As ongoing regulatory pressures ramp up towards respective cryptocurrencies, Bitcoin (BTC)has shown awesome resilience, breaking the $31,000 obstruction contiguous and marking its highest adjacent of the year.

This leap comes aft a prolonged play of stagnant trading, with Bitcoin wavering betwixt $25,000 and $30,000 since March 16.

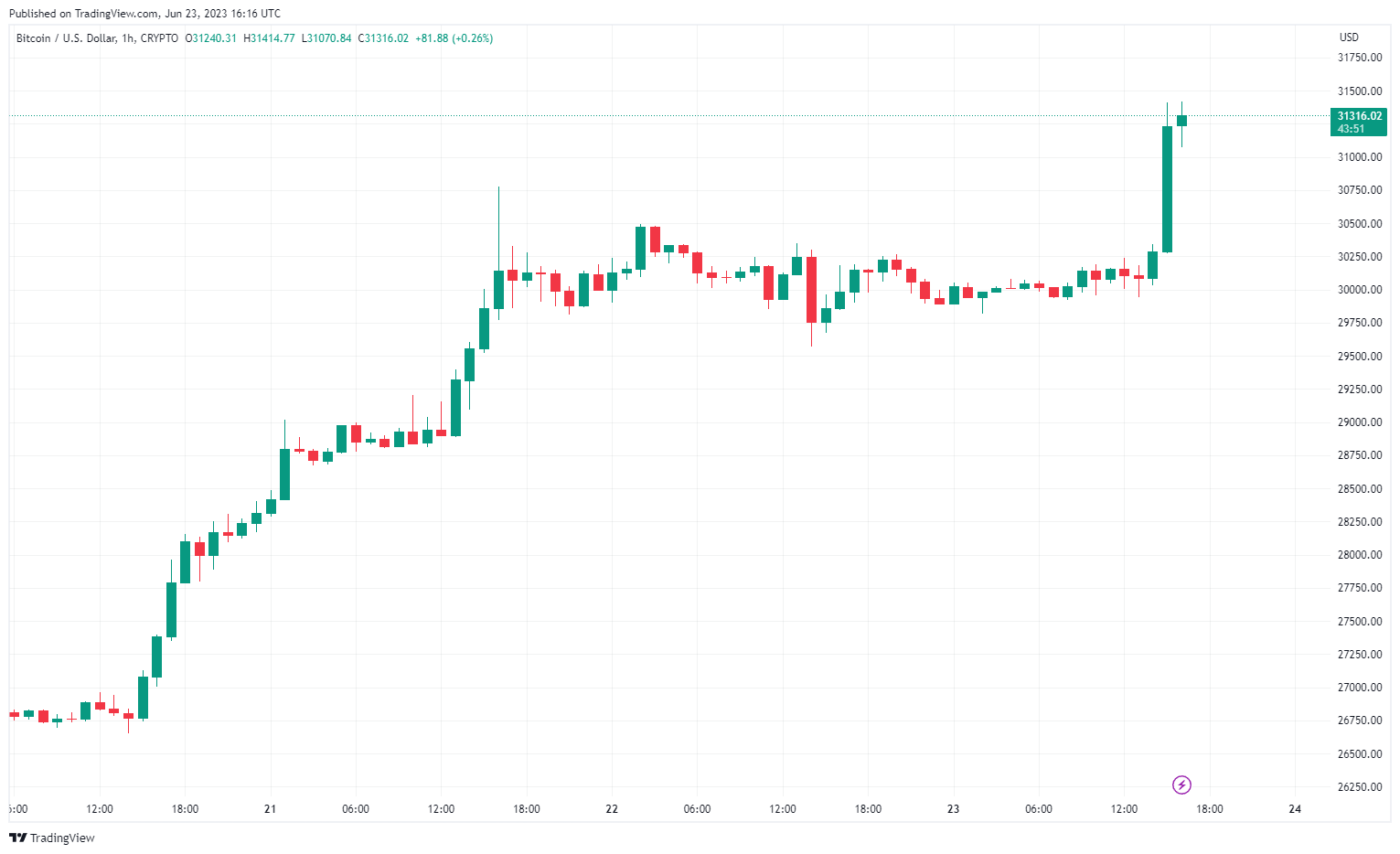

BTCUSD (Source: TradingView)

BTCUSD (Source: TradingView)The liquidation volumes for each cryptocurrency implicit the past 4 hours were $30.01 cardinal successful Bitcoin, $17.27 cardinal successful Ethereum (ETH), and $3.15 cardinal successful Bitcoin Cash (BCH), according to Coinglass data. These values lend to the full 4-hour liquidation magnitude of $72.20 million, comprised of $13.01 cardinal of agelong positions and $59.18 cardinal of abbreviated positions.

Bitcoin was trading astatine $31,234 arsenic of property time.

BTC surge aft organization interest

This Bitcoin surge follows a question of organization interest. Global concern elephantine BlackRock submitted an application past week to the U.S. Securities and Exchange Commission for a spot Bitcoin ETF. The regulator has yet to assistance support for a spot Bitcoin ETF.

Adding to the affirmative sentiment astir Bitcoin, the launch of EDX Markets connected June 20, which coincided with Bitcoin reclaiming the $28,000 mark, has been well-received by the market. Backed by heavyweights Fidelity, Charles Schwab, and Citadel Securities, EDX Markets is simply a promising organization crypto exchange.

Bitcoin’s emergence is simply a stark opposition to the remainder of the cryptocurrency market, which has been struggling successful the aftermath of the SEC’s unprecedented lawsuits against Binance and Coinbase. The SEC has alleged that respective fashionable cryptocurrency tokens are, successful their view, unregistered securities.

SEC Chair Gary Gensler has been explicit astir his program to instrumentality enactment against crypto firms that, successful his view, run extracurricular U.S. law. Gensler has stated that each cryptocurrencies, with the sole objection of Bitcoin, suffice arsenic securities nether U.S. law. However, Gensler’s stance connected Ethereum, the second-largest cryptocurrency by marketplace cap, remains unclear.

The station Bitcoin breaks $31k arsenic it continues to shingle disconnected caller slumps appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)