As Bitcoin’s terms breached the $44,000 people connected Feb. 7, a important milestone was achieved, signaling a robust betterment to levels seen before the launch of spot Bitcoin ETFs. This terms betterment marks a notable comeback and brings a renewed sense of confidence among investors, arsenic evidenced by the accompanying spike successful unrealized profits crossed the Bitcoin market.

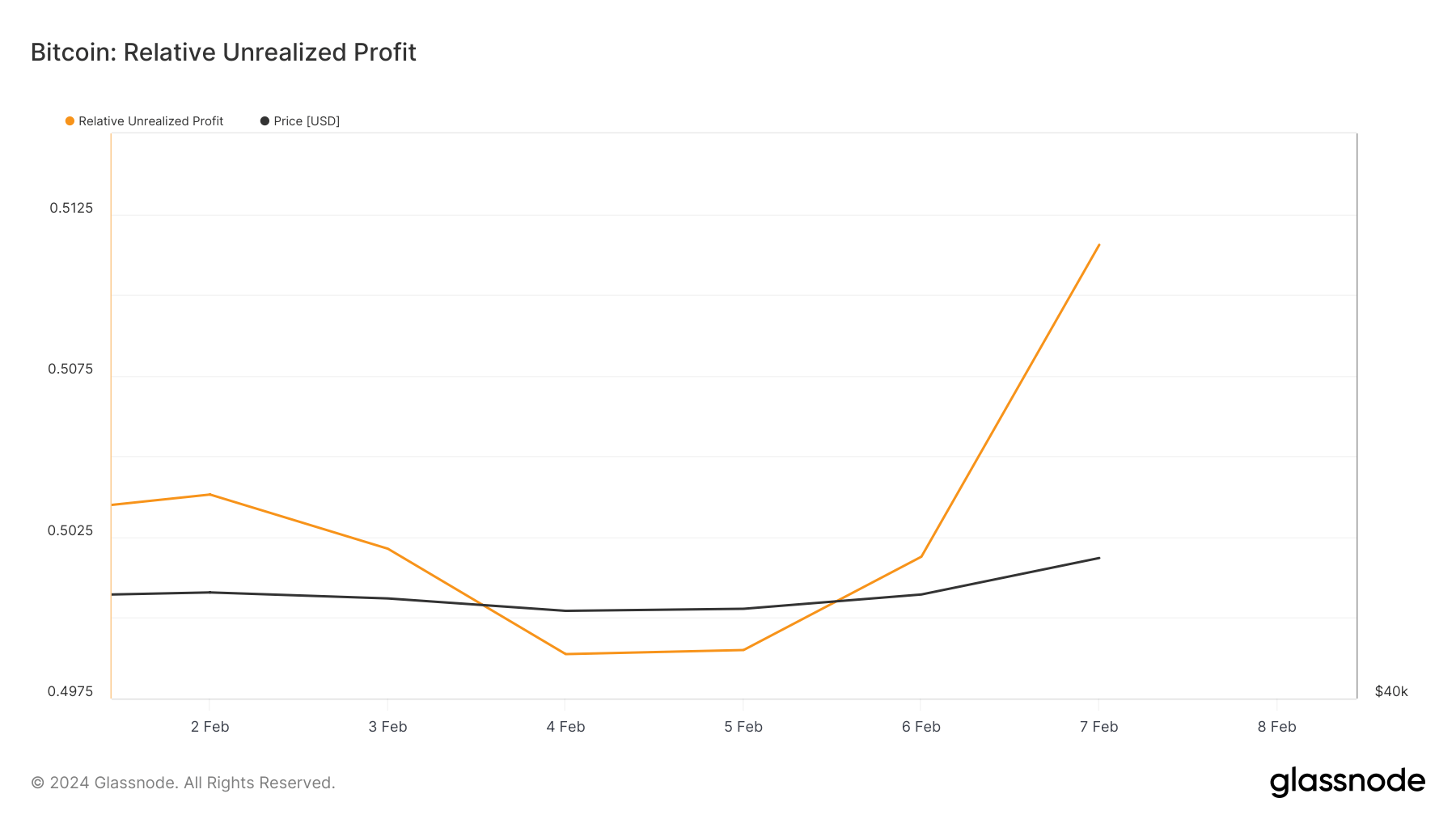

The comparative unrealized profit, an indicator measuring the wide proportionality of the marketplace holding Bitcoin astatine an unrealized profit, witnessed an summation from 0.499 to 0.511 successful the abbreviated span from Feb. 5 to Feb. 7. Although this emergence mightiness look minimal, it represents a important displacement successful marketplace sentiment wrong specified a little timeframe. This metric is simply a gauge for the level of optimism pervading the market, suggesting that a much important conception of investors are present sitting successful profitable positions without the contiguous volition to sell.

