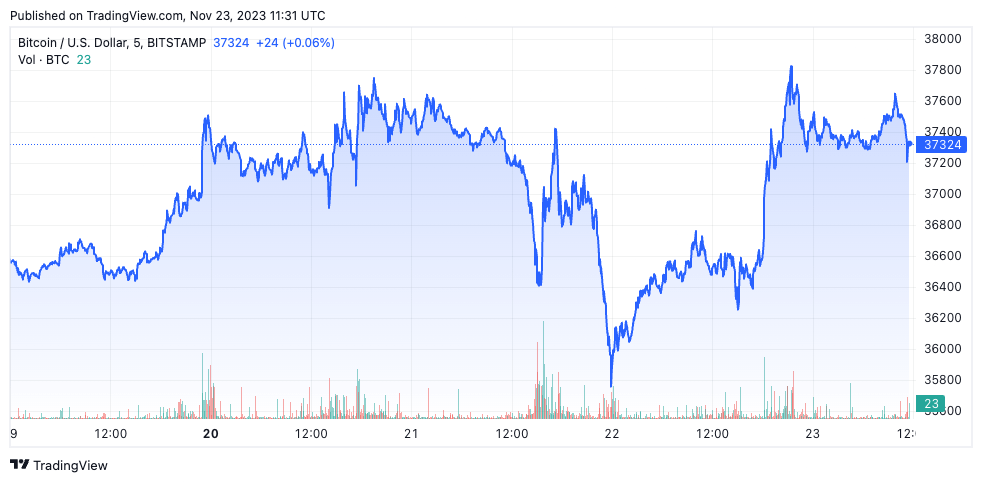

The SEC’s $4 cardinal good connected Binance and the consequent stepping down of the exchange’s CEO, Changpeng Zhao, importantly impacted the market. While Bitcoin’s terms dipped somewhat connected Nov. 21, it experienced a important driblet to $35,740 successful the aboriginal hours of Nov. 22, showing an contiguous and assertive marketplace absorption to the news.

Graph showing Bitcoin’s terms from Nov. 19 to Nov. 23, 2023 (Source: CryptoSlate BTC)

