Binance, the world’s largest cryptocurrency speech by marketplace value, said its organization clients are optimistic connected the outlook of crypto for the adjacent twelvemonth and beyond, according to a survey it conducted betwixt March and May 2023.

The study, conducted by Binance Research and Binance VIP & Institutional team, surveyed 208 of their clients from March 31 to May 15 of this year. The respondents consisted of 52% funds with crypto assets nether absorption (AUM) nether $25 cardinal and 22.6% had AUM larger than $100 million.

63.5% of respondents said they are affirmative connected the outlook of crypto for the adjacent twelvemonth and 88% said they are optimistic for the adjacent decade, according to the report.

The survey besides recovered that contempt antagonistic marketplace events successful the past year, respondents maintained their crypto allocations. 47% of organization investors kept their crypto allocations implicit the past twelvemonth and implicit a 3rd accrued their allocation successful the aforesaid period, said the report. Just 4.3% said they expect to trim allocation to crypto successful the adjacent 12 months.

Institutional clients appeared affirmative successful Binance's survey contempt regulatory crackdown against Binance and Coinbase from the U.S. Securities and Exchange Commission earlier this period and a continued carnivore marketplace that started past year.

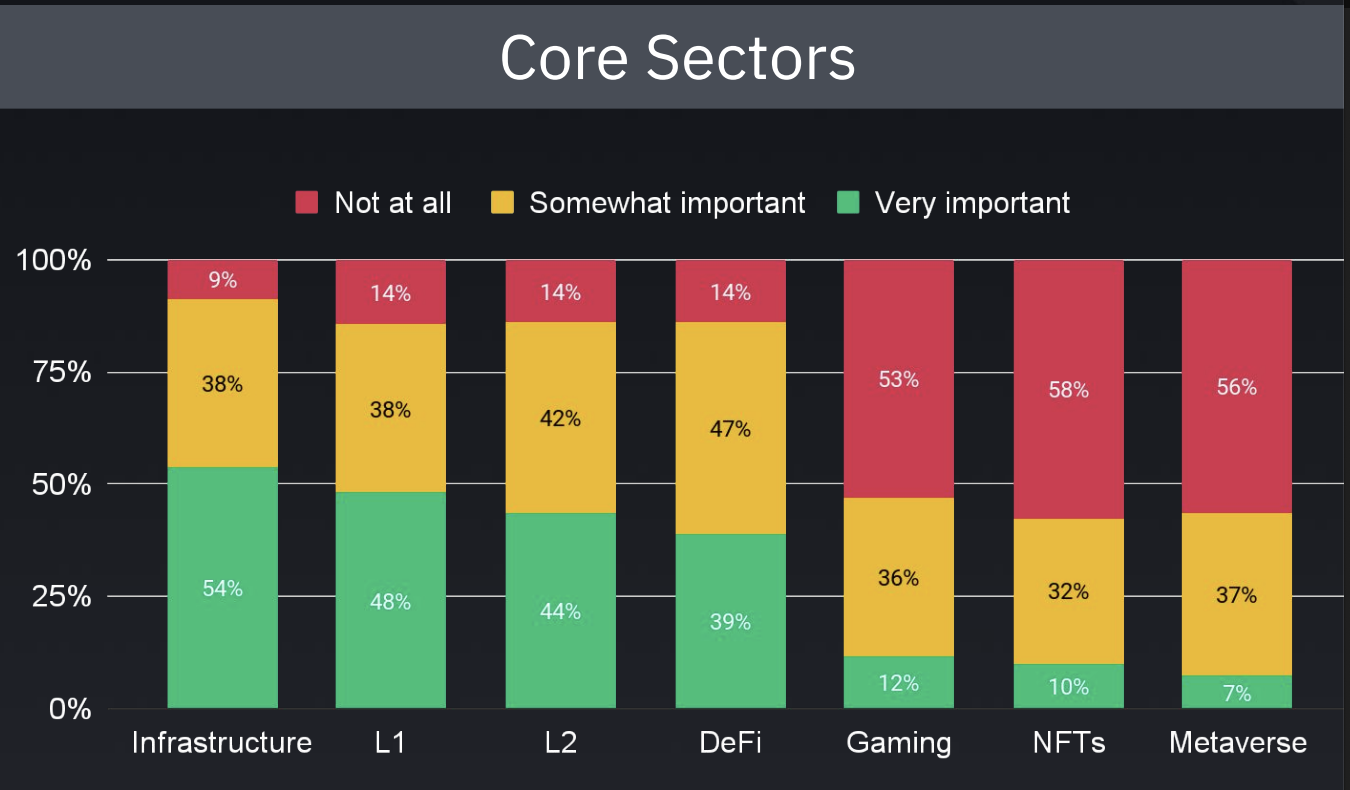

In presumption of areas of involvement for investing, 54% of investors saw infrastructure to beryllium the astir important, intimately followed by furniture 1 and furniture 2 projects with 48% and 44%, respectively.

Binance

BinanceWeb3 infrastructure has been an capitalist darling from the opening of this twelvemonth pursuing past year's FTX implosion. The word - infrastructure - is utilized broadly and tin scope from inter-blockchain portals to on-chain wallets.

Most recently, blockchain infrastructure supplier LayerZero Labs raised $120 million successful a Series B backing circular astatine a valuation of $3 billion, tripling its valuation from its $135 cardinal round successful March 2022.

On the flipside, NFTs, metaverse and gaming sectors were slightest important for the organization investors, according to the survey.

NFTs and metaverse saw a meteoric emergence successful popularity during the bull marketplace of 2021, with Eye-watering NFT sales, similar "Beeple’s Everydays: the First 5000 Days and Facebook rebranding to Meta to absorption connected the metaverse. Since then, the hype has dwindled owed to continued carnivore marketplace which saw little NFT trading volume and a stagnant growth for metaverse.

However, Apple's astir caller mixed world headset brought immoderate short-lived optimism backmost into the metaverse industry.

Edited by Aoyon Ashraf.

2 years ago

2 years ago

English (US)

English (US)