Binance’s regulatory challenges successful assorted jurisdictions successful June look to person resulted successful a important diminution successful users’ crypto assets.

Binance users retreat assets.

The exchange’s latest proof of reserve snapshot, taken connected July 1, showed that users’ Bitcoin deposits fell by 3.5% to 592,450 BTC from 614.800 recorded connected June 1. This meant that the level users withdrew astir 22,000 BTC from the level during the period.

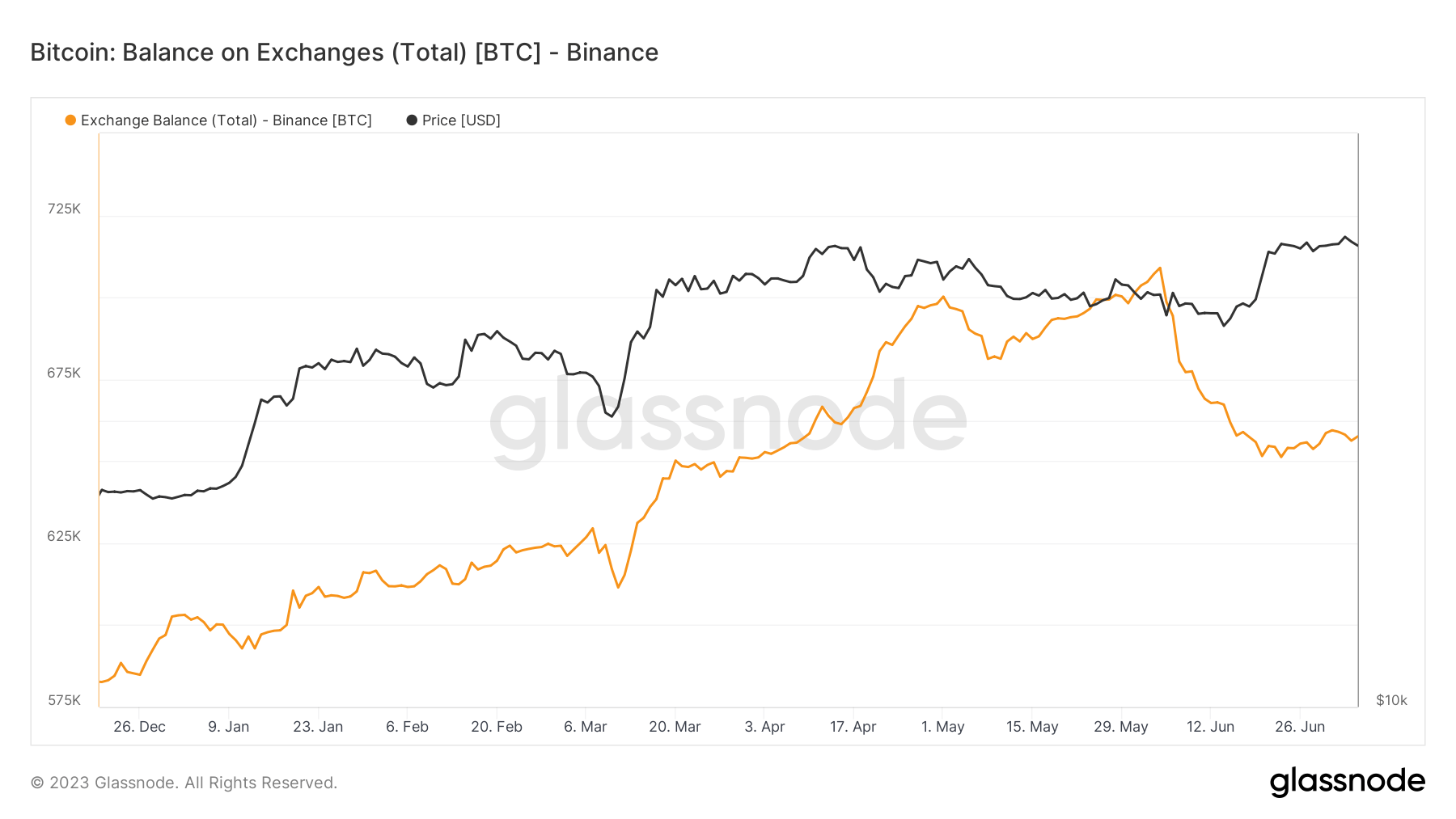

Data from Glassnode corroborates that Binance’s BTC speech importantly decreased. Per the information aggregator, Binance’s BTC speech equilibrium declined from a highest of 709,001 BTC connected June 4 to arsenic debased arsenic 651,275 BTC connected June 23 earlier rising to its existent equilibrium of 657,536 BTC arsenic of July 6.

