By James Van Straten (All times ET unless indicated otherwise)

Bitcoin (BTC) has dropped 3% successful the past 24 hours and is presently immoderate 7% beneath its June 14 all-time high.

This raises the question of however overmuch further it mightiness drop. In the discourse of a continuing bull market, double-digit corrections are not unusual, with the largest drawdown reaching 30% since this rhythm began successful January 2023.

One method origin to support an oculus connected is the CME Bitcoin Futures spread betwixt $114,355 and $115,670. These gaps typically hap erstwhile terms question happens extracurricular of the CME's trading hours, mostly implicit weekends, and they often get filled aboriginal arsenic the terms revisits those levels.

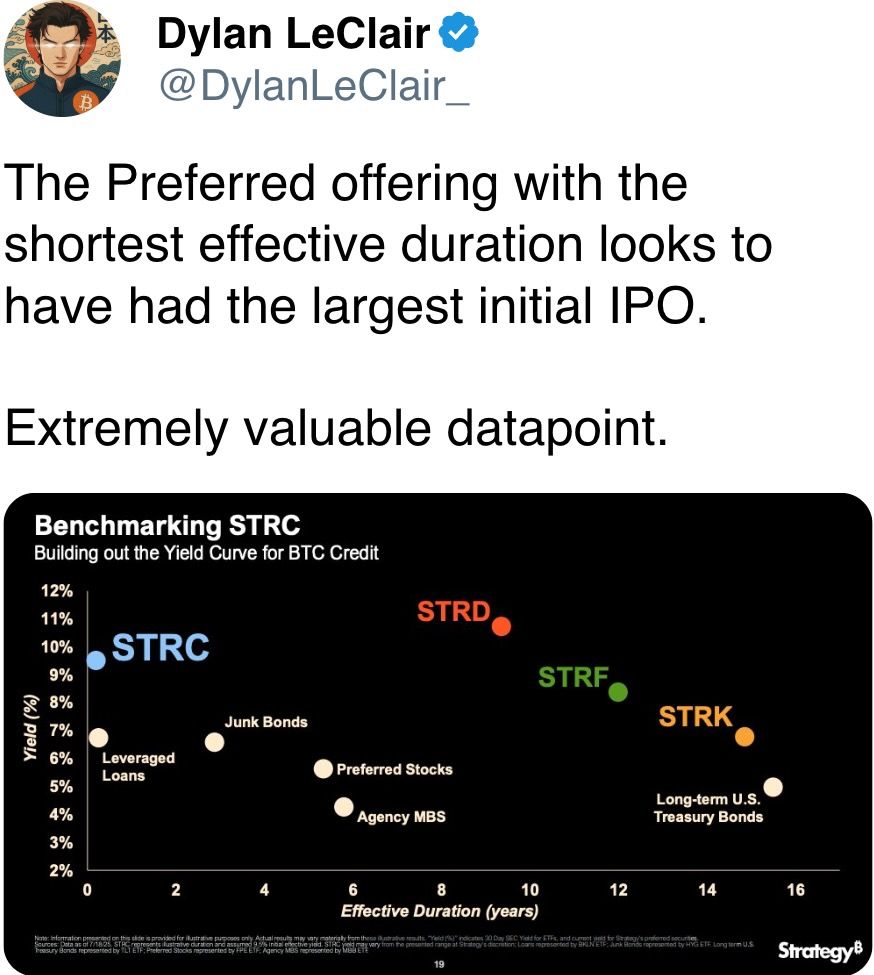

In different news, Strategy (MSTR) reportedly quadrupled the size of its Stretch (STRC) perpetual preferred banal sale. Analyst Brian Brookshire notes the offering includes 28 cardinal STRC shares. At $90 a pop, that totals implicit $2.5 cardinal and imaginable request for immoderate 21,500 BTC fixed a terms of $115,000.

Meantime, request already seems to beryllium outstripping supply, according to on-chain information from Glassnode. Since aboriginal this month, much than 210,000 BTC has been sold by semipermanent holders (those who've owned their BTC for longer than 155 days) and astir 250,000 BTC bought by short-term holders, the information shows.

With the month-end conscionable a week away, bitcoin is astir 8% higher than astatine the start. That's successful enactment with its humanities trend. On average, the largest cryptocurrency has returned astir 7% successful July since 2013.

