In the discourse of the volatile Bitcoin marketplace of the past year, a cardinal inclination identified successful previous CryptoSlate analyses has emerged: the accelerated summation successful speech withdrawals for Bitcoin since November 2022. According to Glassnode, this inclination has gathered gait since April 2023, resulting successful implicit 100,000 BTC being withdrawn from speech balances since April 18.

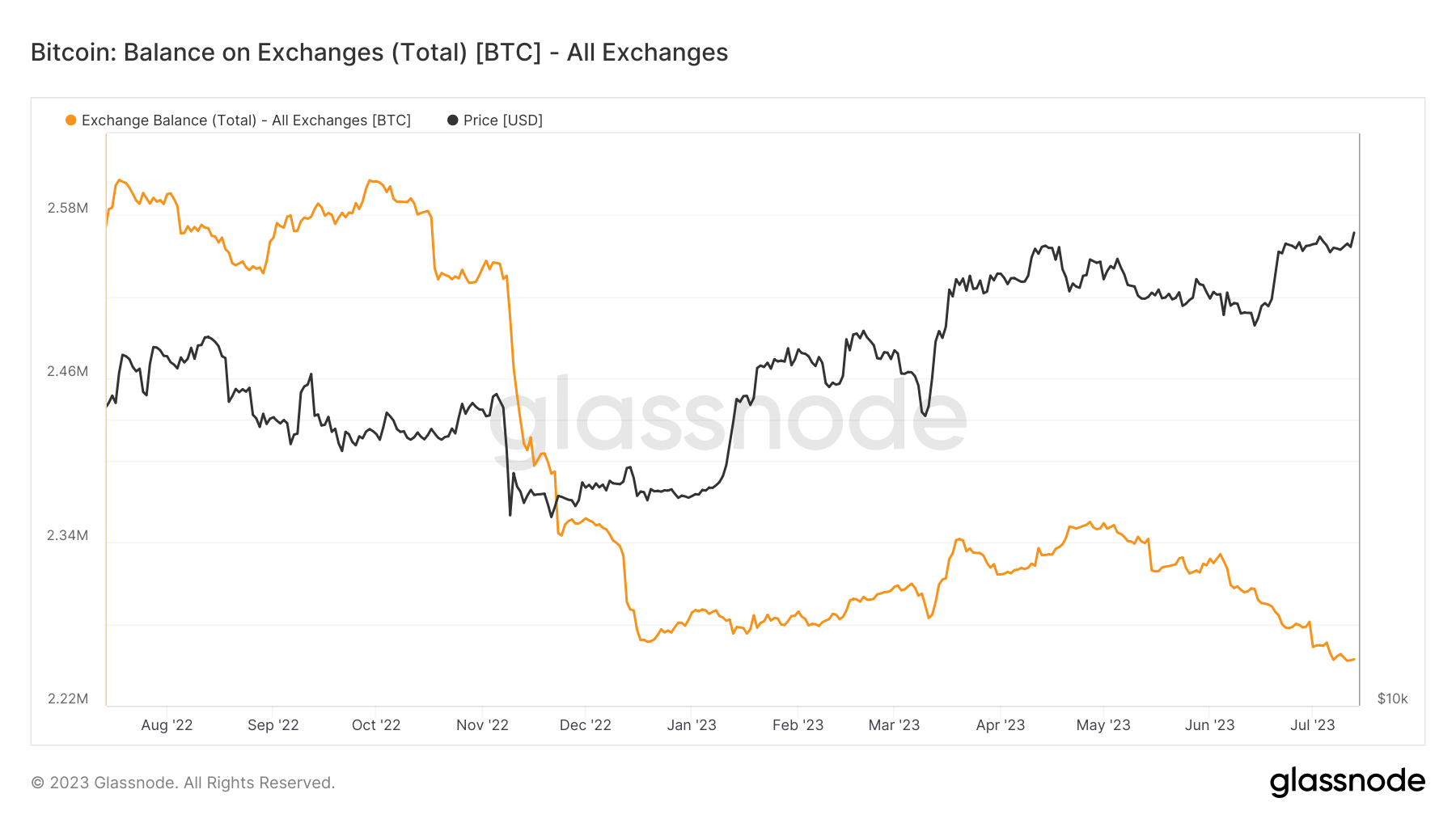

Graph showing Bitcoin’s equilibrium crossed each exchanges from July 2022 to July 2023 (Source: Glassnode)

Graph showing Bitcoin’s equilibrium crossed each exchanges from July 2022 to July 2023 (Source: Glassnode)Understanding the equilibrium of Bitcoin connected exchanges is important for gauging marketplace sentiment. Increased deposits typically awesome a imaginable sell-off arsenic investors determination their Bitcoin to exchanges to liquidate. Conversely, accrued withdrawals often bespeak a bullish sentiment arsenic investors determination their Bitcoin disconnected exchanges for holding oregon usage, reducing the disposable proviso for trading.

