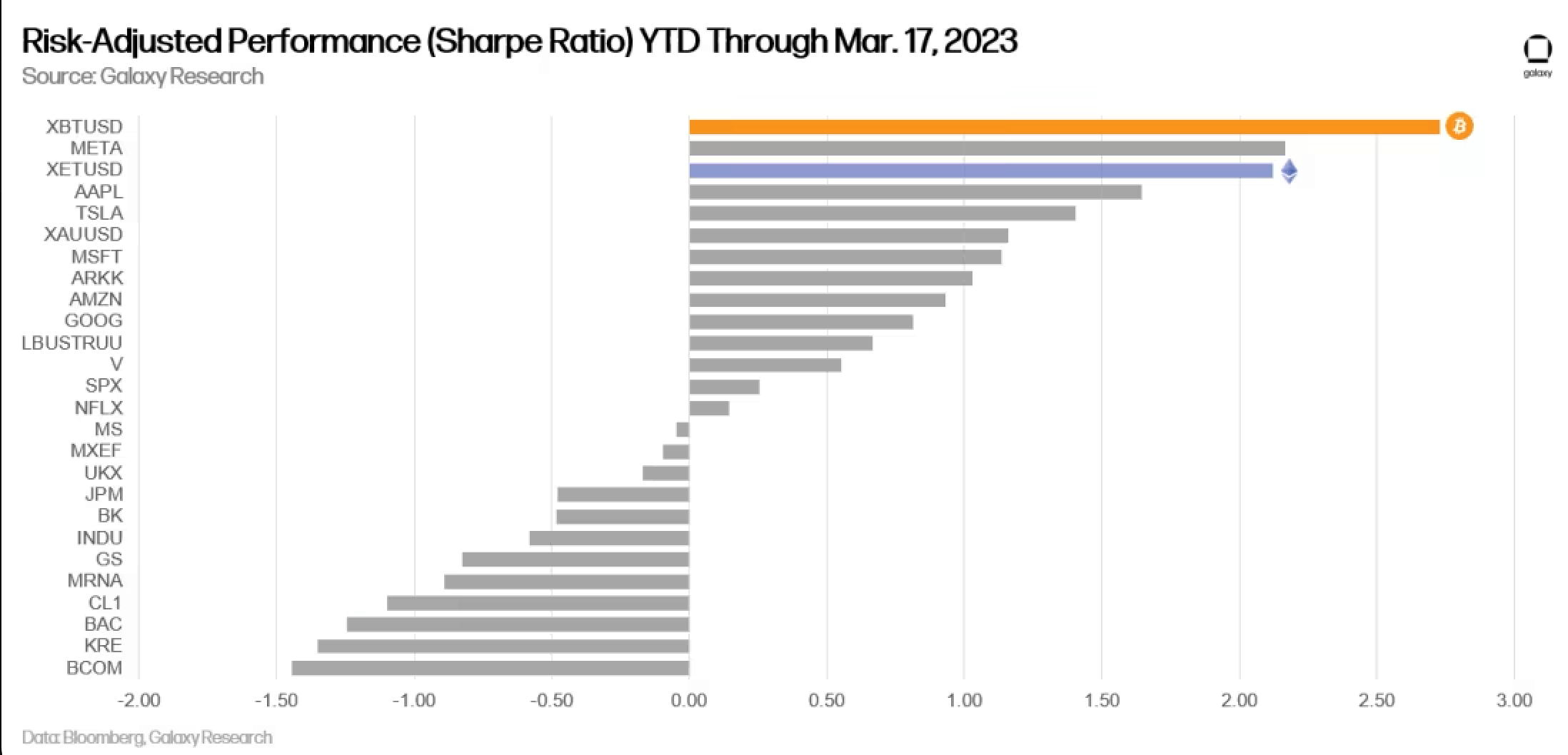

According to caller information from the integer plus absorption institution Galaxy, Bitcoin (BTC) is the best-performing plus of the twelvemonth compared to equities, fixed-income securities, indices, and commodities connected a risk-adjusted basis.

The recently released data corresponds to golden expanding and equities decreasing. It explains however the volatility of Bitcoin is connected a multi-year downward trend, and that futures unfastened involvement and perpetual swap backing rates suggest the rally is not based purely connected speculation.

On-chain information shows ongoing accumulation, longer holding times, and increasing ownership dispersion. The upcoming 4th halving is expected to precede a longer-term bullish advance.

Bitcoin show arsenic compared to different assets

Bitcoin has been the top-performing plus of 2023 erstwhile measuring risk-adjusted show (Sharpe ratio) compared to equities, fixed-income securities, indices, and commodities. It has consistently been 1 of the champion performers crossed assorted timeframes, with the objection of the one-year timeframe.

