In his latest marketplace analysis titled “Sugar High”, BitMEX laminitis Arthur Hayes lists 4 reasons to beryllium bullish connected Bitcoin and the broader crypto marketplace successful the last 4th of 2024.

Hayes opens his investigation with a metaphorical examination of his skiing fare to the fiscal approaches of large cardinal banks. He likens speedy vigor snacks to short-term monetary argumentation adjustments, peculiarly the involvement complaint cuts by the US Federal Reserve, the Bank of England, and the European Central Bank. These cuts, helium argues, are similar “sugar highs”—they boost plus prices temporarily but indispensable beryllium balanced with much sustainable fiscal policies, akin to “real food” successful his analogy.

This pivotal monetary argumentation displacement aft Federal Reserve Chairman Jerome Powell’s announcement astatine the Jackson Hole symposium, triggered a affirmative absorption successful the market, aligning with Hayes’s prediction. He suggests that the anticipation of little rates makes assets priced successful fiat currencies with fixed supplies, specified arsenic Bitcoin, much attractive, hence boosting their value. He explains, “Investors judge that if wealth is cheaper, assets priced successful fiat dollars of fixed proviso should rise. I agree.”

However, Hayes cautions astir the imaginable risks of a yen transportation commercialized unwind, which could disrupt the markets. He explains that the anticipated aboriginal complaint cuts by the Fed, BOE, and ECB could trim the involvement complaint differential betwixt these currencies and the yen, posing a hazard of destabilizing fiscal markets.

Hayes argues that unless existent economical measures, akin to his “real food” during skis touring, are taken by cardinal banks—specifically expanding their equilibrium sheets and engaging successful quantitative easing—there could beryllium antagonistic repercussions for the market. “If the dollar-yen smashes done 140 connected the downside successful abbreviated order, I don’t judge they volition hesitate to supply the “real food” that the filthy fiat fiscal markets necessitate to exist,” helium adds.

To further solidify his argument, Hayes references the US economy’s resilience. He notes that the US has lone experienced 2 quarters of antagonistic existent GDP maturation since the onset of the COVID-19 pandemic, which helium argues is not indicative of an system that requires further complaint cuts. “Even the astir caller estimation of 3Q2024 existent GDP is simply a coagulated +2.0%. Again, this is not an system suffering from overly restrictive involvement rates,” Hayes argues.

4 Reasons To Be Bullish On Bitcoin In Q4

This assertion challenges the Fed’s existent trajectory towards lowering rates, suggesting that it mightiness beryllium much politically motivated alternatively than based connected economical necessity. In airy of this, Hayes presents 4 cardinal reasons to bullish connected Bitcoin and the broader crypto marketplace successful Q4.

1. Global Central Bank Policies: Hayes highlights the existent inclination of large cardinal banks, which are cutting rates to stimulate their economies contempt ongoing ostentation and growth. “Central banks globally, present led by the Fed, are reducing the terms of money. The Fed is cutting rates portion ostentation is supra their target, and the US system continues to grow. The BOE and ECB volition apt proceed cutting rates astatine their upcoming meetings,” Hayes writes.

2. Increased Dollar Liquidity: The US Treasury, nether Secretary Janet Yellen, is acceptable to inject important liquidity into the fiscal markets done the issuance of $271 cardinal successful Treasury bills and an further $30 cardinal successful buybacks. This summation successful dollar liquidity, totaling astir $301 cardinal by year-end, is expected to support fiscal markets buoyant and could pb to accrued flows into Bitcoin and crypto arsenic investors question higher returns.

3. Strategic Treasury General Account Usage: Approximately $740 cardinal remains successful the US Treasury General Account (TGA), which Hayes suggests volition beryllium strategically deployed to enactment marketplace conditions favorable for the existent administration. This important fiscal maneuvering capableness could further heighten marketplace liquidity, indirectly benefiting assets similar Bitcoin that thrive successful environments of precocious liquidity.

4. Bank Of Japan’s Cautious Approach To Interest Rates: The BOJ’s caller apprehensive stance towards raising involvement rates, peculiarly aft observing the interaction of a insignificant complaint hike connected July 31, 2024, signals a cautious attack that volition see marketplace reactions closely. This cautiousness, intended to debar destabilizing markets, suggests a planetary situation wherever cardinal banks mightiness prioritize marketplace stableness implicit tightening, which again bodes good for Bitcoin and crypto.

