Bitcoin (BTC) is astatine 17-month highs with conscionable 164 days until the adjacent Bitcoin halving event, alongside anticipation of a spot Bitcoin exchange-traded money (ETF) approval successful the coming months.

Yet, amid Bitcoin’s 106.38% year-to-date gains, the stablecoin proviso complaint oscillator (SSRO) has raised a large emblem contempt suggesting the opening of a caller bull cycle.

Stablecoin buying powerfulness weakens up of Bitcoin ETF

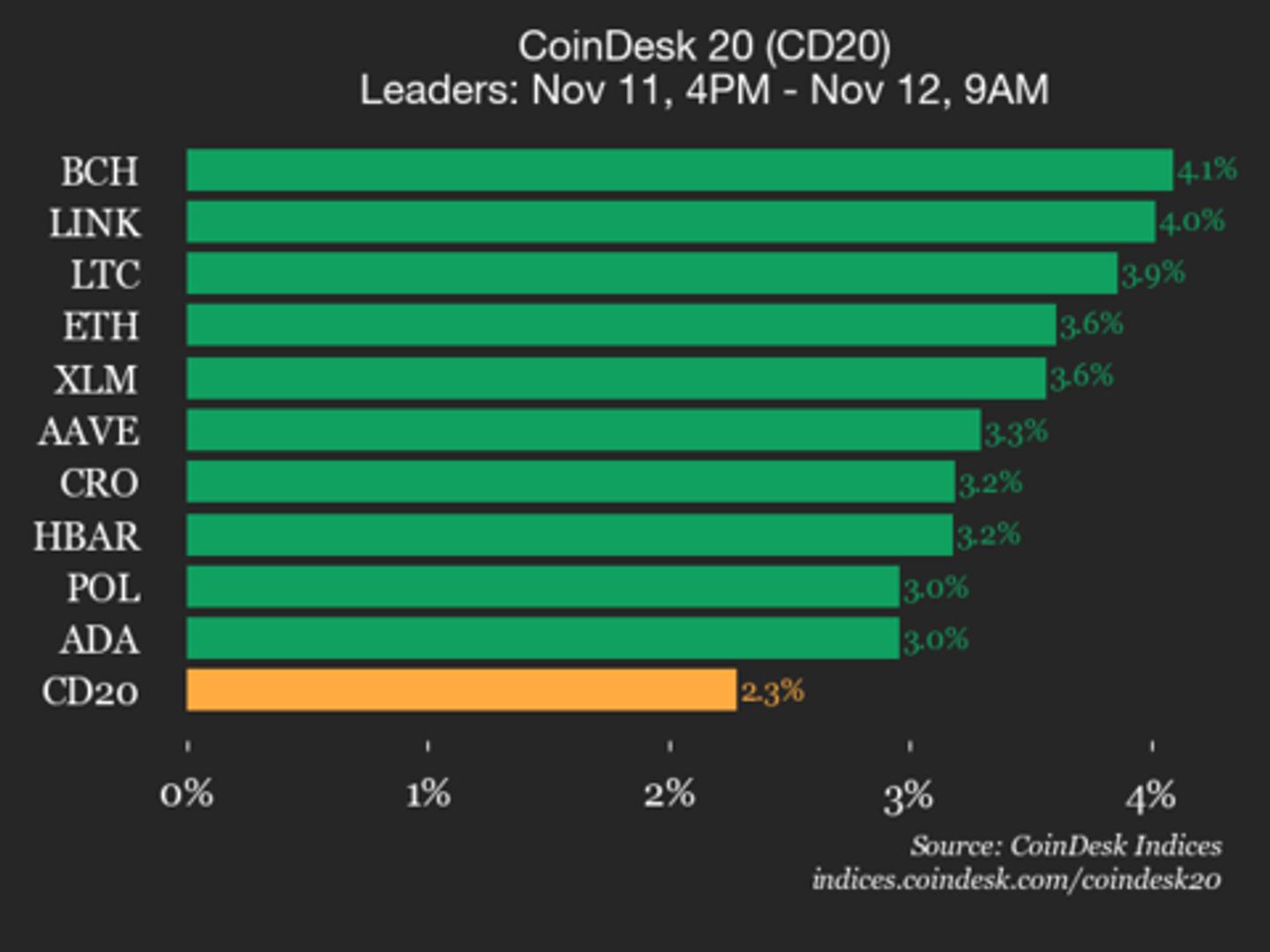

This stablecoin proviso ratio metric, which acts arsenic an important measurement of the dominance of stablecoins vs. Bitcoin, has surged to a caller all-time precocious astatine 4.13 connected Oct. 25, according to information from Glassnode. Such a surge hints astatine a important appetite for Bitcoin accumulation on-chain.

The SSRO deed a caller all-time precocious astatine 4.13 connected Oct. 25. Source: Glassnode

The SSRO deed a caller all-time precocious astatine 4.13 connected Oct. 25. Source: GlassnodeHowever, this besides suggests that the purchasing powerfulness of stablecoins is astatine a comparative all-time low.

Historically, this is the highest SSRO divergence since 2019, erstwhile it rocketed up to 4.12 connected June 26 — precisely 320 days earlier the May 2020 halving.

The emergence of this aforesaid apical awesome connected the SSRO this week could, therefore, precede a retracement play earlier the adjacent halving lawsuit successful April 2024.

Nevertheless, portion the comparative buying powerfulness is presently anemic — and a section apical similar the 1 successful 2019 is surely imaginable — the larger accusation is that precocious SSRO levels person besides aligned with the start of bigger bull marketplace cycles.

“Reserve risk” suggests this BTC rally whitethorn beryllium different

As a imaginable spot Bitcoin ETF support tantalizes markets with implications for BTC’s price, 1 metric is coating a unsocial representation of marketplace sentiment, suggesting this Bitcoin rally could beryllium antithetic from 2019.

Namely, the reserve hazard (RR) indicator, which measures the risk-reward incentives successful narration to the existent “HODL bank” and spot BTC price. As Glassnode puts it:

When assurance is precocious and terms is low, determination is an charismatic risk/reward to put (Reserve Risk is low). When assurance is debased and terms is precocious past risk/reward is unattractive astatine that clip (Reserve Risk is high)." The RR indicator measures the risk-reward incentives successful narration to the existent “HODL bank” and spot BTC price. Source: Glassnode

The RR indicator measures the risk-reward incentives successful narration to the existent “HODL bank” and spot BTC price. Source: GlassnodeWhen the SSRO accelerated to likewise precocious levels successful June 2019, the RR followed suit, climbing supra the greenish band, arsenic shown successful the illustration above.

Yet, amid the existent record-high SSRO reading, the RR is inactive astatine multiyear lows astatine the bottommost of the greenish band. Historically, buying Bitcoin erstwhile the RR is astatine specified debased levels (i.e., ample hodl slope comparative to existent BTC price) has produced outsized returns.

It besides implies that contempt the Bitcoin terms sitting astatine 17-month highs, assurance remains precise precocious successful Bitcoin’s aboriginal terms performance.

Thus, semipermanent holders whitethorn beryllium well-positioned for large gains, considering these entities control an all-time high of the full supply.

Factor successful the imaginable multibillion-dollar inflows into a Bitcoin ETF, and it’s casual to spot wherefore six-figure BTC terms predictions are becoming communal for the post-halving period.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)