On-chain information suggests a bulk of the Bitcoin speech inflows are presently coming from investors holding their coins astatine a loss.

Bitcoin Exchange Inflow Volume Is Tending Towards Losses Right Now

According to information from the on-chain analytics steadfast Glassnode, the short-term holders are mostly contributing to these nonaccomplishment inflows. The “exchange inflow” is an indicator that measures the full magnitude of Bitcoin that’s presently flowing into the wallets of centralized exchanges.

Generally, investors deposit to these platforms whenever privation to sell, truthful a ample magnitude of inflows tin beryllium a motion that a selloff is going connected successful the BTC marketplace close now. Low values of the metric, connected the different hand, connote holders whitethorn not beryllium participating successful overmuch selling astatine the moment, which tin beryllium bullish for the price.

In the discourse of the existent discussion, the speech inflow itself isn’t of relevance; a related metric called the “exchange inflow measurement profit/loss bias” is. As this indicator’s sanction already suggests, it tells america whether the inflows going to exchanges are coming from nett oregon nonaccomplishment holders currently.

When this metric has a worth greater than 1, it means the bulk of the inflow measurement contains coins that their holders had been carrying astatine a profit. Similarly, values nether the threshold connote a dominance of the nonaccomplishment volume.

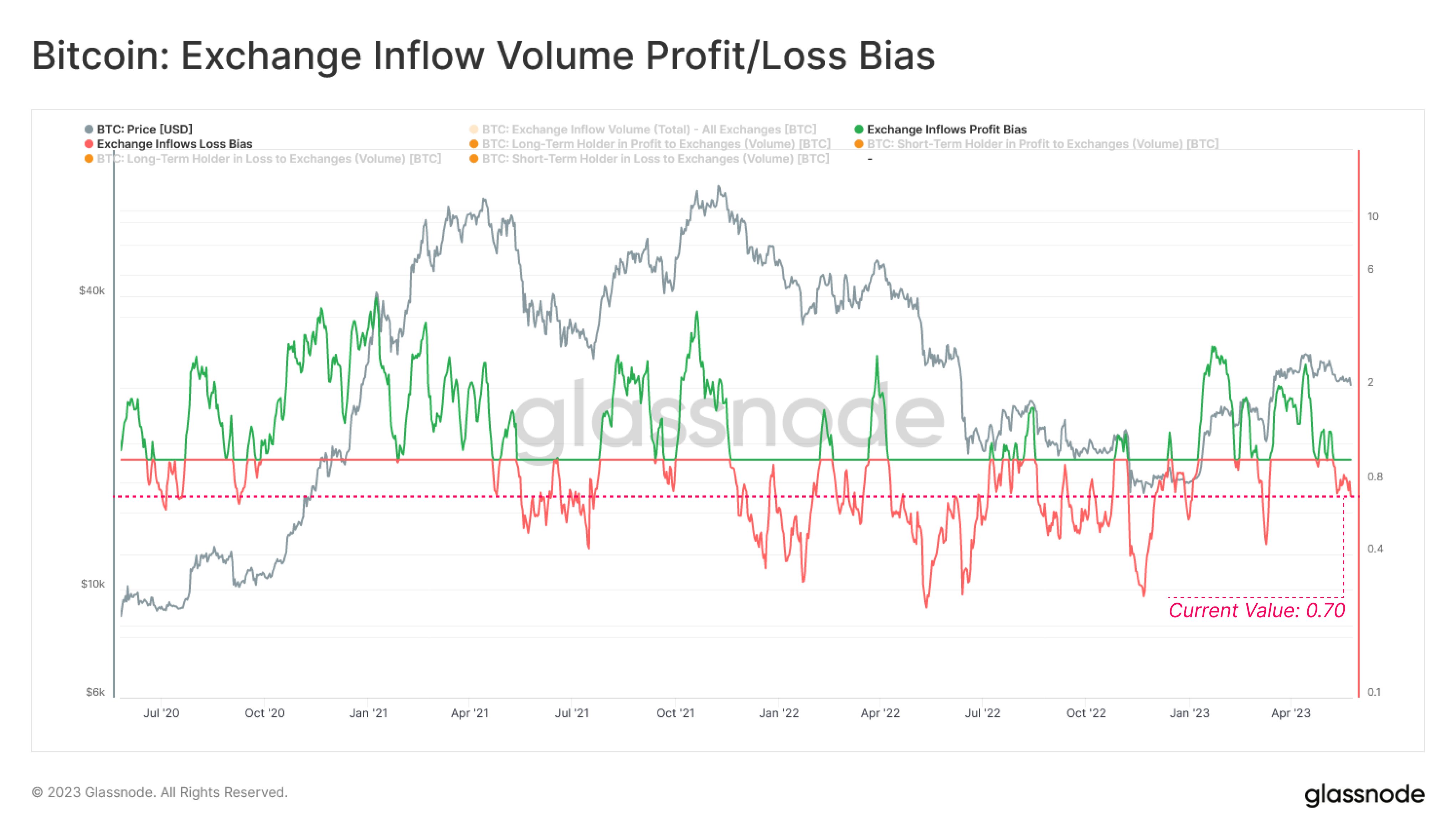

Now, present is simply a illustration that shows the inclination successful the Bitcoin speech inflow profit/loss bias implicit the past fewer years:

As shown successful the supra graph, the Bitcoin speech inflow measurement profit/loss bias has had a worth supra 1 for astir of the ongoing rallies that started backmost successful January of this year.

