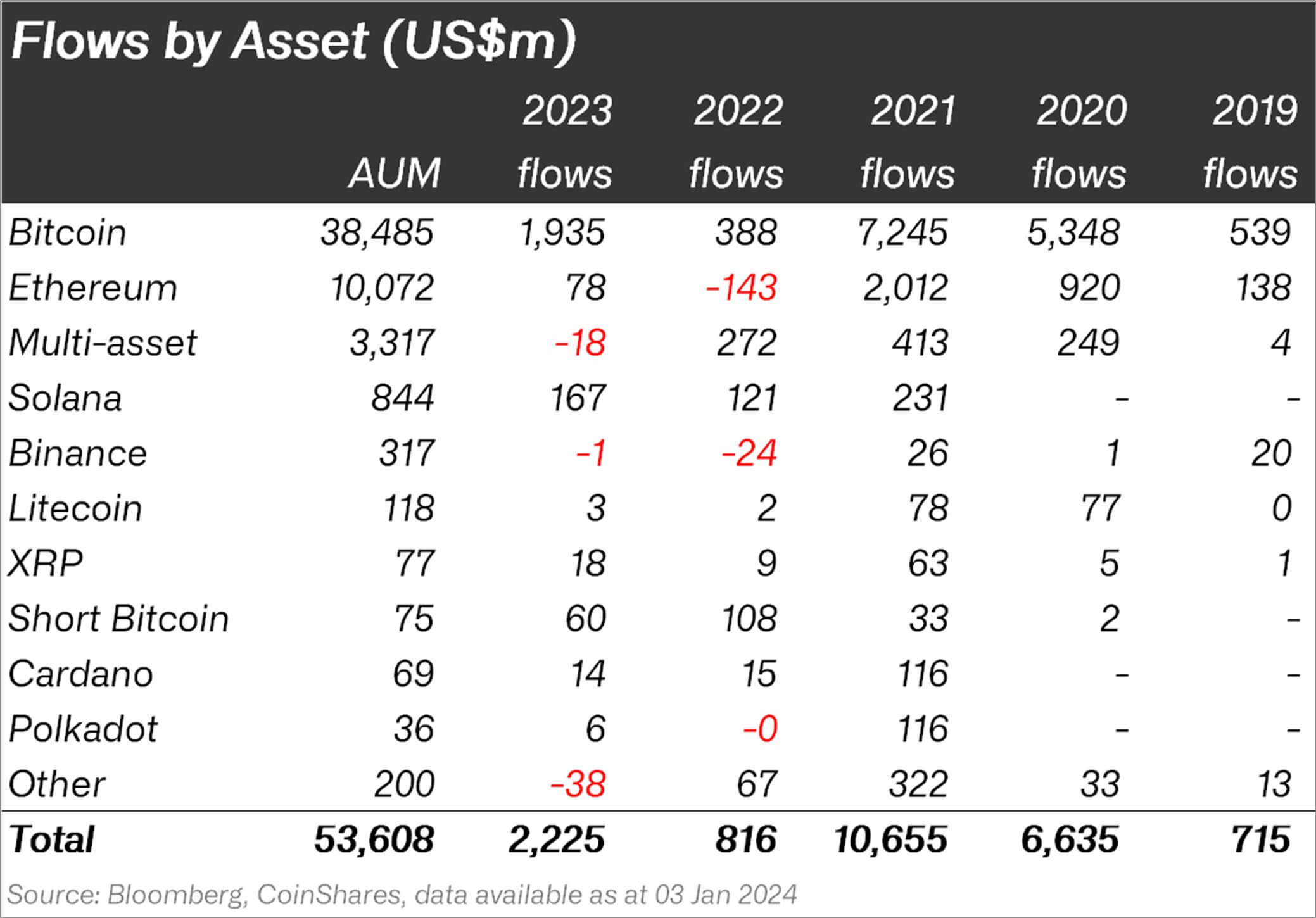

Inflows into crypto-related concern products accrued 170% year-on-year to $2.2 cardinal past twelvemonth from the $816 cardinal recorded successful 2022, according to CoinShares data shared by its caput of probe James Butterfill, connected societal media level X (formerly Twitter).

The summation reflects the resurgence of the burgeoning crypto sector, fueled by singular rallies successful cryptocurrencies similar Solana and Bitcoin. This surge has been mostly attributed to the anticipation surrounding the imaginable support of an inaugural spot Bitcoin exchange-traded funds (ETFs) successful the U.S.

Bitcoin dominates inflow

Last year, Bitcoin-related assets dominated the market, constituting implicit 86% of the recorded inflows, equating to $1.9 billion. This marks a important surge of astir 400% from the $388 cardinal inflows documented successful 2022. However, it is worthy noting that this fig reflects a diminution of 74% from the $7.2 cardinal highest seen successful 2021.

Market observers person attributed this upsurge of inflows to the anticipation of a spot Bitcoin ETF motorboat successful the U.S. CryptoSlate reported that the U.S. Securities and Exchange Commission (SEC) could commencement approving assorted pending spot Bitcoin ETFs by the extremity of the week.

Inflows into crypto-related products. (Source: CoinShares)

Inflows into crypto-related products. (Source: CoinShares)Solana emerged arsenic 1 of the astir favorable assets for investors past year, witnessing full inflows of $167 million. During the period, Solana’s SOL token terms rallied by much than 850% to supra $100 from nether $10 arsenic the plus attracted caller users and forged strategic alliances with renowned planetary fiscal players similar Visa and Shopify.

On the different hand, Ethereum concern products saw inflows of little than $100 cardinal past twelvemonth and attracted the “least loved altcoin” tag for respective weeks. The second-largest cryptocurrency by marketplace capitalization did not spot overmuch involvement contempt the launch of respective Ether futures-based exchange-traded funds (ETF) successful October.

Meanwhile, the wide bullish sentiment resulted successful immoderate investors taking a bearish basal connected the market, with $60 cardinal successful inflows to Short Bitcoin products past year.

Other integer assets similar Litecoin, XRP, Polkadot, and Cardano ended the twelvemonth with cumulative inflows of $41 million.

The station Bitcoin dominates arsenic crypto investments skyrocket by 170% to $2.2 cardinal successful 2023 appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)