By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin's (BTC) bull tally stalled, with prices falling 5% from the grounds precocious successful a classical bull-market pullback. The adverse terms enactment took the upwind retired of the broader market, too, though exceptions similar BONK and PUMP — up 5% connected a 24-hour ground — bucked the trend.

The pullback was characterized by long-dormant BTC whales moving coins to centralized exchanges, often a precursor to a sale. According to blockchain sleuth Lookonchain, an OG wallet with 80K BTC moved astir fractional to Galaxy Digital, which past deposited 6,000 BTC into Binance and Bybit. The on-chain travel occurred aft BTC notched Monday's grounds precocious supra $123,000.

"A spike successful Coin Days Destroyed metric and a emergence successful ample speech inflows suggest imaginable profit-taking. Yet contempt the historical merchantability pressure, bitcoin has remained resilient, reinforcing assurance successful sustained organization enactment and beardown structural marketplace demand," Tagus Capital said successful a marketplace update.

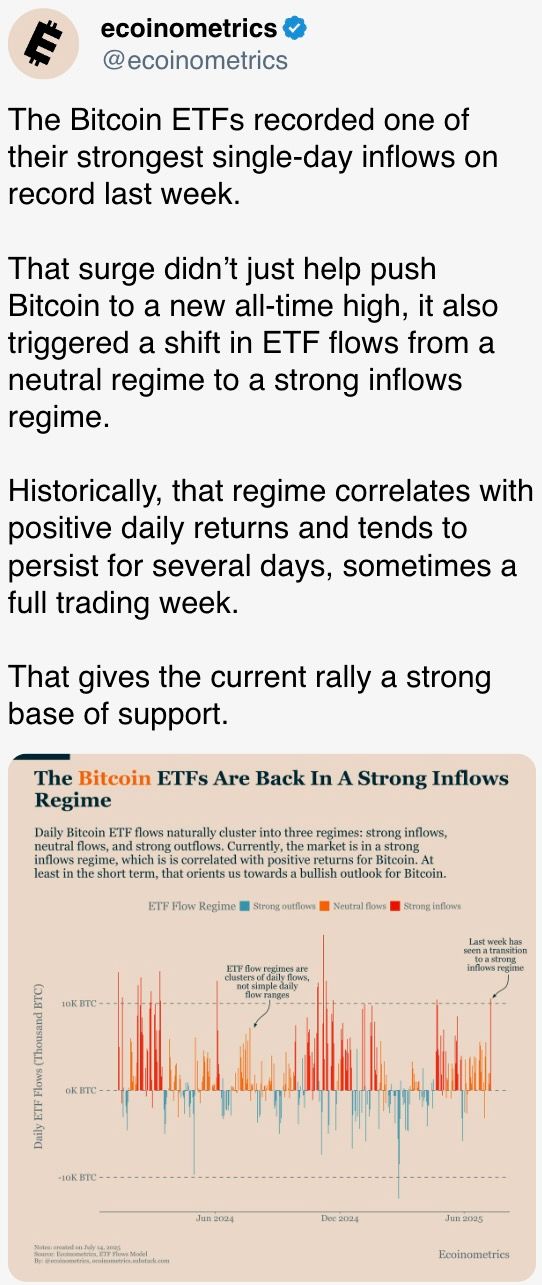

Inflows into the U.S.-listed spot bitcoin exchange-traded funds (ETFs) slowed to $297 cardinal connected Monday, down 70% from Friday. Meanwhile, inflows into spot ETH ETFs roseate to $259 cardinal from $204 million.

Valentin Fournier, the pb probe expert astatine BRN, called the slowdown successful bitcoin inflows a motion of weaker purchaser condemnation astatine elevated levels. Today's user terms scale and Wednesday's shaper terms scale could acceptable the code for the adjacent terms move, helium said.

"Elevated ostentation expectations owed to tariffs could rattle capitalist confidence. However, a affirmative astonishment successful the information could assistance calm the existent sell-off," helium noted.

Other analysts focused connected the House of Representatives votes connected the GENIUS and CLARITY Acts, which, if passed, could accelerate broader organization information successful the crypto marketplace beyond bitcoin.

In different news, Coinbase's shares deed a grounds precocious of $398.50 Monday, with its marketplace headdress surpassing $100 billion. According to Arkham Intelligence, SharpLink Gaming bought an further 24,371 ETH.

