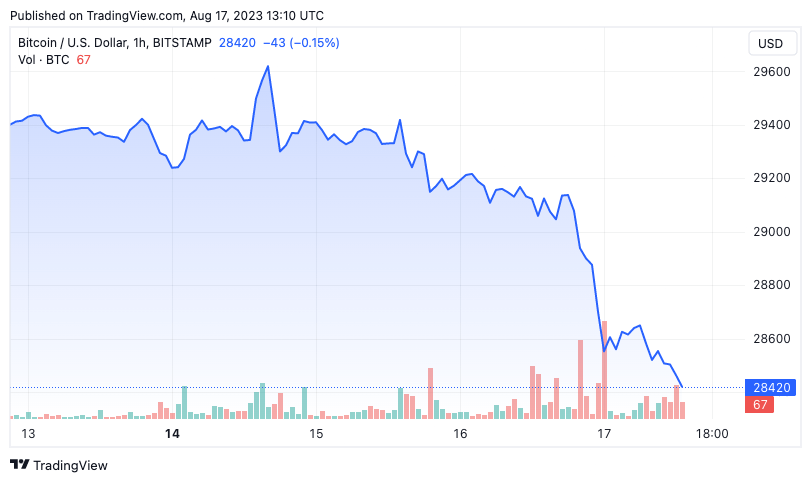

On Aug. 17, Bitcoin’s terms dropped beneath the $29,000 mark, settling astir $28,500. While this diminution mightiness look insignificant fixed Bitcoin’s historically volatile nature, the discourse of its recent trading range magnifies the value of this move.

Graph showing Bitcoin’s terms betwixt Aug. 14 and Aug. 17, 2023 (Source: CryptoSlate BTC)

Graph showing Bitcoin’s terms betwixt Aug. 14 and Aug. 17, 2023 (Source: CryptoSlate BTC)Bollinger Bands are a fiscal instrumentality utilized to measure the terms volatility of assorted assets, including Bitcoin. The bands incorporate 3 lines — 1 cardinal enactment and 2 outer ones. The cardinal enactment connected the illustration represents the elemental moving mean (SMA) of the asset’s price, portion the outer bands are determined by the modular deviation, a measurement indicating however dispersed retired the prices are from the average.

These bands widen during periods of precocious volatility and declaration during debased volatility. These bands are a important marketplace indicator, helping traders place imaginable bargain and merchantability signals. When an asset’s terms moves extracurricular these bands, it tin bespeak a important terms question successful the breakout direction.