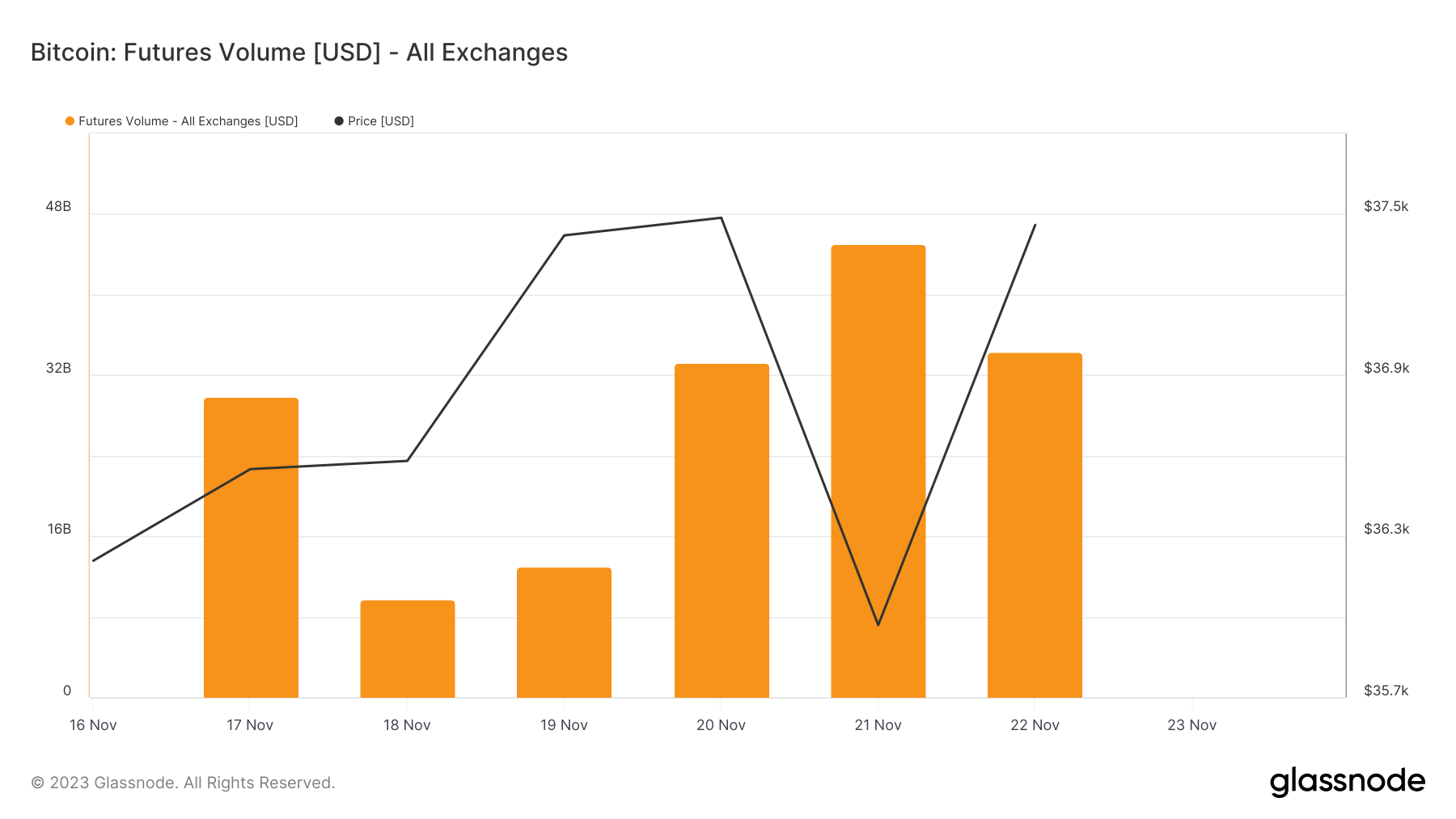

Graph showing Bitcoin’s terms from Nov. 19 to Nov. 23, 2023 (Source: CryptoSlate BTC)The futures marketplace wasn’t spared from the volatility, experiencing an arsenic crisp spike successful activity. The full measurement traded successful Bitcoin futures contracts surged to $45.05 cardinal by Nov. 21, up from $9.79 cardinal connected Nov. 18. This spike, much than quadrupling successful a substance of days, shows a flurry of trading enactment successful the futures market. It apt reflects a premix of speculative trading, hedging strategies, and accelerated adjustments by traders successful effect to the uncertainty and volatility introduced by the quality from Binance. The consequent alteration to $34.3 cardinal connected Nov. 2 indicates a partial normalization but inactive reflects heightened enactment compared to the play earlier the SEC’s announcement.

Graph showing the futures trading measurement from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)

