Bitcoin traded astatine astir $25,900 astatine the opening of September, marking a important displacement from its summertime performance. Throughout the past 3 months, Bitcoin maintained a historically unparalleled choky trading range. However, a notable dip beneath $29,000 successful mid-August eradicated billions successful leverage from the market, signaling a long-awaited marketplace shift.

As Bitcoin matures, its derivatives marketplace is evolving successful tandem. Products specified arsenic futures, options, and perpetual futures person grown exponentially, wielding the powerfulness to power Bitcoin’s terms much than the accepted spot market.

This inclination underscores the value of monitoring the derivatives market. Specifically, gauging the magnitude of leverage successful this marketplace tin supply insights into the inherent risks associated with imaginable long/short squeezes and ensuing liquidation cascades.

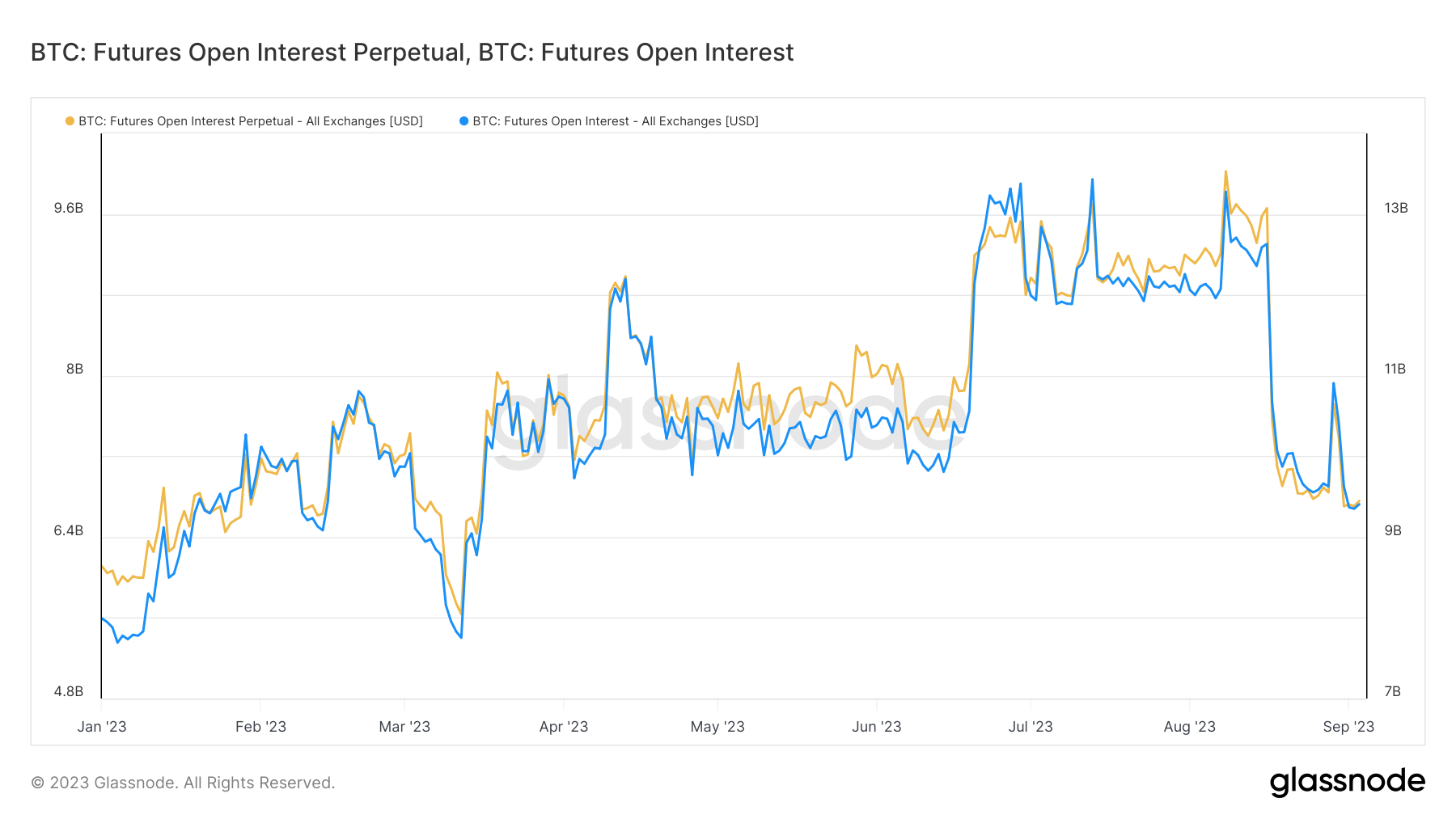

Graph showing the unfastened involvement connected Bitcoin futures and perpetual futures YTD (Source: Glassnode)

Graph showing the unfastened involvement connected Bitcoin futures and perpetual futures YTD (Source: Glassnode)A cardinal metric that offers a model into the market’s wellness is the Futures Open Interest Leverage Ratio.

This ratio is derived by dividing the market’s unfastened involvement by the asset’s marketplace cap, with the effect presented arsenic a percentage. Essentially, it estimates the existing leverage successful narration to the marketplace size, serving arsenic a barometer for imaginable deleveraging risks. Open involvement refers to the full fig of outstanding derivative contracts, specified arsenic futures and options, that person not been settled. It provides penetration into the travel of wealth and trading enactment successful a peculiar market.

High values successful this metric suggest that the futures marketplace unfastened involvement is important erstwhile juxtaposed with the marketplace size, elevating the hazard of events similar short/long squeezes oregon liquidation cascades. Conversely, debased values bespeak a smaller futures market unfastened involvement comparative to the marketplace size, typically showing reduced risks of derivative-led forced buying, selling, oregon volatility.