Ether (ETH), for its part, has surged implicit 46% and is presently trading adjacent $3,725. This is the 3rd clip it's topped 40% since November. Interestingly, successful each the different months, it fell.

August is typically quieter, which often results successful little marketplace liquidity. Stay alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 connected mainnet.

- July 31, 12 p.m.: A unrecorded webinar featuring Bitwise CIO Matt Hougan and Bitzenship laminitis Aleesandro Palombo discussing bitcoin’s imaginable arsenic the adjacent planetary reserve currency amid de-dollarization trends. Registration link.

- Aug. 1: The Helium Network (HNT), present moving connected Solana, undergoes its halving event, cutting yearly caller token issuance to 7.5 cardinal HNT.

- Aug. 1: Hong Kong’s Stablecoins Ordinance takes effect, introducing a licensing authorities to modulate stablecoin activities successful the city.

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Macro

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured durable goods orders data.

- Durable Goods Orders MoM Est. -10.8% vs. Prev. 16.4%

- Durable Goods Orders Ex Defense MoM Prev. 15.5%

- Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.5%

- July 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases June unemployment complaint data.

- Aug. 1, 12:01 a.m.: New U.S. tariffs instrumentality effect connected imports from trading partners that failed to scope agreements by the July 9 deadline. These accrued duties could scope from 10% to arsenic precocious arsenic 70%, impacting a wide scope of goods.

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured durable goods orders data.

- Earnings (Estimates based connected FactSet data)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS), pre-market

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Coincheck Group (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting connected a proposal to merchantability its treasury of astir 16 cardinal GHST for astir 3.2 cardinal USDC to VC steadfast Rongming Investment , dissolve the DAO and administer funds to progressive members. The VC steadfast aims to standard Aavegotchi globally portion Pixelcraft retains IP ownership. Voting ends July 25.

- Lido DAO is voting connected a caller strategy that lets validator exits be triggered automatically done the execution layer, not conscionable by node operators. It includes tools for antithetic authorization pathways, exigency controls, and built‑in limits to forestall misuse. The update is expected to marque staking much decentralized, much unafraid and much responsive. Voting ends July 28.

- GnosisDAO is voting connected a connection to supply $30 cardinal a year, paid quarterly, to Gnosis Ltd., present a non-profit, to prolong its 150‑person squad gathering captious Gnosis Chain infrastructure, products (like Gnosis Pay and Circles), concern improvement and operations. Voting ends July 28.

- Aavegotchi DAO is voting on backing 3 caller features for the authoritative decentralized application: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- NEAR Protocol is voting connected potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators indispensable support the connection for it to pass, and if truthful it could beryllium implemented by precocious Q3. Voting ends Aug. 1.

- July 25: MEXC, Ethena and TON to big an X Spaces league on “Stablecoin for You & Me.”

- July 29, 10 a.m.: Ether.fi to big a bi-quarterly expert call.

- Unlocks

- July 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $28.77 million.

- July 31: Optimism (OP) to unlock 1.79% of its circulating proviso worthy $22.08 million.

- Aug. 1: Sui (SUI) to unlock 1.27% of its circulating proviso worthy $162.78 million.

- Aug. 2: Ethena (ENA) to unlock 0.64% of its circulating proviso worthy $22.29 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating proviso worthy $13.38 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating proviso worthy $53.27 million.

- Token Launches

- July 25: 5ireChain (5IRE), Aperture Finance (APTR), Ertha (ERTHA), Gummy (GUMMY), Pip (PIP), and Teleport System Token (TST) to beryllium delisted from Bybit.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- WWE fable Hulk Hogan died Thursday pursuing a cardiac arrest, triggering a question of tribute posts for the wrestler and a near-instant surge of branded memecoins connected Ethereum and Solana.

- The recently launched Wrapped ETH token “Hulkamania (HULK)” pumped implicit 122,000% wrong hours of deployment, peaking astatine $0.001335 and concisely hitting a seven-figure marketplace cap, according to DEXTools.

- On Solana, a memecoin named HULKAMANIA (HULK) — launched successful June 2024 — surged implicit 2,000% successful 24 hours, trading adjacent $0.0006146 with a revived marketplace headdress of $500,000.

