On Feb. 3, spot Bitcoin ETFs saw a nett outflow of astir $235 million, marking the archetypal nett outflow aft a four-day streak of nett inflows totaling $1 billion. The outflows travel Bitcoin’s drop to a three-week low, with BTC concisely touching $92,000 during the weekend.

It’s a stark opposition to the erstwhile week erstwhile ETFs saw accordant nett inflows averaging $250 cardinal per day. The monolithic outflows connected Feb. 3 are besides a notable deviation from the inflows we’ve seen implicit the past month, showing conscionable however delicate the ETF marketplace is to outer governmental and economical factors.

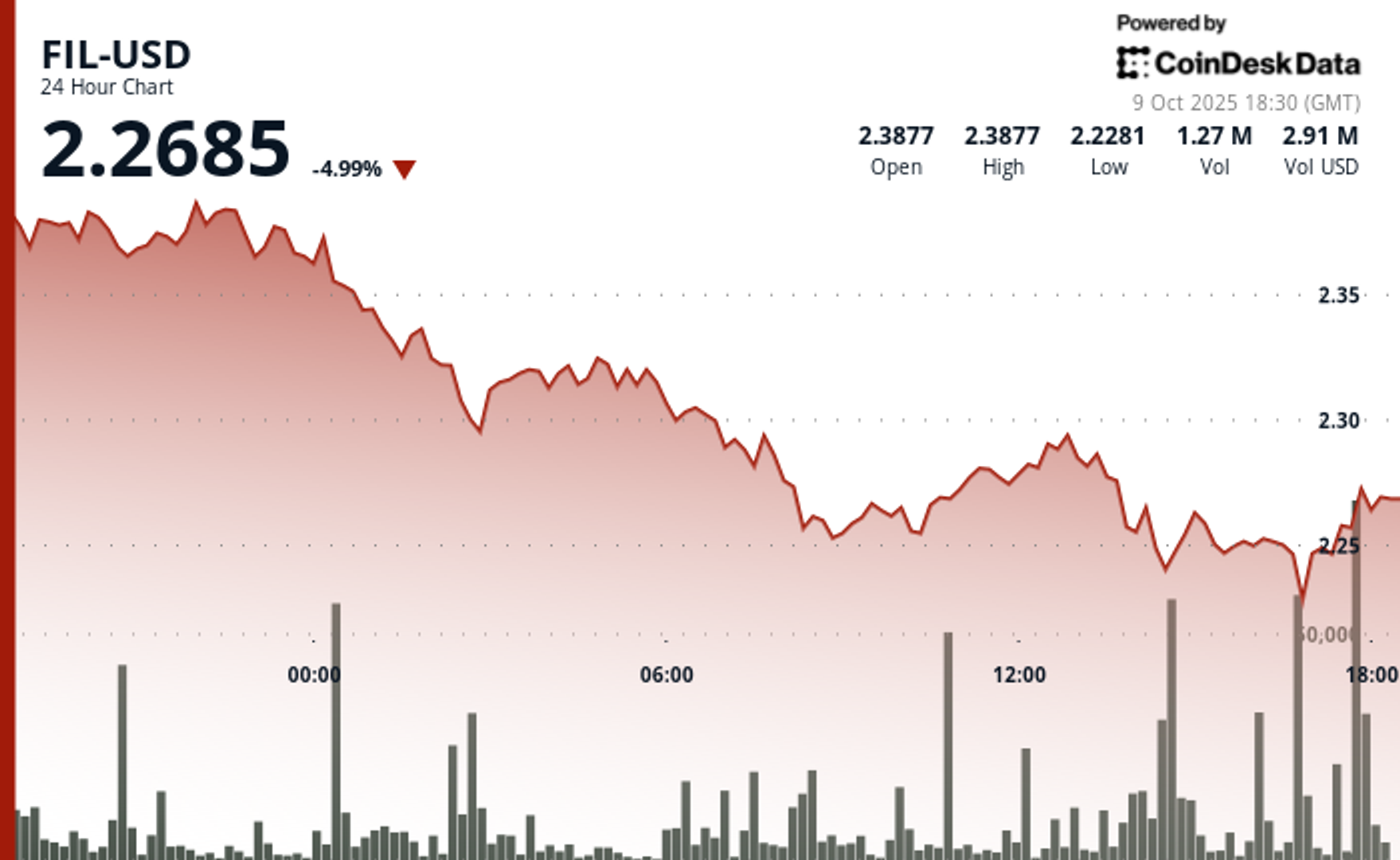

Table showing the inflows and outflows for spot Bitcoin ETFs from Jan. 16 to Feb. 3, 2025 (Source: Farside)

Table showing the inflows and outflows for spot Bitcoin ETFs from Jan. 16 to Feb. 3, 2025 (Source: Farside)The largest outflows came from Fidelity’s FBTC, which recorded a staggering $177.6 cardinal successful nett redemptions, marking the azygous largest outflow of the day. Grayscale’s GBTC besides saw notable outflows, though astatine a overmuch little scale, shedding $8.6 million. Other ETFs that experienced nett antagonistic flows included Bitwise’s BITB, which mislaid $5.5 million, and ARK’s ARKB, which saw a $50.7 cardinal outflow. The remaining ETFs, including BlackRock’s IBIT, Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, VanEck’s HODL, and WisdomTree’s BTCW, reported nary inflows oregon outflows, indicating a intermission successful capitalist enactment for those funds. Interestingly, Grayscale’s BTC (different from GBTC) recorded a tiny but affirmative inflow of $8 million, making it the lone ETF to pull caller capital.

President Donald Trump’s announcement of caller tariffs connected imports from Canada, Mexico, and China was the superior catalyst for the volatility. Initially, the medication declared a 25% tariff connected goods from Canada and Mexico and a 10% tariff connected Chinese products, acceptable to instrumentality effect connected Feb. 4. However, pursuing negotiations, the tariffs connected Canada and Mexico were postponed for 30 days, portion those connected Chinese imports proceeded arsenic planned.

The tariff announcements had contiguous repercussions crossed planetary fiscal markets. Major indices, including the Dow Jones Industrial Average, S&P 500, and Nasdaq, experienced notable declines arsenic investors grappled with the imaginable economical implications of a commercialized war. The uncertainty stemming from these developments prompted a displacement distant from hazard assets, including Bitcoin and different integer assets.

The imposition of tariffs introduces concerns astir accrued accumulation costs, disrupted proviso chains, and imaginable retaliatory measures from affected countries. Such factors lend to broader economical uncertainty, starring investors to reassess their portfolios and trim vulnerability to volatile assets similar Bitcoin.

The station Bitcoin ETFs spot $234M successful outflows aft Trump’s tariff war appeared archetypal connected CryptoSlate.

8 months ago

8 months ago

English (US)

English (US)