This suggests that astir of the speech inflows successful this play person travel from the nett holders. This people makes sense, arsenic immoderate rally mostly entices a ample fig of holders to merchantability and harvest their gains.

There person been a mates of exceptional instances, however. The archetypal was backmost successful March erstwhile the asset’s terms plunged beneath the $20,000 level. The bias successful the marketplace shifted towards nonaccomplishment selling then, implying that immoderate investors who bought astir the section apical had started capitulating.

A akin signifier has besides occurred recently, arsenic the cryptocurrency’s terms has stumbled beneath the $27,000 level. Following this plunge, the indicator’s worth has travel down to conscionable 0.70.

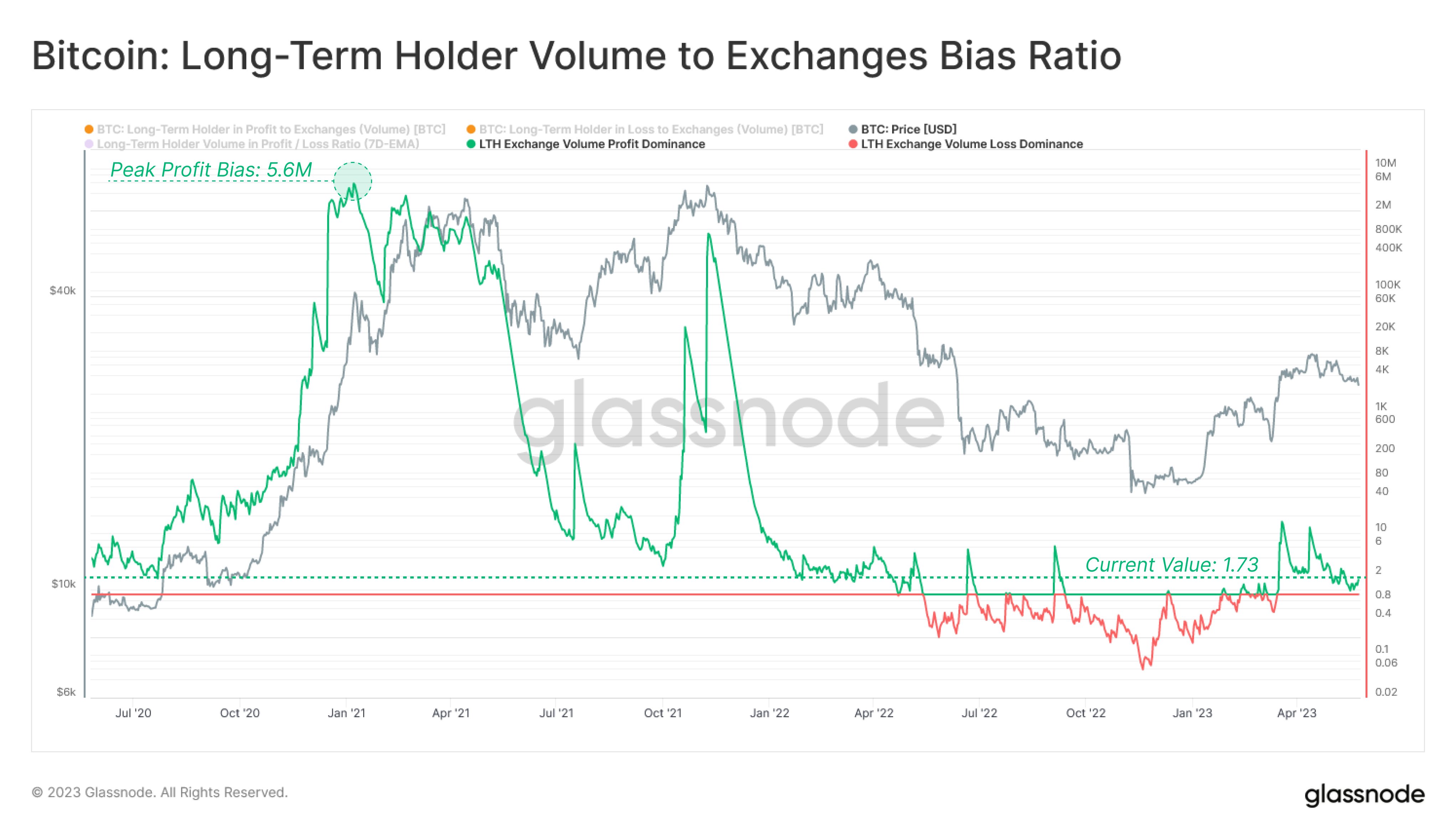

Further information from Glassnode reveals that the bias of the long-term holders (LTHs), the investors holding their coins since astatine slightest 155 days ago, person really leaned towards profits recently.

