Bitcoin reaching an all-time precocious of $107,000 reflects the beardown bullish sentiment successful the marketplace successful the past 2 months.

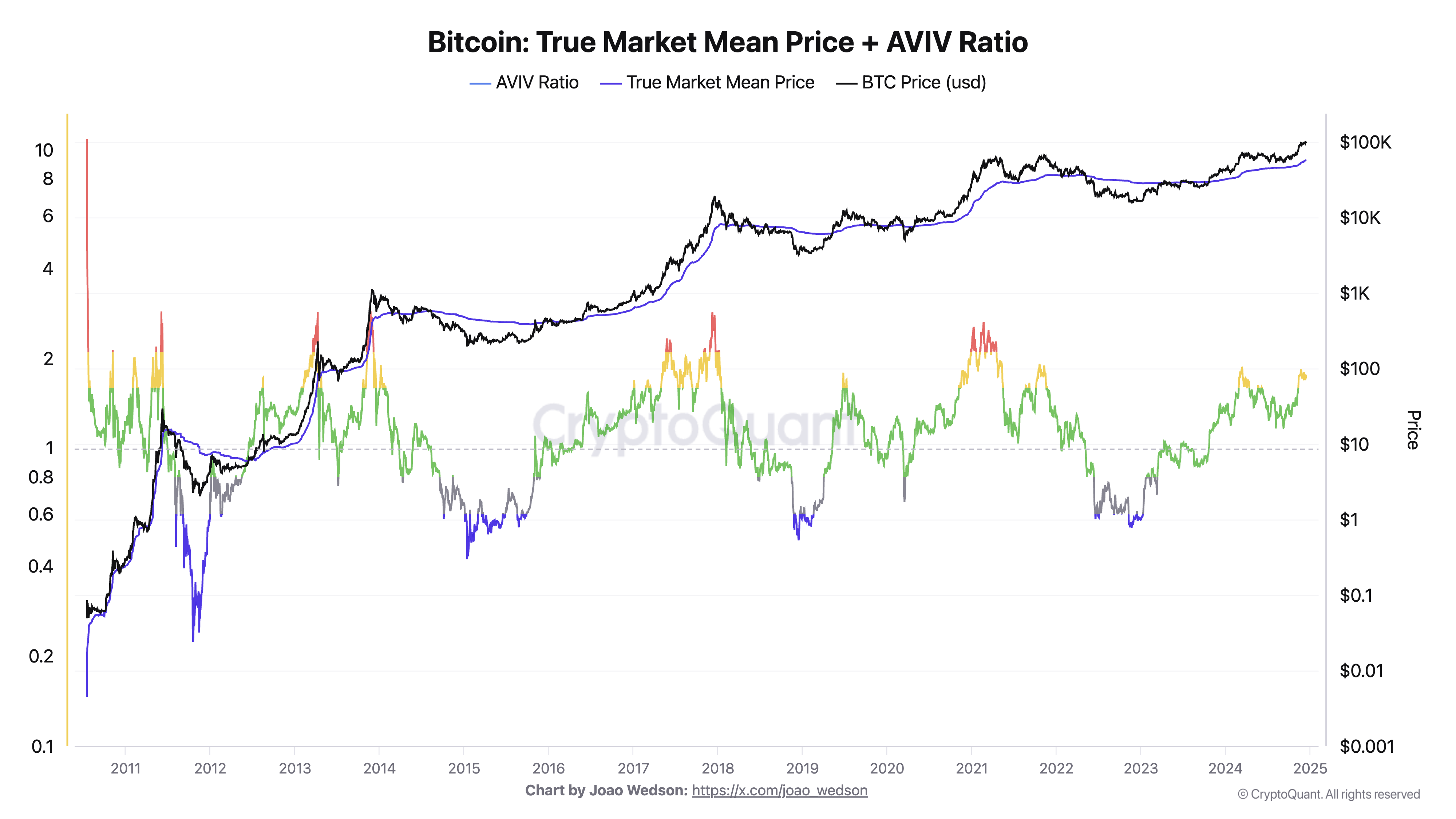

To recognize what caused the persistent upward momentum this year, we tin crook to the existent marketplace mean terms (TMMP) and AVIV ratio. These on-chain indicators clarify capitalist behaviour and supply penetration into cost-basis trends.

