The pursuing is simply a impermanent nonfiction from Vincent Maliepaard, Marketing Director astatine IntoTheBlock.

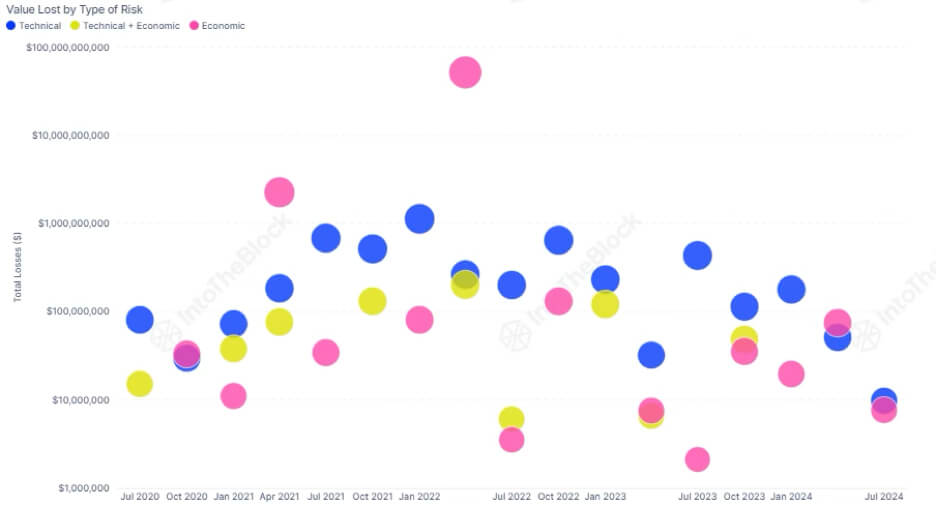

Economic risks person led to astir $60 cardinal successful losses crossed DeFi protocols. While this fig whitethorn look high, it lone reflects losses astatine the protocol level. The existent full is apt overmuch larger erstwhile factoring successful idiosyncratic individual losses owed to assorted economical hazard factors. These idiosyncratic losses often originate from volatile marketplace conditions, analyzable inter-protocol dependencies, and unexpected liquidations.

Understanding Economic Risk successful DeFi

Economic hazard successful DeFi refers to the imaginable fiscal nonaccomplishment owed to adverse movements successful marketplace conditions, liquidity crises, flawed protocol design, oregon outer economical events. These risks are multi-faceted and tin stem from assorted sources:

- Market Risk: Volatility successful the worth of assets tin pb to important losses. For example, abrupt terms drops successful collateralized assets tin origin liquidation events, starring to a cascade of forced selling and further terms drops.

- Liquidity Risk: The inability to rapidly bargain oregon merchantability assets without causing a important interaction connected the price. In DeFi, this tin manifest during a marketplace sell-off erstwhile liquidity pools adust up, exacerbating losses.

- Protocol Risk: This hazard arises from flaws oregon inefficiencies successful the plan of DeFi protocols. Impermanent loss, oracle manipulation, and governance attacks are examples of however protocol-specific risks tin materialize.

- External Risk: Factors extracurricular the protocol specified arsenic actions by ample marketplace players oregon changes successful macro rates and conditions, tin present important risks that are often beyond the power of users oregon a protocol.

The Layers Within Economic Risk

In DeFi, economical risks are pervasive, but they tin beryllium understood connected 2 chiseled levels: protocol-level risks and user-level risks. Distinguishing betwixt the 2 helps users amended specify the risks that impact their strategies and show cardinal signals to instrumentality preventative action.

Protocol Level Risks

Protocols instrumentality safeguards done adaptable parameters designed to bounds vulnerability to economical losses. A communal illustration is the lending and borrowing parameters acceptable by lending protocols, which are tested and calibrated to forestall atrocious indebtedness from accumulating. These measures are mostly utilitarian, aiming to support the protocol from economical risks connected a wide scale, benefiting the largest fig of users.

While managing economic risks is becoming progressively important for preventing large-scale losses astatine the protocol level, the absorption is narrow—on the protocol itself. They don’t code the risks that idiosyncratic users whitethorn present by making economically risky decisions wrong their ain strategies.

User Level Risks

User-level risks are often reduced to the magnitude of leverage an idiosyncratic takes successful agelong oregon abbreviated positions, but this lone scratches the surface. Users look a scope of further risks, specified arsenic liquidations, impermanent loss, slippage, and the imaginable for locked lending liquidity. These idiosyncratic risks don’t usually autumn nether the scope of protocol hazard management, but tin person a important fiscal interaction connected idiosyncratic users.

The bully quality is that these user-level economical risks are highly actionable. By knowing their ain hazard profile, users tin actively negociate and mitigate the risks circumstantial to their strategy. This personalized attack to hazard absorption remains 1 of the astir underutilized tools disposable to DeFi participants today.

The interconnected quality of risks crossed DeFi protocols

Economic hazard absorption is indispensable erstwhile addressing risks that span aggregate DeFi protocols. While protocol audits and hazard parameters fortify idiosyncratic protocols, DeFi users often prosecute with aggregate protocols successful their strategies. This makes user-level hazard absorption crucial.

Each further protocol oregon plus introduces caller hazard factors, not lone from that caller protocol but besides from however these protocols interact. Even if each protocol is unafraid connected its own, risks tin look from however your strategy combines these antithetic protocols.