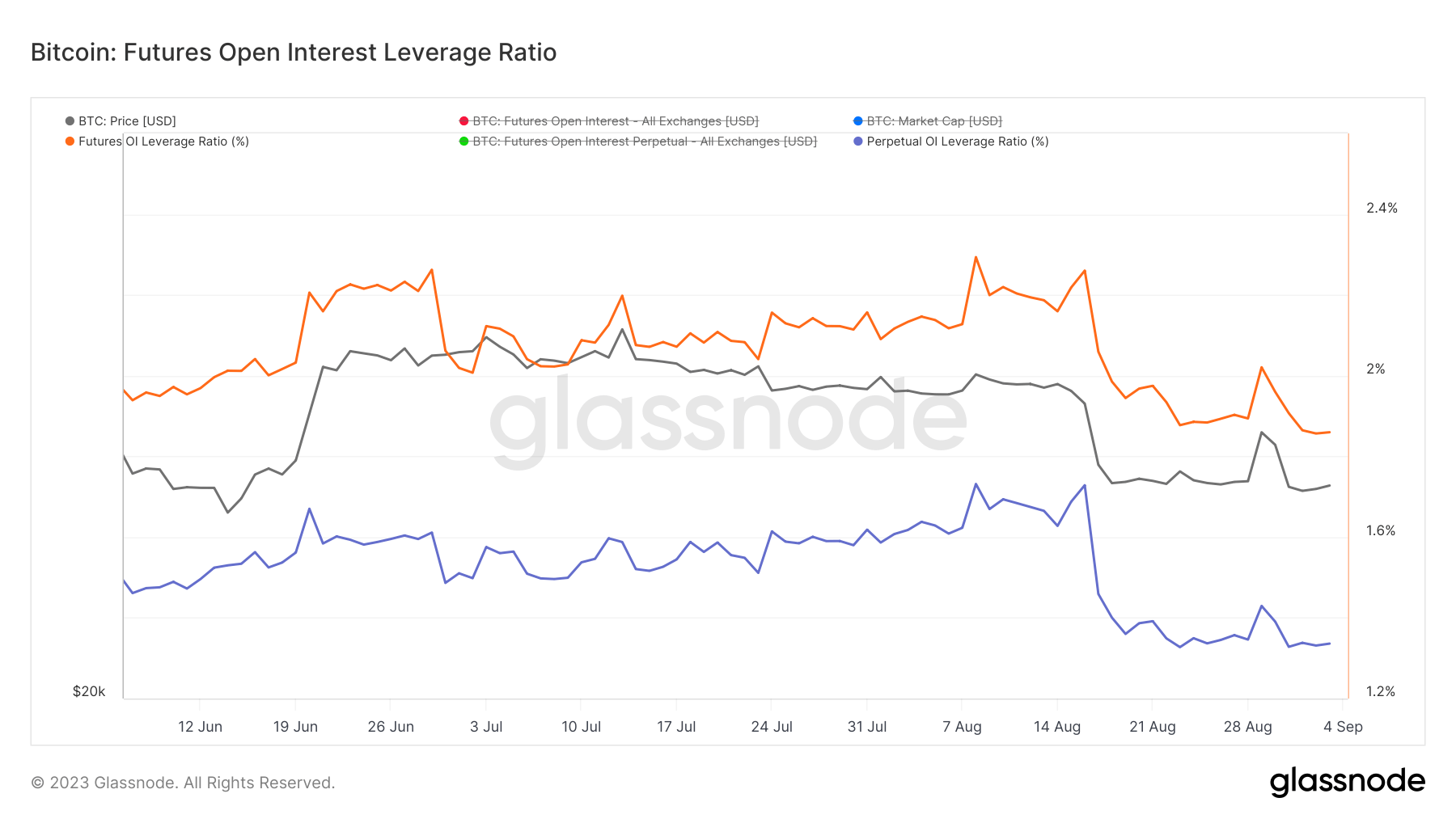

According to information from Glassnode, determination was a notable alteration successful the futures unfastened involvement leverage ratio successful August.

On Aug. 16, the futures unfastened involvement leverage ratio stood astatine 2.26%, portion its perpetual counterpart was astatine 1.72%. However, by Aug. 18, these figures had dwindled to 1.94% and 1.36%, respectively. Although determination was a brief spike connected Aug. 29 during Bitcoin’s short-lived stint astatine $27,000, the ratios soon plummeted.

In September, the marketplace recorded a 6-month debased successful futures unfastened involvement leverage ratios, with figures of 1.86% and 1.33%.

Graph showing the Futures Open Interest Leverage Ratio from June 7 to Sep. 3, 2023 (Source: Glassnode)

Graph showing the Futures Open Interest Leverage Ratio from June 7 to Sep. 3, 2023 (Source: Glassnode)Historically, the all-time precocious of the unfastened involvement leverage ratio was observed connected Oct. 20, 2022, close earlier the illness of FTX. The excessive leverage that had permeated the marketplace meant that FTX’s downfall triggered a liquidation cascade, erasing billions from the market. Had the marketplace been little leveraged, the repercussions of FTX’s demise mightiness person been considerably little catastrophic.

