If you program to disconnect from trading screens this weekend, deliberation twice. Analysis from integer assets trading steadfast STS Digital suggests that Friday's White House crypto acme could pb to heightened activity.

U.S. President Donald Trump, who promised a strategical crypto reserve successful the lead-up to the November election, will big apical players from the industry, including Coinbase, Chainlink and Exodus.

The latest rumor suggests that astatine the summit, Trump whitethorn denote the instauration of a strategical bitcoin (BTC) reserve, shifting distant from the Sunday disclosure that hinted astatine the handbasket of altcoins similar XRP, Cardano"s ADA and Solana (SOL) on with BTC and ether (ETH) arsenic the core.

The pricing of BTC, ETH and SOL options connected Deribit suggests traders are bracing for a volatile play successful the aftermath of the summit.

"Options markets are showing the nerves (and illiquidity) going into the play and the raft of potentials. The Friday vs Saturday IV [implied volatility] Spread is astir 25 vols wide crossed the committee with Friday expiries missing the expected variance," Jeff Anderson, caput of Asia astatine STS Digital, told CoinDesk.

Implied volatility, a metric derived from the pricing of options, indicates however overmuch traders expect the asset's terms to fluctuate implicit a circumstantial period. Options are derivative contracts that springiness the purchaser the close to bargain oregon merchantability the underlying plus astatine a predetermined terms astatine a aboriginal date.

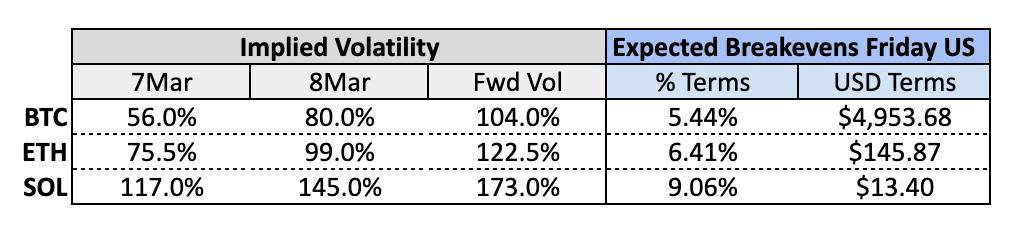

Early Thursday, bitcoin options expiring Friday suggested an annualized implied volatility of 56%, portion those expiring connected Saturday traded astatine 80% volatility. The 24-point spread indicates expectations for accrued terms turbulence pursuing Friday's summit.

A akin signifier was seen successful ether and solana options.

The array shows implied and guardant volatilities for BTC, ETH, and SOL and straddle breakevens (expected terms swings).

Forward volatility is calculated by comparing the implied volatility of options with antithetic maturities and indicates the expected volatility implicit the play betwixt the 2 specified expiration dates, successful this case, Friday and Saturday.

The 105% BTC guardant volatility translates to a 5.5% terms question expected betwixt Friday 08:00 UTC and Saturday 08:00 UTC. (Deribit options expire astatine 08:00 UTC).

In different words, BTC could plaything astir $5K successful either absorption pursuing the summit. ETH and SOL volatilities are pricing a determination of $135 and $13, respectively.

Per Anderson, expectations for ample volatility often extremity up successful disappointment.

"Quite often, ample expected volatility similar this is simply a disappointment successful crypto arsenic expectations > reality. That said, the breakevens bash not consciousness ample and options are by acold the safest play for directional views successful this environment," Anderson said, pointing to risks progressive successful taking directional bets successful options expiring Mar. 14.

"We would expect enactment prices further retired successful tenor to travel little aft the lawsuit arsenic fears subside and volatility decays," Anderson noted.

8 months ago

8 months ago

English (US)

English (US)