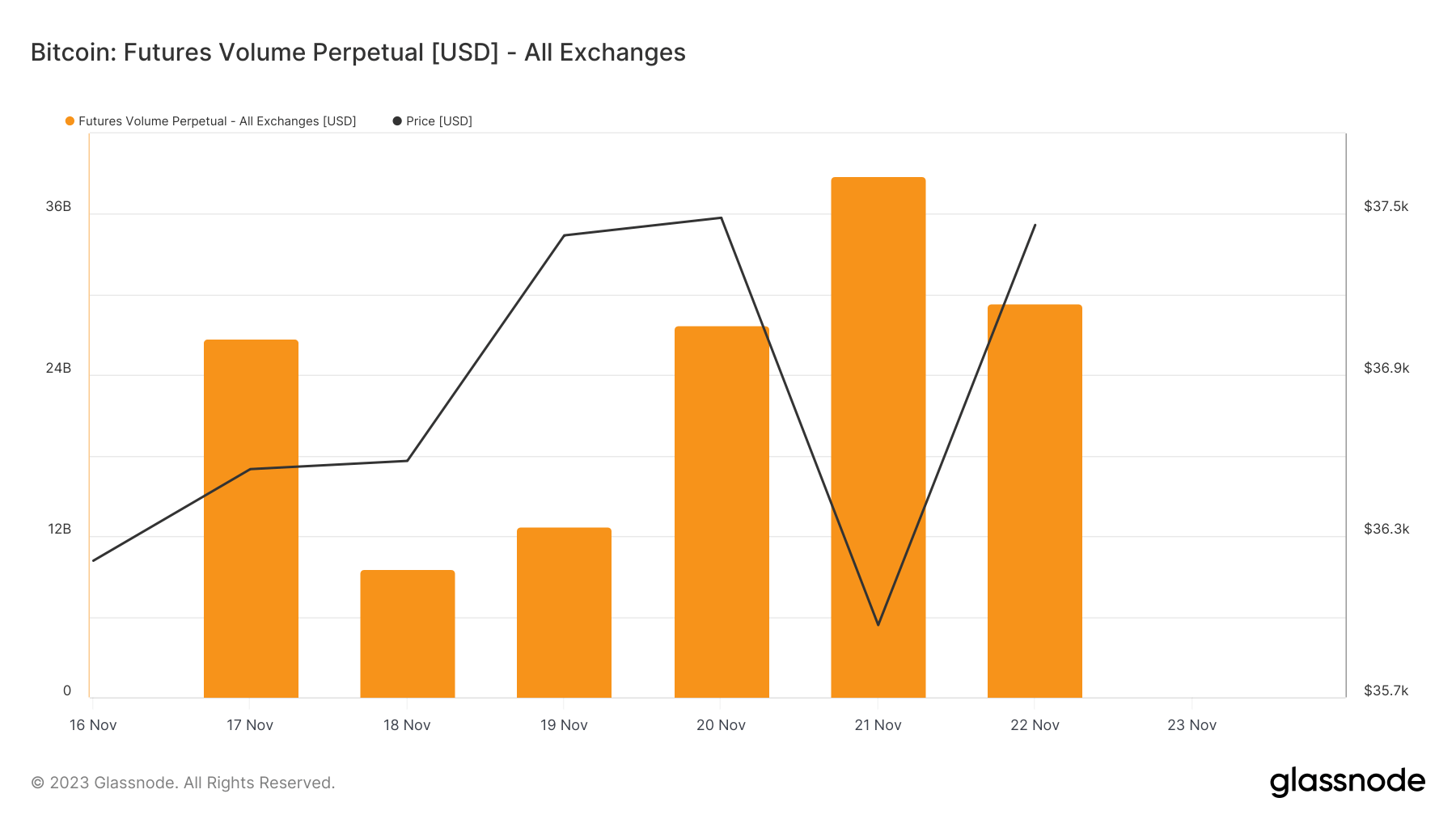

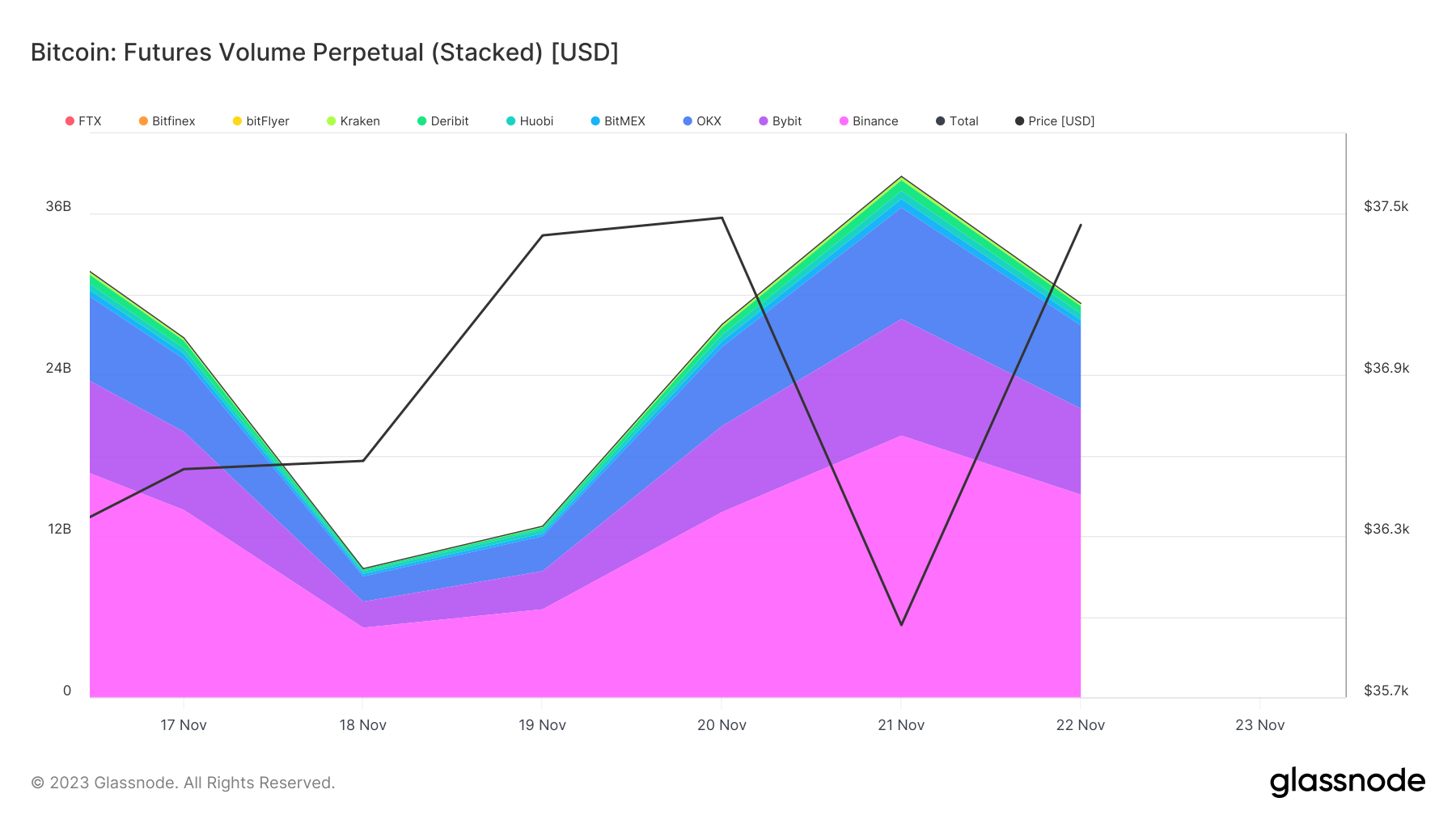

Graph showing the futures trading measurement from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)Parallel trends were seen successful the perpetual futures marketplace arsenic well. Here, the measurement accrued from $9.58 cardinal connected Nov. 18 to $38.79 cardinal connected Nov. 21 earlier reducing to $29.33 cardinal connected Nov. 22. Perpetual futures, being non-expiring contracts, are often favored for semipermanent positions. The accrued measurement successful this conception shows conscionable however reactive the marketplace is to changes successful the industry.

Graph showing the perpetual futures trading measurement from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)

