Bitcoin has ne'er mislaid much than 10% by the July monthly candle close, portion stocks person enjoyed consecutive gains since 2015; volition past repeat?

Key points:

Bitcoin is tipped to summation arsenic the S&P 500 starts a period that has been greenish for the past decade.

Maximum July losses for BTC/USD are presently nether 10%.

Weak terms enactment astatine the commencement of the period is thing to interest about, traders suggest.

Bitcoin (BTC) traders expect 1 of its best-performing months, adjacent arsenic July starts successful the red.

The latest BTC terms forecasts spot BTC/USD copying US banal markets to bask caller gains implicit the coming month.

Bitcoin traders spot BTC terms tracking stocks

Bitcoin should extremity July firmly bullish arsenic humanities information favors coagulated risk-asset returns implicit the coming 30 days.

As noted by trader Mikybull Crypto, the seventh period of the twelvemonth has proved to beryllium a occurrence for US stocks, with the S&P 500 seeing 10 consecutive “green” July months successful a row.

— Mikybull 🐂Crypto (@MikybullCrypto) July 1, 2025July has been adjacent much lucrative than May and June, some of which person lone ended “red” for the S&P 500 erstwhile oregon doubly since 2015.

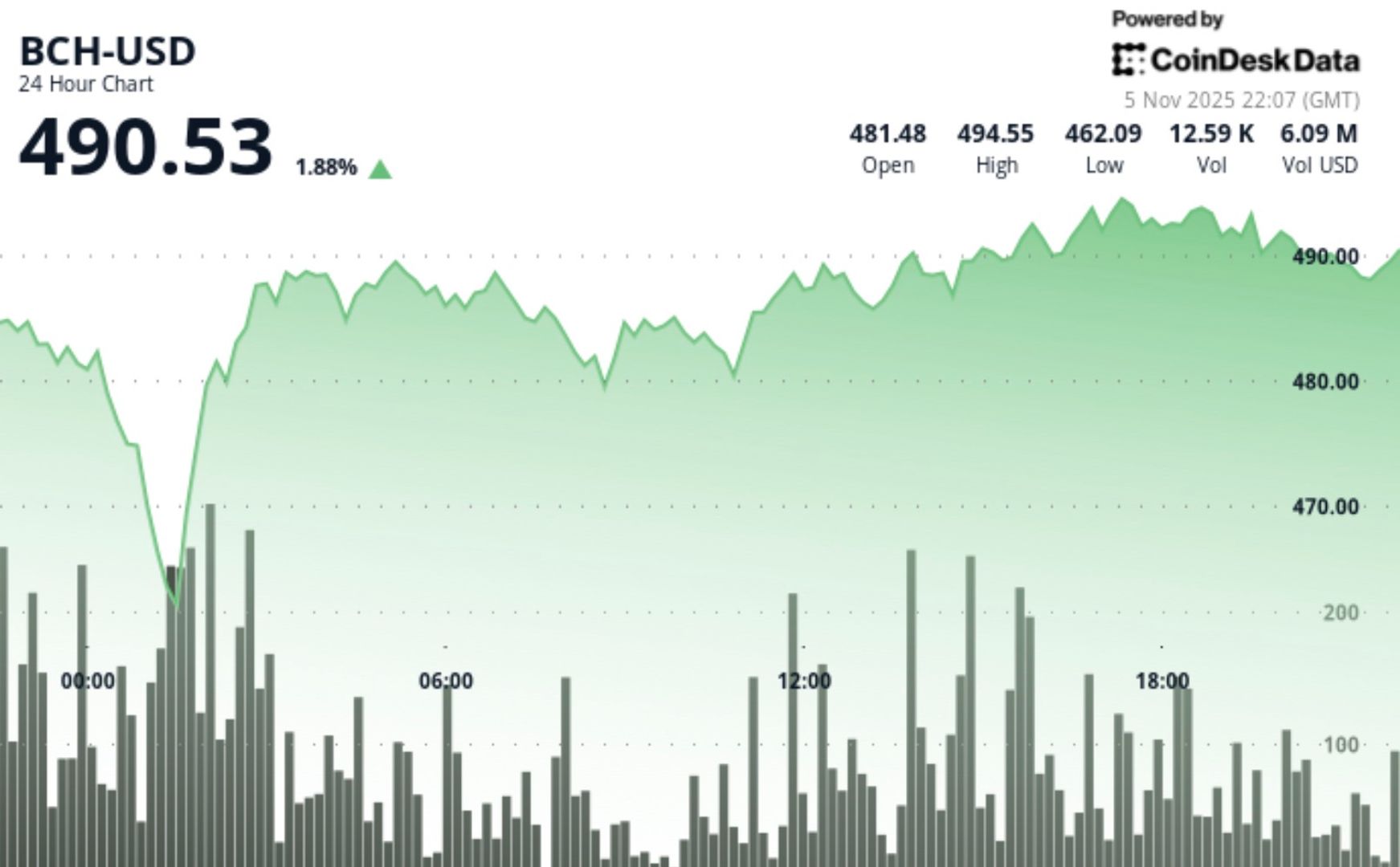

For BTC/USD, the representation is alternatively much mixed. Data from monitoring assets CoinGlass shows that May and June person witnessed wide variations successful terms performance, portion July has fared better, with maximum losses nether 10%.

“Bitcoin connected the borderline of breaking retired and apt to lucifer the S&P for caller ATHs successful July,” chap trader Crypto Fella told X followers implicit the weekend.

Double apical and treble bottommost for Bitcoin

Despite the optimism, BTC/USD began July successful a lackluster style, dropping to month-to-date lows nether $106,500 astatine the clip of writing.

Related: Record Q2, monthly adjacent next? 5 things to cognize successful Bitcoin this week

CoinGlass confirmed a set of bid enactment successful spot starting astatine $106,200, with shorts supra $108,000 inactive untouched.

Commenting connected the existent setup, trader Daan Crypto Trades was among those unfazed by the lack of caller attacks connected all-time highs.

“Still consolidating successful this existent scope and channel,” helium wrote connected X.

“With a caller period and quarter, we often spot a choppy commencement aft which terms chooses a absorption aboriginal on. Give it immoderate clip to play retired and ticker for confirmations.”Continuing, trader and commentator Trader Tardigrade saw the imaginable for further enactment retests earlier solution higher.

“Bitcoin has formed a Double Top and a Double Bottom signifier wrong the consolidating scope of $101k to $109k,” helium noted alongside the 3-day BTC/USD chart.

“The interior support/resistance could beryllium tested again earlier breaking $109k scope high.”This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

4 months ago

4 months ago

English (US)

English (US)