Bitcoin’s (BTC) dip beneath $29,000 successful aboriginal trading hours resulted successful liquidations totaling astir $160 cardinal crossed the cryptocurrency market.

Coinglass data revealed $48 cardinal successful liquidation for investors holding positions successful the flagship asset, chiefly affecting agelong traders who incurred astir of the losses.

$160 cardinal liquidated

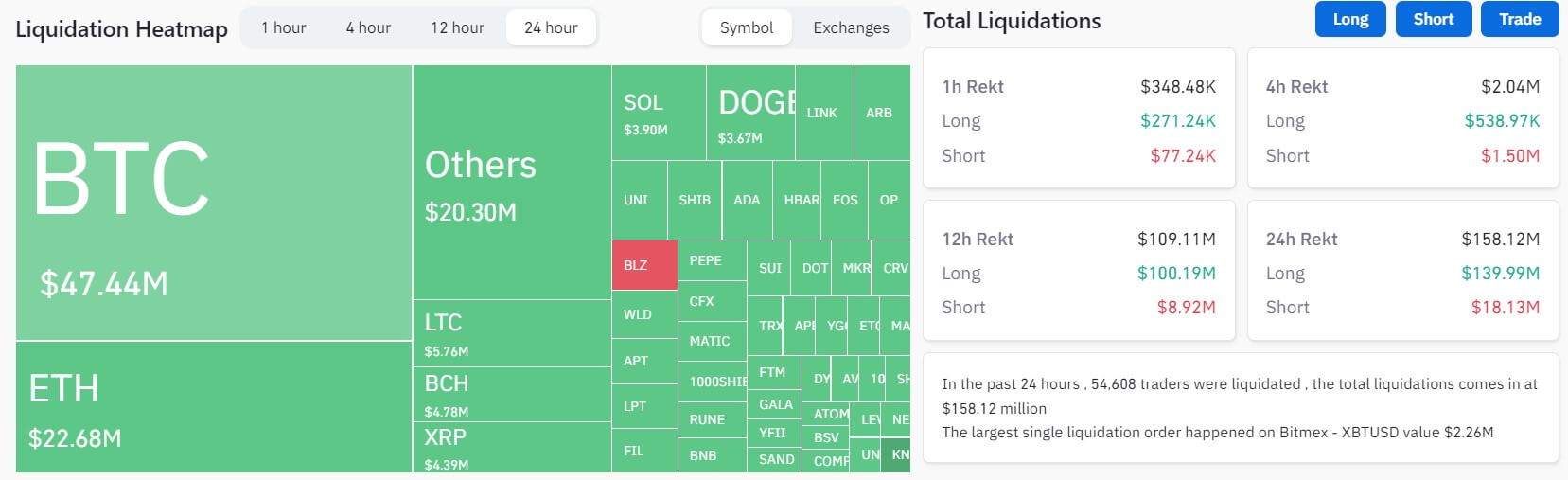

In the past 24 hours, the cryptocurrency marketplace witnessed a important liquidation of $158.12 million, with 54,608 traders liquidated.

Source: Coinglass

Source: CoinglassAccording to Coinglass data, astir losses were borne by agelong traders, who mislaid astir $140 million. Bitcoin and Ethereum (ETH) contributed importantly to this figure, accounting for a combined nonaccomplishment of $62.67 million. On the different hand, abbreviated traders recorded losses lesser than $20 million.

Across exchanges, implicit 60% of the full liquidations were connected OKX and Binance. During the reporting hours, traders connected these exchanges mislaid much than $100 million. Other exchanges similar Huobi, Deribit, and Bitmex besides recorded a sizeable magnitude of the full liquidations.

The azygous astir important liquidation occurred connected Bitmex, with an XBTUSD presumption valued astatine $2.26 million.

Bitcoin down to $28k

Earlier today, Bitcoin declined 2% to a multi-week debased of $28,428 aft trading supra $29,000 for an extended period.

CryptoSlate Insights attributed the drop-off to aggregate macroeconomic factors, including the U.S. treasury yields signaling its highest adjacent since June 2008 and the U.S. dollar scale rising supra 103. Per the report, these factors “create a challenging situation for Bitcoin” to thrive.

