It has been a whirlwind. Bitcoin surpassing $100,000 whitethorn person been the champagne moment, but the integer plus people has had overmuch to cheer astir and digest since the Fed’s easing rhythm began connected September 18, and adjacent much since the U.S. election.

New incoming enactment astatine the SEC and different regulatory agencies, blockchain-savvy furniture appointees, a caller “AI and Crypto Czar,” and predominant mentions of bitcoin and crypto by the President-elect each constituent towards much enactment for the manufacture from the U.S. government.

The availability and aboriginal occurrence of bitcoin ETF and ETF scale options connection hazard absorption tools that individuals and institutions tin entree done brokerage accounts. This not lone invites investors with much blase hazard absorption needs, but besides provides different venue for bitcoin liquidity.

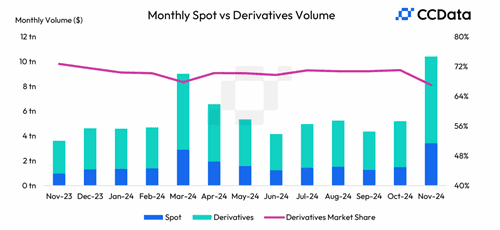

Record spot and derivatives volumes connected integer plus exchanges, topping $10 trillion successful November, punctual america that it’s not each astir U.S. ETF inflows and outflows — determination are elephantine crypto planetary markets retired determination and they similar what they see.

Medium- and semipermanent optimism whitethorn beryllium well-placed here, fixed the tailwinds of regulatory expectations (better, stronger, easier to navigate), the macroeconomic authorities (an easing cycle, but with the anticipation of inflation), manufacture wellness (oceans of talent, planetary competition, a hiccup-free 2024), and greenish shoots of organization adoption (over $100 cardinal successful bitcoin and ether ETFs, MSTR’s equilibrium sheet).

While timing — whether successful markets, regularisation oregon macro — is ne'er easy, present are a fewer predictions for the months and quarters up successful integer assets.

Prediction 1: bitcoin adoption momentum volition persist

Among integer assets, bitcoin's regulatory enactment is the astir "complete" today. In the United States, you tin get vulnerability to bitcoin natively oregon via futures, ETFs, plus absorption products, oregon options. Bitcoin stands to summation the slightest from much prescriptive integer plus regularisation successful the U.S. However, bitcoin's adoption momentum is strong, with plentifulness of country to run. With a fixed eventual proviso of 21 cardinal bitcoins, a known and hard-coded "monetary policy," and a better-understood communicative and discourse for concern allocation, we expect much integration of bitcoin into individual, advised, and organization portfolios. Adoption momentum volition beryllium bitcoin’s semipermanent terms driver, with macro factors affecting short- and medium-term fluctuations. Every clip we spot a bitcoin-skeptical article, we cognize that adoption momentum volition persist.

Prediction 2: little bitcoin volatility lies ahead

The increasing colonisation of bitcoin holders and the broader array of fiscal instruments to supply vulnerability to bitcoin's terms volition proceed to dampen bitcoin's volatility, bringing it closer, connected average, to equities (or, astatine slightest immoderate equities). Options connected bitcoin ETFs successful the U.S. volition licence much blase and accessible hazard absorption strategies. This has 2 implications. First, investors with institutional-grade hazard absorption requirements — and steadier hands — whitethorn beryllium capable to ain bitcoin fixed the availability of options. Second, investors whitethorn usage the extortion properties of options to debar selling positions successful a anemic market, which would different exacerbate drawdowns. We besides judge retail investors volition merchantability bitcoin telephone options against agelong ETF positions, a output strategy permitted successful status accounts, which volition depress options prices and volatility.

Prediction 3: greater sustained breadth volition spotlight the “5%-er conundrum”