The complaint astatine which Bitcoin is being withdrawn from exchanges has exceeded the complaint of deposits since the mediate of May 2023. The 30-day alteration of the proviso held successful speech wallets shows that the magnitude of BTC has decreased by 51,903 BTC. In different words, 51,903 much Bitcoins were withdrawn from exchanges than were deposited during this period. This is simply a important shift, indicating a beardown inclination of Bitcoin moving retired of exchanges.

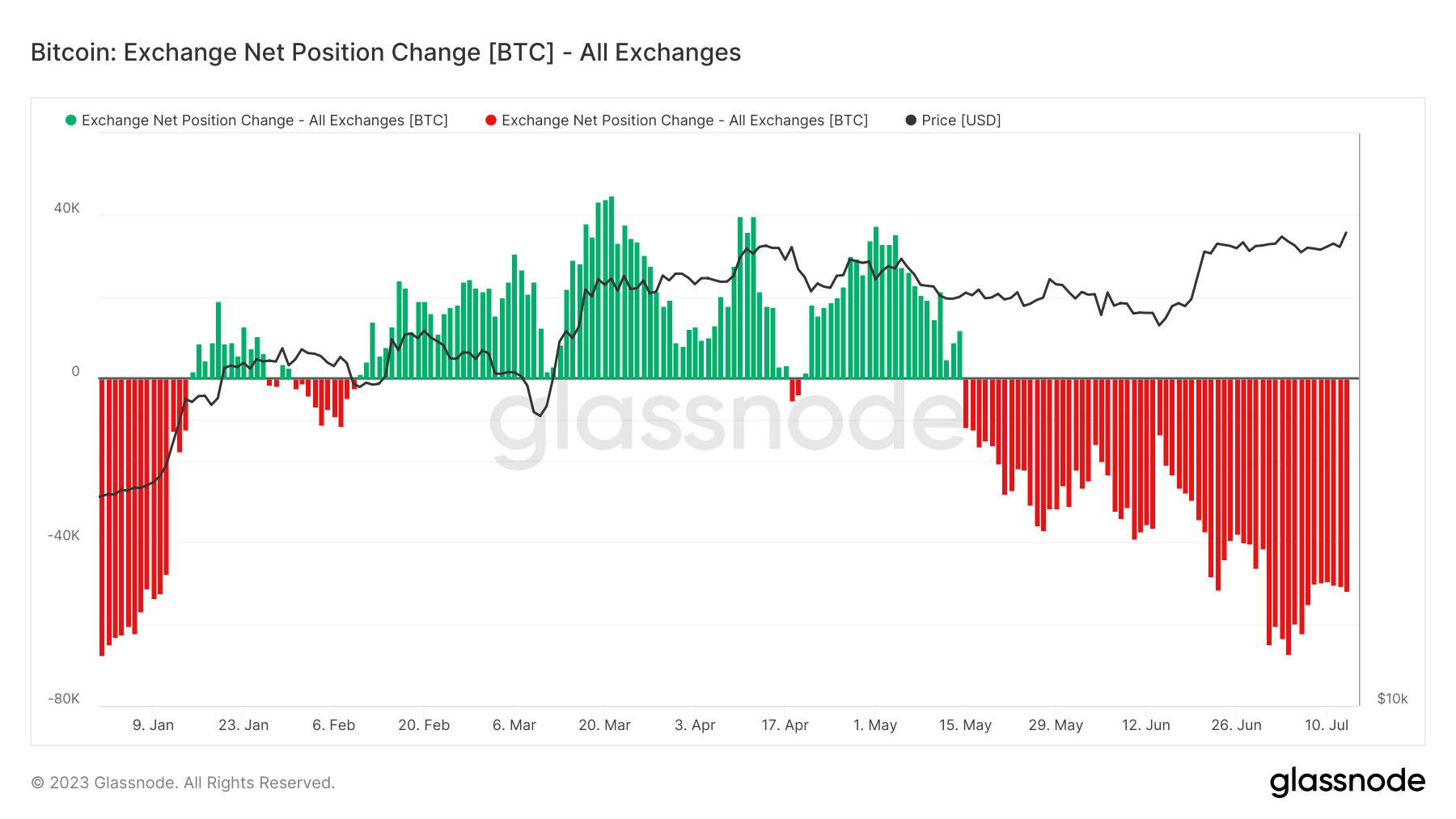

Graph showing Bitcoin’s speech nett presumption alteration successful 2023 (Source: Glassnode)

Graph showing Bitcoin’s speech nett presumption alteration successful 2023 (Source: Glassnode)This accelerated gait of withdrawals, coupled with a deficiency of caller deposits, could amplify buying unit for Bitcoin.