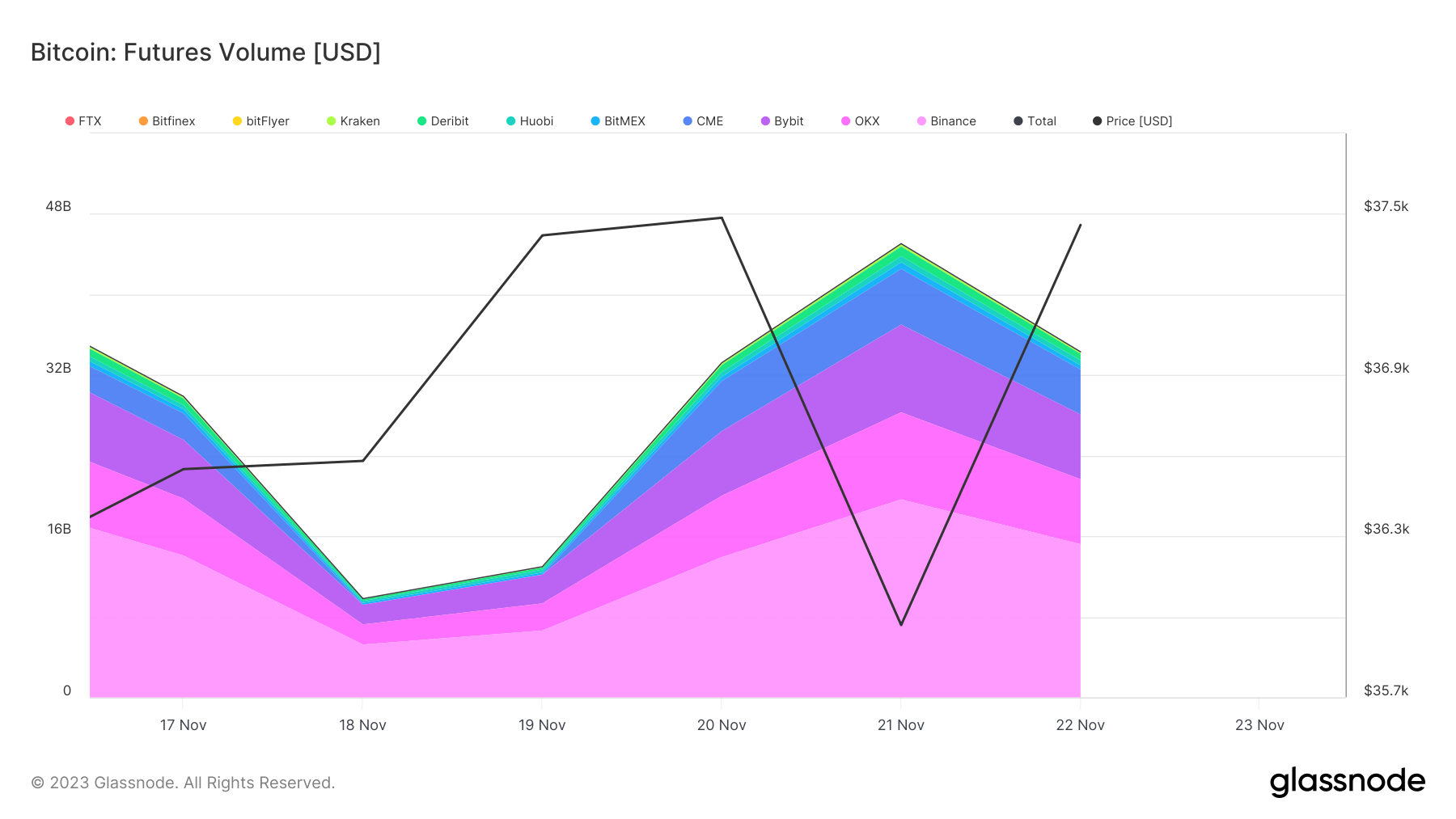

Graph showing the perpetual futures trading measurement from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)The organisation of volumes crossed exchanges shows wherever astir of the trading occurred. Binance, straight impacted by the news, saw its futures trading measurement leap from $5.24 cardinal connected Nov. 18 to $19.65 cardinal connected Nov. 21. contempt the antagonistic news, this summation mightiness bespeak traders’ attempts to liquidate positions oregon capitalize connected expected marketplace movements. The similar, though little pronounced, maturation successful trading volumes connected different exchanges similar OKX and Bybit, from $2 cardinal and $1.94 billion, respectively, connected Nov. 18 to $8.65 cardinal and $8.71 cardinal connected Nov. 21, shows a broader marketplace absorption not constricted to Binance.

Graph showing the futures trading measurement crossed exchanges from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)

Graph showing the futures trading measurement crossed exchanges from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)In the perpetual futures segment, Binance’s measurement accrued from $5.18 cardinal to $19.48 during the aforesaid period, again showing important trader enactment connected the platform. The akin increases successful volumes connected Bybit and OKX amusement a market-wide effect for perpetual futures arsenic well.

Graph showing the futures trading measurement crossed exchanges from Nov. 17 to Nov. 23, 2023 (Source: Glassnode)

Graph showing the futures trading measurement crossed exchanges from Nov. 17 to Nov. 23, 2023 (Source: Glassnode)The information shows an assertive but short-lived marketplace absorption to the quality of Changpeng Zhao’s stepping down and the SEC fine. A little dip successful Bitcoin’s terms beneath the seemingly-established $36,000 level caused a important spike successful trading volumes crossed large exchanges. This effect highlights the sensitivity of the crypto marketplace to regulatory quality and enactment changes successful large manufacture players.

The station Binance turmoil leads to grounds futures enactment – analyzing the impact appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)