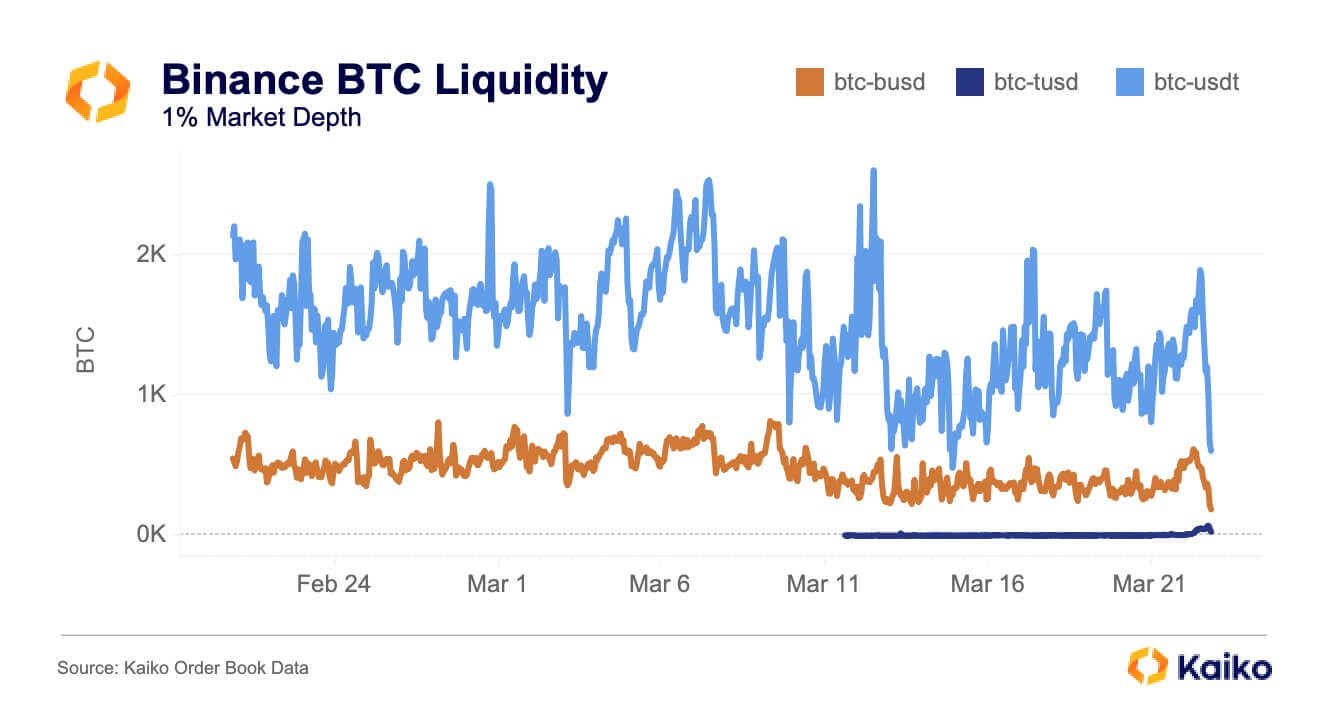

Binance’s Bitcoin (BTC) liquidity for its TrueUSD (TUSD) roseate much than 250% connected March 22 aft it phased retired its zero-fee trading for different stablecoins.

Kaiko Data researcher Riyad Carey highlighted that the exchange’s BTC liquidity for Binance USD (BUSD) and Tether’s USDT declined by 60% and 70%, respectively.

Source: Kaiko

Source: KaikoMeanwhile, the exchange’s liquidity for TUSD accrued to 29 BTC from 9 BTC wrong a fewer hours.

On March 15, Binance announced it was moving the zero-fee BTC trading diagnostic from BUSD to TUSD connected March 22. At the time, CEO Changpeng ‘CZ’ Zhao blamed the regulatory upheaval the different stablecoins faced for the firm’s decision.