- Despite the rally, the Solana-based HULK is inactive acold beneath its $18.8 cardinal all-time precocious from past year, which followed a now-deleted promotional tweet from Hogan’s authoritative X account.

- Hogan, astatine the time, claimed the station wasn’t made by him.

- None of the existent HULK tokens are officially affiliated with Hogan’s property oregon marque and aggregate copycat versions person already vanished from the DEX landscape, suggesting they are apt rug pulls and honeypots.

- Hogan joins a increasing database of celebrities whose posthumous memecoins spot accelerated speculative inflows, often fueled by nostalgia, daze and societal media virality earlier liquidity drains arsenic accelerated arsenic it arrives.

- It's worthy remembering that tribute memecoins connection nary legitimacy, nary roadmap and nary protections contempt often being the fastest-moving tokens connected DEX platforms during news-driven spikes.

Derivatives Positioning

- Open involvement (OI) for bitcoin crossed apical derivatives venues remains astatine each clip highs.

- According to Velo, OI presently sits astatine $34.1 billion. Binance inactive leads with $14.2 cardinal unfastened involvement followed by Bybit astatine $9.5 billion.

- Three-month annualized ground for BTC is astatine 6.3%, dropping disconnected from 9% earlier successful the week.

- In presumption of perpetual volumes, ETH volumes presently transcend BTC volumes astatine 140.6 cardinal versus 121.4 cardinal respectively, arsenic per Coinglass.

- Bitcoin put-call measurement presently stands astatine 44,600 contracts, with calls accounting for 52% of the total, according to Velo. Options OI for bitcoin is conscionable nether each clip highs astatine $83.5 billion, according to Coinglass.

- Ether, connected the different hand, presently has 196,400 put-call declaration measurement with 54% being calls. Open involvement is presently astatine $9.6 billion, beneath the March 2024 all-time precocious of $14.8 billion.

- Funding complaint APRs for BTC are muted crossed astir venues but Hyperliquid, wherever the complaint presently is astatine 90% annualized funding. This is good supra altcoins specified arsenic SOL and HYPE, which presently amusement an annualized backing of 10% and 32%, respectively, arsenic per Coinglass.

Market Movements

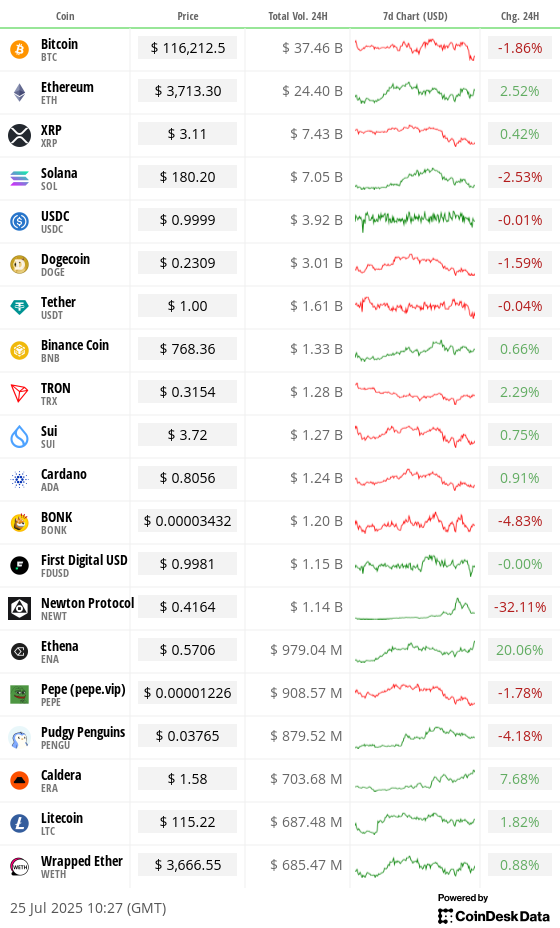

- BTC is down 2.39% from 4 p.m. ET Thursday astatine $115,912.54 (24hrs: -1.99%)

- ETH is down 0.41% astatine $3,721.30 (24hrs: +2.54%)

