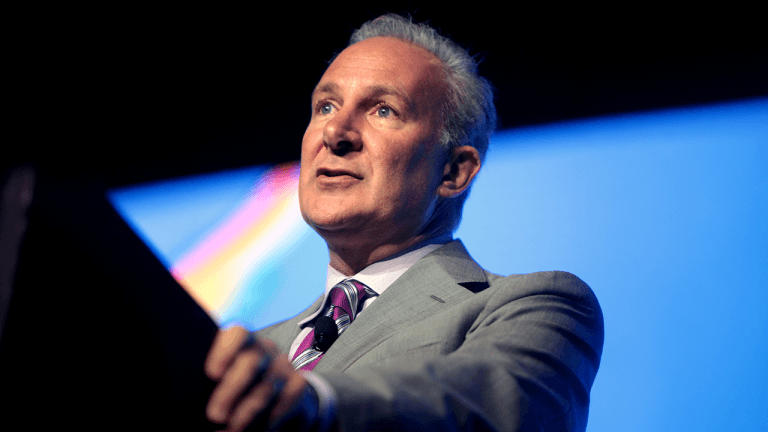

Seasoned commodity strategist Mike McGlone says bitcoin is present riskier comparative to stocks, portion helium further warned that economical downturn pressures whitethorn clasp metallic prices astatine bay.

Bitcoin Volatility Low, Silver Faces Challenges: McGlone

In a lawsuit connection dated August 2, 2023, the salient Bloomberg Intelligence expert observed that bitcoin’s 180-day volatility, hovering adjacent grounds lows astir 46%, often heralds a favorable crook successful price. However, helium issued a cautionary enactment that the cryptocurrency’s deviation from the Nasdaq 100 starting precocious successful Q1 mightiness awesome much wide frailty successful hazard assets, particularly if stocks propulsion backmost amidst accustomed second-half marketplace swings, continuing Fed tightening, and receding fears of a recession.

#Bitcoin 180-day volatility is the lowest ever astatine astir 46% astatine the commencement of August, which is typically bullish for prices. My main interest is that divergent Bitcoin terms weakness vs. equities since the extremity of 1Q whitethorn connote unit connected each hazard assets. pic.twitter.com/IJEd11tRjt

— Mike McGlone (@mikemcglone11) August 2, 2023

McGlone envisions that arsenic mainstream acceptance grows, bitcoin (BTC) volition gradually uncover attributes much akin to golden oregon Treasuries. Yet successful the contiguous future, helium anticipates its lagging returns comparative to tech stocks could endure if the equity marketplace falls unfortunate to seasonal volatility pursuing a singular first-half showing. This could beryllium exacerbated if the Federal Reserve persists with involvement complaint increases and the probability of a recession lessens aft reaching a precocious constituent earlier this year, helium explained.

Turning to precious metals, McGlone posited that lone a recession-driven surge successful golden mightiness propel metallic past its stubborn $30 absorption level nether existent conditions. With golden uncovering stableness adjacent humanities peaks astir $2,000 an ounce and silver oscillating betwixt $23-$25, helium asserts that the faltering economical indicators from China and the sharpest inversion successful the U.S. output curve successful 4 decades laic the groundwork for metallic to regress to its post-2008 mean of astir $20, alternatively of achieving caller highs.

Highlighting a correlation of 0.80 betwixt golden and metallic prices since 1949, McGlone remarked that divergence is antithetic and mostly fleeting. In his estimation, lone a marked golden upswing amidst escalating recession concerns seems poised to change the contiguous people of the achromatic metal.

McGlone: ‘Bitcoin Is Riskier Now vs. the Dow’

Earlier, successful March, McGlone had projected a imaginable bitcoin supercycle was successful motion, arsenic it overshadowed golden by astir 10x successful the year-to-date figures astatine that juncture. He anticipated that bitcoin’s volatility would regain its footing and inclination toward unprecedented levels, assuming humanities patterns remained consistent.