Will this determination impact Binance’s marketplace share?

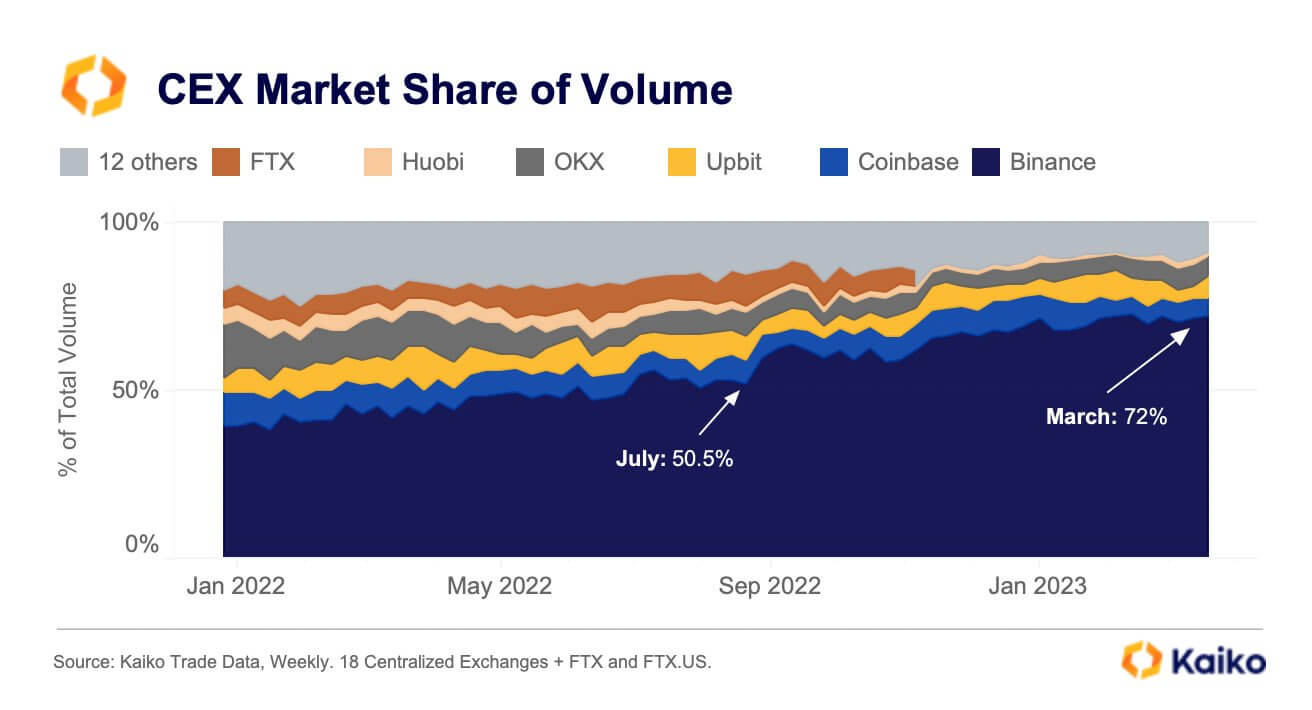

Kaiko’s manager of research, Clara Medalie, highlighted the relation the zero-trading interest enactment played successful improving Binance’s marketplace share.

Source: Kaiko

Source: KaikoAccording to Medalie, the escaped trading enactment helped Binance summation an further 20% of the marketplace since it was introduced successful July 2022. At the time, Binance controlled lone 50.5% of the market; however, the exchange’s marketplace power accrued to 72% pursuing FTX’s illness successful November 2022.