Source: Glassnode

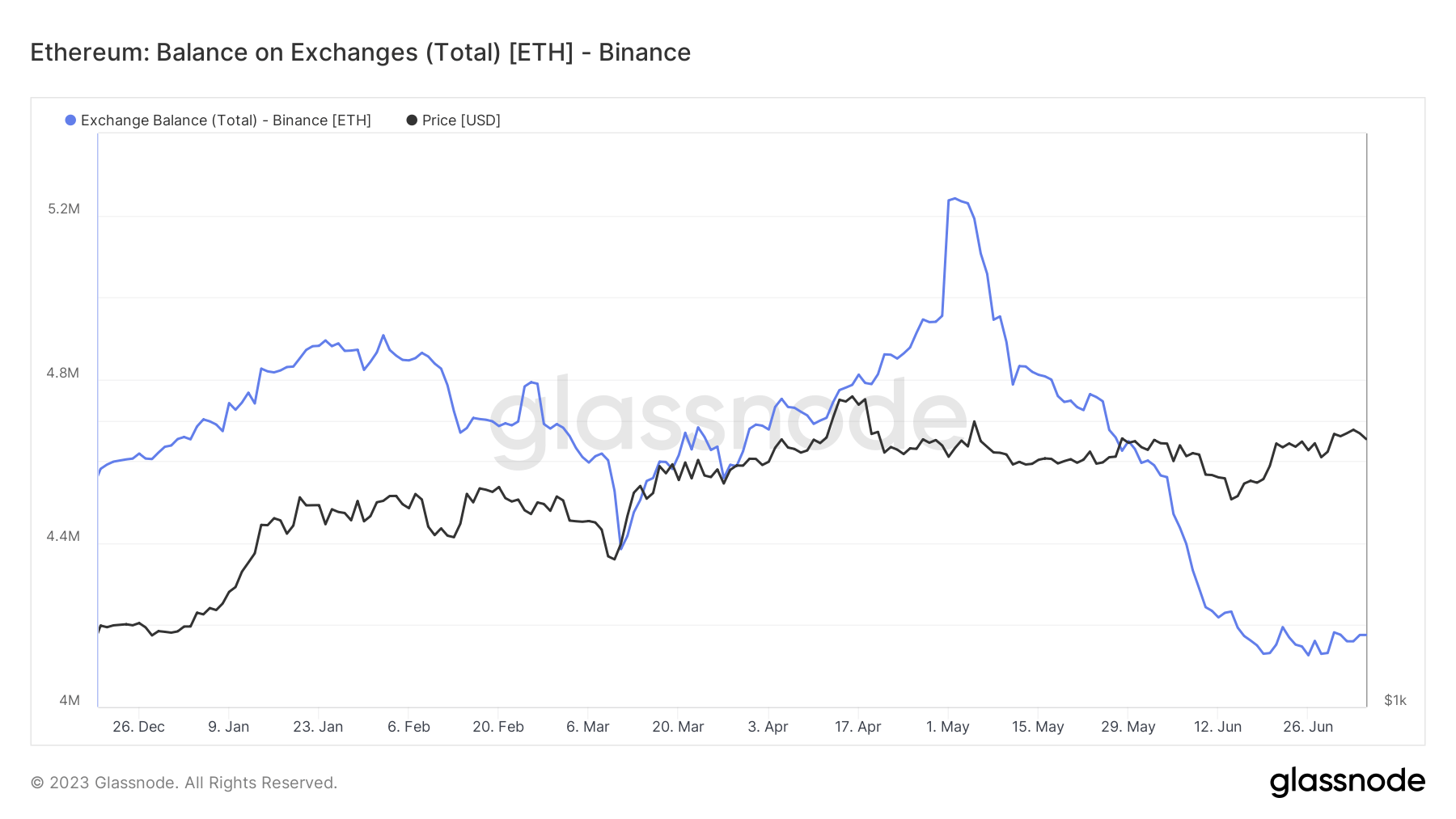

Source: GlassnodeThe speech users’ Ethereum deposits declined by 4.4% to 4.16 cardinal ETH arsenic of July 1 from the 4.35 cardinal ETH held for users connected June 1. This means the speech users withdrew astir 200,000 ETH from the level implicit 30 days.

Meanwhile, Glassnode information shows that Binance’s ETH equilibrium has been connected a downward inclination since the opening of May, coinciding with a play erstwhile the full fig of ETH held crossed each exchanges fell to a five-year low.

Source: Glassnode

Source: GlassnodeAnother large crypto plus that saw its deposits autumn implicit the past period is Tether’s USDT. The stablecoin equilibrium connected Binance declined by 1.61 cardinal to 15.47 billion, representing a 9.45% decrease.

Meanwhile, Binance’s BNB equilibrium bucked the deposits diminution trend, expanding by 6.6% to 29.7 cardinal BNB arsenic of July 1. Other assets that recorded accrued deposits included Ripple’s XRP, USD Coin (USDC), and others.

Binance regulatory issues

In June, Binance faced important regulatory hurdles successful respective jurisdictions. The U.S., assorted European nations, and Nigeria accrued their scrutiny of the exchange’s activities.

The U.S. Securities and Exchange Commission (SEC) alleged that Binance violated national securities instrumentality with its operation, adding that the speech offered crypto securities tokens to Americans.

While Binance has pledged to contention these allegations, CEO Changpeng ‘CZ’ Zhao has characterized the suit arsenic much than a firm ineligible conflict – helium sees it arsenic an attack connected the broader crypto industry.

The speech mislaid its Euro outgo spouse successful Europe and exited respective determination markets, including Austria, the Netherlands, Cyprus, and Germany. During these exits, French authorities raided the speech bureau successful France, and a cease and desist bid was issued against it successful Belgium.

Despite these issues, a Binance spokesperson told CryptoSlate that the firm’s absorption was ensuring compliance with Europe’s forthcoming Markets successful Crypto Assets (MiCA) regulations.

The station Binance users retreat assets successful June amid planetary regulatory pressure appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)