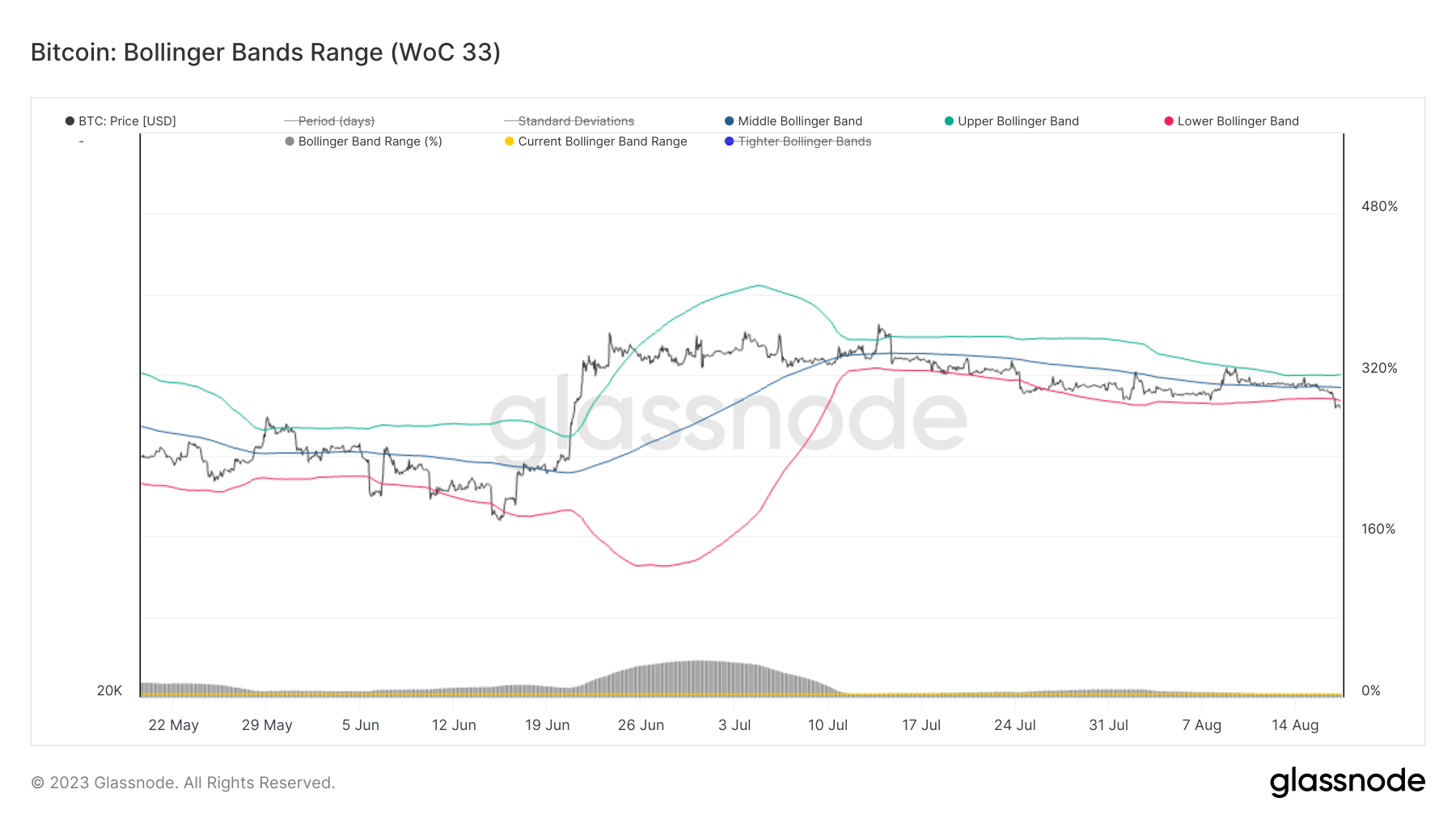

August has seen Bitcoin’s terms volatility plummet to humanities lows. Before today’s driblet to $28,500, the precocious and little Bollinger Bands were separated by a specified 2.9%. Such a choky dispersed has lone been witnessed doubly successful Bitcoin’s history. With the descent to $28,500, Bitcoin’s terms breached the little Bollinger Band, which stood astatine $28,794. Consequently, the Bollinger Band scope expanded somewhat to 3.2%.

Graph showing the scope for Bitcoin Bollinger Bands from May 17 to Aug. 17, 2023 (Source: Glassnode)

Graph showing the scope for Bitcoin Bollinger Bands from May 17 to Aug. 17, 2023 (Source: Glassnode)Historical information suggests that erstwhile Bitcoin’s terms breaks beneath the little Bollinger Band, it is often followed by a swift betterment and an upward trajectory. This signifier has been observed aggregate times, reinforcing the value of the Bollinger Bands arsenic a predictive tool.