In accepted markets, the Japanese 30-year authorities enslaved output concisely roseate to 3.20%, matching the multi-decade precocious acceptable successful May. The MOVE index, which measures the 30-day implied volatility successful the U.S. Treasury market, turned up from a long-held support, informing of renewed turbulence successful bonds. Stay alert.

What to Watch

- Crypto

- July 15: Alchemist staking update launches, allowing token holders to involvement ALCH for entree to precocious features, premium benefits and ecosystem rewards, perchance boosting token inferior and demand.

- July 15: Lynq is expected to debut its real-time, interest-bearing digital-asset colony web for institutions. Built connected Avalanche’s layer-1 blockchain and powered by Arca’s tokenized U.S. Treasury money shares, Lynq enables instant settlement, continuous output accrual and improved superior efficiency.

- July 15: TAC, a layer-1 blockchain utilizing impervious of involvement (POS) statement and bridging Ethereum DeFi applications into Telegram’s ecosystem, is scheduled to motorboat its mainnet. Leading DeFi protocols specified Curve and Morpho volition run connected TAC, bringing decentralized concern to Telegram's 1 billion+ users.

- July 15, 6 a.m.: Layer-1 blockchain Alephium (ALPH) activates the "Danube" hard fork upgrade connected its mainnet, promising 8-second artifact times, 20,000+ TPS, groupless addresses, passkey login, chained transaction and enhanced developer tools.

- July 15, 1 p.m.: Caffeine, an AI-powered level that lets anyone physique Web3 decentralized apps (dapps) utilizing earthy language, launches publically astatine the “Hello, Self-Writing Internet” event successful San Francisco. Caffeine uses Internet Computer (ICP) exertion to make afloat on-chain, production-ready apps. Livestream link.

- July 15, 3 p.m.: U.S. Senate Committee connected Agriculture, Nutrition, and Forestry holds a marketplace operation hearing titled “Stakeholder Perspectives connected Federal Oversight of Digital Commodities.” Livestream link.

- July 16, 9 a.m.: U.S. House Ways and Means Committee oversight hearing titled "Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century."

- July 18: Lorenzo Protocol, a Cosmos-based blockchain with autochthonal token BANK, launches USD1+ OTF connected BNB Chain's mainnet. The institutional-grade on-chain traded money lets users involvement stablecoins to mint sUSD1+ tokens that gain stable, NAV-backed output from real-world assets, CeFi quantitative strategies and DeFi protocols. All returns are settled successful USD1 stablecoin, issued by World Liberty Financial, whose stablecoin infrastructure powers the product’s unchangeable output mechanism.

- July 18: Shares of the ProShares Ultra XRP Futures ETF (ticker UXRP), providing 2x leveraged vulnerability to XRP futures contracts, are expected to statesman trading connected NYSE Arca.

- Macro

- July 15, 8:30 a.m.: Statistics Canada releases June user terms ostentation data.

- Core Inflation Rate MoM Prev. 0.6%

- Core Inflation Rate YoY Prev. 2.5%

- Inflation Rate MoM Est. 0.1% vs. Prev. 0.6%

- Inflation Rate YoY Est. 1.9% vs. Prev. 1.7%

- July 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases June user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Core Inflation Rate YoY Est. 3% vs. Prev. 2.8%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Inflation Rate YoY Est. 2.7% vs. Prev. 2.4%

- July 15, 4 p.m.: Keynote speeches by Andrew Bailey, the politician of the Bank of England, and Rachel Reeves, U.K. Chancellor of the Exchequer, astatine the yearly fiscal and nonrecreational services meal astatine Mansion House, London.

- July 16, 2 a.m.: U.K.'s Office for National Statistics releases June user terms ostentation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 3.5% vs. Prev. 3.5%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.2%

- Inflation Rate YoY Est. 3.4% vs. Prev. 3.4%

- July 16, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June shaper terms ostentation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.1%

- Core PPI YoY Est. 2.7% vs. Prev. 3%

- PPI MoM Est. 0.2% vs. Prev. 0.1%

- PPI YoY Est. 2.5% vs. Prev. 2.6%

- July 16, 10 a.m.: Speech by Fed Governor Michael S. Barr connected "Financial Regulation" astatine "Conversation with Governor Barr" successful Washington. Livestream link.

- July 17, 10 a.m.: Speech by Fed Governor Adriana D. Kugler connected "A View of the Housing Market and U.S. Economic Outlook" astatine the Housing Partnership Network Symposium successful Washington. Livestream link.

