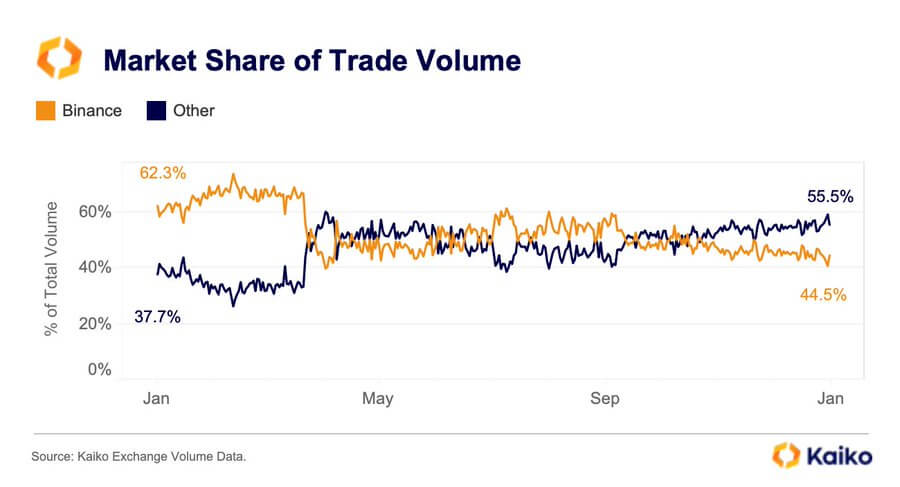

Crypto speech Binance’s marketplace stock experienced a important diminution past twelvemonth to 44.5%, according to data from Paris-based crypto quality level Kaiko.

This diminution follows a three-year upward trend, wherever Binance’s marketplace stock surged from 22% successful 2020 to highest astatine 60% successful 2022. However, the consequent regulatory hurdles crossed respective jurisdictions contributed to the downturn of its marketplace stock during the past year.

Binance Market Share (Source: Kaiko)

Binance Market Share (Source: Kaiko)Binance regulatory issues

Due to regulatory non-compliance issues successful 2023, Binance withdrew from Canada, the United Kingdom, and assorted European countries, including Austria, Cyprus, the Netherlands, and others.

However, the superior catalyst for its marketplace stock diminution stems from the regulatory problems it encountered successful the United States, wherever national agencies similar the Commodities Futures Trading Commission (CFTC), the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN), and the Office of Foreign Assets Control (OFAC), brought ineligible actions against it.

The Justice Department said Binance, the world’s largest crypto exchange, prioritized maturation and profits implicit compliance with U.S. instrumentality and was charged accordingly.

The regulatory actions resulted successful its CEO and co-founder Changpeng Zhao’s resignation and the statement of a grounds $4.3 cardinal colony with the authorities. Zhao is presently successful the U.S., awaiting sentencing for his relation astatine the crypto trading platform.

Despite this development, the U.S. Securities and Exchange Commission (SEC) remains a formidable challenge for Binance, with pending charges against the speech and its U.S. affiliate. The regulator alleges that the steadfast was progressive successful listing unregistered securities, plus commingling, and marketplace manipulation.

Additionally, the SEC classified Binance-related cryptocurrencies similar BNB and the BUSD stablecoin arsenic securities.

Notwithstanding the marketplace stock diminution and regulatory battles, Binance attracted 40 cardinal caller users successful 2023, expanding its idiosyncratic basal to 170 cardinal worldwide. The institution besides stated that it spent implicit $200 cardinal to bolster its regulatory compliance efforts past year.

The station Binance dominance fell to 44% past twelvemonth amid mounting regulatory and ineligible woes appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)