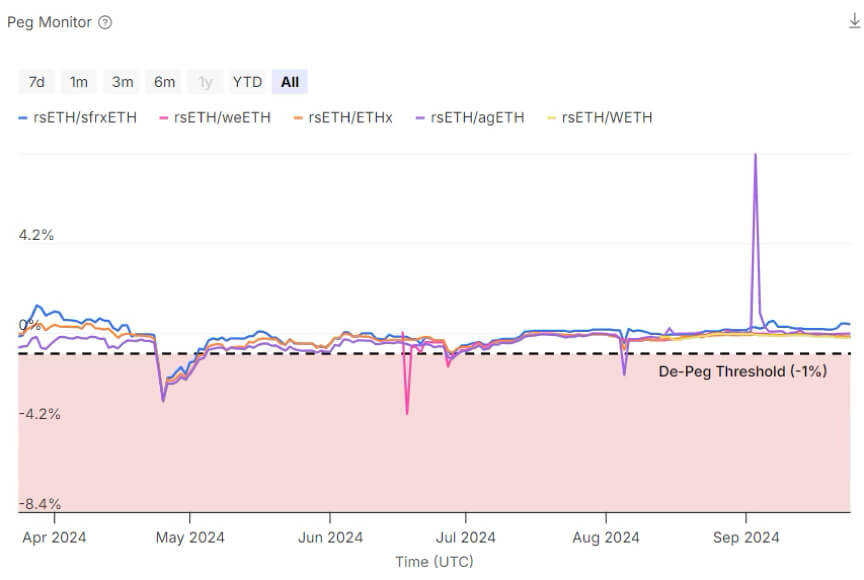

For example, ideate a script wherever a idiosyncratic utilizes a Liquid Restaking Token (LRT) arsenic collateral to get an asset, which is past deployed successful a liquidity excavation (LP) connected an outer automated marketplace shaper (AMM). The superior interest mightiness beryllium the leveraged borrowing position, but determination are further risks. The stableness of the LRT’s peg could interaction liquidation successful the lending protocol, portion the creation of the LP could impact slippage and exit fees, perchance causing superior nonaccomplishment erstwhile repaying the loan. These interconnected risks don’t autumn nether immoderate azygous protocol’s power and are truthful champion managed by the user.

Steps to Understand and Manage Economic Risk

Managing economical hazard successful DeFi requires a well-thought-out approach, arsenic the complexity of multi-protocol strategies tin present unforeseen vulnerabilities.

- Deep Dive into Protocol Mechanics: Understanding the underlying mechanics of a protocol is the archetypal measurement successful identifying imaginable economical risks. Investors and developers should scrutinize the economical models, assumptions, and dependencies wrong the protocol.

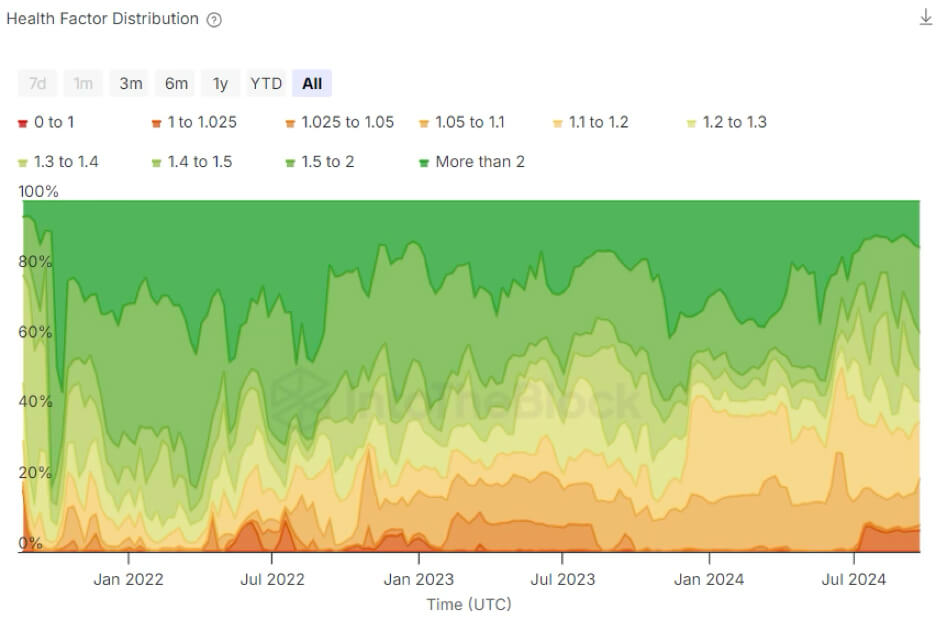

- Monitor Market Indicators: Keeping an oculus connected marketplace signals, specified arsenic plus volatility, liquidity, and wide sentiment, is essential. Analyzing on-chain information circumstantial to the protocols you’re utilizing is simply a applicable mode to enactment informed. For instance, if you’re engaging with a lending strategy connected Benqi, monitoring the wellness origin of loans connected the level is crucial. This provides insights into however unchangeable your lending presumption is and helps you expect imaginable issues earlier they escalate.

- Create a holistic hazard profile: Understanding however interconnected risks whitethorn interaction your wide strategy is cardinal to effectual hazard management. While idiosyncratic strategies vary, hazard analytics tin assistance successful identifying areas of concern. For example, if you’re utilizing a Liquid Restaking Token (LRT) arsenic collateral to get assets, monitoring the stableness of the LRT’s peg is indispensable to debar unexpected liquidations. Sudden spikes oregon volatility successful the peg could awesome a request to instrumentality precautionary measures, specified arsenic reducing vulnerability oregon expanding collateral.

In summary, managing economical hazard successful DeFi is astir being proactive. By knowing protocol mechanics, keeping a adjacent ticker connected marketplace indicators, and gathering a holistic presumption of imaginable risks, users tin amended navigate the challenges of multi-protocol strategies and support their positions.

The station Beyond Hacks: Understanding and managing economical risks successful DeFi appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

Source:

Source:  Source:

Source:

English (US)

English (US)