According to its latest impervious of reserves report, Binance experienced a important diminution successful its Bitcoin equilibrium successful November, dropping by implicit 23,000 BTC, oregon astir 4%, coinciding with the exchange’s regulatory issues with U.S. authorities.

According to data from Binance’s website, the full BTC equilibrium of its customers was 584,659 BTC astatine the opening of November. However, the equilibrium had decreased to 561,003 BTC by the commencement of December. This suggests a important withdrawal of assets from the level during the regulatory challenges it faced.

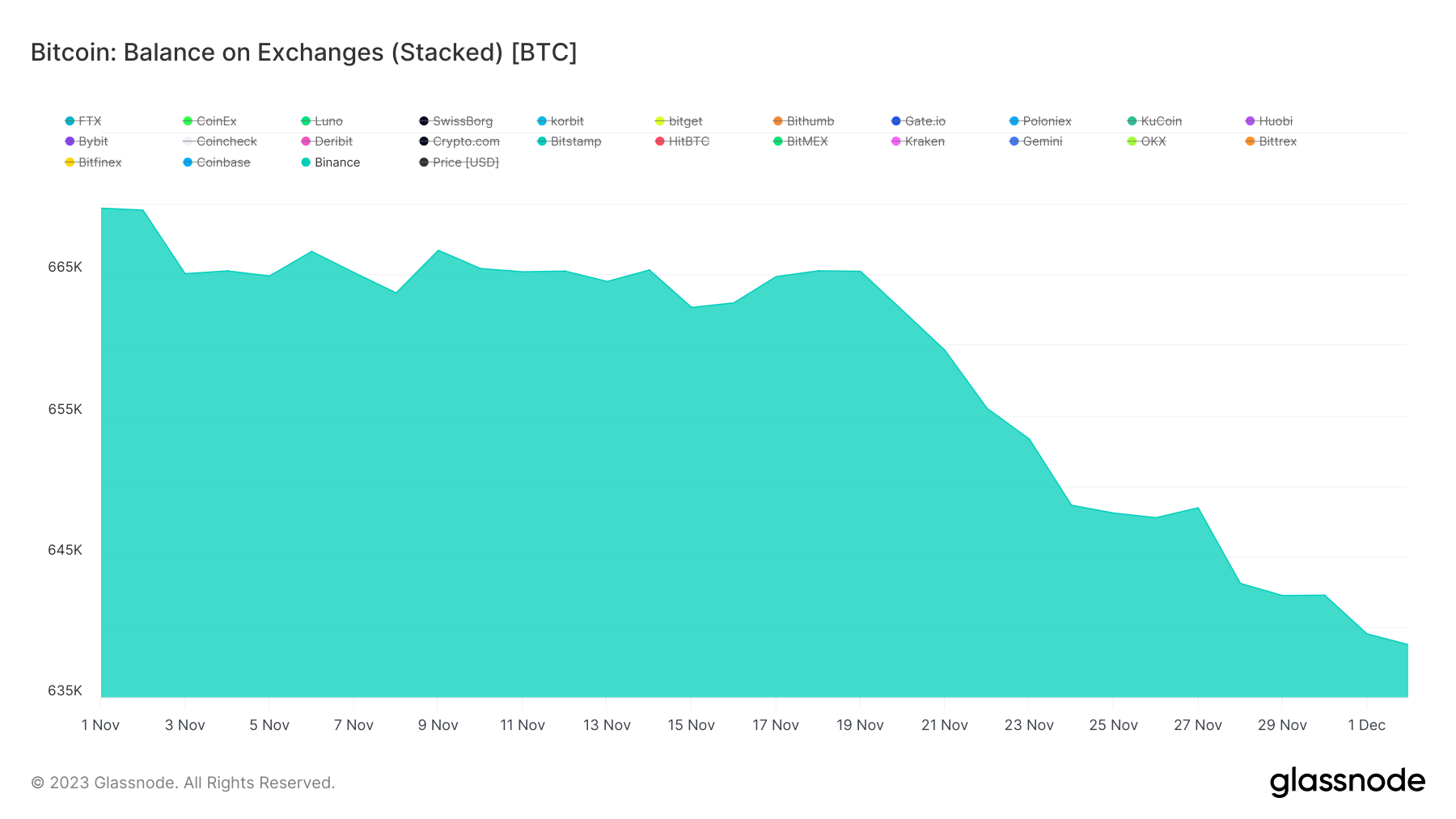

Binance Bitcoin Balance successful November. (Source: Glassnode)

Binance Bitcoin Balance successful November. (Source: Glassnode)A CryptoSlate Insight investigation highlighted a chiseled inclination among Binance users during this period. The level witnessed important BTC outflows from larger holders, portion incoming funds chiefly originated from retail users.

Supporting this observation, DeFillama’s information dashboard revealed that Binance encountered outflows surpassing $2 cardinal betwixt Nov. 1 and Dec. 1.

This diminution successful Binance’s Bitcoin holdings occurred arsenic the level resolved to a settlement exceeding $4 cardinal with the U.S. authorities connected issues relating to aggregate violations of respective fiscal laws. Additionally, the exchange’s founder, Changpeng ‘CZ’ Zhao, stepped down arsenic CEO aft pleading guilty to charges related to wealth laundering.

Other plus balances

Binance’s website further shows that the level balances connected different large cryptocurrencies besides recorded declines during the period.

For context, Ethereum holdings for Binance users dropped by astir 0.67%, moving from 3.91 cardinal to 3.88 cardinal arsenic users withdrew their assets.

Similar trends were observed successful balances for different assets specified arsenic XRP, Litecoin, USDC, and Binance’s autochthonal BNB token.

In contrast, Binance saw a much than 5% surge successful the equilibrium of Tether’s USDT, reaching $15.2 billion. This summation coincided with implicit 860 cardinal units of the stablecoin being sent to the level by users during the aforesaid period.

Some analysts judge that the upsurge successful USDT’s equilibrium connected Binance is linked to the stablecoin’s growing marketplace supply. As Binance maintains its presumption arsenic the starring cryptocurrency speech by trading volume, crypto traders progressively deposit their USDT connected the level for trading purposes.

Despite regulatory concerns, information connected Binance’s website indicates that the exchange’s assets stay afloat backed.

The station Binance Proof-of-Reserves amusement Bitcoin equilibrium dropped 23k BTC successful November amid regulatory woes appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)