The premium successful bitcoin (BTC) futures listed connected the planetary derivatives elephantine Chicago Mercantile Exchange (CME) has narrowed sharply, a motion of reduced organization appetite.

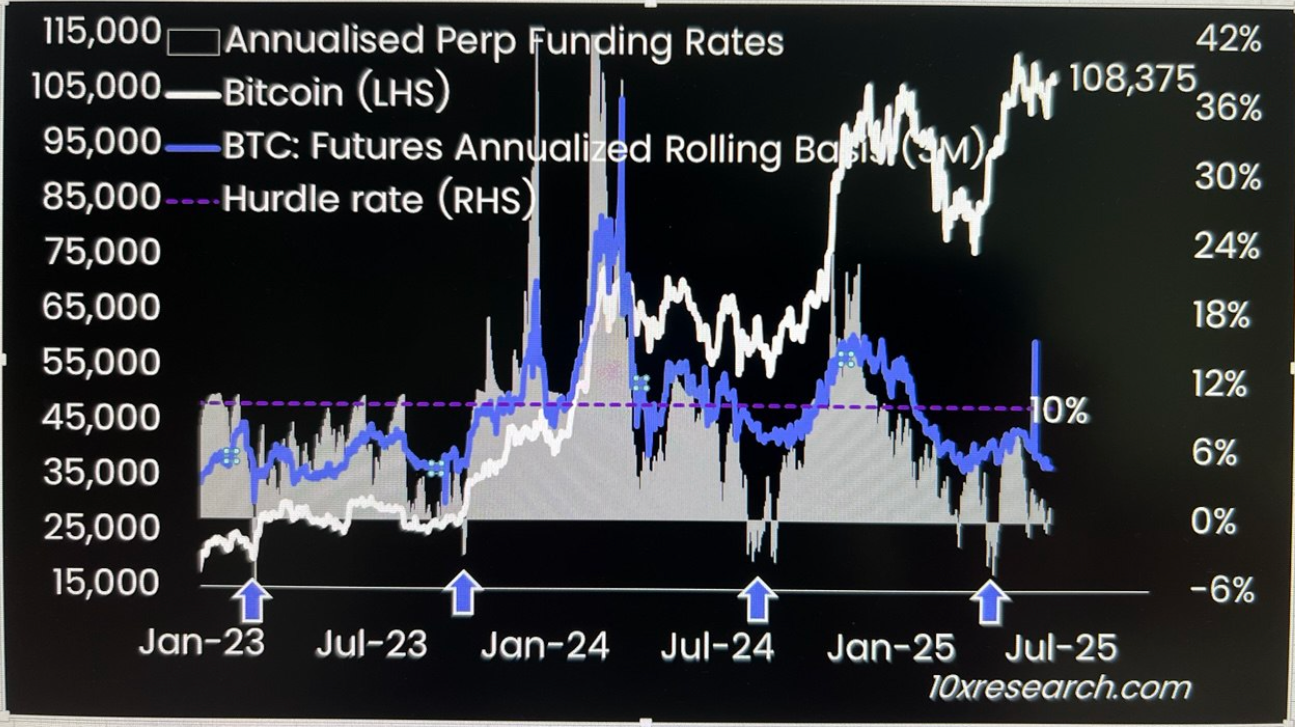

The annualized premium successful rolling three-month futures has dropped to 4.3%, the lowest since October 2023, according to information tracked by 10x Research. That's down importantly from highs supra 10% seen aboriginal this year.

The diminution successful the alleged basis, contempt BTC's terms holding dependable supra $100,000, indicates fading optimism oregon uncertainty astir aboriginal terms prospects.

The driblet is accordant with the descent successful the backing rates successful perpetual futures listed connected large offshore exchanges. According to 10x, backing rates precocious flipped negative, suggesting a discount successful perpetual futures comparative to the spot price, which is besides a motion of bias for bearish abbreviated positions.

The dwindling terms differential is simply a setback for those seeking to prosecute the non-directional cash-and-carry arbitrage, which involves simultaneously purchasing spot ETFs (or really BTC) and shorting the CME futures.

"When output spreads autumn beneath a 10% hurdle rate, Bitcoin ETF inflows are typically driven by directional investors alternatively than arbitrage-focused hedge funds. This dynamic often coincides with terms consolidation. Currently, these spreads are down to 1.0% (perpetual futures backing rate) and 4.3% (CME ground rate), indicating a important diminution successful hedge money arbitrage activity," Markus Thielen, laminitis of 10x Research, told CoinDesk.

Thielen added that the drop-off coincides with muted retail participation, arsenic indicated by depressed perpetual backing rates and debased spot marketplace volumes.

Padalan Capital voiced a akin sentiment successful a weekly update, calling the diminution successful backing rates a motion of retrenchment successful speculative interest.

"A much acute awesome of risk-off positioning comes from regulated venues, wherever the CME-to-spot ground for some Bitcoin and Ethereum has inverted into profoundly antagonistic territory, indicating assertive organization hedging oregon a important unwind of cash-and-carry structures.," Padalan Capital noted.

4 months ago

4 months ago

English (US)

English (US)