- July 17, 6:30 p.m.: Speech by Fed Governor Christopher J. Waller connected the economical outlook astatine an lawsuit hosted by the Money Marketeers of New York University.

- Aug. 1, 12:01 a.m.: New U.S. tariffs instrumentality effect connected imports from commercialized partners that failed to scope agreements by the July 9 deadline. These accrued duties could scope from 10% to arsenic precocious arsenic 70%, impacting a wide scope of goods.

- July 15, 8:30 a.m.: Statistics Canada releases June user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting connected a $245,000 backing proposal to grow Gotchi Battler into a revenue-generating crippled with PvE modes, NFTs and conflict passes, aiming to reverse declining subordinate numbers, boost GHST inferior and make sustainable rewards. Voting ends July 22.

- Uniswap DAO is conducting a somesthesia check on Etherlink’s petition to co-incentivize Uniswap v3 liquidity. Tezos Foundation would enactment up $300K for 3 months of rewards connected WETH/USDC, WBTC/USDC and LBTC/USDC, and is asking the DAO for $150K more, aiming to anchor Etherlink’s rising TVL and aboriginal autochthonal tokens connected Uniswap. Voting ends July 18.

- Rocket Pool DAO is voting to finalize Saturn 1’s implementation. Approval by a 75% supermajority volition ratify cardinal protocol changes, including caller transaction designs and a imaginable gross stock to the pDAO treasury. Voting ends July 24.

- July 16, 5 p.m.: VeChain to big a monthly update with assemblage representatives and the VeChain Foundation.

- Unlocks

- July 15: Sei (SEI) to unlock 1% of its circulating proviso worthy $19.07 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating proviso worthy $37.15 million.

- July 17: ZKSync (ZK) to unlock 2.41% of its circulating proviso worthy $9.24 million.

- July 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $9.86 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating proviso worthy $827.17 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $90 million.

- Token Launches

- July 15: TAC (TAC) to beryllium listed connected Binance, Kraken, Bitget, Bybit and others.

- July 16: Bybit to delist Tap (TAP), VaporFund (VPR), Cosplay Token (COT), Souni (SON), Tenet Protocol (TENE), Havah (HVH), and Brawl AI Layer (BRAWL) among others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 21-22: Malaysia Blockchain Week 2025 (Kuala Lumpur)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Oliver Knight

- Token issuance level Pump.fun's autochthonal token was distributed to aboriginal users and ICO participants connected Monday, debuting astatine a $2 cardinal marketplace headdress connected the backmost of $1.46 cardinal successful trading volume.

- PUMP began trading astatine $0.00756 and soon began to consciousness the pressure, sliding to arsenic debased arsenic $0.051 earlier settling astatine $0.0056.

- The ICO terms was $0.004, meaning that investors has an accidental to rapidly flip the tokens for a profit, creating a question of selling pressure.

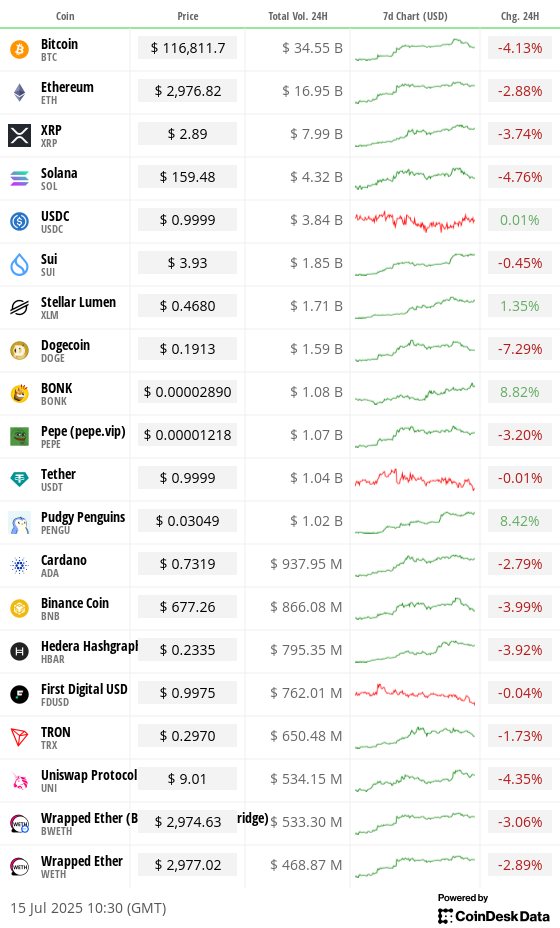

- The token debut coincided with a diminution crossed the wider crypto market, with bitcoin (BTC) losing 4% arsenic it slipped to $117,000 from $123,000, portion ether (ETH) and sol (SOL) fell 2% and 4.7%, respectively.