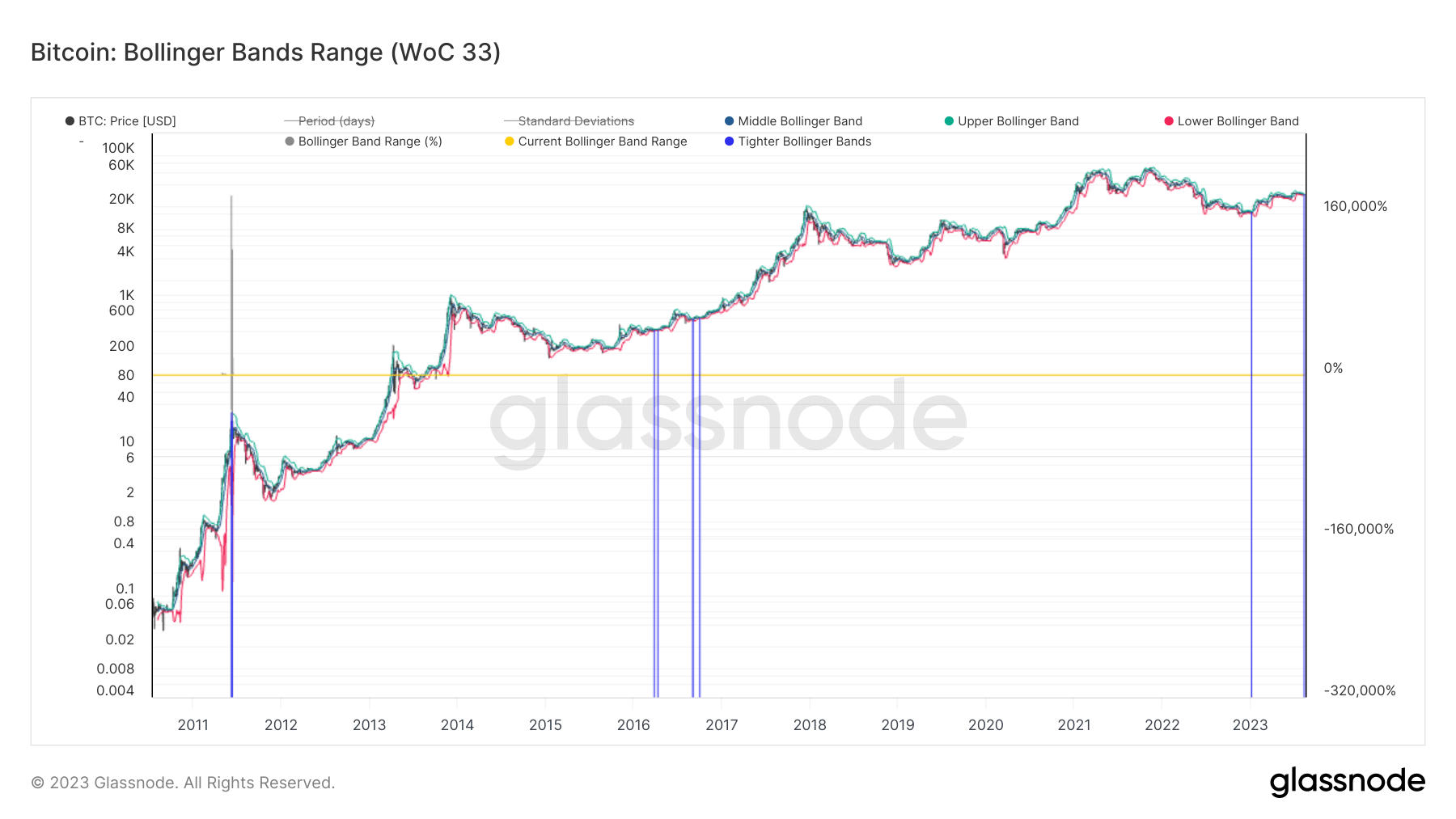

Furthermore, each lawsuit of highly choky Bollinger Bands successful Bitcoin’s past has preceded a notable terms swing. For instance, respective occurrences of arsenic choky bands were recorded successful 2016. This play was the precursor to the rally that propelled Bitcoin to its all-time precocious successful 2018. More recently, successful January 2023, Bitcoin’s terms remained stagnant astatine astir $16,800, with the bands indicating debased volatility. Shortly after, Bitcoin surged, astir doubling its worth to $30,000.

Graph showing the scope for Bitcoin Bollinger Bands from 2010 to 2023 (Source: Glassnode)

Graph showing the scope for Bitcoin Bollinger Bands from 2010 to 2023 (Source: Glassnode)So, what bash these observations connote for the market? The existent tightness of the Bollinger Bands, combined with Bitcoin’s terms question beneath the little band, suggests a imaginable for a important terms upswing successful the adjacent future.

The station Bitcoin astatine $28.5K: Unpacking the value of choky Bollinger Bands appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)