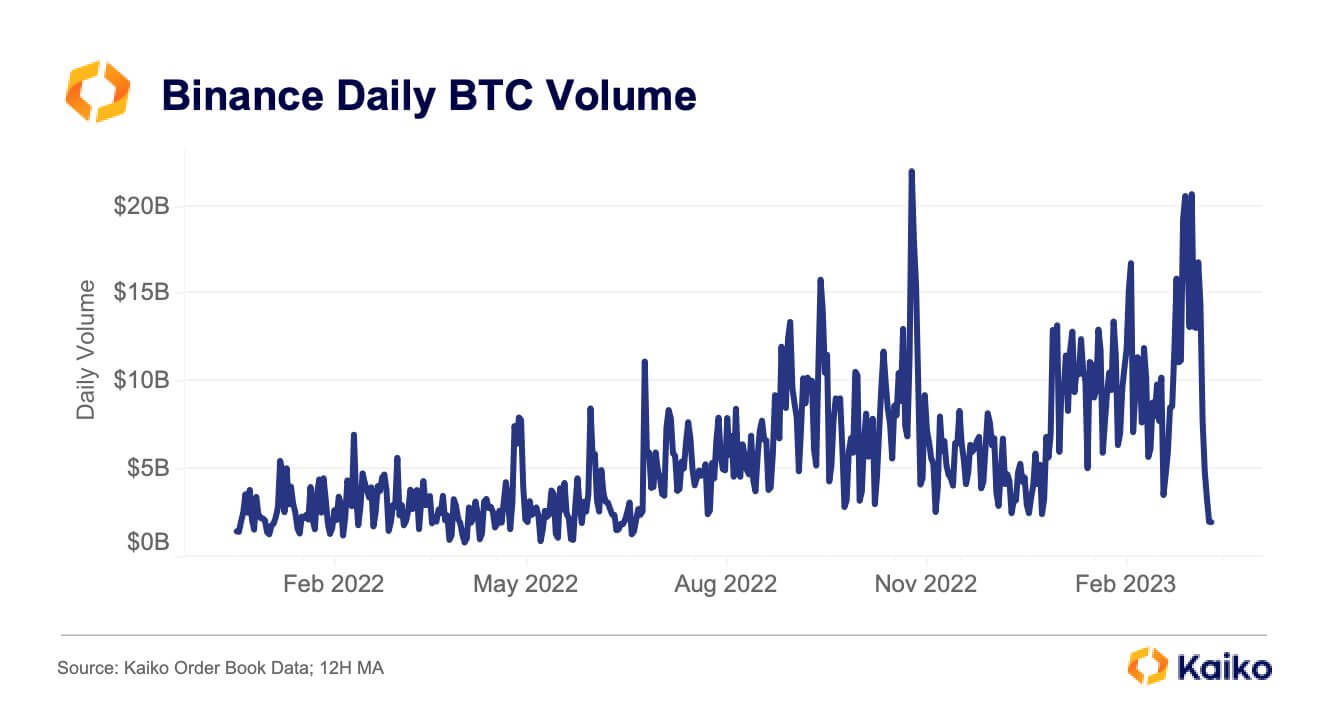

Binance’s Bitcoin (BTC) regular trading measurement has fell to its lowest levels since July 4, 2022, arsenic the effect of ending its zero-fee trading for each trading pairs but TrueUSD (TUSD), according to Kaiko data.

Kaiko researcher Riyad Carey pointed out that the past clip Binance’s measurement went this debased was 2 days earlier it introduced the zero-fee trading options. According to him, the measurement diminution coincided with the extremity of escaped trading.

Binance Bitcoin Daily Volume (Source: Kaiko)

Binance Bitcoin Daily Volume (Source: Kaiko)Binance ended the escaped trading enactment for astir of its BTC’s stablecoin brace connected March 22 — citing the caller regulatory issues facing the space. The escaped trading enactment helped the speech summation its marketplace stock to 72% from 50.5% — it besides accounted for astir 61% of its full volume.

