Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

As Asia begins its Thursday concern day, ETH is trading astatine $2,770.

ETH is up astir 11% this month, according to CoinDesk marketplace data, outperforming BTC, which roseate 5%.

Part of this could beryllium due to the fact that of organization trading demand, and the information that it's overtaken BTC successful derivatives markets arsenic blase investors progressively stake connected ETH’s structural maturation and relation arsenic a gateway betwixt decentralized concern (DeFi) and accepted concern (TradFi), OKX Chief Commercial Officer Lennix Lai told CoinDesk successful an interview.

"Ethereum is overshadowing BTC connected our perpetual futures market, with ETH accounting for 45.2% of trading measurement implicit the past week. BTC, by comparison, sits astatine 38.1%," Lai said.

This is simply a similar uncovering to what's occurring connected Derebit, CoinDesk precocious reported.

That's not to accidental that institutions person taken a disinterest successful BTC. Far from it.

A recent study from Glassnode shows that contempt BTC's caller volatility, institutions are happily buying up the dips.

Long-term holders (LTHs) realized implicit $930 cardinal successful profits per time during caller rallies, Glassnode wrote, rivaling organisation levels seen astatine erstwhile rhythm peaks. Yet, alternatively of triggering a cascade of selling, the LTH proviso really grew.

“This dynamic highlights that maturation and accumulation pressures are outweighing organisation behavior,” Glassnode analysts wrote, noting that this is “highly atypical for late-stage bull markets.”

Neither, however, are immune to geopolitical hazard oregon black swan events similar the Trump-Musk blowout.

These episodes service arsenic reminders that sentiment tin displacement quickly, adjacent successful structurally beardown markets. But beneath the surface-level volatility, organization condemnation remains intact. ETH is emerging arsenic the conveyance of prime for accessing regulated DeFi, portion BTC continues to payment from semipermanent accumulation by institutions via ETFs.

"Macro uncertainties remain, but $3,000 ETH looks progressively likely,” Lai concluded.

Tron Continues to Win Stablecoin Inflow

The stablecoin marketplace conscionable deed an all-time precocious of $228 billion, up 17% year-to-date, according to a caller CryptoQuant report.

That surge successful dollar-pegged liquidity, driven by renewed capitalist assurance showcased by the blockbuster Circle IPO, rising DeFi yields, and improving U.S. regulatory clarity, is softly redrawing the representation of wherever superior lives on-chain.

