Bitcoin’s (BTC) correlation with the Nasdaq sank to 3% successful June, according to information from Kaiko – indicating diverging sentiment betwixt cryptocurrencies and tech stocks.

The price-performance for the starring cryptocurrency successful June was betwixt $24,800 and $31,360, opening the period astatine $27,200.

BlackRock’s spot Bitcoin ETF filing connected June 15 was a bullish catalyst, reversing the anterior downtrend to a caller year-to-date precocious of $31,440 immoderate 8 days later.

Since then, Bitcoin has been trading successful a constrictive set betwixt $29,860 and $31,030 – falling 3% since its YTD precocious connected June 23.

Source: BTCUSD connected TradingView.com

Source: BTCUSD connected TradingView.comMeanwhile, the tech-heavy Nasdaq 100 has been successful a continuous uptrend since the commencement of the twelvemonth – reaching a YTD precocious of $15,230 connected June 16. Since Bitcoin’s year-to-date precocious connected June 23, the Nasdaq has risen 0.7%.

Source: NDX connected TradingView.com

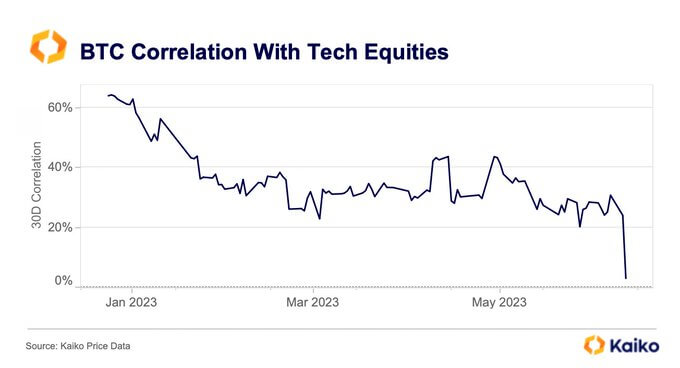

Source: NDX connected TradingView.comOn a 30-day basis, the Bitcoin-Nasdaq correlation started the twelvemonth astatine 60% and slipped to 22% by March, indicating a alteration successful the similarity of terms movements betwixt the two. This play of alteration consolidated somewhat, with the correlation struggling to emergence supra 45%.

The Bitcoin-Nasdaq correlation has continued to determination little passim the year, dropping sharply to 3% this week from implicit 20% successful May.

Source: @KaikoData connected Twitter.com

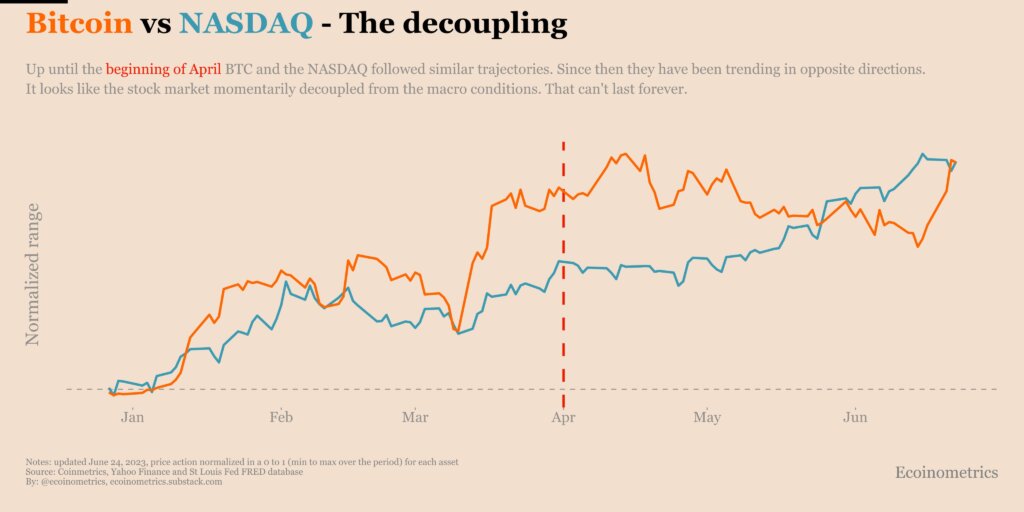

Source: @KaikoData connected Twitter.comData probe steadfast Ecoinometrics published a illustration of Bitcoin-Nasdaq scope movements from the commencement of the twelvemonth to June 24. It showed a akin inclination betwixt the 2 until April, aft which a “nice decoupling” occurred.

Ecoinometrics further commented that the Nasdaq’s show is disconnected from the broader macroeconomic scenery – implying an uptrend reversal is connected the cards.

“But this carnivore marketplace rally for stocks cannot flight the bleak macro representation forever.“

Source: @ecoinometrics connected Twitter.com

Source: @ecoinometrics connected Twitter.comThe station Bitcoin correlation to Nasdaq sinks to 3% debased successful June appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)