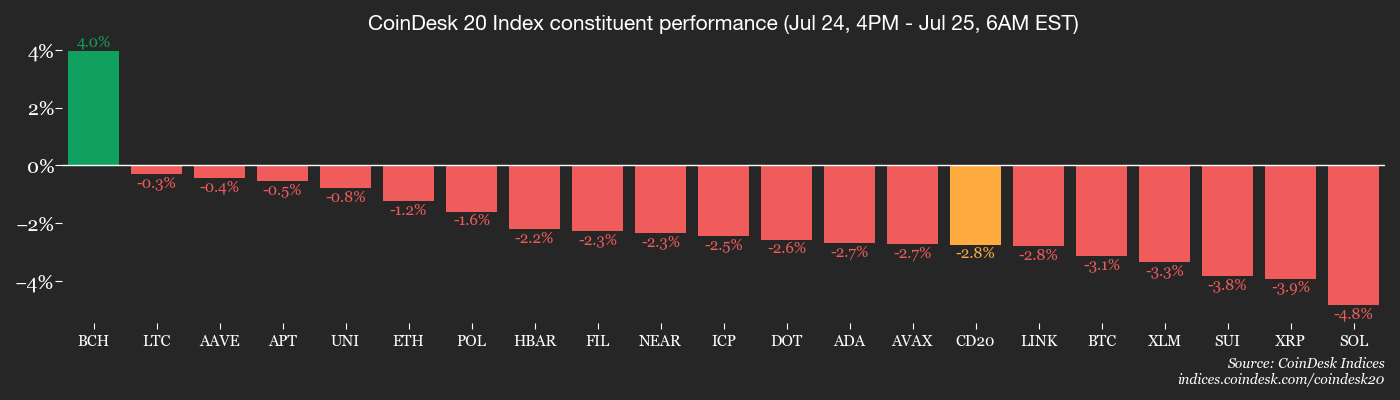

- CoinDesk 20 is down 1.94% astatine 3,940.10 (24hrs: +0.64%)

- Ether CESR Composite Staking Rate is up 1 bp astatine 2.96%

- BTC backing complaint is astatine 0.0367% (40.1865% annualized) connected KuCoin

- DXY is up 0.32% astatine 97.68

- Gold futures are down 0.72% astatine $3,349.30

- Silver futures are down 0.34% astatine $39.09

- Nikkei 225 closed down 0.88% astatine 41,456.23

- Hang Seng closed down 1.09% astatine 25,388.35

- FTSE is down 0.29% astatine 9,112.22

- Euro Stoxx 50 is down 0.15% astatine 5,347.34

- DJIA closed connected Thursday down 0.70% astatine 44,693.91

- S&P 500 closed unchanged astatine 6,363.35

- Nasdaq Composite closed up 0.18% astatine 21,057.96

- S&P/TSX Composite closed down 0.16% astatine 27,372.26

- S&P 40 Latin America closed down 0.44% astatine 2,627.58

- U.S. 10-Year Treasury complaint is up 1.2 bps astatine 4.42%

- E-mini S&P 500 futures are unchanged astatine 6,407.00

- E-mini Nasdaq-100 futures are unchanged astatine 23,374.00

- E-mini Dow Jones Industrial Average Index are up 0.13% astatine 44,956.00

Bitcoin Stats

- BTC Dominance: 61.46% (-0.58%)

- Ether-bitcoin ratio: 0.03184 (1.65%)

- Hashrate (seven-day moving average): 914 EH/s

- Hashprice (spot): $59.04

- Total fees: 9.82 BTC / $1,166,840

- CME Futures Open Interest: 147,320 BTC

- BTC priced successful gold: 34.4 oz.

- BTC vs golden marketplace cap: 9.66%

Technical Analysis

- Ethena's ENA has been 1 of the strongest performers successful the market, pursuing the announcement of StablecoinX, a SPAC that has raised $360 cardinal to get ENA arsenic treasury holdings.

- On the regular timeframe, ENA has breached its downtrend and retested the erstwhile absorption astatine $0.45.

