Historically, a Santa rally happens successful the weeks starring up to Christmas erstwhile a corporate consciousness of goodwill bleeds into equity markets. This is typically a seasonal blip and thing to constitute location about. But this year, we could spot a acold much important rally arsenic the United States Federal Reserve, the Securities and Exchange Commission and BlackRock enactment up to present a bonanza of vacation cheer.

The Federal Open Market Committee (FOMC) finished its penultimate gathering of 2023 connected Wednesday, and it decided to clasp involvement rates steady. As we know, U.S. ostentation has been tamed from a precocious of 9.1% successful June 2022 to its existent level of 3.7% acknowledgment to the Fed’s assertive involvement complaint hiking rhythm that brought the Federal Funds Rate to 5.25-5.5% — its highest level since 2001.

However, portion this run has been unquestionably successful, markets stay profoundly acrophobic astir the imaginable of higher rates, oregon adjacent rates sustained astatine this level, to trigger a recession successful the U.S. The Fed besides present shares these concerns arsenic it softens to immoderate grade against inflation.

Related: Bitcoin is evolving into a multiasset network

Should the adjacent Bureau of Labor Statistics ostentation speechmaking connected Nov. 14 amusement a determination downward, we tin expect to spot wealth flooding into hazard assets arsenic investors expect the adjacent involvement complaint determination to beryllium a cut. This will, of course, person a affirmative interaction connected equity markets, and adjacent enslaved markets arsenic yields autumn and the backmost extremity of the output curve flattens.

