Bitcoin (BTC) tightened its grip connected the crypto marketplace connected Tuesday, with dominance surging to caller four-year precocious arsenic crypto traders rotated into the market’s anchor plus up of tomorrow's cardinal Federal Reserve argumentation meeting.

BTC held dependable astir the $94,000-$95,000 area, up a humble 0.4% implicit the past 24 hours and extending a tight-range trading signifier that has persisted since the weekend.

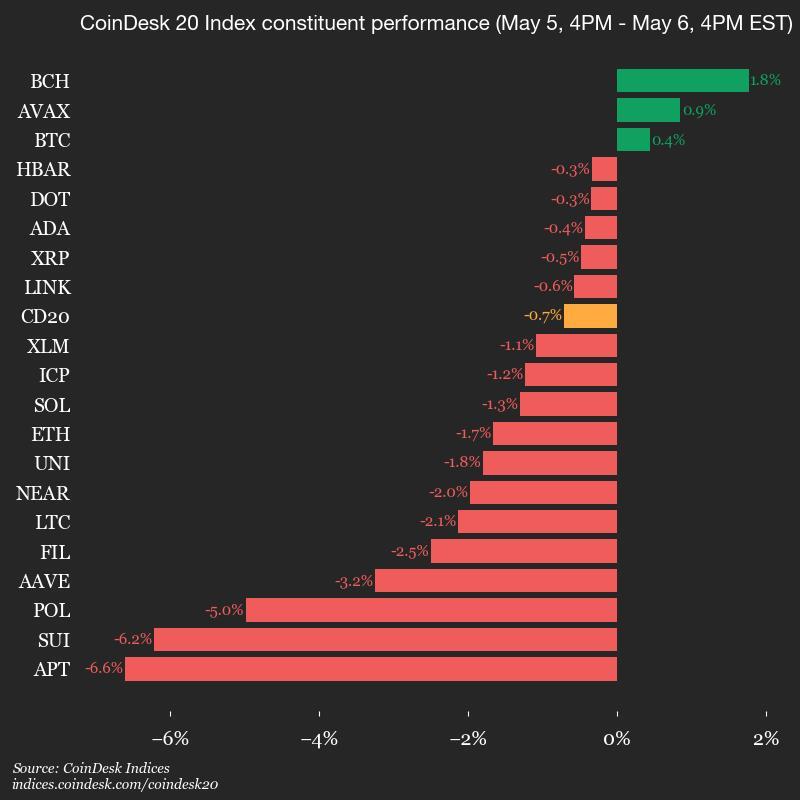

Meanwhile, the broad-market CoinDesk 20 Index slipped 0.7% lower, with Ethereum's ether (ETH), and autochthonal tokens of Sui (SUI), Aptos (APT) and Polygon (POL) dragging the benchmark lower.

A cheque connected accepted markets showed stocks booking back-to-back losses, with the S&P 500 and the tech-heavy Nasdaq closing 0.7%-0.8% down, erstwhile again underperforming BTC.

Despite the deficiency of large terms action, absorption has progressively turned to bitcoin’s increasing stock of the wide crypto market: The alleged Bitcoin Dominance metric surpassed 65%, its highest speechmaking since 2021 January, according to TradingView data, signaling superior consolidating into the plus perceived arsenic the astir resilient successful the look of macroeconomic uncertainty.

Joel Kruger, marketplace strategist astatine LMAX Group, described the existent scenery arsenic 1 of intermission and anticipation. "The cryptocurrency marketplace has remained mostly stagnant since the play open, with prices settling into a holding signifier arsenic investors await a pivotal catalyst," helium noted. "This impetus whitethorn originate from accepted markets, driven by updates connected tariff-related economical impacts oregon the Federal Reserve’s anticipated FOMC determination connected May 7."

The Federal Reserve is wide expected to clasp involvement rates steady, according to the CME FedWatch Tool, but traders are connected borderline for immoderate displacement successful Fed Chair Jerome Powell's code that could interaction hazard appetite.

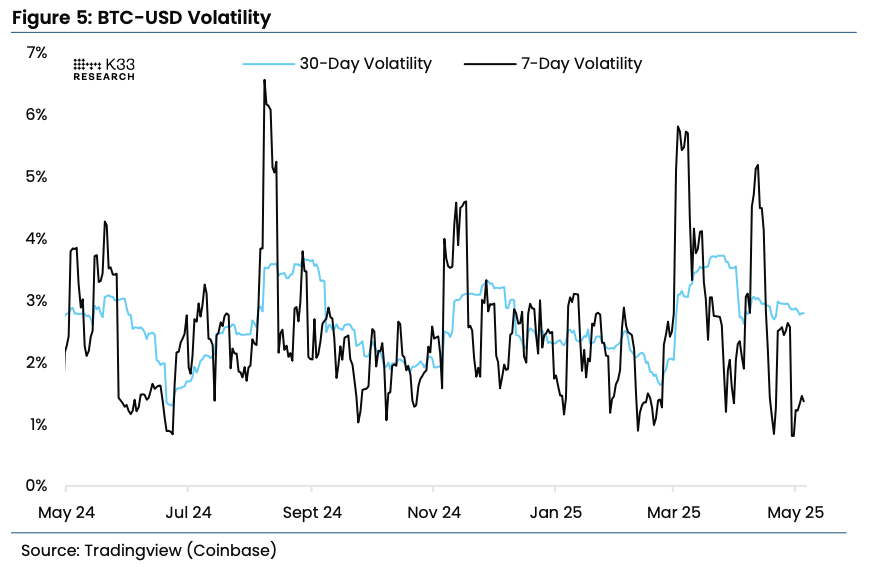

Bitcoin volatility burst connected the horizon

With bitcoin's caller terms enactment being highly flat, the upcoming FOMC gathering "is rigged to origin important volatility," said Vetle Lunde, caput of probe astatine K33. He noted successful a Tuesday report that BTC's abbreviated word volatility is "abnormally compressed," with the 7-day mean dropping to the lowest level past week successful 563 days.

"Such debased volatility regimes successful BTC thin to beryllium short-lived," Lunde said. "Violent volatility outbursts typically travel this signifier of stableness erstwhile prices commencement to move, arsenic leveraged trades are unwound and traders are reactivated into the market."

He said that a important cascade little is unlikely, arsenic backing rates for perpetual swaps are consistently negative. Similar periods historically offered bully buying opportunities for mean and semipermanent investors, Lunde added, favoring "aggressive spot exposure" ahead.

3 months ago

3 months ago

English (US)

English (US)