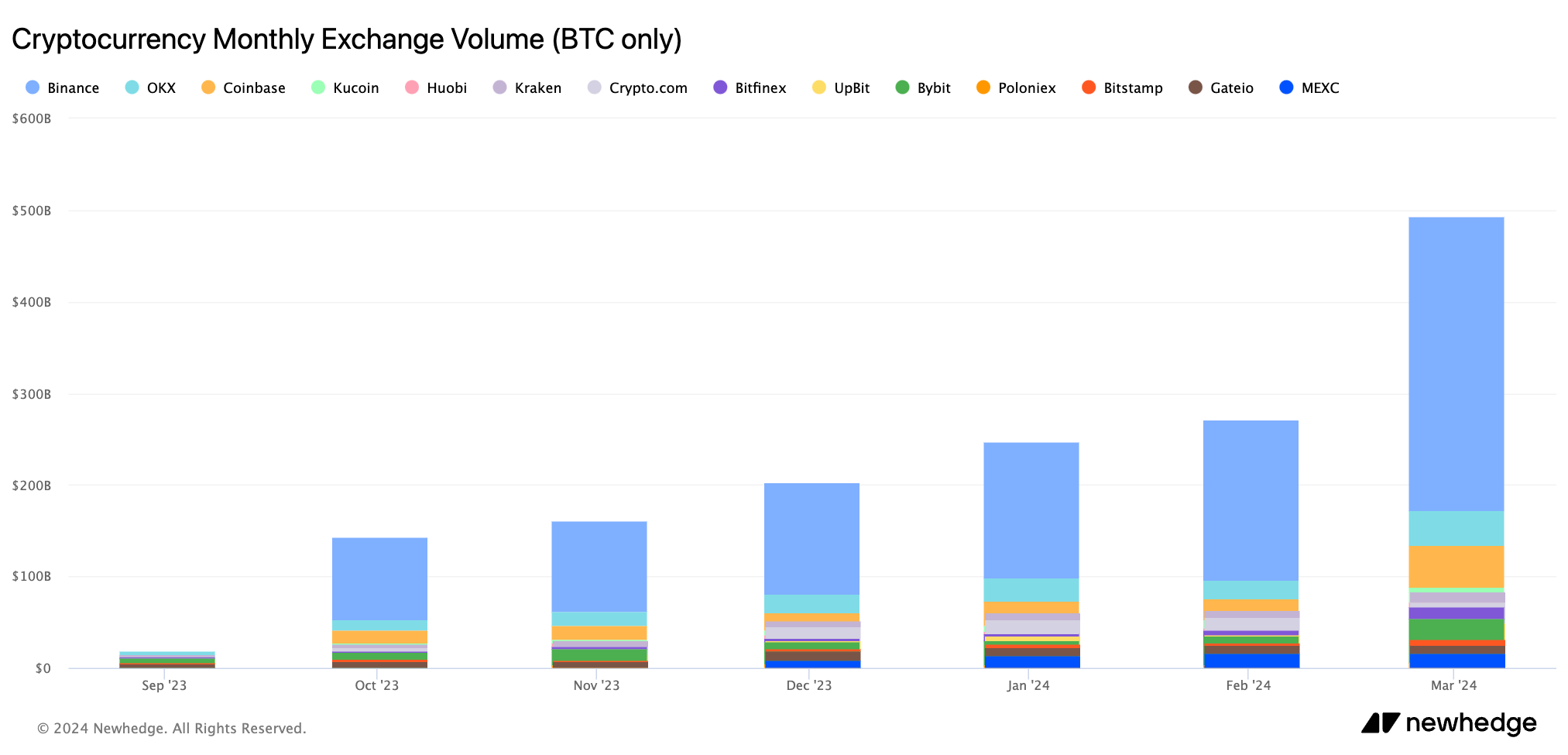

Bitcoin‘s trading measurement connected centralized exchanges (CEXs) saw a important spike successful March, marking the highest recorded CEX measurement since May 2021 — and the period isn’t implicit yet. Monitoring trading measurement connected CEXs offers invaluable insights into marketplace sentiment, liquidity, and the wide wellness of the crypto market.

From September 2023 to Mar. 24, 2024, Bitcoin’s trading measurement connected CEXs saw an astronomical rise from $18.409 cardinal to $494.056 billion. This eightfold summation successful measurement implicit conscionable 7 months is peculiarly noteworthy, considering Bitcoin’s terms escalated from a adjacent of $34,667 successful September to implicit $73,000 successful mid-March 2024. Despite a important correction, with Bitcoin consolidating astatine $67,000 by Mar. 23, trading measurement continued its upward trajectory, indicating robust marketplace information and liquidity.

The organisation of this trading measurement crossed assorted exchanges reveals a astonishing trend, particularly considering the important relation the US plays successful the planetary crypto market. Despite hosting fashionable spot Bitcoin ETFs and driving overmuch of the marketplace sentiment, a comparatively small information of CEX trading volume occurs successful the US. On Mar. 24, information showed that 52% of Bitcoin’s full CEX trading measurement was connected Binance, aligning with the year-to-date mean of supra 50%. Following ineligible challenges past fall, Binance saw its BTC trading measurement surge from $91.9 cardinal successful October 2023 to $321.6 cardinal successful March 2024, with the period yet to close.