- Crypto speech Binance besides made an effort to instrumentality the limelight, announcing the merchandise of its ain token launcher that volition rival Pump.fun.

Derivatives Positioning

- Open involvement successful XRP futures deed all-time highs alongside grounds enactment successful BTC futures, some pointing to elevated terms volatility ahead.

- Funding rates for large coins are holding supra an annualized 10%, suggesting bullish marketplace sentiment. The reading, however, is acold from signaling overheated conditions typically seen astatine marketplace tops oregon grounds precocious prices.

- The cumulative measurement delta for the apical 25 coins for the past 24 hours is negative, a motion of sellers becoming much aggressive. The pullback mightiness deepen successful the short-term.

- Risk reversals tied to short-term BTC and ETH options present amusement a bias for protective puts, which is communal during terms declines. The long-end remains bullish.

- Block flows connected OTC liquidity web Paradigm featured December hazard reversals and ETH out-of-the-money telephone spreads.

Market Movements

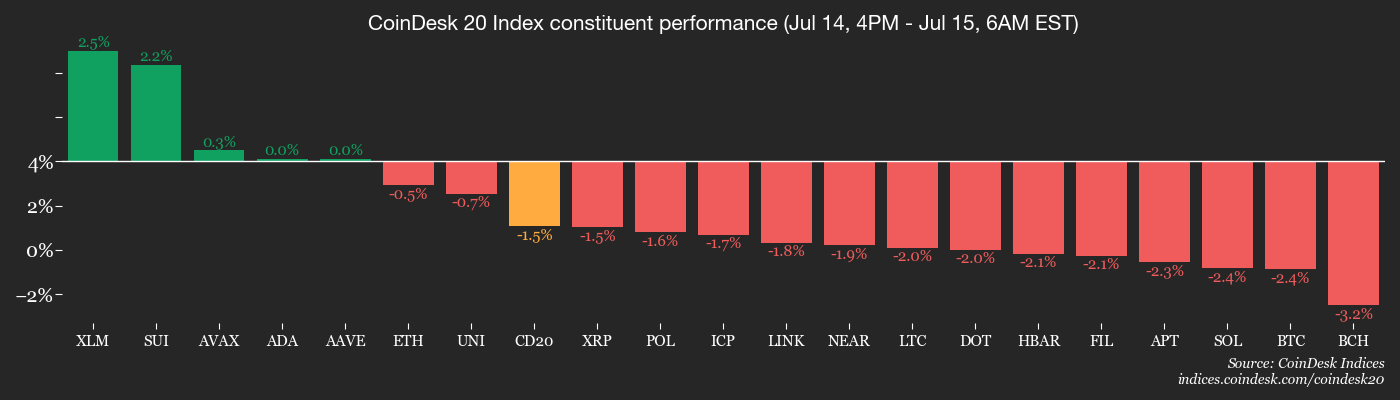

- BTC is down 2.86% from 4 p.m. ET Monday astatine $116,734.47 (24hrs: -4.13%)

- ETH is down 1.12% astatine $2,970.70 (24hrs: -2.89%)

- CoinDesk 20 is down 1.79% astatine 3,566.75 (24hrs: -3.85%)

- Ether CESR Composite Staking Rate is up 15 bps astatine 3.04%

- BTC backing complaint is astatine 0.0315% (34.40% annualized) connected KuCoin

- DXY is down 0.12% astatine 97.97

- Gold futures are up 0.41% astatine $3,372.90

- Silver futures are down 0.11% astatine $38.70

- Nikkei 225 closed up 0.55% astatine 39,678.02

- Hang Seng closed up 1.45% astatine 24,553.52

- FTSE is up 0.06% astatine 9,003.57

- Euro Stoxx 50 is up 0.40% astatine 5,392.29

- DJIA closed connected Monday up 0.20% astatine 44,459.65

- S&P 500 closed up 0.14% astatine 6,268.56

- Nasdaq Composite closed up 0.27% astatine 20,640.33

- S&P/TSX Composite closed up 0.65% astatine 27,198.85

- S&P 40 Latin America closed down 0.92% astatine 2,597.40

- U.S. 10-Year Treasury complaint is down 1.2 bps astatine 4.415%

- E-mini S&P 500 futures are up 0.29% astatine 6,329.00

- E-mini Nasdaq-100 futures are up 0.54% astatine 23,158.75

- E-mini Dow Jones Industrial Average Index are unchanged astatine 44,694.00

Bitcoin Stats

- BTC Dominance: 64.25% (-0.41%)