Source: Kaiko

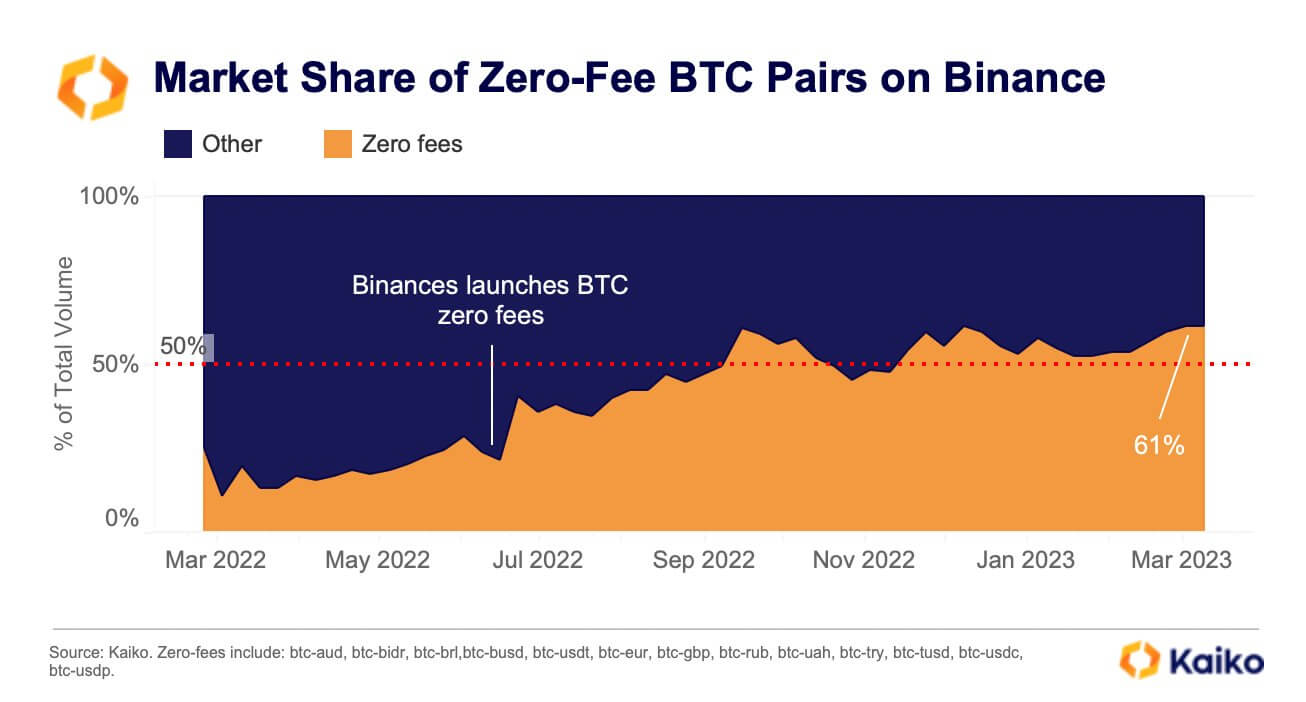

Source: KaikoAdditional accusation from Kaiko pointed retired that the zero-trading enactment accounted for 61% of the full measurement connected Binance arsenic of the erstwhile week.

Binance users drawn to the speech due to the fact that of its zero-fee diagnostic could permission for different rival platforms, Medalie noted.

TUSD keeps growing

Binance’s determination would greatly payment TUSD — emerging arsenic a important victor from its rivals’ caller debacle.

Carey added that Binance’s determination showed that it had made an evident determination to beforehand TUSD arsenic the successor to BUSD.

Since the crackdown connected BUSD, TUSD has seen its circulating proviso double to implicit $2 cardinal and go the second-largest stablecoin connected the Tron network. During the period, Binance minted much TUSD stablecoin and added caller trading pairs for the asset.

Meanwhile, Protos’ researcher Bennett Tomlin pointed out that TUSD is 1 of the weirdest stablecoins successful the crypto market. According to the researcher, TUSD has immoderate undisclosed relations with Justin Sun, and bankrupt Alameda Research was besides a pb capitalist successful the asset.

The station Binance’s Bitcoin liquidity for TUSD surges 250% appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)