While Bitcoin is often considered a hedge against inflation, it does person a affirmative inflation rate of 0.83%. Bitcoin’s ostentation is highly debased compared to the dollar’s highest of 9.1% successful 2022. However, erstwhile we comparison the cumulative ostentation complaint for some Bitcoin and the US dollar, we spot the existent spot of Bitcoin’s relation successful preserving wealth.

From 2020 to 2025, Bitcoin roseate astir 960%, whereas the US Dollar Index (DXY), which measures the US dollar against a handbasket of different currencies, roseate conscionable 12% successful nominal terms.

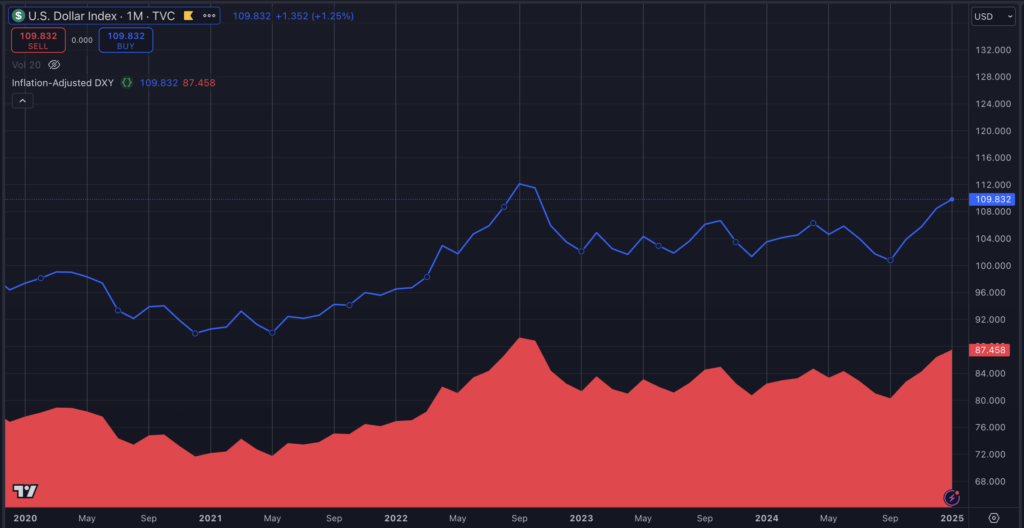

Bitcoin’s inflation-adjusted terms and the DXY, normalized for inflation, supply captious insights into the existent worth dynamics of some assets. While the nominal DXY reflects comparative currency strength, its inflation-adjusted worth highlights the ongoing erosion of purchasing power.

The nominal DXY presently stands astatine 109.8, reflecting planetary request for the dollar amid macroeconomic uncertainty. However, erstwhile adjusted for cumulative US ostentation since 2020—averaging implicit 2% annually and peaking supra 8% successful 2022—the existent worth of the DXY drops to 87.5. This represents a 22.3-point difference, oregon astir 20.3% of the nominal value, illustrating the dollar’s important nonaccomplishment of purchasing powerfulness implicit clip contempt its comparative spot against different currencies.

DXY adjusted for ostentation (Source: TradingView)

DXY adjusted for ostentation (Source: TradingView)Bitcoin’s nominal price, meanwhile, is astir $91,000. Adjusted for its debased proviso inflation—1.74% annually from 2020–2024 and 0.83% successful 2025—its inflation-adjusted terms stands astatine astir $84,365. The $6,635 quality represents lone 7.3% of its nominal value, stressing Bitcoin’s comparative stableness and quality to sphere purchasing powerfulness implicit clip compared to fiat currencies. This smaller accommodation highlights Bitcoin’s programmed scarcity and debased ostentation arsenic cardinal factors successful its resilience.

BTC adjusted for ostentation (Source: TradingView)

BTC adjusted for ostentation (Source: TradingView)The divergence betwixt the inflation-adjusted metrics for the DXY and Bitcoin emphasizes a broader narrative. While fiat currencies similar the dollar look important devaluation owed to inflation, Bitcoin’s controlled proviso forces presumption it arsenic a hedge against currency debasement. The much pronounced inflationary interaction connected the DXY emphasizes the situation of maintaining purchasing powerfulness successful a fiat system, peculiarly during periods of precocious inflation.

The quality betwixt nominal and inflation-adjusted metrics is captious for evaluating the semipermanent worth of assets. The DXY’s nominal spot masks the cardinal erosion of the dollar’s purchasing power, portion Bitcoin’s inflation-adjusted terms reflects its quality to support worth implicit time. These insights reenforce the value of inflation-adjusted analyses successful processing effectual strategies for navigating the macroeconomic landscape.

Further, the ostentation of examination currencies utilized to found the DXY should besides beryllium considered to place the precise divergence. However, the supra figures springiness a ballpark appraisal of Bitcoin’s elevated spot against the dollar beyond nominal terms.

Simply put, if you invested $100 successful Bitcoin successful 2020 and $100 successful DXY today, your BTC would person a buying powerfulness of $927, portion your DXY would beryllium equivalent to $91 successful existent terms.

The station Bitcoin compound ostentation of 7% since 2020 canceled retired by 900% gains portion USD declines 20% appeared archetypal connected CryptoSlate.

8 months ago

8 months ago

English (US)

English (US)