There is simply a fashionable saying, that goes, "If you privation to recognize America, ticker a pro wrestling match." Though it whitethorn beryllium glib and a small implicit simplified, it appears to 'ring' true, arsenic the U.S. fiscal markets are present exhibiting traits akin to pro-wrestling's conception of "kayfabe."

Kayfabe means an illusion that the in-ring scripted enactment is real, with the assemblage buying the aforesaid portion suspending their content for entertainment.

A akin dynamic has played retired successful the fiscal marketplace for astatine slightest a decade, wherever the U.S. authorities has repeatedly deed its self-imposed debt ceiling, oregon borrowing limit, a motion of fiscal crisis. Still, investors continued lending wealth to the authorities astatine ultra-low yields, including during times of accent successful the planetary economy, thereby maintaining the kayfabe that the authorities is simply a harmless and reliable borrower.

Recently, however, enslaved marketplace participants person exposed kayfabe, arsenic legendary trader Paul Tudor Jones had warned, weakening the illusion and strengthening the lawsuit for investing successful assets with haven and store-of-value entreaty similar bitcoin (BTC) and gold.

Bonds blast the kayfabe

This week's large quality is the U.S. 30-year Treasury output topping the 5% people and however it could destabilize fiscal markets. However, we person been determination earlier successful October past year, according to the information root TradingView.

Read more: U.S. 30-Year Treasury Yield Breaches 5% Amid Moody's Rating Downgrade, Fiscal Concerns

The existent communicative is the spike successful yields connected the Treasury inflation-protected securities (TIPS). Their main magnitude is adjusted for inflation.

The 30-year TIPS output precocious roseate supra 2.7%, the highest since 2001. In different words, investors request a output astatine slightest 2.7% greater than ostentation successful instrumentality for loaning wealth to the authorities for 3 decades.

This comes arsenic the user terms scale (CPI) maturation continued to dilatory toward the Fed's 2% target, and the market-based forward-looking ostentation measures similar breakevens stay stable successful acquainted ranges seen since 2022. Plus, the supposedly inflationary U.S.-China tariff warfare has eased.

Divergence is simply a wide indicator that investors are seeking the astir costly existent output owed to concerns astir fiscal argumentation and not inflation, tariffs, oregon maturation dynamics.

"The satellite is saying, we don't spot your semipermanent fiscal trajectory and we privation to beryllium compensated for it," pseudonymous expert EndGame Macro said successful an explainer connected X.

As of May 19, the U.S. nationalist debt, besides known arsenic the full nationalist debt, stood astatine $36.22 trillion. It is projected to emergence by $22 trillion implicit the adjacent 10 years, with debt-to-GDP reaching 156% by 2055, according to analysis conducted by EY's Quantitative Economics and Statistics (QUEST) practice. The QUEST study besides said the burgeoning indebtedness volition measurement heavy connected economical growth.

Robin Brooks, elder chap successful the Global Economy and Development programme astatine the Brookings Institution, pointed to the five-year guardant existent involvement complaint arsenic grounds of enslaved players questioning the fiscal sustainability.

"The 5y5y guardant existent involvement complaint present stands astatine 2.5%, which is the highest level going each the mode backmost to 2010. Most importantly, it acold exceeds levels seen during hawkish Fed episodes, similar the 2013 "taper tantrum" oregon the 2022/23 hiking rhythm aft the COVID ostentation scare," Brooks said successful a Substack post, portion noting the stableness successful the 5y5y guardant ostentation breakevens.

"That makes it each the much apt that galore years of irresponsible fiscal argumentation are catching up with the U.S, adding urgency to the request to get our fiscal location successful order," Brooks added.

FX-bond correlations are dead

Another motion that the marketplace is waking up to the information that the emperor has nary apparel is the breakdown successful the accepted correlation betwixt the overseas speech (forex) and enslaved markets.

Typically, rising enslaved yields boost the entreaty of the location currency, causing it to admit against different fiat currencies. For example, the EUR/USD has historically intimately tracked the dispersed betwixt yields connected German and U.S. two-year authorities bonds.

But not anymore. The EUR/USD has risen sharply since aboriginal April contempt the narrowing of the two-year output differential, led by a crisp emergence successful the U.S. two-year yield. The breakdown successful correlations indicates that concerns implicit fiscal stableness person apt prompted investors to determination distant from U.S. assets.

The grade of dollar bearishness is evident from the options market, which is present astir bullish connected EUR/USD since COVID. It's antithetic for the options marketplace to enactment a greater premium connected the upside successful euro than the downside, according to Brooks.