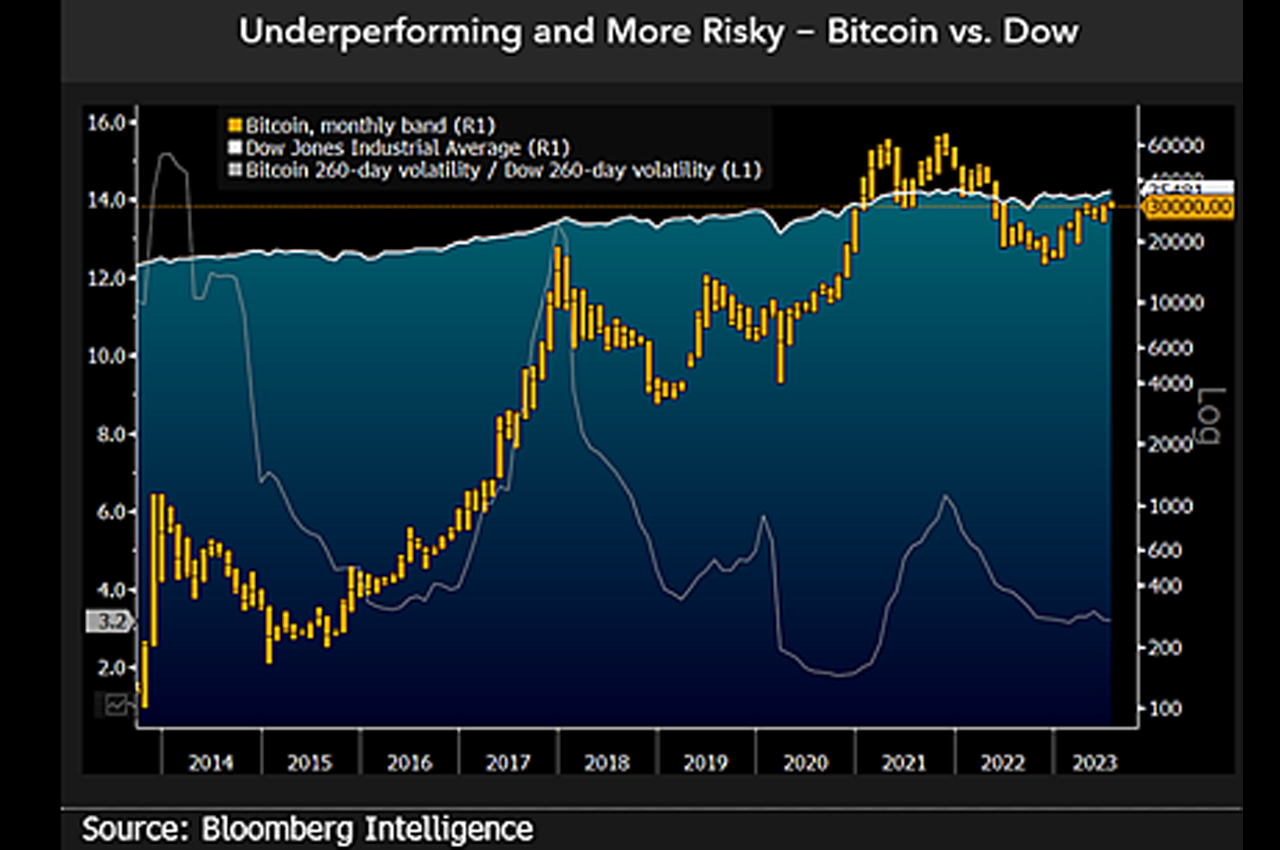

In an update connected August 6, McGlone warned bitcoin (BTC) present looks riskier comparative to stocks than successful aboriginal 2021 erstwhile it archetypal matched the Dow Jones Industrial Average. With crypto volatility triple the blue-chip index’s, versus little than treble successful Q1 2021, McGlone sees small diversification inducement supporting bitcoin unless it tin boost portfolio returns.

Moreover, the strategist sees the hazard of a mean recession-driven banal retreat not priced into statement forecasts. This could unit bitcoin, fixed correlation is adjacent a humanities highest of astir 0.3. McGlone believes the Dow 30,000 level, matched by bitcoin erstwhile it breached $30,000 successful January 2021, whitethorn stay absorption for the cryptocurrency if equities decline.

With McGlone’s insights into the analyzable interplay betwixt bitcoin, precious metals, and planetary economical factors, what are your thoughts connected the aboriginal of these assets? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)