From the chart, it’s disposable that the indicator has a worth of 1.73 for the LTHs, implying a beardown bias toward profits. Naturally, if the LTHs haven’t been selling astatine a loss, the other cohort indispensable beryllium the short-term holders (STHs).

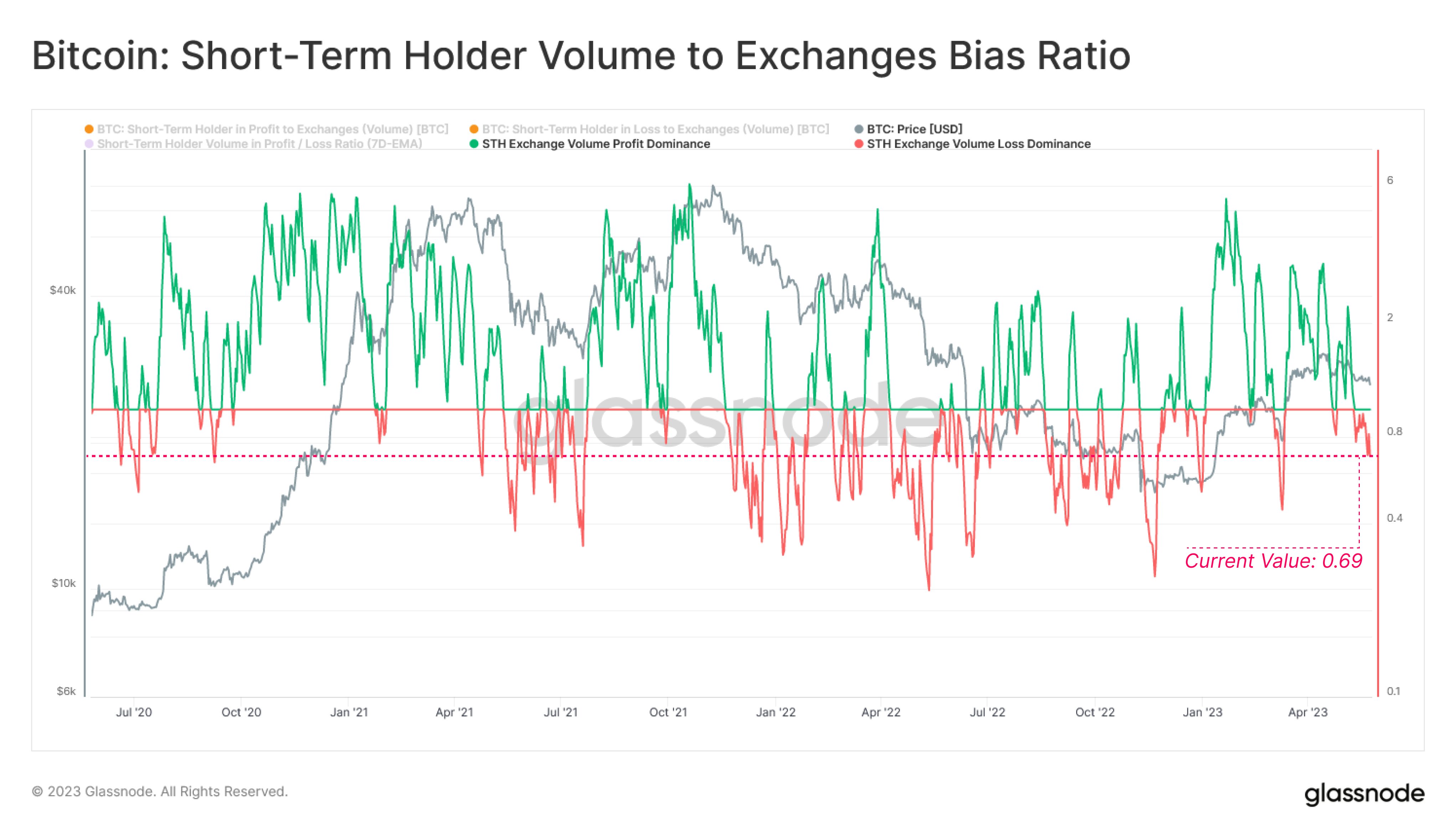

Interestingly, the indicator’s worth for the STHs is 0.69, which is astir precisely the aforesaid arsenic the mean for the full market. This would mean that the LTHs person contributed comparatively small to selling unit recently.

The STHs selling close present would beryllium the ones that bought astatine and adjacent the apical of the rally truthful acold and their capitulation whitethorn beryllium a motion that these anemic hands are presently being cleansed from the market.

Although the indicator hasn’t dipped arsenic debased arsenic successful March yet, this capitulation could beryllium a motion that a section bottommost whitethorn beryllium adjacent for Bitcoin.

BTC Price

At the clip of writing, Bitcoin is trading astir $26,400, down 1% successful the past week.

Featured representation from 愚木混株 cdd20 connected Unsplash.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)