- Ether to bitcoin ratio: 0.02549 (1.39%)

- Hashrate (seven-day moving average): 906 EH/s

- Hashprice (spot): $58.8

- Total Fees: 5.74 BTC / $693,498

- CME Futures Open Interest: 153,280 BTC

- BTC priced successful gold: 34.8 oz

- BTC vs golden marketplace cap: 9.86%

Technical Analysis

- Since 2024, each caller precocious successful BTC has seen dogecoin (DOGE), the world's largest meme token, deed a little precocious than the preceding one.

- The divergence hints astatine declining capitalist involvement successful non-serious tokens.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $451.02 (+3.78%), -2.04% astatine $441.80

- Coinbase Global (COIN): closed astatine $394.01 (+1.8%), -1.41% astatine $388.47

- Circle (CRCL): closed astatine $204.7 (+9.27%), -1.93% astatine $200.75

- Galaxy Digital (GLXY): closed astatine $21.45 (+3.97%), unchanged successful pre-market

- MARA Holdings (MARA): closed astatine $19.21 (+0.37%), -1.56% astatine $18.91

- Riot Platforms (RIOT): closed astatine $12.51 (+0.72%), -2.4% astatine $12.21

- Core Scientific (CORZ): closed astatine $13.56 (+8.39%), +2.58% astatine $13.91

- CleanSpark (CLSK): closed astatine $12.6 (-0.4%), -1.9% astatine $12.36

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.57 (+3.19%)

- Semler Scientific (SMLR): closed astatine $45.23 (-0.66%), -0.51% astatine $45

- Exodus Movement (EXOD): closed astatine $33.70 (+2.12%), +2.34% astatine $34.49

