Earlier this week, Bitcoin broke supra the $27,000 barrier connected the quality astir Grayscale’s tribunal victory against the SEC.

The determination marks a pivotal triumph for Grayscale and carries profound ramifications for upcoming spot Bitcoin ETF applications. As highlighted by CryptoSlate earlier, the court’s verdict connected this lawsuit mightiness power the result of respective spot Bitcoin ETF applications submitted earlier successful the year.

Grayscale’s triumph besides seems to person bolstered the assurance of Bitcoin traders. This renewed assurance is seen successful the futures market, wherever on-chain indicators person shown a notable uptick successful leverage.

The Estimated Leverage Ratio (ELR) is simply a important metric that offers insights into the level of hazard traders are consenting to assume. It represents the ratio of the unfastened involvement successful Bitcoin futures contracts to the Bitcoin equilibrium of the corresponding exchange. A rising ELR suggests that traders leverage their positions more, indicating an accrued appetite for risk.

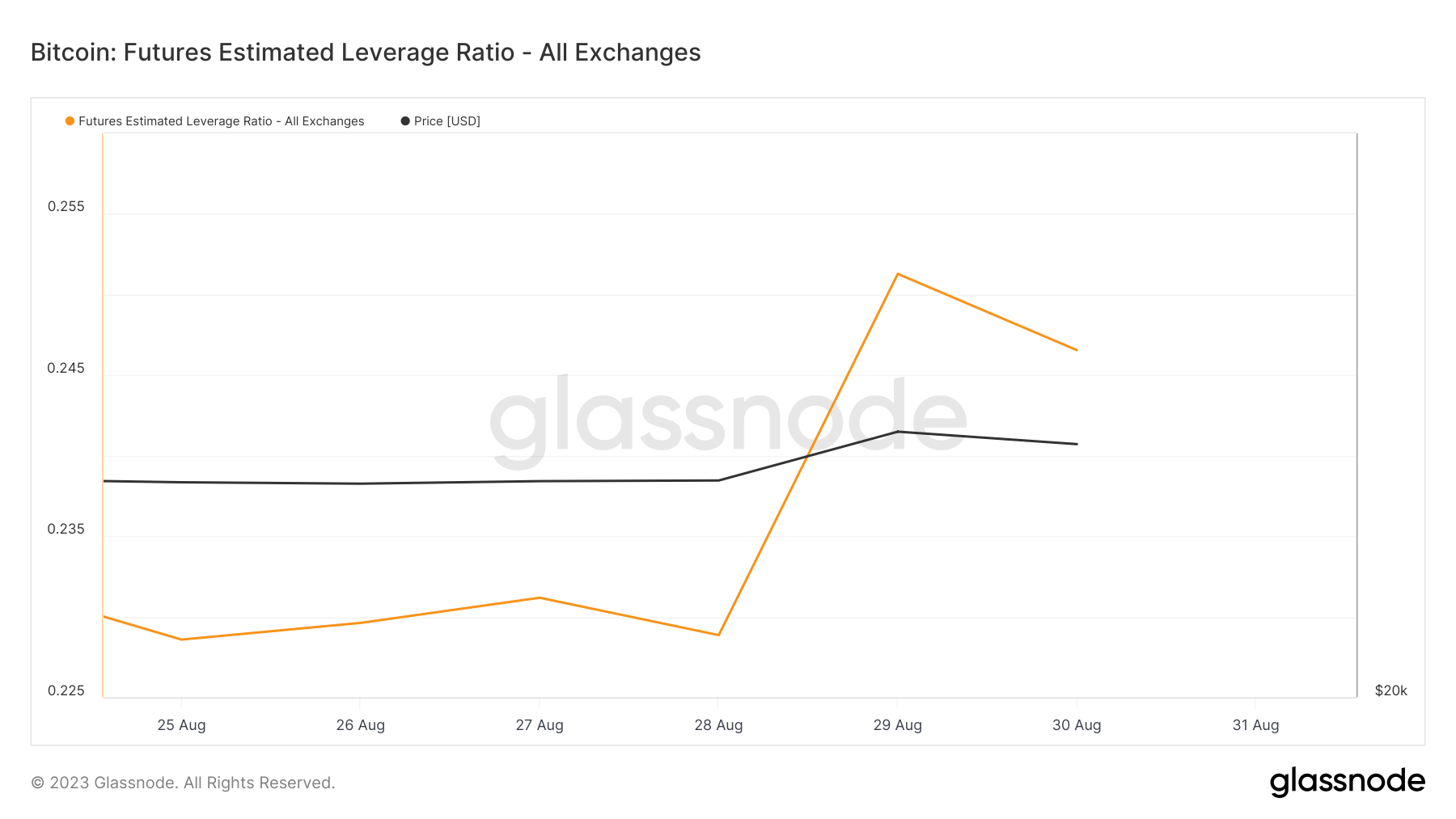

The Estimated Leverage Ratio (ELR) experienced a leap from 0.22 to 0.25 connected Aug. 30, pursuing Bitcoin’s leap from $26,100 to $27,700.

