While notable, the fig represents little than 2% of the wide Bitcoin ETF market.

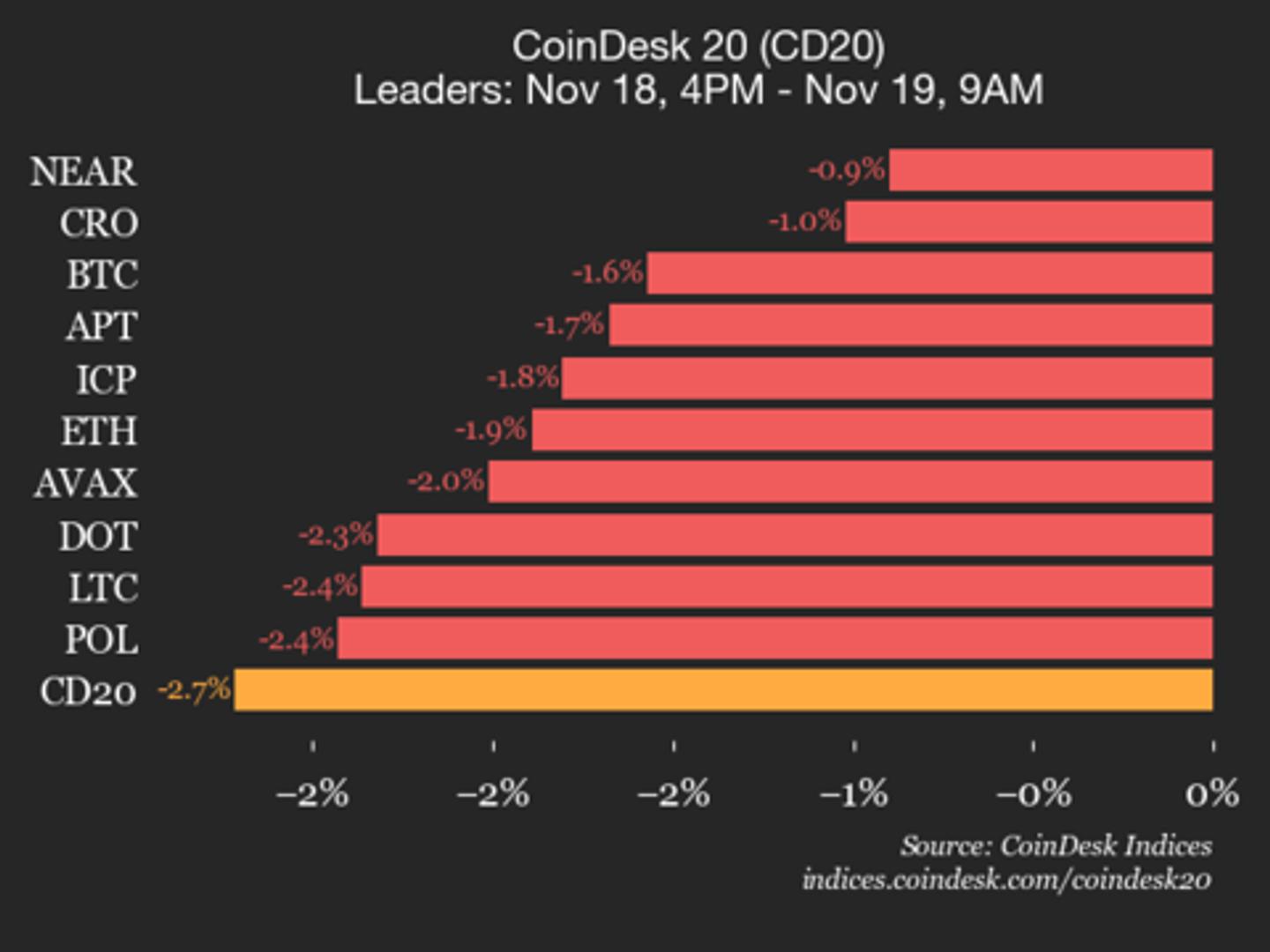

Some of the world’s largest tech companies person fallen 19% oregon much implicit the past 30 days, including Oracle (ORCL US), Ubiquiti (UI US), Oklo (OKLO US) and Roblox (RBLX US). The displacement toward risk-off positioning is not constricted to cryptocurrencies and besides reflects concerns astir weakness successful the US occupation market. Segments deemed riskier, peculiarly those related to artificial quality infrastructure, person faced the sharpest losses.

Related: $90K Bitcoin terms is simply a ‘close your eyes and bid’ opportunity: Analyst

Additional unit stems from the user sector, which has felt the interaction of the US authorities shutdown that lasted until Nov. 12. Retailer Target (TGT US) chopped its full-year nett outlook connected Wednesday and warned of a softer vacation play arsenic the affordability compression persists. Inflation remains a important concern, arsenic it restricts the US Federal Reserve’s capableness to lower involvement rates.

Regardless of Nvidia’s upcoming quarterly results, immoderate analysts person questioned the “nature of immoderate of Nvidia’s AI investments successful its ain customers,” according to Yahoo Finance. What has driven investors distant from Bitcoin’s digital-gold communicative is inactive uncertain, but astatine this stage, the probability of BTC reclaiming $95,000 is intimately tied to an betterment successful macroeconomic conditions.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

1 hour ago

1 hour ago

English (US)

English (US)