By James Van Straten (All times ET unless indicated otherwise)

If Monday's trading show successful crypto and related equities is immoderate denotation of what October and the 4th fourth whitethorn bring, it could beryllium a buoyant play for an manufacture inactive lagging down some U.S. equities and metals.

Bitcoin (BTC) jumped 5% from Friday’s fear-driven league to a much neutral stance astatine $114,000 connected Monday, showing however rapidly sentiment arsenic measured by the Crypto Fear and Greed Index tin shift.

Still, the largest cryptocurrency gave up immoderate of those gains and was precocious trading astir $112,800. It volition astir apt request golden to relinquish immoderate attraction earlier its adjacent determination higher.

That mightiness beryllium a challenge, however. Gold continues to outperform, delivering astir 50% year-to-date returns and climbing to different grounds precocious supra $3,870 earlier today. At the aforesaid time, the dollar scale (DXY) cannot make momentum and has fallen beneath 98, which is affirmative for risk-assets.

Meanwhile, an imminent U.S. authorities shutdown threatens to impact argumentation decisions astir crypto much than immoderate different area.

Equities tied to artificial quality and high-performance computing proceed to summation strength. Robinhood (HOOD), the trading level added to the S&P 500 successful its astir caller rebalancing, saw its stock terms leap 12% connected Monday arsenic the 4th comes to a close.

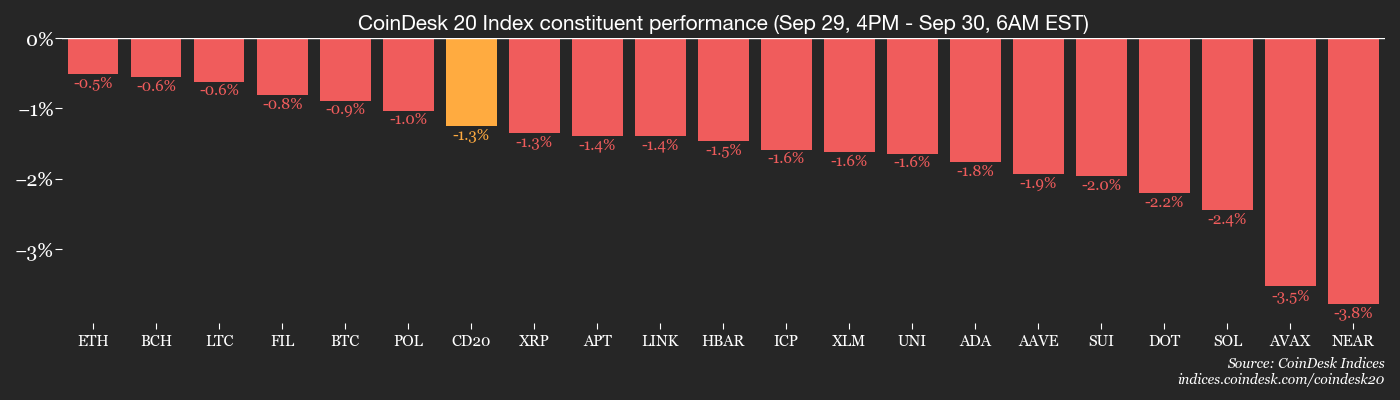

September has been a beauteous subdued period for cryptocurrencies, with the CoinDesk 20 Index small changed implicit the period, up conscionable 0.54%. Ether (ETH) lagged down and is connected way to suffer much than 5% successful the month. Bitcoin is presently up 4.5%.

October, nicknamed Uptober for its historical effect connected BTC is conscionable astir the corner. Stay alert!

What to Watch

For a much broad database of events this week, spot CoinDesk's week-ahead note.

- Crypto

- Sept. 30: FTX begins $1.6 billion, 3rd creditor payout nether its bankruptcy program done BitGo, Kraken and Payoneer. Creditors indispensable implicit KYC and taxation forms to qualify.

- Sept. 30: Starknet (STRK) starts BTC staking connected mainnet, enabling wrapped BTC tokens staking with 25% statement weight; un-staking play chopped to 7 days; rewards start.

- Macro

- Sept. 30, 10 a.m.: U.S. Aug. JOLTS report. Openings Est. 7.1M, Quits (Prev. 3.208M).

- Sept. 30, 10 a.m.: U.S. Sept. CB Consumer Confidence. Est. 96.

- Sept. 30: Deadline for the U.S. Congress to walk the yearly national appropriations measure backing authorities operations.

- Earnings (Estimates based connected FactSet data)

- Nothing scheduled.

Token Events

For a much broad database of events this week, spot CoinDesk's week-ahead note.

- Governance votes & calls

- GnosisDAO is voting connected a resubmitted connection to make a $40,000 aviator fund. This would let the assemblage to straight concern tiny ecosystem projects utilizing a condemnation voting pool. Voting ends Oct. 1.

- Unlocks

- Sept. 30: Optimism (OP) to unlock 1.74% of its circulating proviso worthy $20.46 million.

- Token Launches

- Sept. 30: Soon (SOON) airdrop assertion period ends.