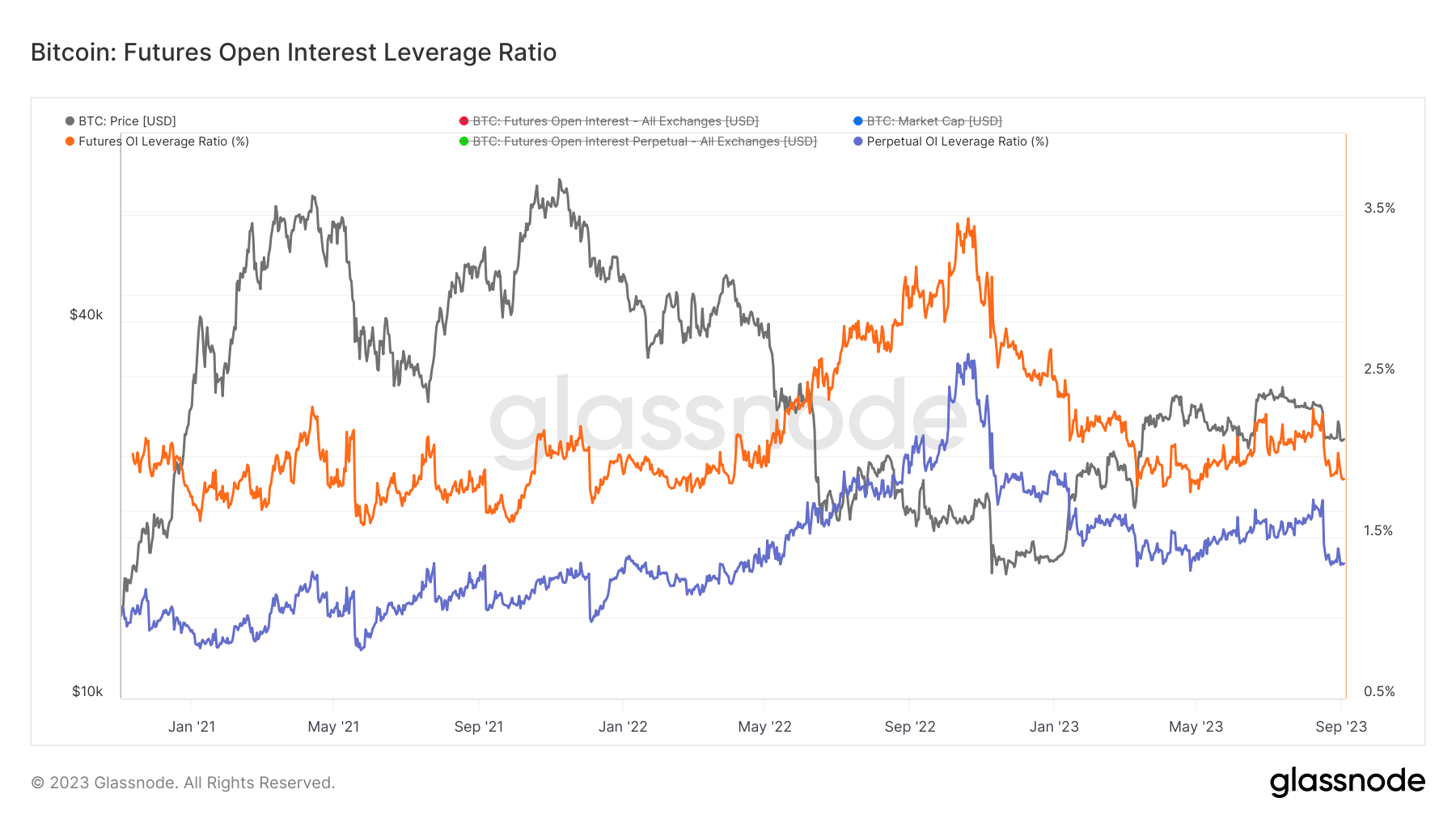

Graph showing the Futures Open Interest Leverage Ratio from November 2020 to September 2023 (Source: Glassnode)

Graph showing the Futures Open Interest Leverage Ratio from November 2020 to September 2023 (Source: Glassnode)The alteration successful leverage suggests a displacement towards caution among traders and institutions. While precocious leverage tin connection important returns, it besides comes with accrued risks, arsenic evidenced by the FTX debacle. The existent low-leverage situation suggests the marketplace is successful a consolidation phase, with participants wary of imaginable outer shocks.

The station Bitcoin enters September with diminished marketplace leverage appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)