- This bullish communicative is further supported by the confluence of reclaiming Monday’s debased and the 50-day exponential moving mean connected the play chart.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $414.92 (+0.55%), -2.44% astatine $404.79 successful pre-market

- Coinbase Global (COIN): closed astatine $396.7 (-0.28%), -1.75% astatine $389.74

- Circle (CRCL): closed astatine $193.08 (-4.61%), -0.64% astatine $191.84

- Galaxy Digital (GLXY): closed astatine $31.89 (+2.77%), -4.2% astatine $30.55

- MARA Holdings (MARA): closed astatine $17.26 (-1.76%), -2.95% astatine $16.75

- Riot Platforms (RIOT): closed astatine $14.69 (+2.44%), -2.59% astatine $14.31

- Core Scientific (CORZ): closed astatine $13.69 (+1.48%), unchanged successful pre-market

- CleanSpark (CLSK): closed astatine $12.34 (-0.88%), -2.35% astatine $12.05

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $27.11 (-0.84%)

- Semler Scientific (SMLR): closed astatine $38.89 (-1.09%), -3.57% astatine $37.5

- Exodus Movement (EXOD): closed astatine $33.61 (-1.75%), +3.01% astatine $34.62

- SharpLink Gaming (SBET): closed astatine $23.32 (-9.65%), +2.44% astatine $23.89

ETF Flows

Spot BTC ETFs

- Daily nett flows: $226.7 million

- Cumulative nett flows: $54.67 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