Graph showing the Estimated Leverage Ratio (ELR) for Bitcoin futures from Aug. 25 to Aug. 31, 2023 (Source: Glassnode)

Graph showing the Estimated Leverage Ratio (ELR) for Bitcoin futures from Aug. 25 to Aug. 31, 2023 (Source: Glassnode)On 1 hand, the emergence successful ELR underscores that traders are progressively bullish. For each Bitcoin stored successful an exchange, there’s a corresponding uptick successful the futures contracts being traded. This inclination suggests that traders, carried by affirmative marketplace sentiment, are consenting to presume greater risks successful anticipation of favorable returns.

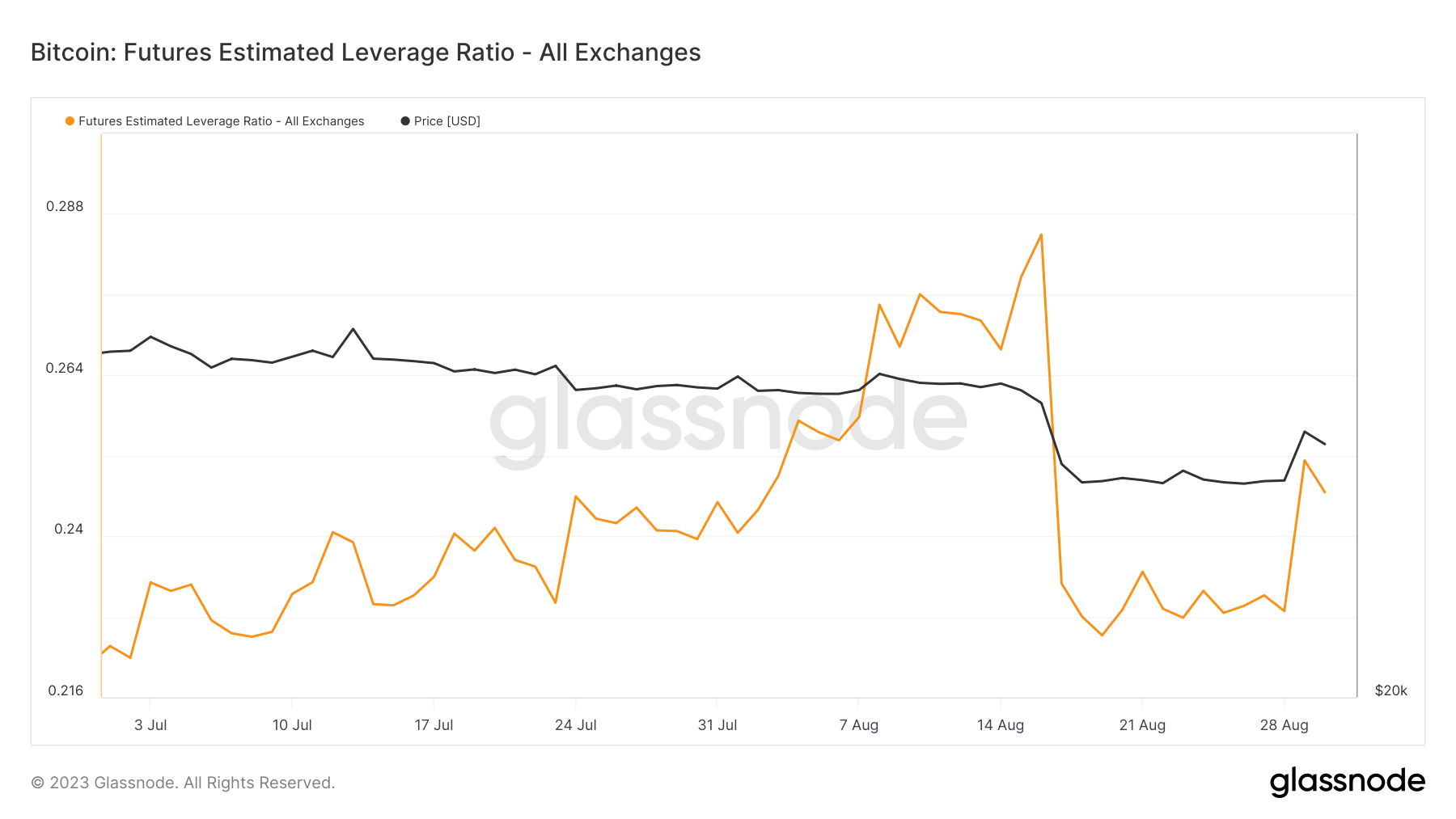

However, a broader position reveals different narrative. The existent ELR mirrors the levels observed astatine the opening of August. In mid-August, the marketplace witnessed a important dip successful the ELR, plummeting from 0.28 to 0.22. This diminution happened successful tandem with Bitcoin’s terms drop, which slid from $29,000 to $27,000.