Chart showing the monthly spot marketplace measurement for BTC pairs crossed crypto exchanges from September 2023 to March 2024 (Source: Newhedge)

Chart showing the monthly spot marketplace measurement for BTC pairs crossed crypto exchanges from September 2023 to March 2024 (Source: Newhedge)In contrast, Coinbase accounted for lone 4.22% of the full CEX trading volume, ranking 3rd overall, portion OKX held the 2nd presumption with conscionable 6.41% of the full BTC trading volume. This dominance of Binance, raking successful hundreds of billions successful BTC volume, highlights its continued dominance successful the CEX landscape, consistently accounting for fractional of the trading measurement connected centralized exchanges.

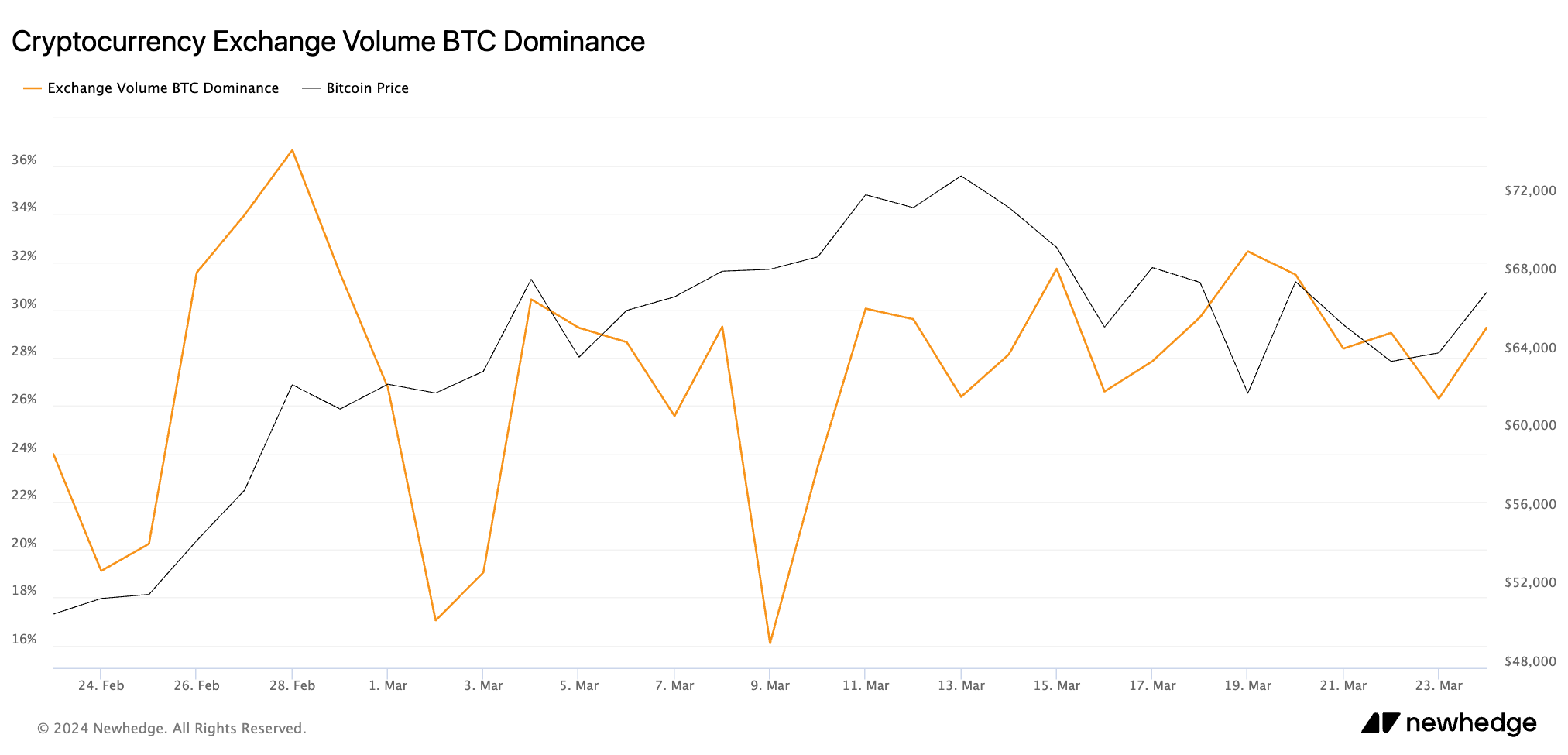

Binance’s presumption becomes adjacent much pronounced erstwhile considering Bitcoin’s trading measurement comparative to the remainder of the market. As of Mar. 24, Bitcoin represented conscionable implicit 29% of the full crypto trading measurement connected CEXs, according to information from Newhedge. Despite the emergence of galore altcoins and the maturation of DeFi platforms, CEX volumes stay a captious gauge of marketplace sentiment and an integral constituent of the crypto marketplace infrastructure.

Graph showing the full crypto trading measurement connected centralized exchanges specifically attributed to Bitcoin from Feb. 23 to Mar. 24, 2024 (Source: Newhedge)

Graph showing the full crypto trading measurement connected centralized exchanges specifically attributed to Bitcoin from Feb. 23 to Mar. 24, 2024 (Source: Newhedge)The important terms correction aft Bitcoin’s highest successful aboriginal March, coupled with the sustained summation successful trading volume, suggests a marketplace that, contempt its inherent volatility, is moving towards greater resilience and stableness implicit the agelong term. This indicates a maturing marketplace landscape, wherever accrued information and liquidity lend to a much stabilized terms situation susceptible of absorbing marketplace shocks and fluctuations.

The station Bitcoin CEX trading measurement hits grounds precocious successful March appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)