As Bitcoin’s marketplace headdress rises, comparing Bitcoin’s terms to that of golden becomes progressively relevant. This examination is embodied successful the BTC/GOLD ratio, a metric that divides the terms of Bitcoin by the terms of golden per ounce.

The value of the ratio lies successful its quality to bespeak shifts successful capitalist penchant and marketplace dynamics. A rising ratio suggests a increasing penchant for Bitcoin implicit gold, often reflecting capitalist assurance successful Bitcoin arsenic a hard plus and a hedge against inflation. Conversely, a declining ratio tin awesome accrued assurance successful golden oregon a cautious attack towards integer currencies.

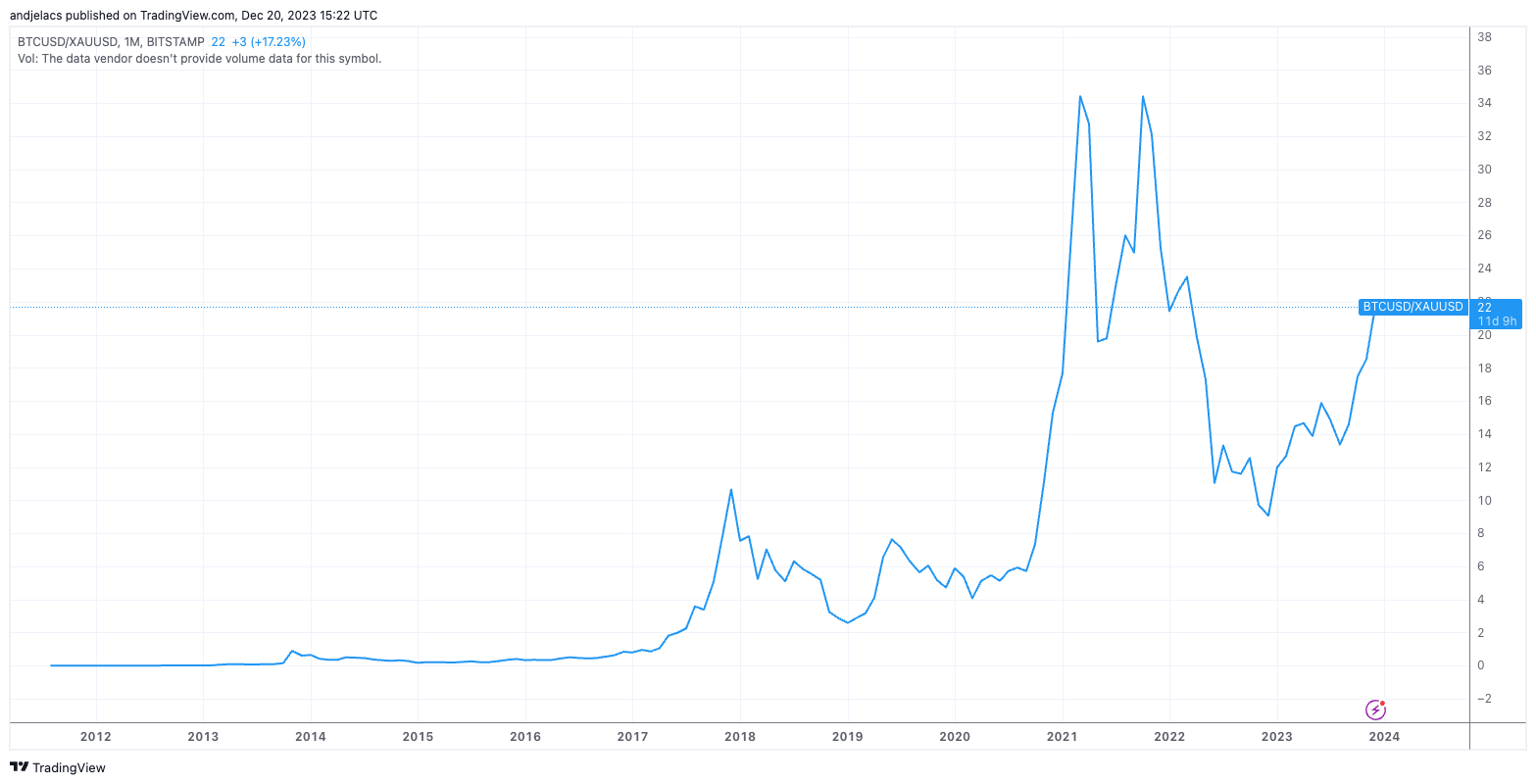

Between 2011 and 2017, the ratio witnessed a dilatory and gradual increase, reflecting the increasing involvement and acceptance of Bitcoin. The crypto industry’s archetypal existent bull marketplace successful 2017 saw this ratio reaching unprecedented heights, lone to diminution sharply by the opening of 2019. Specifically, the ratio plummeted by 75.75% from its highest connected Dec. 1, 2017, showcasing the market’s volatility and the shifting capitalist sentiment during the carnivore market.

The play betwixt 2019 and 2021 marked a phenomenal betterment and maturation for Bitcoin, mirrored successful the BTC/GOLD ratio. The ratio soared 1,232% betwixt Jan. 1, 2019, and Mar. 1, 2021, achieving an all-time high. This play highlighted Bitcoin’s resilience and increasing entreaty arsenic a integer asset. However, this highest was followed by a 37.94% alteration successful the ratio by the opening of 2023, reflecting the analyzable interplay of marketplace forces, regulatory developments, and planetary economical conditions.

Graph showing the BTC/GOLD ratio from August 2011 to December 2023 (Source: TradingView)

Graph showing the BTC/GOLD ratio from August 2011 to December 2023 (Source: TradingView)However, this twelvemonth has been peculiarly important for the ratio’s performance. Since the commencement of the year, the ratio has shown a singular summation of 139.9%. The mean ratio is astir 15.31, peaking astatine astir 21.36 and a trough of astir 11.99. The modular deviation of astir 2.66 indicates important variability, underscoring the inherent volatility of Bitcoin’s price.

Graph showing the BTC/GOLD ratio successful 2023 (Source: TradingView)

Graph showing the BTC/GOLD ratio successful 2023 (Source: TradingView)The show of the BTC/GOLD ratio successful 2023 carries important implications for the valuation and cognition of some Bitcoin and golden successful the fiscal market. The rising ratio indicates the market’s increasing preference for Bitcoin implicit gold, perchance owed to its perceived attributes arsenic a integer store of worth and a hedge against inflation. The variability of the ratio, however, besides speaks to the persistent uncertainties and the evolving regulatory scenery surrounding cryptocurrencies.

The BTC/GOLD ratio is not conscionable a measurement of terms examination — it reflects the changing fiscal scenery wherever integer assets are progressively pitted against accepted ones. While Bitcoin continues to summation crushed arsenic a imaginable alternate to gold, the travel is marked by volatility and uncertainty. This ratio, therefore, remains an indispensable instrumentality for analysis, offering insights into marketplace sentiments and the evolving relation of Bitcoin successful the broader fiscal market.

The station Bitcoin challenges gold’s supremacy arsenic harmless haven asset appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)