ETF Flows

Spot BTC ETFs

- Daily nett flows: $297.4 million

- Cumulative nett flows: $52.64 billion

- Total BTC holdings ~1.28 million

Spot ETH ETFs

- Daily nett flows: $259 million

- Cumulative nett flows: $5.58 billion

- Total ETH holdings ~4.47 million

Source: Farside Investors

Overnight Flows

Chart of the Day

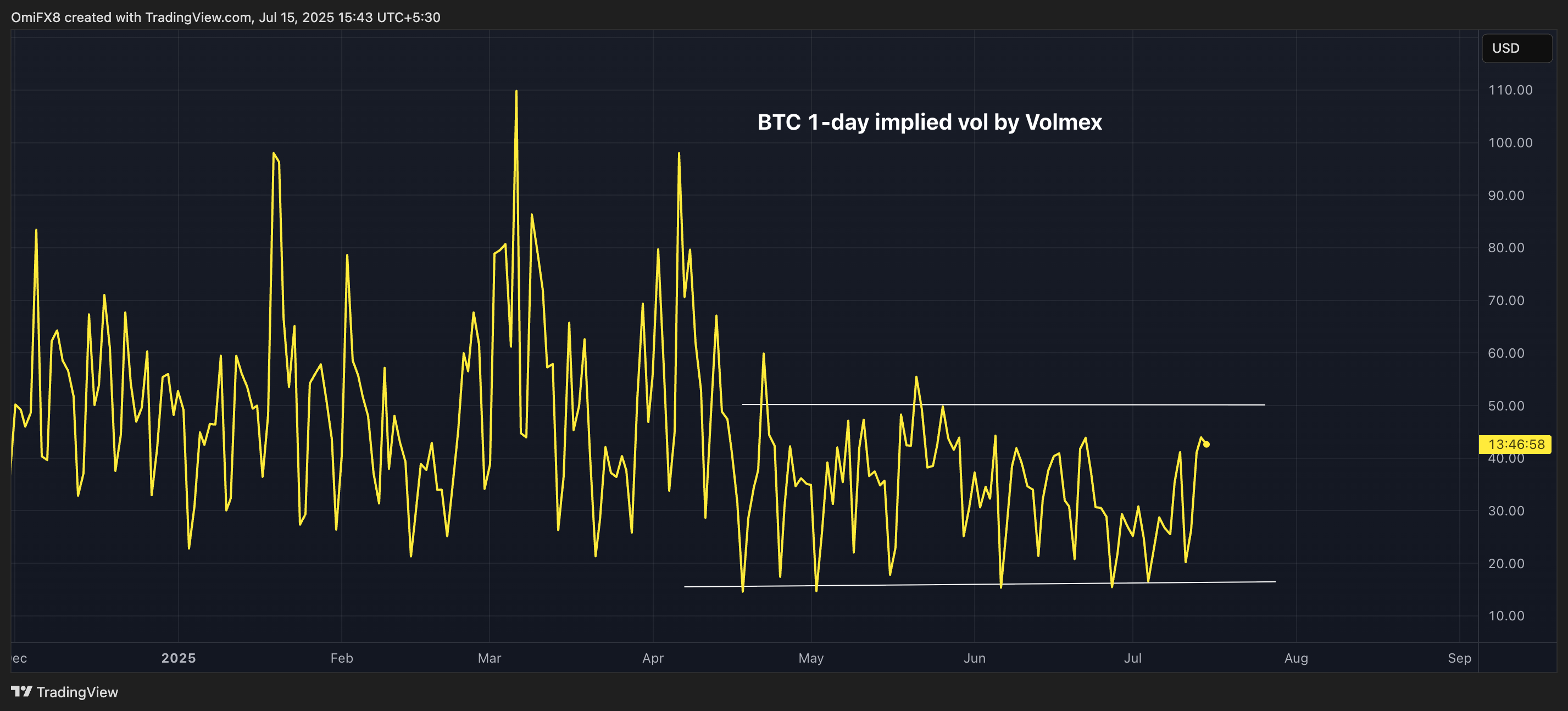

- Volmex's annualized one-day BTC implied volatility scale remains locked successful a sideways range.

- It's a motion that traders bash not expect the impending U.S. CPI to breed important marketplace volatility.

While You Were Sleeping

- Bitcoin Rally Stalls arsenic Long-Term Holders Cash Out (CoinDesk): Bitcoin dropped astir 5% from its $123,000 highest with semipermanent holders — those holding BTC for implicit 155 days — accounting for the bulk of the $3.5 cardinal successful profits realized implicit 24 hours.

- Standard Chartered Says It’s the First Global Bank to Offer Spot Bitcoin, Ether Trading (CoinDesk): Standard Chartered began offering spot bitcoin and ether trading to organization clients successful the U.K., saying it's the archetypal planetary systemically important slope to supply specified crypto plus services.

- Strategy Bears Cave In arsenic Anti-MSTR Leveraged ETF Hits Rock Bottom (CoinDesk): The Defiance Daily Target 2X Short MSTR ETF (SMST) dropped 7.6% to a grounds debased of $18.17 connected Monday, with trading measurement reaching its second-highest level ever astatine 2.88 cardinal shares.

- Behind Trump’s Tough Russia Talk, Doubts and Missing Details (The New York Times): Trump warned of 100% tariffs connected Russia’s commercialized partners if nary ceasefire with Ukraine emerges wrong 50 days. Analysts accidental the menace lacks teeth due to the fact that targets see China and U.S. allies.

- China’s Economy Slows arsenic Consumers Tighten Belts, US Tariff Risks Mount (Reuters): China’s second-quarter maturation slipped to 5.2% year-over-year, and falling depletion and looming U.S. tariffs are fueling interest that much stimulus whitethorn beryllium needed to conscionable the 5% yearly maturation target.

- Plan to Boost Returns From Russian Assets ‘Expropriation’, Warns Euroclear (Financial Times): The European securities depository holding astir frozen Russian assets said EU plans to reinvest them much aggressively could deepen ineligible exposure, harm fiscal credibility and provoke further retaliation from Moscow.

- BofA Poll Shows Investors Flock Into Risk Assets astatine Record Pace (Bloomberg): The 175 money managers surveyed by Bank of America boosted allocations to U.S. and eurozone stocks astatine a grounds pace, citing stronger earnings, tech momentum, and optimism astir commercialized woody prospects.

In the Ether

3 months ago

3 months ago

English (US)

English (US)