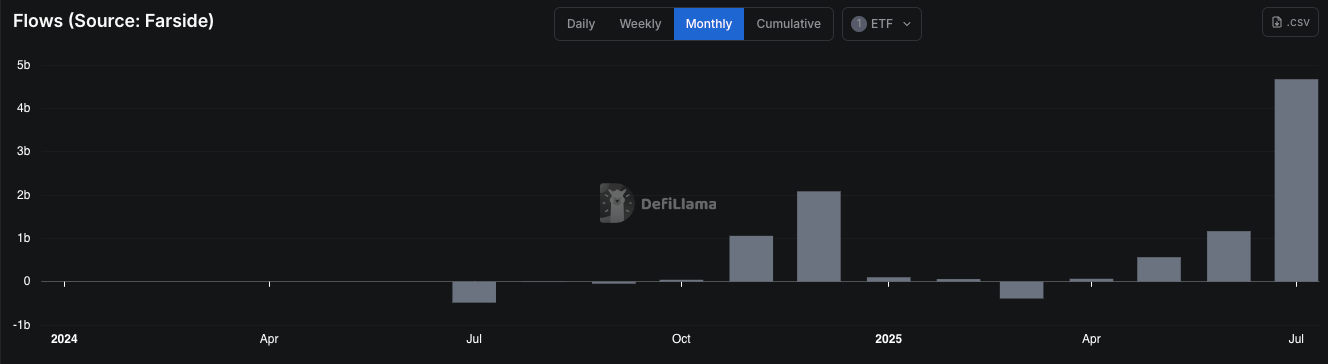

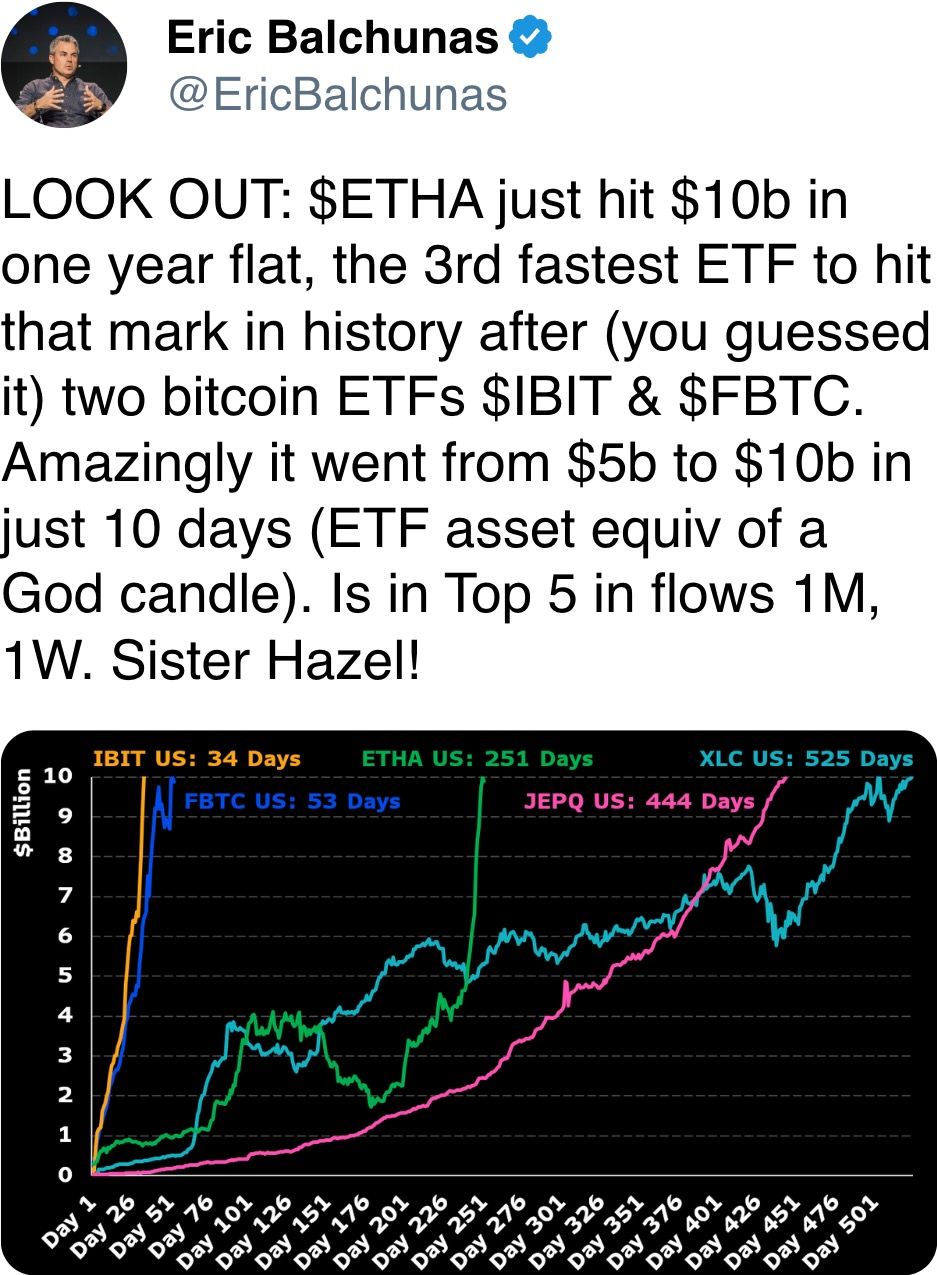

- Daily nett flows: $231.2 million

- Cumulative nett flows: $8.9 billion

- Total ETH holdings ~5.34 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Spot ether ETFs successful the U.S. person recorded $4.67 cardinal successful nett inflows successful July alone, surpassing the full cumulative nett inflows of $4.23 cardinal accumulated from inception done June.

While You Were Sleeping

- Trump’s Tariffs Are Being Picked Up by Corporate America (The Wall Street Journal): American companies are mostly delaying terms hikes and absorbing tariff costs for present arsenic overseas sellers connection constricted alleviation and President Trump’s commercialized deals adhd uncertainty implicit who yet pays.

- Iran Starts New Talks Today Over Its Nuclear Program. Here’s What to Know. (The New York Times): European officials resumed talks with Iran successful Istanbul, informing they’ll reconstruct suspended U.N. sanctions by the extremity of adjacent period if Tehran doesn’t reengage with the U.S. and curb uranium enrichment.

- Bitcoin to Hit $135K by Year-End successful Base-Case Forecast, $199K successful Bullish Scenario: Citi (CoinDesk): In the bank's astir bearish setup, the forecast drops to $64,000.

- Companies Load Up connected Niche Crypto Tokens to Boost Share Prices (Financial Times): Some nationalist companies are turning to altcoin treasuries to differentiate and boost valuation. Analysts accidental this speculative inclination offers nary semipermanent solution for firms already facing fiscal distress.

- Volmex's Bitcoin and Ether Volatility Futures Top $10M Volume Since Debut arsenic Traders Look Beyond Price (CoinDesk): Traders are utilizing these precocious launched products connected the decentralized level to explicit views connected marketplace turbulence without taking a directional stance connected BTC/ETH prices oregon managing analyzable enactment strategies.

- Digital Assets Firm OSL Raises $300 Million to Expand Crypto Business Worldwide (Bloomberg): As Hong Kong awaits its stablecoin instrumentality taking effect Aug. 1, the CFO of 1 of its earliest licensed exchanges says the caller backing volition enactment a broader propulsion into overseas integer plus markets.

In the Ether

3 months ago

3 months ago

English (US)

English (US)