Market expert Willy Woo besides shared akin observations successful a caller station connected X (formerly Twitter). Woo said:

“Macro headwinds from US dollar strength. Meanwhile there’s expanding request connected futures marketplace (pro traders) and on-chain fundamentals picking up.”

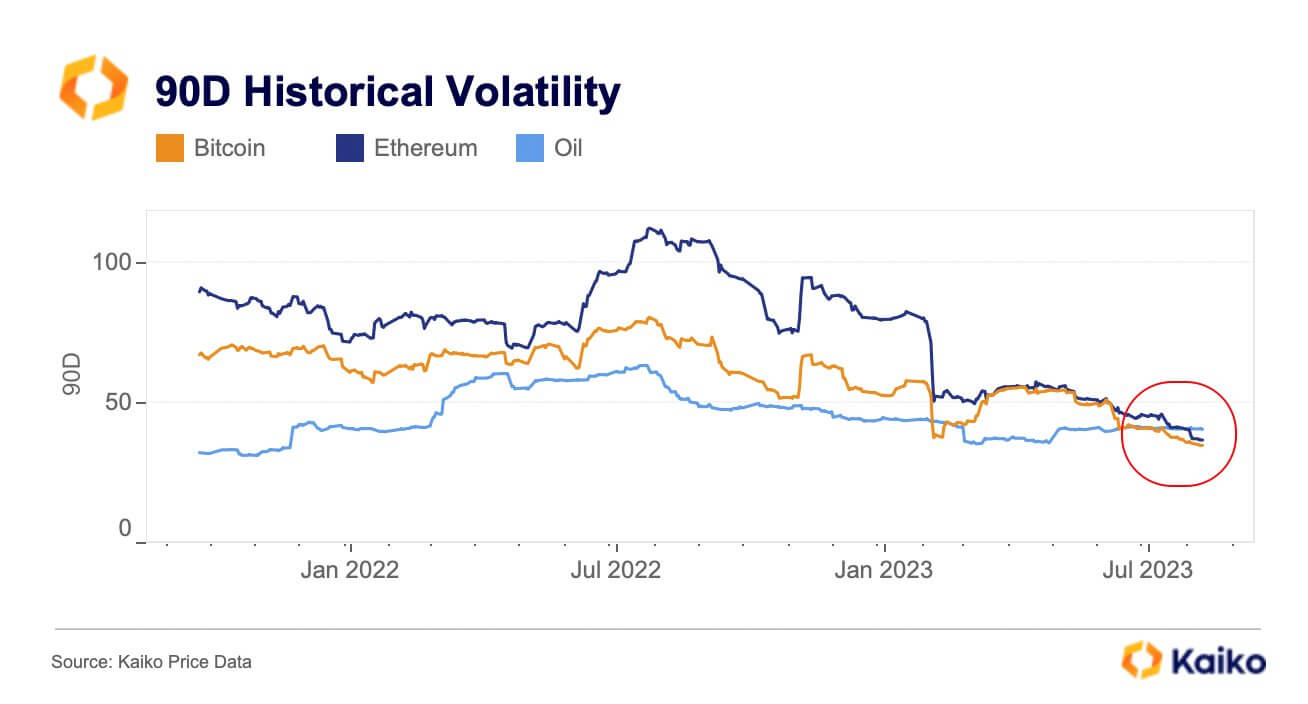

The abrupt terms question marks a notable displacement from the comparatively unchangeable show observed past month. On Aug. 16, blockchain analytical steadfast Kaiko stated that BTC’s and ETH’s 90-day volatility dropped to multi-year lows of 35% and 37% each, making them little volatile than lipid astatine 41%.

Source: Kaiko

Source: KaikoMeanwhile, information from CryptoSlate shows that each apical 50 crypto assets, including Ethereum and BNB, saw losses during the reporting play arsenic the broader marketplace plunged 1.83%.

The station Bitcoin dips beneath $29k sparking $160M liquidation successful crypto market appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)