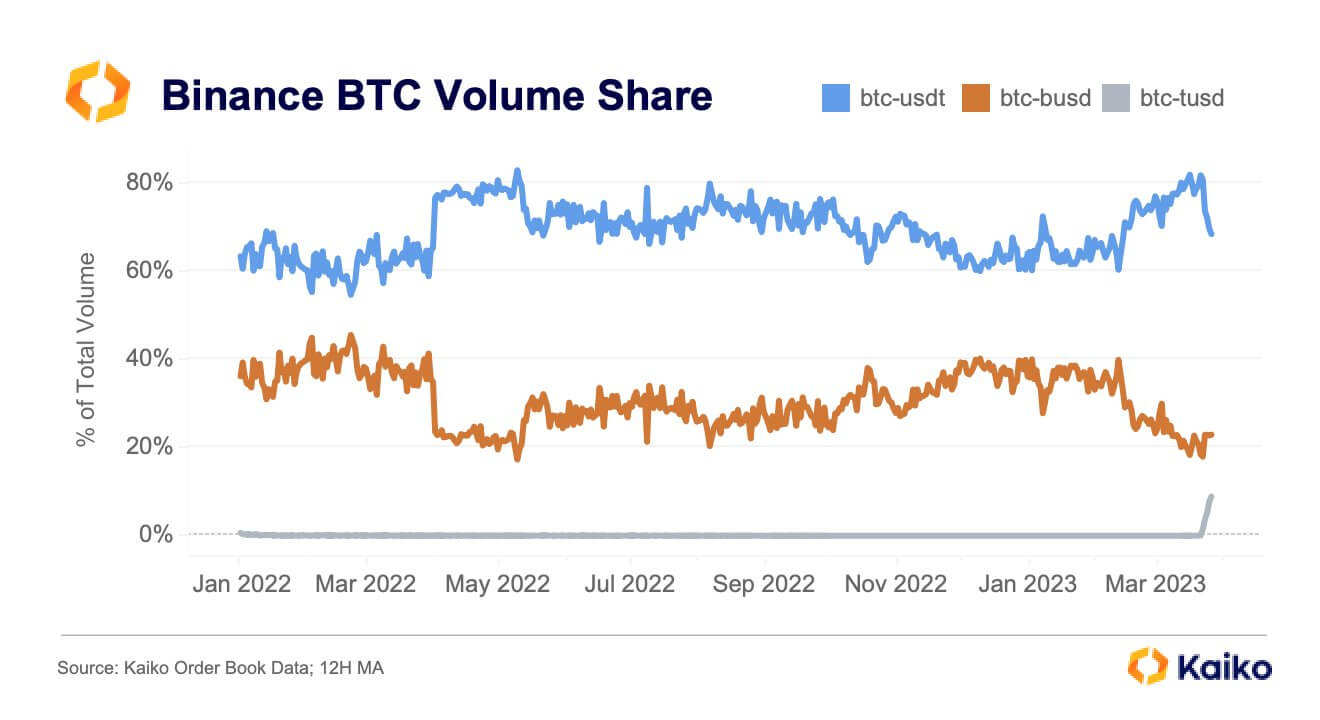

Meanwhile, Binance’s BTC-TUSD marketplace stock accrued to astir 10% portion BTC-USDT measurement connected the speech plunged to 68% from 81%.

Binance Bitcoin Volume (Source: Kaiko)

Binance Bitcoin Volume (Source: Kaiko)Since Binance phased retired the zero-fee trading, TUSD’s liquidity has risen by much than 250% — portion liquidity for stablecoins similar Tether’s USDT and Binance USD (BUSD) has declined much than 60%, respectively.