Graph showing the comparative unrealized nett for Bitcoin from Feb.2 to Feb. 8, 2024 (Source: Glassnode)

Graph showing the comparative unrealized nett for Bitcoin from Feb.2 to Feb. 8, 2024 (Source: Glassnode)Further broadening the marketplace perspective, nett unrealized profit/loss (NUPL), which differentiates betwixt unrealized nett and nonaccomplishment crossed each Bitcoin holders, accrued from 0.474 to 0.492. A affirmative uptrend shows the prevailing profitability wrong the network, reinforcing the bullish sentiment that the marketplace arsenic a full is benefiting from the terms resurgence.

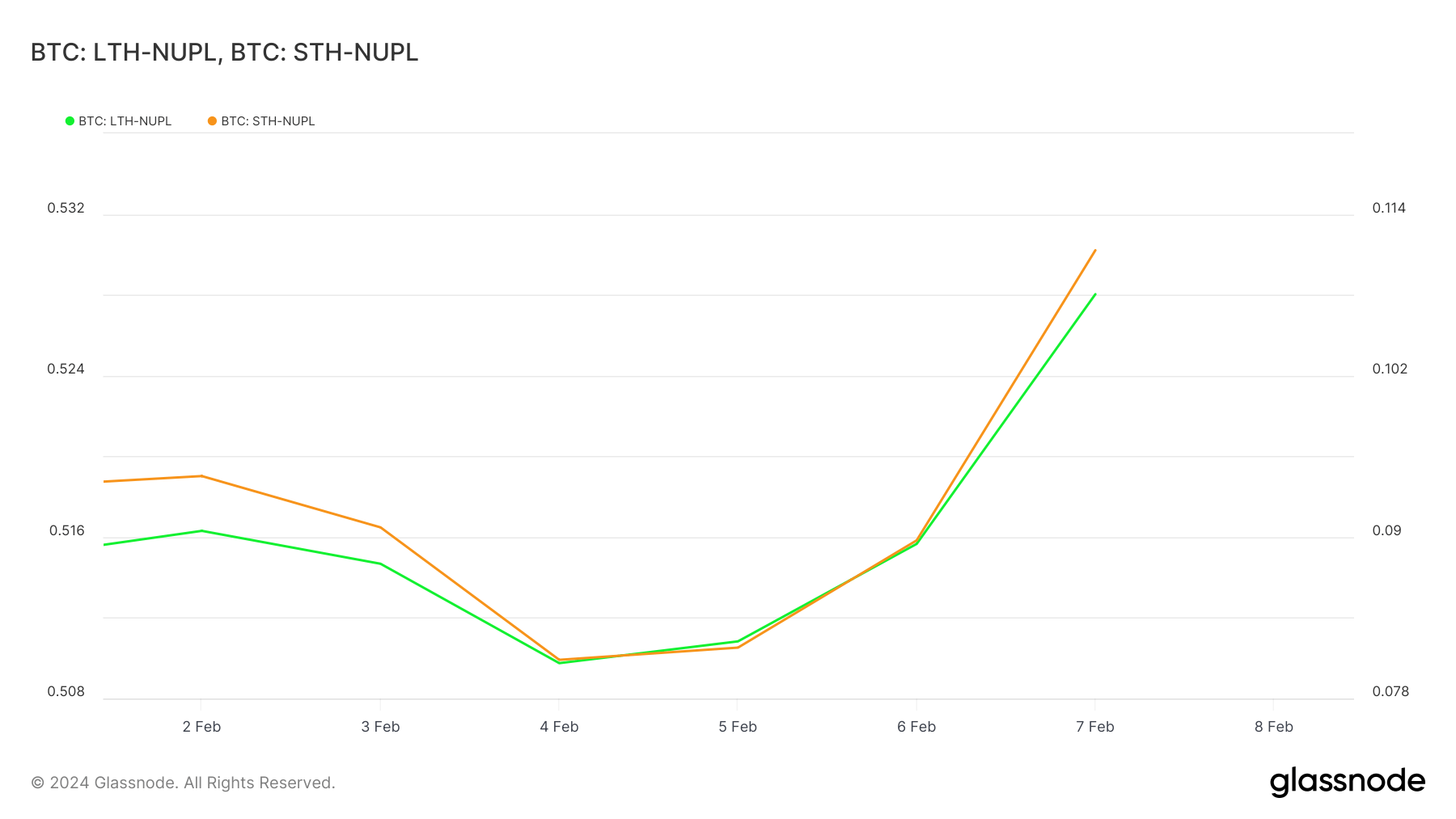

To dive adjacent deeper into however overmuch unrealized gains each marketplace conception is sitting on, we tin look astatine information for semipermanent and short-term holders. The accordant summation successful LTH NUPL from 0.510 to 0.528, alongside a much pronounced emergence successful STH NUPL from 0.081 to 0.111, reveals that some capitalist classes are experiencing increasing profitability, with short-term holders seeing a important boost successful unrealized gains. This divergence whitethorn bespeak that short-term traders are much reactive to caller terms movements, portion semipermanent holders stay steadily successful profit.