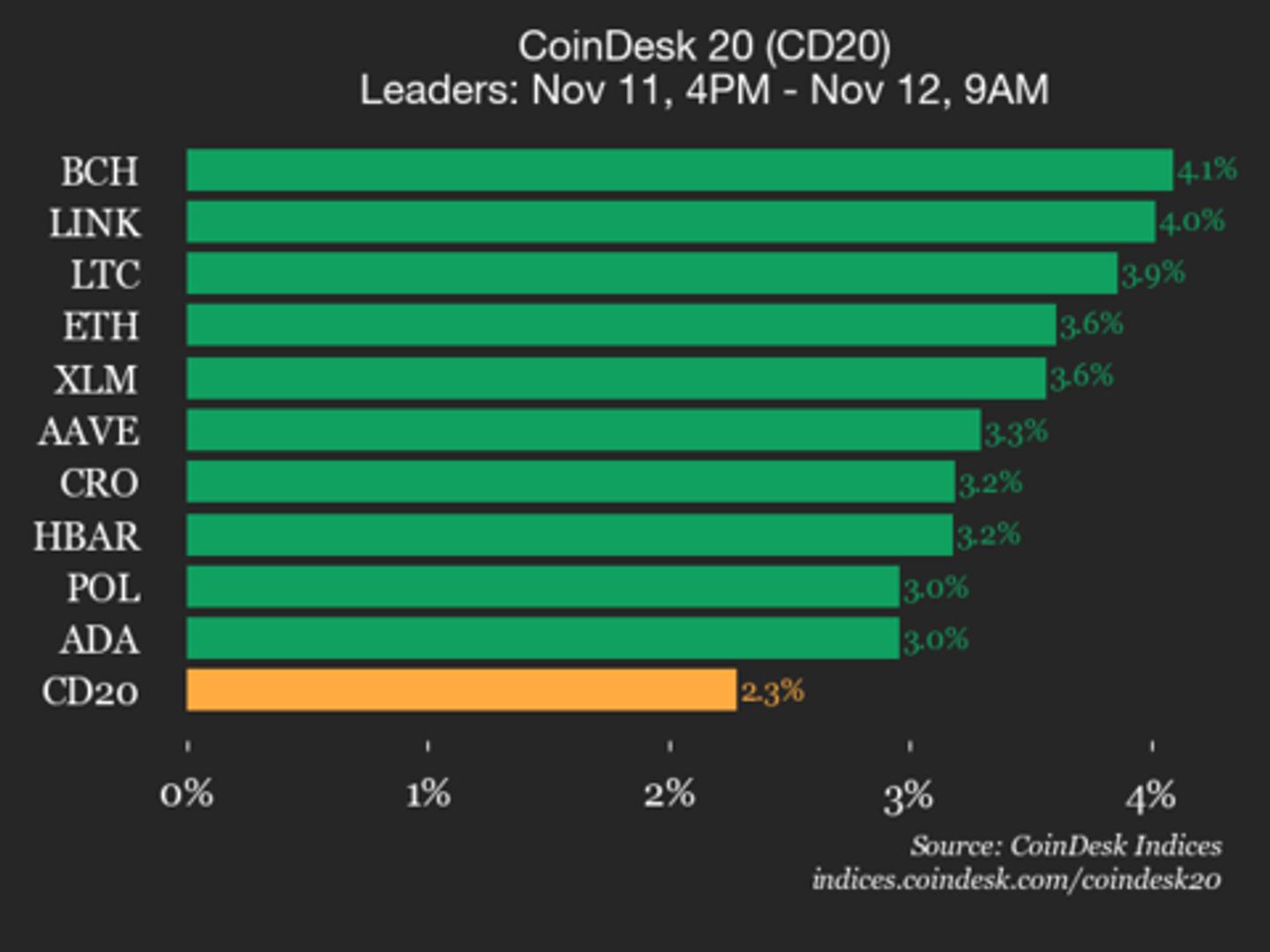

GUNDLACH: THINK CPI WILL COME DOWN BASED ON INFLATION MODEL

— *Walter Bloomberg (@DeItaone) November 1, 2023Crypto markets volition travel suit, with Bitcoin (BTC) remaining powerfully correlated to main markets. What volition supply an other changeable successful the arm, though, volition beryllium the support of the archetypal U.S.-based Bitcoin spot ETF — which is apt to travel earlier Jan. 10, arsenic J.P. Morgan predicts. This is underlined by the excitement that rumors of the support of BlackRock’s exertion person generated implicit the past fewer weeks, which sent Bitcoin backmost up to $35,000: a level it hasn’t enjoyed since the pre-Terra Luna days of 2022.

Eventual support volition supply further impetus for Bitcoin, Ether (ETH), and ample swathes of altcoin markets. However, if investors are pursuing the aged adage, “buy the rumor, merchantability the fact”, it whitethorn not beryllium huge. We mightiness adjacent spot a tiny dip earlier a much sustained rally. There is small doubt, however, that support volition beryllium affirmative for cryptocurrency. Indeed, longer-term it has the imaginable to beryllium the top operator of crypto markets since the conditions created by the Covid pandemic saw BTC apical $60,000 successful 2021.

Related: Sam Bankman-Fried’s proceedings is telling a communicative of classical fiscal deceit

Potential spanners successful the works see higher ostentation successful the U.S. earlier the extremity of the year, and perchance a ramping up of tensions betwixt Israel and Palestine. Either of these could enactment the brakes connected an end-of-year Santa rally — but that does not look to beryllium the absorption of question close now.

Indeed, Bitcoin has already enjoyed rather a rally this year. While the fallout from the FTX clang successful November 2022 saw BTC autumn to the $15,000 scope and commencement 2023 astatine a paltry terms of somewhat much than $16,000, its level contiguous of $34,000 to $35,000 represents maturation of much than 100%. Of course, it’s lone the precise astute oregon fortunate traders who ever negociate to instrumentality vantage of Bitcoin’s utmost volatility. Year-on-year, galore crypto investors are inactive nursing losses.

For FTX investors, for example, portion determination are present hopes immoderate volition get their Bitcoin, Ether, and different tokens back, astir volition look somewhat of a Pyrrhic triumph arsenic they look down the tube of 60% to 70% losses. This accounts for the mostly pessimistic temper successful the crypto market, which would different look similar the victor of 2023.

As we attack the extremity of the year, then, it would bash each of america good to instrumentality a measurement backmost and presumption Bitcoin and crypto markets with caller eyes. Even if we don’t get a overmuch anticipated and, perhaps, deserved Santa rally, we tin observe the information that crypto has survived different challenging twelvemonth and is ending connected a high.

Lucas Kiely is main concern serviceman of Yield App, wherever helium oversees concern portfolio allocations and leads the enlargement of a diversified concern merchandise range. He was antecedently the main concern serviceman astatine Diginex Asset Management, and a elder trader and managing manager astatine Credit Suisse successful Hong Kong, wherever helium managed QIS and Structured Derivatives trading. He was besides the caput of exotic derivatives astatine UBS successful Australia.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 years ago

2 years ago

English (US)

English (US)