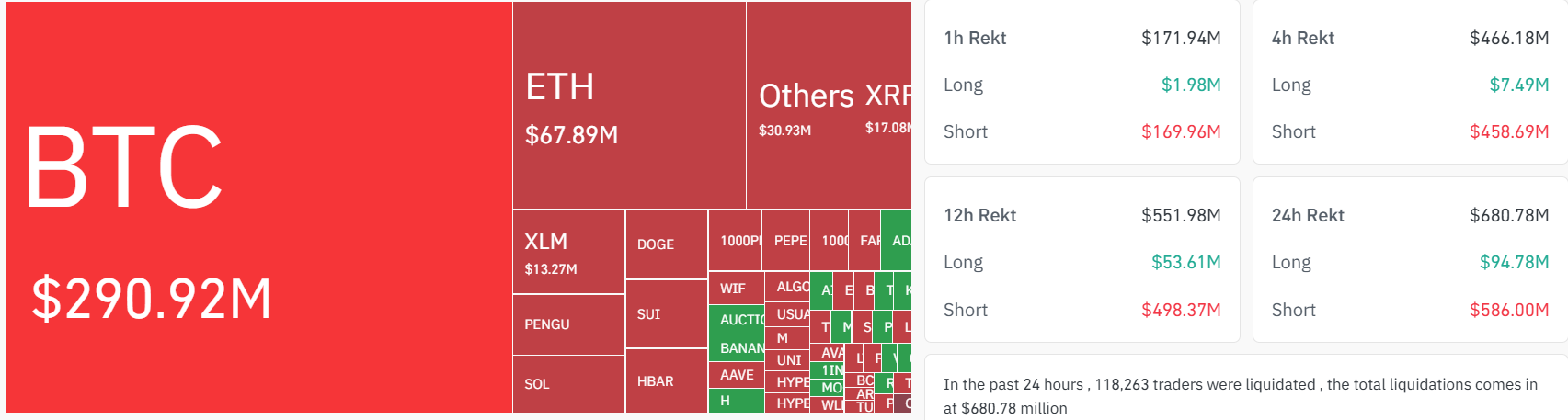

More than $680 cardinal successful crypto positions were liquidated implicit the past 24 hours with abbreviated traders taking the bulk of the symptom arsenic a bitcoin (BTC) breakout supra $121,000 triggered a concatenation absorption crossed derivatives markets.

Roughly $426 cardinal of the full liquidations came from bearish bets, according to Coinglass data, making it 1 of the largest play liquidation events successful caller months. The largest azygous order, a $92.5 cardinal BTC short, was flushed connected HTX.

BTC unsocial saw $291 cardinal successful forced closures, with futures tracking ether (ETH) and XRP (XRP) pursuing astatine $68 cardinal and $17 million, respectively. XLM (XLM) and pepecoin (PEPE) besides posted elevated activity, signaling that the compression extended heavy beyond large tokens.

Meanwhile, dogecoin (DOGE), Solana's SOL (SOL), and SUI (SUI) saw rising unfastened interest, though with comparatively smaller drawdowns, indicative of higher spot-based demand.

Liquidations hap erstwhile traders utilizing leverage are forced to adjacent their positions owed to borderline calls. While they often awesome excessive positioning, they besides service arsenic a reset mechanics for markets, flushing anemic hands and clearing the mode for caller directional flow.

Bitcoin’s rally successful the past week has sparked a broader breakout crossed large crypto assets. Traders accidental that marketplace operation is evolving nether the value of organization power — with eyes connected the $130,000 people successful the abbreviated term.

Read more: Bitcoin, Ether Traders Bet Big With Tuesday's U.S. Inflation Data Seen arsenic Non-Event

3 months ago

3 months ago

English (US)

English (US)