Bitcoin suffered a abrupt and heavy driblet successful November, losing astir a 4th of its worth and wiping retired implicit $1 trillion crossed the crypto market.

Whales Trim Positions Before Crash

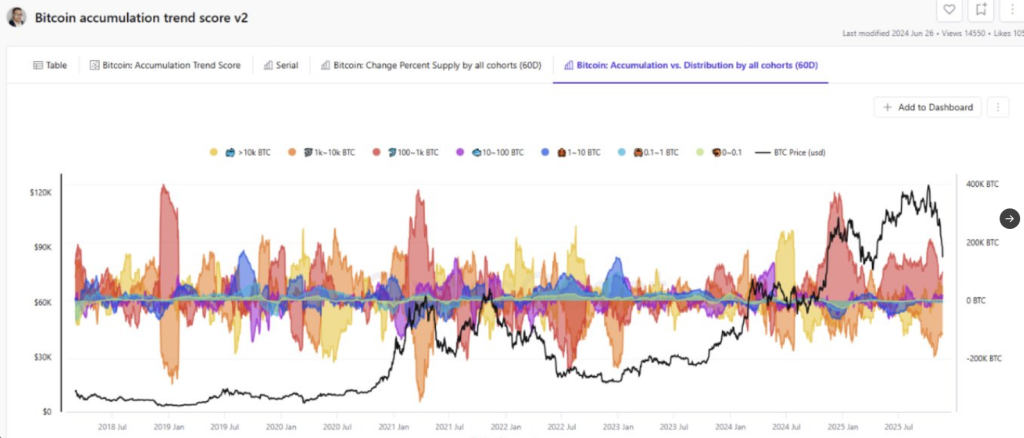

According to on-chain information from CryptoQuant, ample holders played a cardinal role. Wallets holding betwixt 1,000–10,000 BTC pared backmost their stakes successful the weeks starring up to the fall.

Those large sellers took profits aft the October rally, and successful galore cases selling was dependable alternatively than panicked. When ample players measurement backmost similar that, marketplace extent tin vanish quickly.

A speedy overview of Bitcoin’s terms diminution shows prices slid from grounds highs supra $126,000 successful October to astir $81,000 astatine the lowest point, earlier a partial bounce to $87k was recorded. Traders and funds were caught disconnected defender by the velocity of the move.

At the clip of writing, Bitcoin was trading astatine $87,086, up 1.5% successful the past 24 hours.

Retail Selling Added To Pressure

Based connected reports, tiny wallets besides leaned toward safety. Holders nether 10 BTC and groups up to 1,000 BTC reduced positions, removing different furniture of imaginable buyers.

Has Bitcoin Found Its Bottom? Cohorts Tell the Whole Story

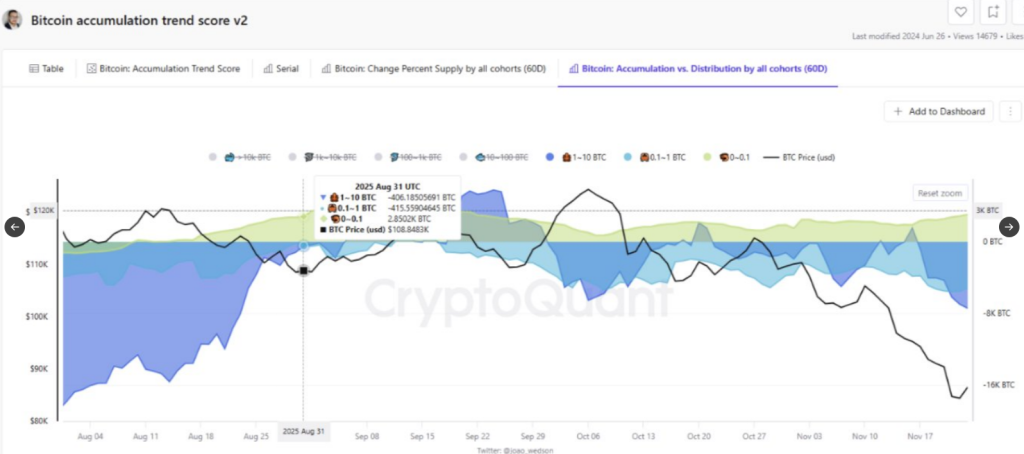

“BTC whitethorn person formed a section bottom, supported by a beardown rebound and accumulation from:

100–1k BTC holders.

