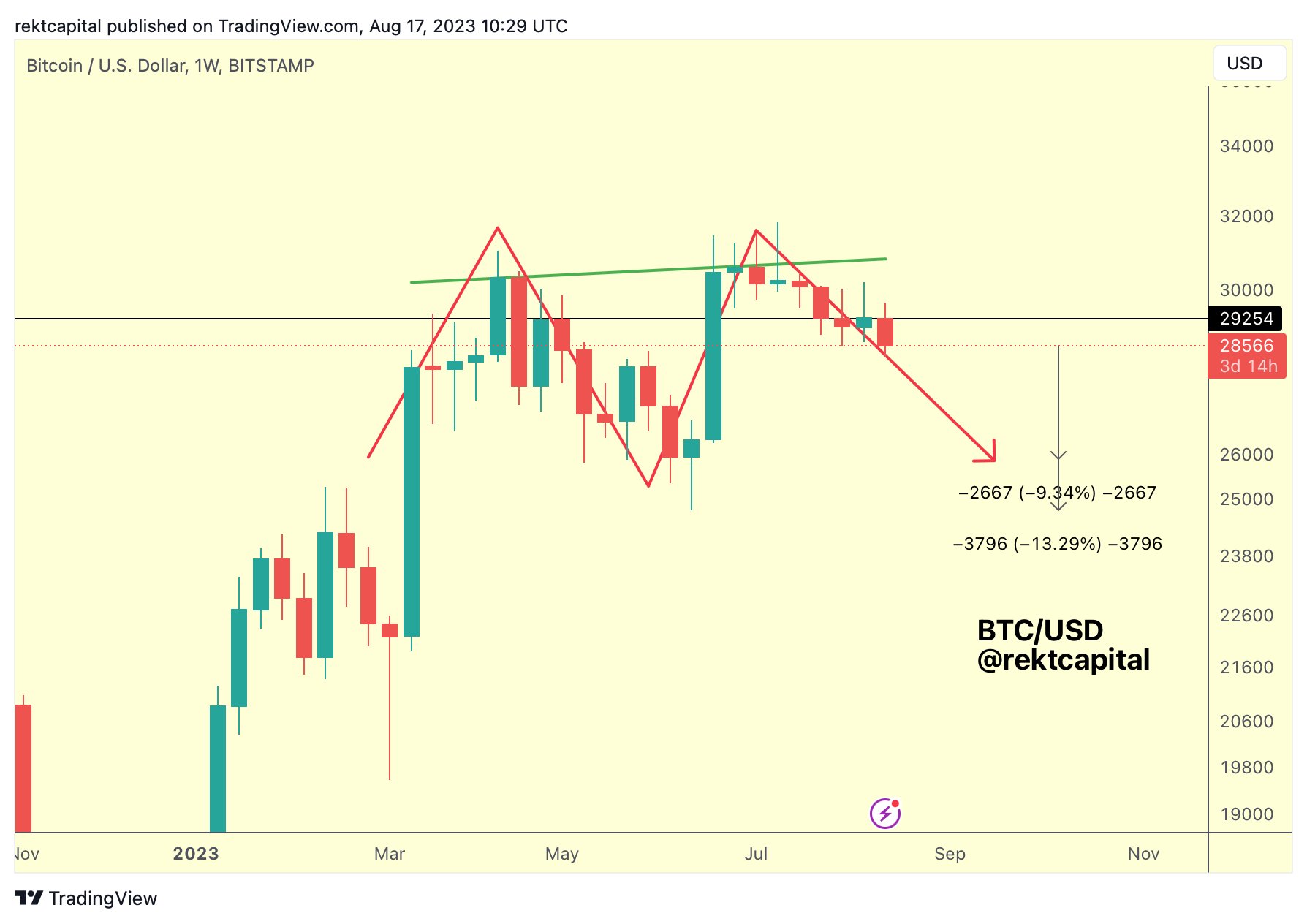

In a caller investigation of the Bitcoin price, seasoned crypto expert Rekt Capital discussed the looming beingness of a imaginable treble apical enactment connected the play chart. The scenario paints a representation of impending volatility, with some bullish and bearish narratives emerging from this often foreboding pattern.

“The BTC Double Top inactive remains intact,” tweeted Rekt Capital, emphasizing the method structure’s significance. He continues, “Weekly Bearish Divergence lends further bearish confluence to this operation arsenic well. More, the carnivore div is processing a caller little precocious (dotted green) comparative to its superior downtrend (solid green).” However, BTC would request to driblet an further -9% to -13% from existent prices to implicit its imaginable treble top.

Bitcoin play treble apical | Source: Twitter @rektcapital

Bitcoin play treble apical | Source: Twitter @rektcapitalBut what makes this investigation peculiarly intriguing is the existent authorities of Bitcoin’s volume. Rekt Capital further observes, “What’s absorbing astir the measurement down BTC’s terms enactment is that the 2 caller peaks formed connected inclining measurement portion the RSI formed little highs.” For many, this simultaneous summation successful measurement with descending RSI hints astatine underlying marketplace weakness, an penetration further supported by the consequent declining measurement aft the section apical astatine astir $31,000.

Diving deeper successful his video analysis, Rekt Capital highlighted the request for a chiseled “M”-shaped formation, a hallmark of the treble apical pattern. “For Bitcoin to signifier a treble apical here, we person to spot an ‘M’-shaped enactment instrumentality place. When we spot a M form, that’s fundamentally a treble top. One apical present [at $30,800] and 1 apical present [at $31,300].”

Losing pivotal enactment levels could invitation important downward movement. “Losing this [neckline] level astatine $26,000 arsenic enactment would alteration further downside,” warns the analyst. However, for traders and investors hoping for symmetrical behavior, Rekt Capital speculates, “And if we spot symmetry here, a 3 period 2nd portion of this M could signifier truthful that’s going to punctual further downside and conscionable dilatory bleeding into that 90 day-mark which would beryllium astir adjacent month.”

But not each is bleak. Should Bitcoin hint backmost to $24,000, a retracement would “see america retest the neckline of this inverse caput & shoulders that we saw interruption out.” Rekt Capital adds, “So a retest of this level arsenic a caller enactment should really alteration further upside.”

Also, a look astatine the 1-week illustration besides shows that determination is different script for the invalidation of the treble top. Bitcoin has formed an ascending trendline from its debased successful aboriginal January. Provided BTC tin clasp this trendline connected a play ground and bounce up from determination (at astir $28,200), an invalidation would instrumentality place. The symmetry of the M would beryllium broken, the uptrend connected the higher clip frames could continue.

BTC’s trendline is inactive intact, 1-week illustration | Source BTCUSD connected TradingView.com

BTC’s trendline is inactive intact, 1-week illustration | Source BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)