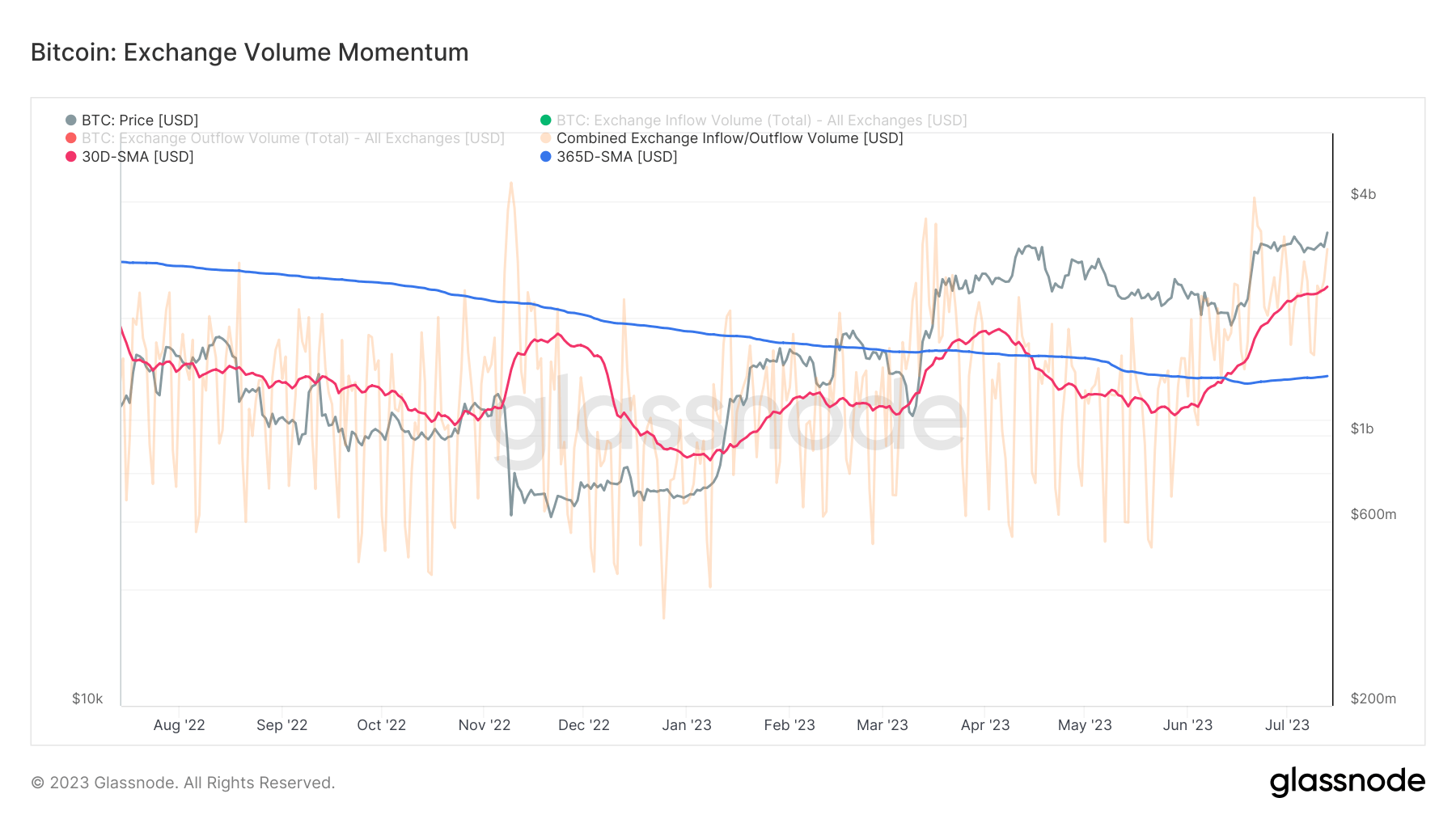

This is evident erstwhile analyzing the speech measurement momentum, a metric that compares the monthly mean of combined speech inflows and outflows to the yearly average.

When the monthly mean surpasses the yearly average, it indicates an enlargement successful exchange-related on-chain enactment — a motion of accrued capitalist involvement successful Bitcoin and increasing web utilization. Conversely, a higher yearly mean signals a contraction successful exchange-related on-chain activity, indicative of little capitalist involvement and declining web utilization.

Graph showing Bitcoin’s speech measurement momentum from July 2022 to July 2023 (Source: Glassnode)

Graph showing Bitcoin’s speech measurement momentum from July 2022 to July 2023 (Source: Glassnode)As of June 12, the monthly exchange-related measurement crossed the yearly mean and has continued to emergence passim July. This suggests an summation successful capitalist involvement and web utilization, which, combined with the aforementioned withdrawal trends, could perchance summation buying unit for Bitcoin.

The station Bitcoin buying unit could surge amid rising speech withdrawals appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)