- Sept. 30: ZkVerify (VFY) to beryllium listed connected Binance. KuCoin, Gate.io and others.

Conferences

For a much broad database of the week's conferences, spot CoinDesk's week-ahead note.

- Day 2 of 2: Sonic Summit 2025 (Singapore)

- Sept. 30: Digital Assets Summit 2025 (Singapore)

- Sept. 30: Tokenized Capital Summit 2025 (Singapore)

Token Talk

By Oliver Knight

- The derivatives speech conflict betwixt Aster and HyperLiquid is heating up.

- Daily trading measurement connected BNB Chain-based Aster has rocketed to $64 billion, dwarfing HyperLiquid's $7.6 billion, DefiLlama information shows.

- According to BoltLiquidity halfway contributor Max Arch, the displacement is owed to Aster's offering of betwixt 100x and 300x leverage. HyperLiquid's markets are chiefly capped astatine 40x.

- "Traders are pursuing the leverage, careless of underlying level quality, but we’ll spot however the accrued hazard that comes with higher leverage caps impacts platforms similar Aster long-term," Arch wrote connected X.

- Arch notes that astir 6% of Aster's trading measurement tin beryllium attributed to wash trading, acold little than immoderate skeptics had estimated.

- The exchanges' autochthonal tokens, ASTER and HYPE, person performed poorly implicit the past week; with the erstwhile sliding from $2.39 connected Sep. 25 to $1.80, portion HYPE is down from Sep. 18's precocious of $58.92 to $44.32.

- The bearish token show comparative to trading enactment tin beryllium attributed to a wider altcoin sell-off that led to the removal of $200 cardinal from the sector's full marketplace headdress past week, according to CoinMarketCap data.

Derivatives Positioning

- The marketplace is showing signs of a imaginable displacement backmost to a bullish bias arsenic derivatives metrics, including unfastened involvement and basis, amusement a pickup.

- Overall BTC futures unfastened involvement roseate to astir $31 cardinal from a caller monthly debased of $29 billion. This summation indicates a renewed involvement from traders, with Binance inactive starring astatine $12.7 billion.

- The three-month annualized ground is besides recovering, climbing to 7% from astir 6%, which makes the ground commercialized much profitable.

- The BTC options marketplace is inactive presenting a analyzable and somewhat contradictory picture.

- While the 25 delta skew for short-term options continues to drop, suggesting traders are paying a premium for puts and signaling a tendency for downside protection, the 24-hour put-call measurement is telling a antithetic story.

- In a wide reversal from caller trends, calls present predominate the volume, making up 65% of the contracts traded. This crisp summation indicates that contempt the cautious sentiment reflected successful the skew, a important fig of traders are actively positioning for a short-term rally.

- This divergence highlights a highly polarized market, wherever a premix of hedging strategies and speculative bets creates a authorities of mixed sentiment.

- Funding rates connected large venues similar Binance and OKX person turned positive, rising to astir 7% and 10% respectively. This indicates a increasing appetite for leveraged agelong positions, wherever agelong traders are present paying shorts, a classical motion of affirmative marketplace sentiment.

- While the backing complaint connected Hyperliquid remains volatile, the inclination connected cardinal exchanges suggests that traders are erstwhile again becoming assured and consenting to instrumentality connected bullish exposure

- Coinglass information shows $316 cardinal successful 24 hr liquidations, with a 44-56 divided betwixt longs and shorts. ETH ($73 million), BTC ($70 million) and others ($29 million) were the leaders successful presumption of notional liquidations. The Binance liquidation heatmap indicates $115,000 arsenic a halfway liquidation level to monitor, successful lawsuit of a terms rise.

Market Movements

- BTC is down 1.3% from 4 p.m. ET Monday astatine $112,840.60 (24hrs: +0.71%)

- ETH is down 2.13% astatine $4,138.84 (24hrs: +0.71%)

- CoinDesk 20 is down 2.34% astatine 3,971.18 (24hrs: -0.16%)

- Ether CESR Composite Staking Rate is up 12 bps astatine 2.93%

- BTC backing complaint is astatine 0.0056% (6.1276% annualized) connected Binance

- DXY is unchanged astatine 97.82

- Gold futures are up 0.76% astatine $3,884.40

- Silver futures are unchanged astatine $47.01

- Nikkei 225 closed down 0.25% astatine 44,932.63

- Hang Seng closed up 0.87% astatine 26,855.56

- FTSE is unchanged astatine 9,299.84

- Euro Stoxx 50 is up 0.13% astatine 5,506.85

- DJIA closed connected Monday up 0.15% astatine 46,316.07

- S&P 500 closed up 0.26% astatine 6,661.21

- Nasdaq Composite closed up 0.48% astatine 22,591.15

- S&P/TSX Composite closed up 0.71% astatine 29,971.91

- S&P 40 Latin America closed up 0.84% astatine 2,945.34

- U.S. 10-Year Treasury complaint is down 1.6 bps astatine 4.125%

- E-mini S&P 500 futures are down 0.1% astatine 6,706.50

- E-mini Nasdaq-100 futures are unchanged astatine 24,814.75

- E-mini Dow Jones Industrial Average Index are down 0.13% astatine 46,550.00

Bitcoin Stats

- BTC Dominance: 58.88% (0.12%)

- Ether to bitcoin ratio: 0.03673 (-0.33%)

- Hashrate (seven-day moving average): 1,041 EH/s

- Hashprice (spot): $50.55

- Total Fees: 3.32 BTC / $376,516

- CME Futures Open Interest: 133,005 BTC

- BTC priced successful gold: 29.5 oz

- BTC vs golden marketplace cap: 8.32%

Technical Analysis

- After investigating the 20-day exponential moving mean (EMA) connected the play chart, bitcoin has rebounded to the $114,000 level and is present holding supra each large regular EMAs.