The existent marketplace mean terms (TMMP) is the mean acquisition outgo for the market, calculated by dividing the capitalist headdress by the progressive supply. It excludes miners’ nett realizations to isolate investor-driven acquisition trends and measurement Bitcoin’s outgo ground crossed the secondary market. The AVIV ratio is often analyzed alongside TMMP, representing the ratio betwixt progressive marketplace valuation and realized valuation. It measures however acold existent marketplace prices person diverged from the realized outgo basis, showing imaginable overbought oregon oversold conditions. AVIV ratio is often utilized to place profit-taking opportunities oregon risks during terms volatility.

While TMMP has ever been successful a dependable upward trend, changes successful the gait of its summation tin assistance clarify marketplace behavior. The existent marketplace mean terms has gradually risen passim the twelvemonth pursuing Bitcoin’s terms increase. The correlation betwixt terms summation and TMMP means that higher prices were supported by sustained marketplace interest. As the twelvemonth progressed, the spread betwixt Bitcoin’s terms and TMMP accrued significantly, showing important unrealized profits for investors. This widening has historically been observed during mature bull markets, often preceding periods of accrued volatility oregon corrections.

Graph showing Bitcoin’s existent marketplace mean terms (TMMP) and AVIV ratio from July 2010 to December 2024 (Source: CryptoQuant)

Graph showing Bitcoin’s existent marketplace mean terms (TMMP) and AVIV ratio from July 2010 to December 2024 (Source: CryptoQuant)The AVIV ratio stood astatine mean levels astatine the commencement of 2024, accordant with a marketplace successful an accumulation phase. By mid-year, arsenic Bitcoin’s terms advanced, the ratio climbed higher, reflecting increasing capitalist profits and a strengthening market. In December, the ratio reached levels historically associated with overheated marketplace conditions, akin to patterns seen successful 2013, 2017, and 2021. Such spikes successful the ratio hap erstwhile Bitcoin’s marketplace terms importantly exceeds realized valuation, signaling that the marketplace whitethorn beryllium approaching a section peak.

Data from CryptoQuant shows an absorbing signifier — 2024 has seen comparative stableness successful the AVIV ratio and TMMP compared to erstwhile years. This suggests that the marketplace is maturing and becoming much efficient, with less utmost swings successful acquisition costs. Historically, important fluctuations successful the AVIV ratio and TMMP person often followed crisp terms movements that preceded carnivore markets. However, the reduced volatility successful the AVIV ratio and TMMP passim 2024 indicates that capitalist behaviour is becoming much consistent, supporting a much resilient marketplace structure.

While the TMMP’s emergence signals semipermanent capitalist confidence, the AVIV ratio’s elevated level highlights the short-term risks of a correction. Historically, periods wherever the AVIV ratio exceeds 2 person been followed by terms retracements, arsenic profit-taking pressures measurement connected the market. December 2024 mirrors these humanities trends, with rising AVIV levels and a important deviation from TMMP indicating a imaginable cooling signifier ahead. However, relentless institutional interest and the increasing derivatives market suggest this cooling signifier is improbable to beryllium long-lived oregon peculiarly aggressive.

Investor behaviour successful 2024 supports this analysis. The accordant summation successful TMMP suggests that investors person been accumulating Bitcoin astatine higher prices, raising the wide marketplace outgo basis. At the aforesaid time, the AVIV ratio’s late-year spike points to profit-taking enactment arsenic the marketplace surged to caller highs. This operation of accumulation and realized profits reflects a steadfast bull marketplace operation but raises caution for a imaginable short-term correction.

The station AVIV ratio spikes arsenic Bitcoin reaches caller ATH appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)