>10k BTC holders.

However, the important 1k–10k BTC cohort is inactive distributing, preventing a full… pic.twitter.com/dGU4CBD1Bw

— CryptoQuant.com (@cryptoquant_com) November 25, 2025

Source: CryptoQuant

Source: CryptoQuantBuying involvement from casual investors was weaker than expected. Mid-sized holders — those with 10–100 and 100–1,000 BTC — did bargain during the correction, and their enactment helped dilatory the slide. Still, their buying powerfulness was not capable to lucifer the ample outflows.

Source: CryptoQuant

Source: CryptoQuantFutures Liquidations Intensified The Drop

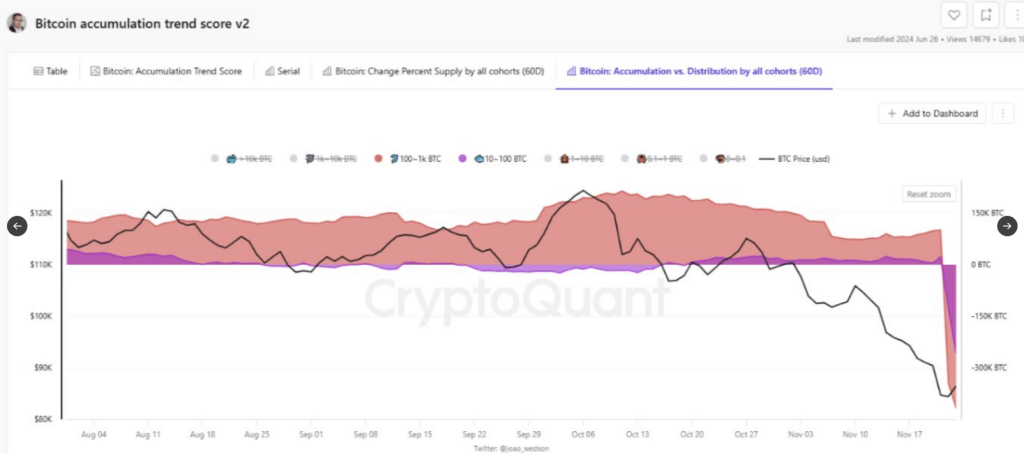

Reports amusement that futures marketplace dynamics turned a correction into a crash. Over a 13-day stretch, agelong positions were forcefully closed out.

That cascade removed bids and created a concatenation absorption of selling that pushed Bitcoin from astir $105K down to $81K. Liquidations were heavy, and the selling unit was compounded arsenic each forced merchantability fed into the next.

Source: CryptoQuant

Source: CryptoQuantA Tentative Rebound Shows Life

After the lows were hit, Bitcoin climbed backmost to astir $87,500. This rebound has been taken by immoderate arsenic a motion that a section bottommost mightiness beryllium forming.

According to CryptoQuant, however, the betterment cannot beryllium considered unafraid portion the 1,000–10,000 BTC radical keeps reducing holdings. The market’s wellness was being tested by who chose to merchantability and who chose to buy.

Bottom Status Hinges On Whale Activity

Market watchers accidental a existent reversal needs selling from ample wallets to stop. If those whales pause, mid-sized buyers mightiness physique a firmer level and assurance could return.

If selling continues, little levels whitethorn beryllium explored erstwhile again. The coming sessions volition beryllium watched intimately by traders who privation to spot whether ample holders alteration people oregon support cashing out.

For now, the concern is elemental and tense astatine the aforesaid time: prices person recovered slightly, but the structural weakness that allowed a 25% autumn was exposed.

Bitcoin could look further losses aft its caller crash, if CryptoQuant’s information is thing to spell by. Large holders person been taking profits, portion retail investors person besides been selling, leaving less buyers to enactment the market.

Analysts accidental the adjacent determination volition beryllium connected whether these large holders proceed selling oregon if mid-sized buyers measurement successful to stabilize prices.

Featured representation from Vecteezy, illustration from TradingView

52 minutes ago

52 minutes ago

English (US)

English (US)