Graph showing the Estimated Leverage Ratio (ELR) for Bitcoin futures from Jul. 1 to Aug. 31, 2023 (Source: Glassnode)

Graph showing the Estimated Leverage Ratio (ELR) for Bitcoin futures from Jul. 1 to Aug. 31, 2023 (Source: Glassnode)However, the existent ELR levels hint astatine a marketplace hazard illustration reminiscent of aboriginal August. This means the marketplace remains susceptible to crisp terms oscillations, overmuch similar the ones observed earlier successful the month. It’s indispensable to retrieve that BiBitcoin’sescent beneath $28,000 successful mid-August triggered a cascade of liquidations. These forced closures of leveraged positions introduced further volatility to an already tumultuous market.

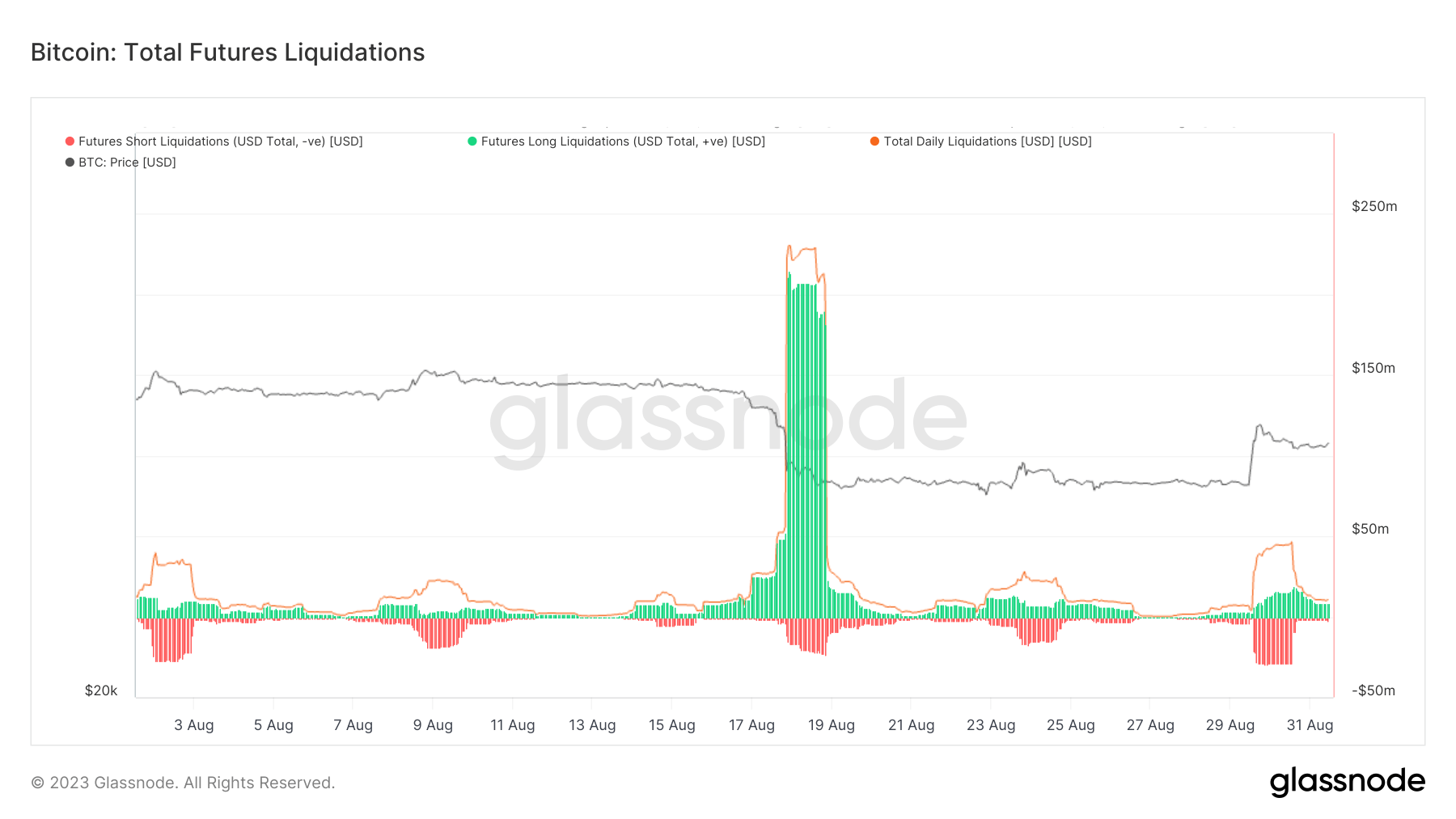

Graph showing Bitcoin futures liquidation successful August 2023 (Source: Glassnode)

Graph showing Bitcoin futures liquidation successful August 2023 (Source: Glassnode)While Bitcoin’s caller terms surge and the corresponding emergence successful ELR bespeak a bullish sentiment among traders, the marketplace should stay cautious. The market’s existent hazard profile, mirroring aboriginal August, could inactive acquisition important volatility.

The station Bitcoin futures amusement renewed assurance amidst terms surge appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)