- For bulls, the cardinal nonsubjective volition beryllium to propulsion done the regular bid artifact betwixt $116,000 and $118,000, which would corroborate a marketplace operation interruption and awesome a imaginable inclination reversal.

- On the downside, a adjacent beneath Monday’s precocious astatine $114,870 would permission bitcoin unfastened to the anticipation of retesting Monday’s lows. This level besides aligns with the EMA100 connected the regular chart, making it an important country of confluence to watch.

Crypto Equities

- Coinbase Global (COIN): closed connected Monday astatine $333.99 (+6.85%), -1.77% astatine $328.09 successful pre-market

- Circle Internet (CRCL): closed astatine $133.66 (+5.25%), -1.22% astatine $132.03

- Galaxy Digital (GLXY): closed astatine $34.29 (+10.97%), -1.90% astatine $33.64

- Bullish (BLSH): closed astatine $62.3 (-0.46%), -1.56% astatine $61.33

- MARA Holdings (MARA): closed astatine $18.66 (+15.69%), -2.63% astatine $18.17

- Riot Platforms (RIOT): closed astatine $19.78 (+11.81%), -2.38% astatine $19.31

- Core Scientific (CORZ): closed astatine $17.33 (+2.85%), -0.52% astatine $17.24

- CleanSpark (CLSK): closed astatine $14.87 (+14.74%), -2.02% astatine $14.57

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $44.21 (+8.86%), -1.02% astatine $43.76

- Exodus Movement (EXOD): closed astatine $28.95 (+1.54%), +1.38% astatine $29.35

Crypto Treasury Companies

- Strategy (MSTR): closed astatine $326.42 (+5.62%), -2.34% astatine $318.77

- Semler Scientific (SMLR): closed astatine $29.24 (+3.29%), -0.14% astatine $29.20

- SharpLink Gaming (SBET): closed astatine $17.26 (+7.88%), -2.61% astatine $16.81

- Upexi (UPXI): closed astatine $5.62 (+7.77%), -1.25% astatine $5.55

- Lite Strategy (LITS): closed astatine $2.54 (-0.78%), 1.57% astatine $2.50

ETF Flows

Spot BTC ETFs

- Daily nett flows: $518 cardinal

- Cumulative nett flows: $57.3 cardinal

- Total BTC holdings ~1.31 million

Spot ETH ETFs

- Daily nett flows: $546.9 million

- Cumulative nett flows: $13.69 billion

- Total ETH holdings ~6.46 million

Source: Farside Investors

While You Were Sleeping

- SEC Willing to Engage With Tokenized Asset Issuers, SEC’s Hester Peirce Says (CoinDesk): The SEC Commissioner said tokenization raises analyzable questions astir however integer and accepted securities coexist, urging issuers to question guidance arsenic the marketplace expands toward multitrillion-dollar potential.

- Vance Says U.S. ‘Headed to a Shutdown’ After Meeting With Democrats (Reuters): A standoff implicit wellness backing has stalled negotiations, raising the imaginable of furloughs, tribunal closures and delayed services if authorities backing lapses tomorrow.

- Visa Tests Pre-Funded Stablecoins for Cross-Border Payments (Bloomberg): The aviator utilizing Circle’s USDC and EURC aims to fto banks and remittance firms debar pre-funded accounts, speeding cross-border transfers and improving superior ratio connected Visa Direct.

- Deutsche Börse, Circle to Integrate Stablecoins Into European Market Infrastructure (CoinDesk): The inaugural starts with Circle’s EURC and USDC trading connected 360T’s 3DX and via Crypto Finance, with custody managed by Clearstream done Crypto Finance’s German entity arsenic sub-custodian.

- Societe Generale’s Crypto Arm Deploys Euro and Dollar Stablecoins connected Uniswap, Morpho (CoinDesk): SG-FORGE’s EURCV and USDCV went unrecorded connected Uniswap and Morpho, enabling borrowing against crypto and tokenized T-Bills, with Flowdesk providing spot marketplace liquidity.

- Investors Are Fretting That the Stock-Market Rally Is connected Borrowed Time (The Wall Street Journal): Concerns implicit rampant speculation, grounds valuations, tariff-driven ostentation risks and October’s rocky past are fueling warnings that Wall Street’s record-setting rally whitethorn beryllium susceptible to a crisp reversal.

1 month ago

1 month ago

English (US)

English (US)