Bullish bitcoin and gold

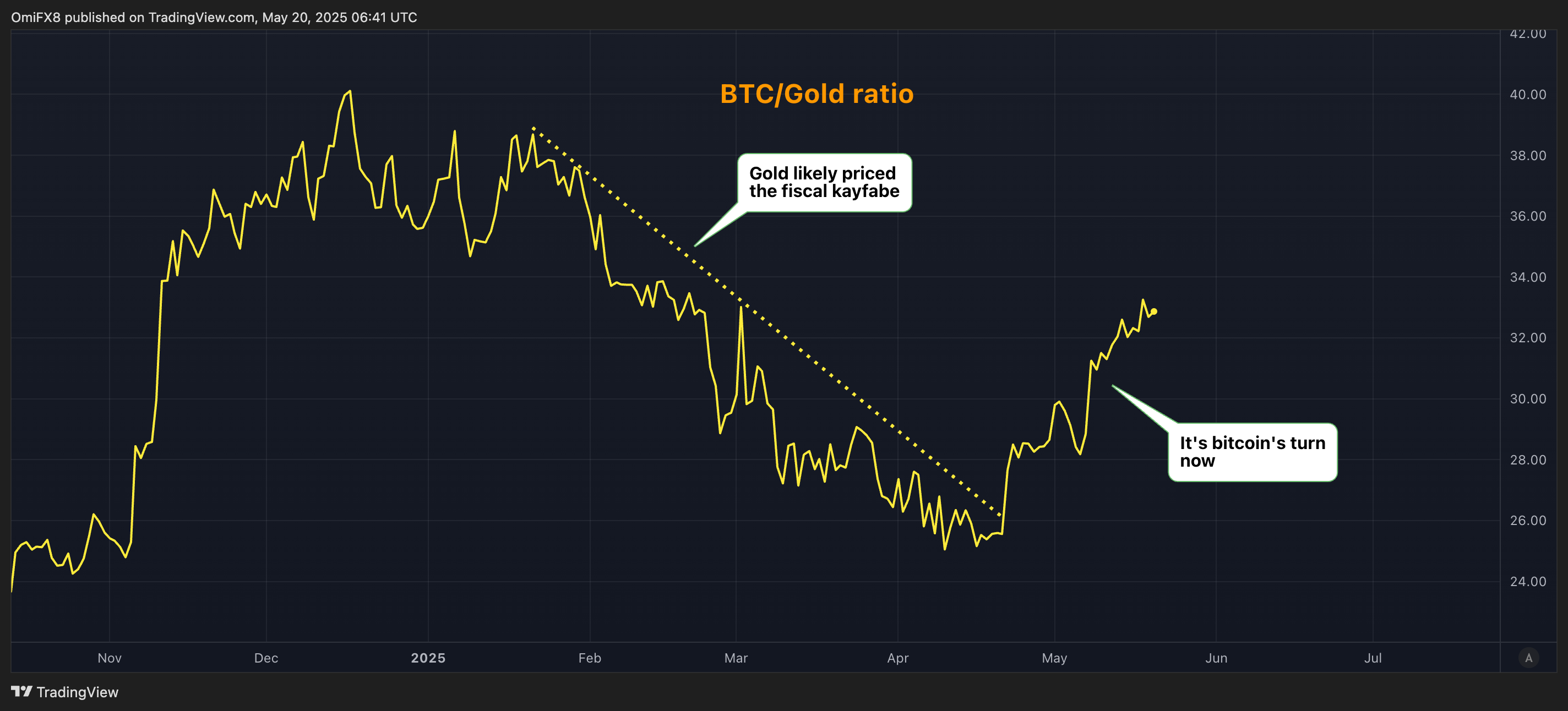

Historically, governments facing fiscal concerns person resorted to ostentation and repaying indebtedness by printing much money. They volition apt retake the aforesaid road, incentivizing request for hard assets similar golden and bitcoin.

"All roads pb to inflation. That’s historically the mode each civilization has gotten retired is that they inflated distant their debts," Tudor Jones said past year, portion naming BTC, gold, and commodities arsenic preferred holdings implicit longer duration bonds.

Two years ago, Economist Russell Napier voiced a akin opinion, saying, "We request to hole for an epoch of expanding fiscal repression and persistently precocious inflation."

Financial repression refers to authorities policies that nonstop funds from the backstage assemblage to the nationalist assemblage to assistance trim nationalist debt. The script is characterized by the ostentation complaint exceeding the instrumentality connected savings, superior controls and involvement complaint caps, each of which could bode good for bitcoin and gold.

Interest complaint caps are usually implemented done policies similar output curve control, which has the cardinal slope targeting a circumstantial level for the agelong enslaved yields, let's accidental 5%. Every time, the output looks to emergence supra the said level, the cardinal slope steps up enslaved purchases, injecting liquidity into the system.

Arthur Hayes, CIO and laminitis of Maelstrom, has said that output curve power volition yet beryllium implemented successful the U.S., torching a grounds rally successful bitcoin.

Hayes precocious said that President Donald Trump's determination to h2o down commercialized tariffs aft aboriginal April panic successful fiscal markets is grounds that the fiscal strategy is excessively levered for pugnacious reforms and warrants further wealth creation.

“They tin telephone it immoderate they want—just don’t telephone it QE—but it has the aforesaid effect: liquidity rises and Bitcoin benefits," Hayes said.

Impending rally won't beryllium smooth

The bullish lawsuit for BTC does not needfully mean determination won't beryllium hiccups.

The U.S. Treasury marketplace serves arsenic a bedrock of planetary concern and accrued volatility successful these bonds could origin fiscal tightening, perchance triggering a planetary dash for currency that sees investors merchantability each asset, including bitcoin.

As of now, however, the MOVE index, which represents the 30-day implied oregon expected volatility successful the U.S. Treasury notes, remains successful a downtrend.

5 months ago

5 months ago

English (US)

English (US)