Graph showing the LTH NUPL (green) and STH NUPL (orange) from Feb.2 to Feb. 8, 2024 (Source: Glassnode)

Graph showing the LTH NUPL (green) and STH NUPL (orange) from Feb.2 to Feb. 8, 2024 (Source: Glassnode)The percent of UTXOs and the proviso successful nett metrics quantify the stock of existing Bitcoin held astatine a profit. The notable summation successful some metrics, with UTXOs successful nett rising from 86.83% to 94.60% and proviso successful nett from 83.49% to 90.7%, underscores a wide instrumentality to profitability crossed the market. This inclination is important for assessing the likelihood of selling pressure, arsenic higher percentages typically trim the contiguous inducement to merchantability astatine a profit. However, prolonged periods implicit 90% of the proviso was successful nett person ever ended successful a important selloff, arsenic astir of the marketplace is eventually pushed to instrumentality profits.

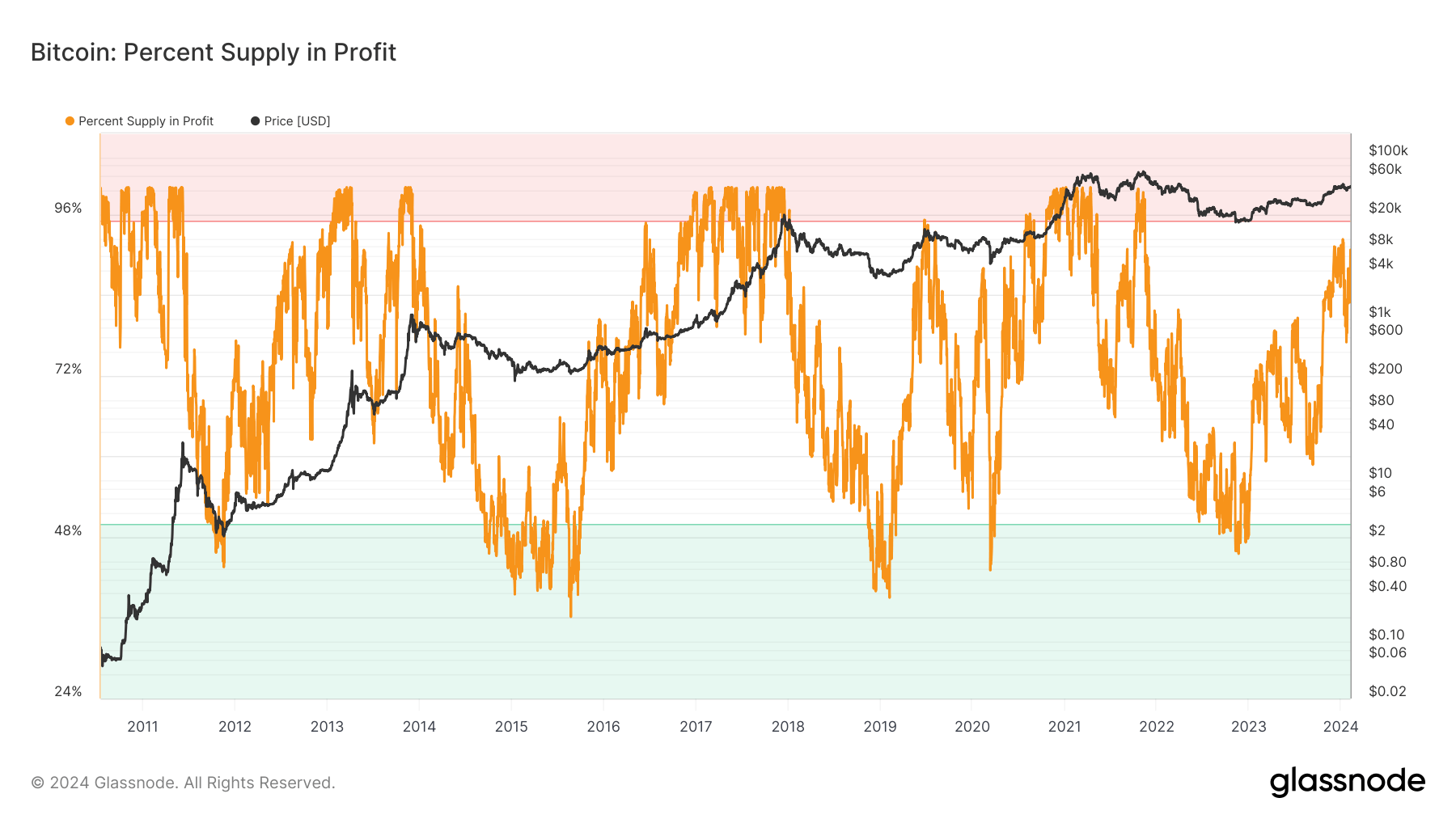

Graph showing the percent of Bitcoin’s proviso successful nett from 2009 to 2024 (Source: Glassnode)

Graph showing the percent of Bitcoin’s proviso successful nett from 2009 to 2024 (Source: Glassnode)The station Bitcoin supra $44k spurs marketplace assurance with spike successful unrealized profits appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)