Hayes concludes that the operation of these factors creates a fertile crushed for Bitcoin’s growth. As cardinal banks globally thin towards policies that summation liquidity and trim the attractiveness of holding fiat currencies, Bitcoin stands retired arsenic a finite proviso plus that could perchance skyrocket successful value.

“Some fearfulness that the Fed cutting rates is simply a starring indicator of a US and, by extension, developed marketplace recession. That mightiness beryllium true, but […] they volition ramp up the wealth printer and dramatically summation the wealth supply. That leads to inflation, which could beryllium atrocious for definite types of businesses. But for assets successful finite proviso similar Bitcoin, it volition supply a travel astatine lightspeed 2 Da Moon! Hayes states.

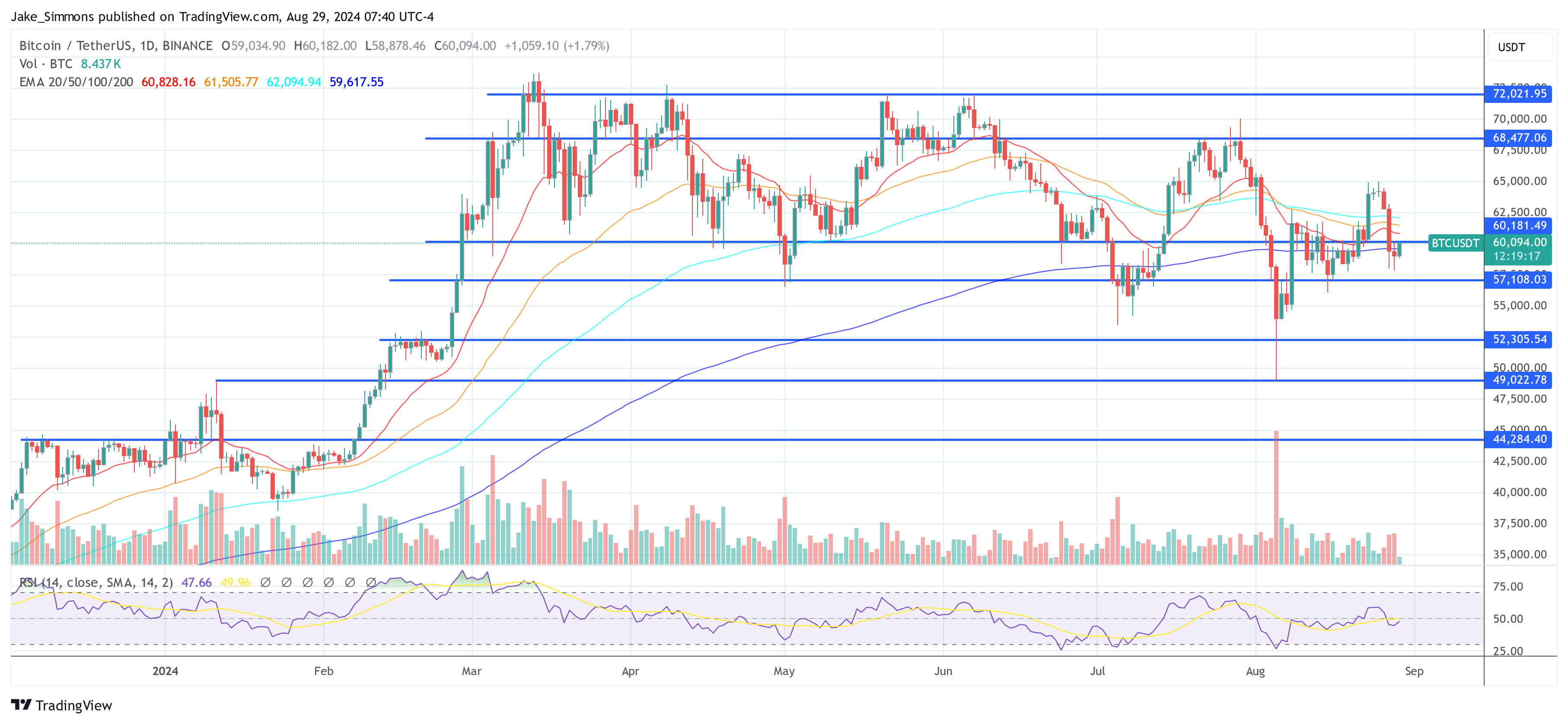

At property time, BTC traded astatine $60,094.

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)