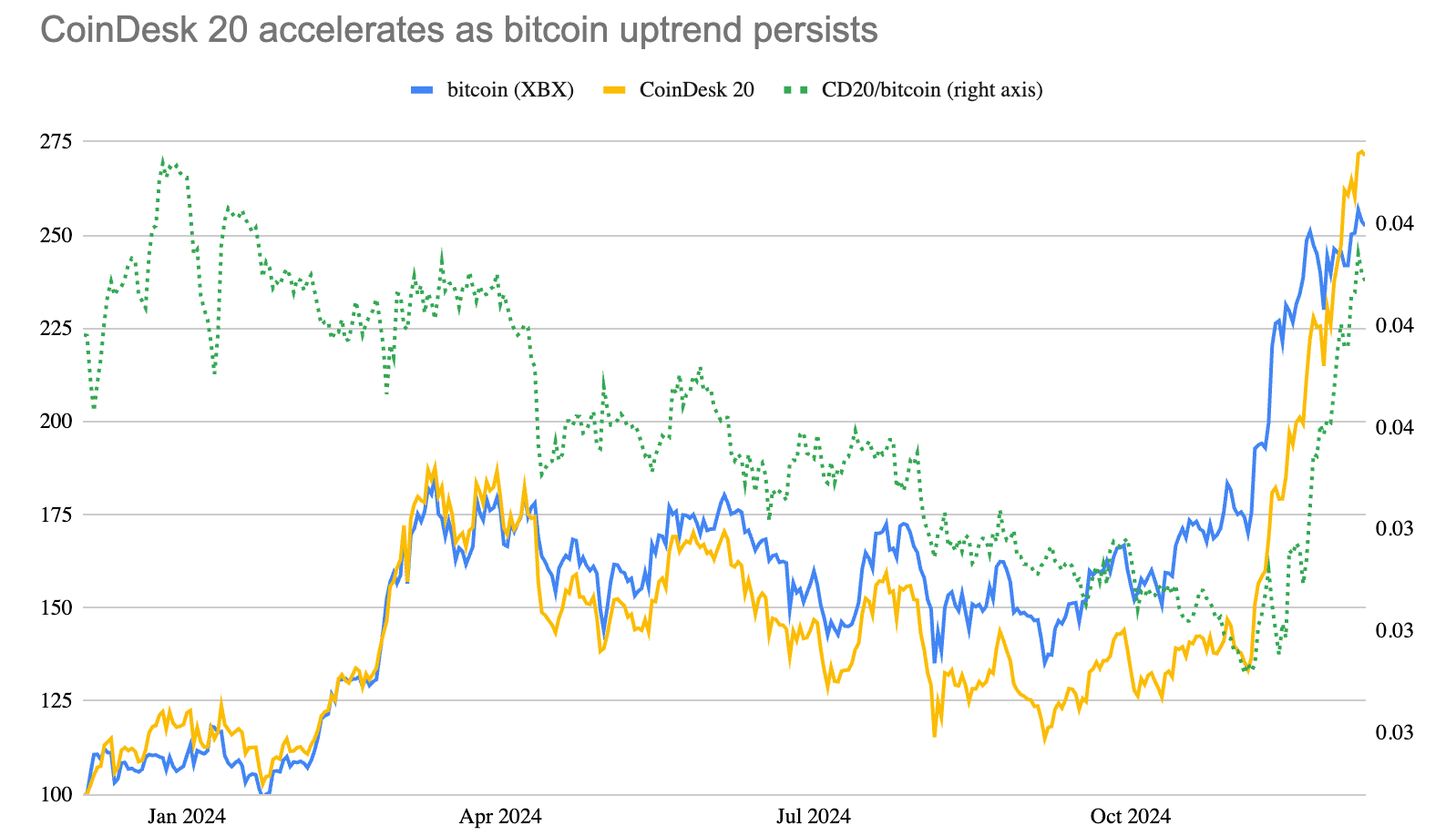

In the period since the U.S. election, the broad-based CoinDesk 20 Index astir doubled, outpacing bitcoin's beardown performance. The CD20/bitcoin ratio besides roseate sharply, reversing Ethereum and different blockchain assets sprang to beingness connected the committedness of much dedicated and usable integer plus regularisation successful the U.S. with the incoming medication successful 2025. We expect this to continue, with CD20's vulnerability to apical integer assets reflecting the growth-side of crypto alongside that of bitcoin’s “store of value” appeal.

This presents a conundrum for “5%-ers,” those investors who privation to allocate to integer assets (beyond bitcoin) but won’t person the clip to go experts successful sectors, prime names, oregon deliberation astir timing. In accepted plus classes, this is simply a classical exertion of indexing to supply access, diversification, and automatic rebalancing. We foretell (and hope!) that regulatory authorities volition licence investors to avail themselves of these benefits successful easy-to-access wrappers.

10 months ago

10 months ago

English (US)

English (US)