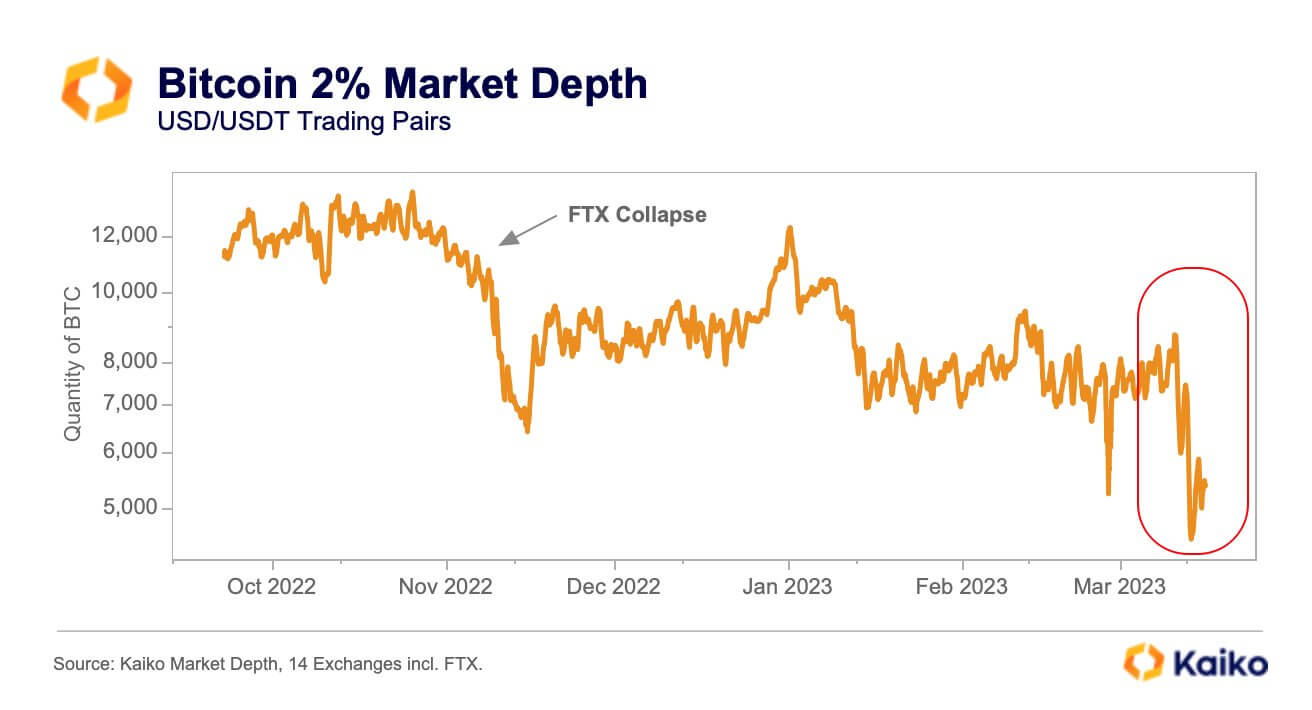

Bitcoin’s declining liquidity

While Bitcoin has rallied by astir 70% successful the existent year, marketplace liquidity surrounding the flagship integer plus has dropped to a 10-month low. Market liquidity is however casual it is to transact an plus without affecting price.

Bitcoin liquidity (Source: Kaiko)

Bitcoin liquidity (Source: Kaiko)Kaiko’s Conor Ryder noted that the caller illness of crypto-friendly banks has profoundly affected U.S.-based exchanges owed to the closure of US Dollar outgo rails. He added that “market makers successful the portion [are] facing unprecedented challenges to their operations.”

According to Ryder, USD pairs spreads person suffered much volatility owed to the uncertainty surrounding the crypto manufacture successful the United States. Besides that, slippage connected U.S-based exchanges has accrued owed to these issues.

For context, the slippage connected a BTC-USD 100,000 merchantability bid connected Coinbase has accrued by 2.5x from what it was successful aboriginal March portion that of Binance has hardly moved.

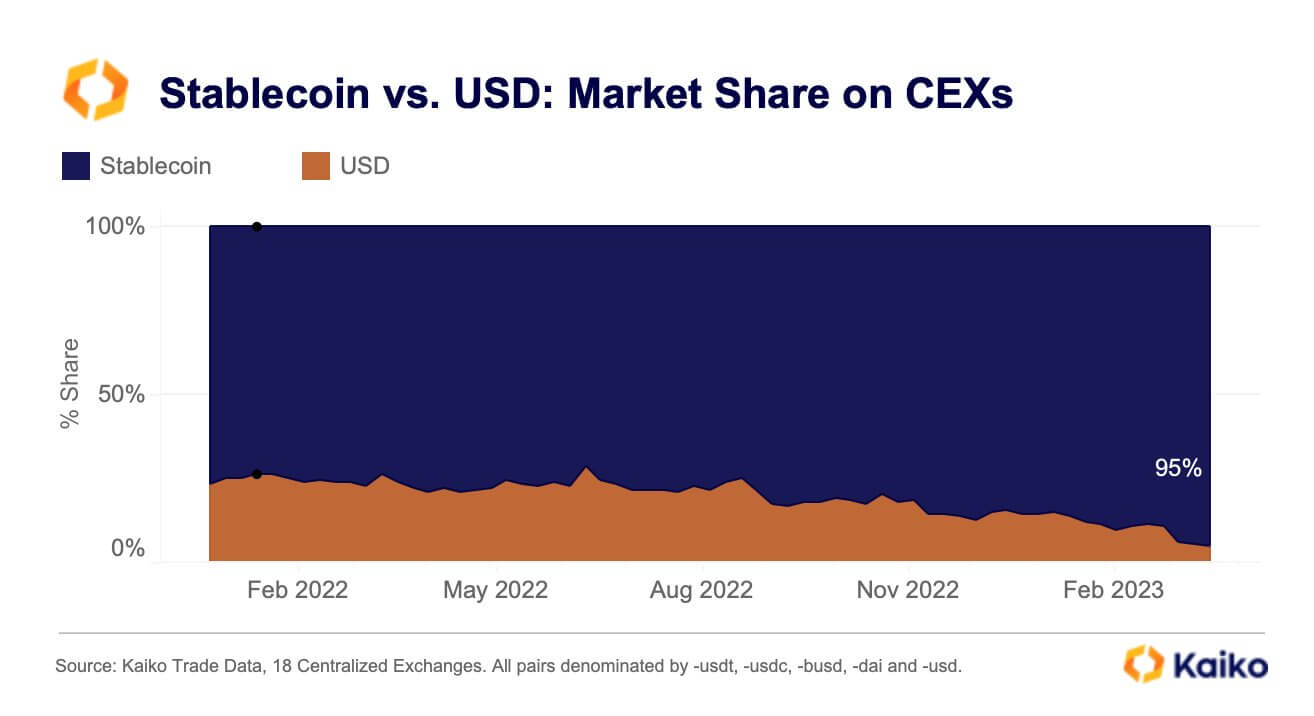

Meanwhile, the accrued tightening of USD entree has seen exchanges pivot to stablecoins. According to Kaiko data, stablecoins present relationship for 95% of trading volumes connected centralized exchanges.

Source: Kaiko

Source: KaikoRyder noted that portion the pivot to stablecoins dulls the interaction of US banking issues, it is impacting liquidity successful the state and could indirectly hurt.

The station Binance Bitcoin trading measurement plunges 13% – lowest level successful 8 months appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)