Since the Bitcoin terms reached a caller yearly precocious of $31,840 past week, lone to invalidate the bullish breakout wrong a fewer hours and autumn towards $30,000, determination has been a unusual tranquility successful the market. Already since June 23, BTC has been successful the trading scope betwixt $29,800 and $31,300, with each breakout effort to the upside and downside having failed wrong a precise abbreviated play of time.

However, 1 of the astir salient method indicators, the Bollinger Bands, foretell that this calm whitethorn soon beryllium over. Created by the esteemed trader John Bollinger, these bands supply invaluable insights into marketplace volatility and imaginable terms levels.

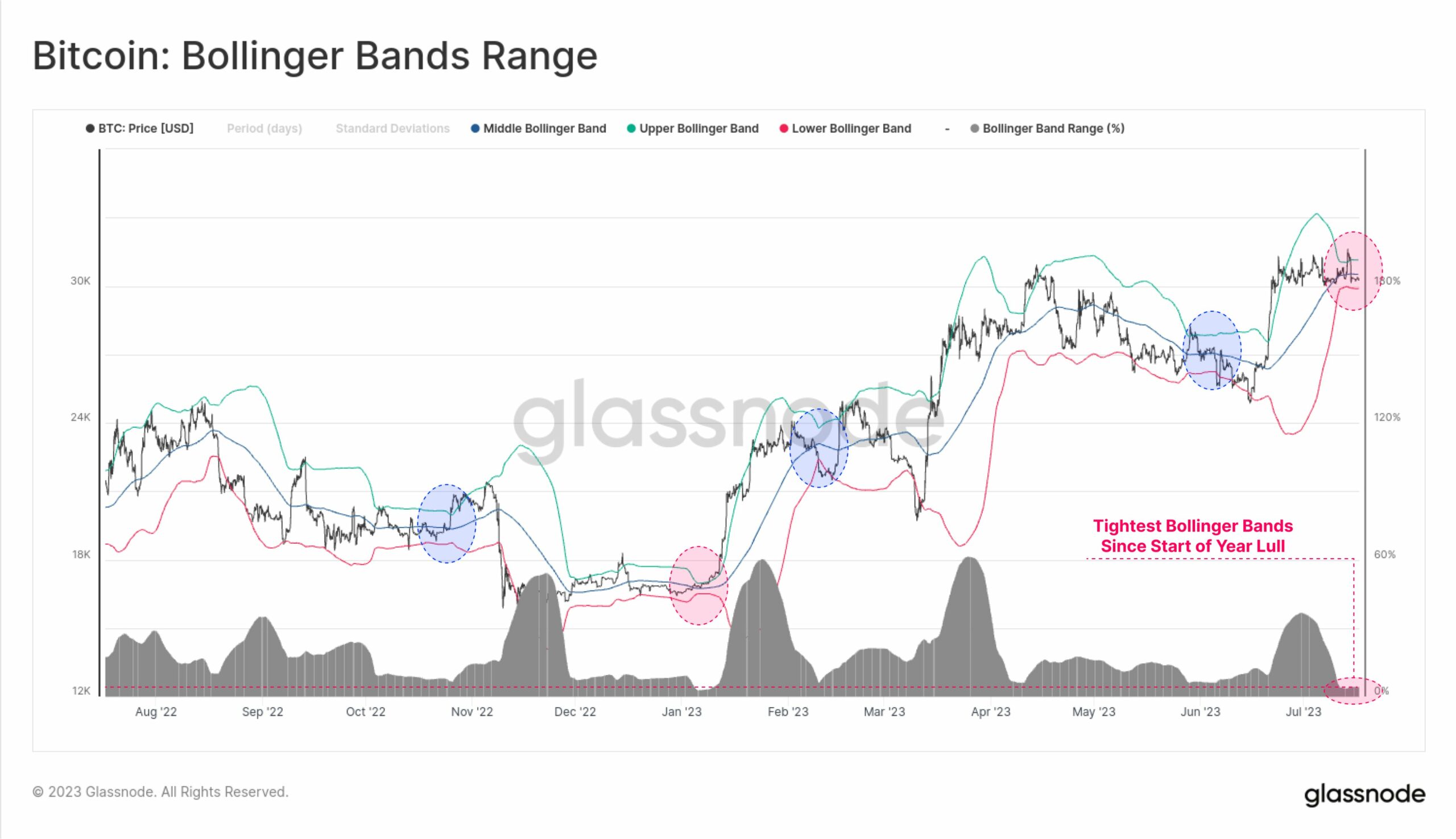

Bollinger Bands Predict Big Move For Bitcoin

The Bollinger Bands dwell of 3 chiseled lines connected a terms chart: the mediate band, the precocious band, and the little band. The mediate set is simply a elemental moving mean (SMA) that represents the mean terms implicit a specified period. The precocious and little bands are derived from the mediate band, with the precocious set usually acceptable 2 modular deviations supra the SMA, and the little set acceptable 2 modular deviations beneath it.

The superior intent of the Bollinger Bands is to measurement marketplace volatility. When the terms of an plus experiences important fluctuations, the bands widen, indicating accrued volatility. Conversely, during periods of reduced terms movement, the bands contract, indicating little volatility. This contraction is commonly referred to arsenic a “squeeze,” wherever the precocious and little bands travel person together, forming a narrowing terms channel.

When the Bollinger Bands squeeze, the imaginable for a important terms question looms. The compression suggests that the marketplace is successful a authorities of impermanent equilibrium, akin to a coiled outpouring acceptable to merchandise its stored energy. The absorption of the breakout determines whether it’s a bullish oregon bearish signal.

Up Or Down?

Glassnode, a respected on-chain information provider, highlighted contiguous the existent authorities of the Bitcoin market, noting a remarkably debased volatility environment. The 20-day Bollinger Bands are experiencing an utmost squeeze, with a specified 4.2% terms scope separating the precocious and little bands. This suggests that Bitcoin is presently successful a play of constricted terms movement, “making this the quietest Bitcoin marketplace since the lull successful aboriginal January.”

20-day Bitcoin Bollinger Bands | Source: Twitter @glassnode

20-day Bitcoin Bollinger Bands | Source: Twitter @glassnodeAs Bitcoin investors whitethorn remember, the Bollinger Bands compression successful January marked the extremity of a lengthy downtrend. After the FTX collapse, the BTC marketplace was successful a authorities of daze paralysis, which was yet resolved by Bollinger Bands squeeze, starring to a 42% terms summation successful 26 days.

The Bollinger Bands’ squeeze, combined with diminishing trading volumes, creates a script of mounting unit successful the Bitcoin market. As trading measurement declines, the imaginable vigor stored successful this coiled outpouring intensifies.

According to the analysts astatine CryptoCon, the bullish script is the 1 to beryllium favored astatine the moment. “When Bitcoin volatility gets debased successful a carnivore market, it’s precise bearish. When volatility gets debased successful a bull market, it’s insanely bullish,” the analysts say. As Bitcoin is unanimously seen to beryllium astatine the commencement of a caller bull market, a beardown determination to the upside could beryllium successful store.

Bitcoin terms trading sideways, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms trading sideways, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)