(Source: Galaxy)

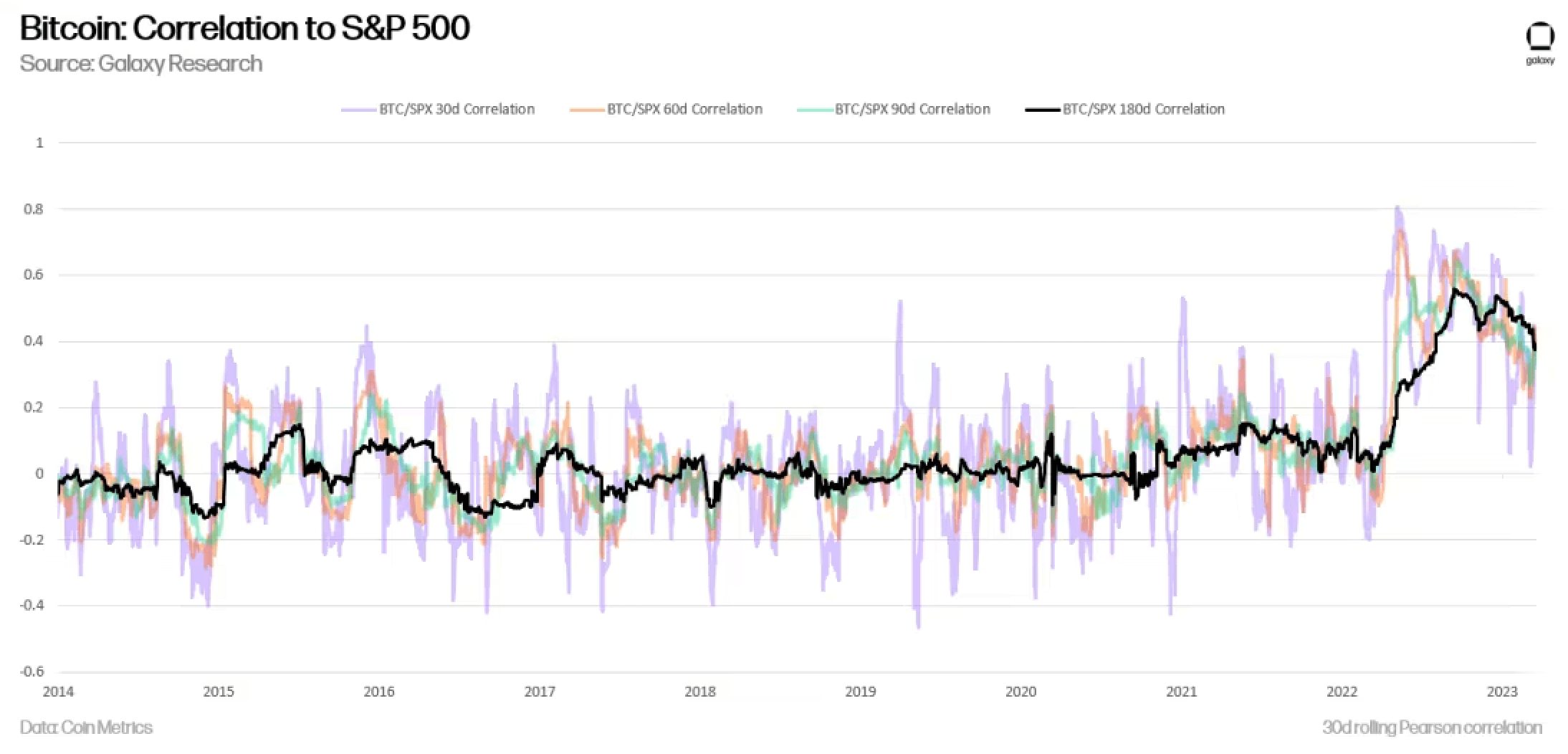

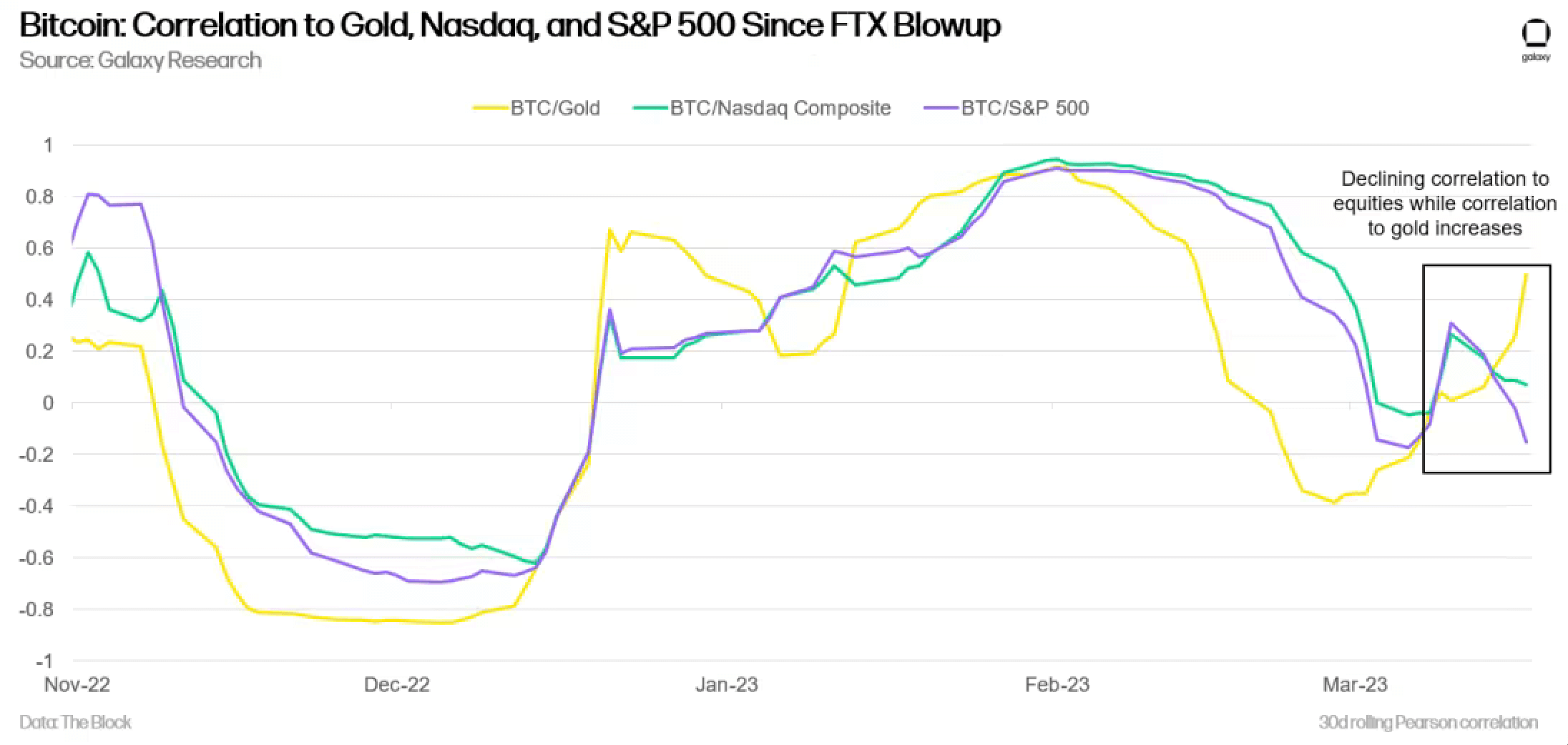

(Source: Galaxy)Bitcoin’s correlation with equities has been precocious implicit the past 18 months but has precocious decreased. Meanwhile, its correlation with golden has accrued importantly — peculiarly since the banking crisis.

(Source: Galaxy)

(Source: Galaxy)These correlations bespeak that Bitcoin has exhibited safe-haven characteristics successful the existent economical clime — demonstrating the worth of Bitcoin’s cardinal characteristics.

(Source: Galaxy)

(Source: Galaxy)Notable aboriginal proviso events

There are 2 upcoming proviso events for Bitcoin — 1 bullish and 1 perchance bearish. The 4th halving — acceptable for April 2024 — is expected to bring the ostentation complaint beneath 1%, historically starring to consequent bull runs. Galaxy notes that the driblet successful caller regular issuance whitethorn beryllium little impactful than expected.

Furthermore, the Mt. Gox bankruptcy trustee holds 141,686 BTC — which it said precocious it does not program to sell. The largest creditor —the Mt. Gox Investment Fund — opted to person aboriginal outgo successful astir 70% BTC and 30% currency and does not program to merchantability the BTC it receives.

The aboriginal organisation day is expected September and it’s expected that astir BTC volition not beryllium sold upon distribution. There whitethorn beryllium second-order impacts successful BTC lending markets if creditors look to lend their BTC either off-chain oregon on-chain via converting to WBTC, according to Galaxy.

Read the afloat Galaxy report.

The station Bitcoin boasts safe-haven characteristics during economical uncertainty: Galaxy appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)