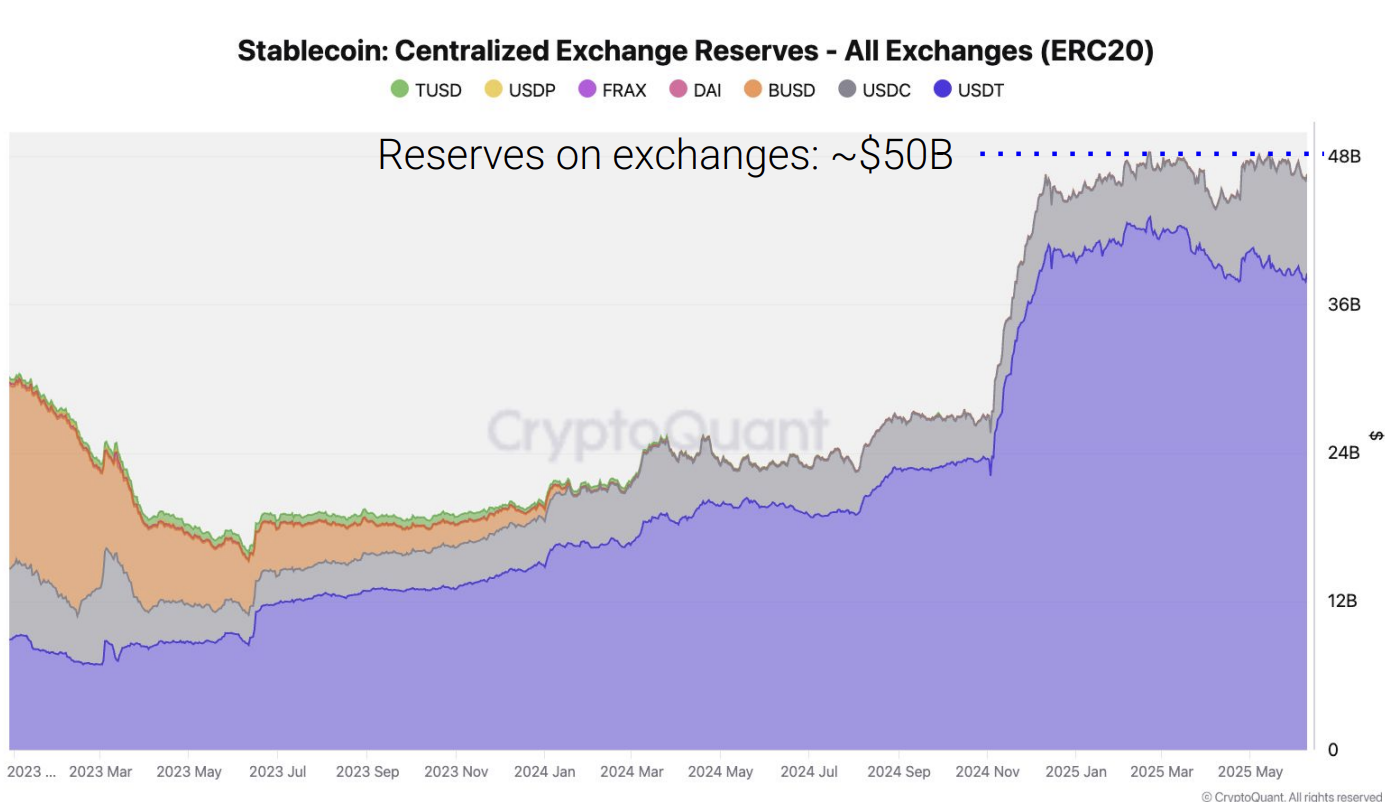

"The magnitude of stablecoins connected centralized exchanges has besides reached grounds precocious levels, supporting crypto trading liquidity," CryptoQuant reported.

CryptoQuant noted that the full worth of ERC20 stablecoins connected centralized exchanges has climbed to a grounds $50 billion.

Most of this maturation successful speech stablecoin reserves has been a effect of the summation successful USDC reserves connected exchanges, per their data, which person grown by 1.6x truthful acold successful 2025 to $8 billion.

As acold arsenic protocols that person been a nett beneficiary of each of this, Tron leads the pack. Tron's blend of accelerated finality and heavy integrations with stablecoin issuers similar Tether is credited with making it a liquidity magnet

Presto Research, which precocious released a likewise themed report, wrote that it notched implicit $6 cardinal successful nett stablecoin inflows successful May, topping each different chains and posting the second-highest fig of regular progressive users down Solana and was the apical performer successful autochthonal full worth locked (TVL) growth.

By contrast, Ethereum and Solana bled capital, Presto's information said.

Both chains experienced important stablecoin outflows and span measurement losses, indicating a deficiency of caller output opportunities oregon large protocol upgrades. Presto’s information confirms a broader trend: organization and retail superior alike are rotating toward Base, Solana, and Tron.

The commonality? These chains connection faster execution, much dynamic ecosystems, and successful immoderate cases, bigger inducement programs

Agent Economies Are Coming, but They Need Crypto Rails to Work

The adjacent procreation of AI won’t conscionable speech to us, it’ll speech to itself. As autonomous agents turn much capable, they'll progressively grip tasks end-to-end: booking flights, sourcing data, adjacent commissioning different bots to implicit subtasks. But there’s a problem: close now, these AI agents are trapped successful silos and they request crypto to get them out.

In a caller a16z Crypto essay, Scott Duke Kominers, a Research Partner astatine a16z Crypto and a Faculty Affiliate astatine Harvard, argues that today’s agent-to-agent interactions are mostly hardcoded API calls oregon interior features wrong closed ecosystems.

There’s nary shared infrastructure for agents to find each other, collaborate, oregon transact crossed systems. That’s wherever crypto comes in. Blockchains, with their open, composable architectures, connection a “forwards-compatible” mode to physique interoperable cause economies, a neutral substrate that tin germinate alongside AI itself.

Early projects similar Halliday are gathering protocol-level standards for cross-agent workflows, portion firms similar Catena and Skyfire are utilizing crypto to alteration autonomous agents to wage each different without a quality being needed.

Coinbase has adjacent stepped successful to enactment infrastructure efforts here. If these rails instrumentality hold, blockchains won’t conscionable beryllium fiscal infrastructure; they’ll beryllium the back-end of an unfastened AI economy, wherever agents transact, coordinate, and enforce idiosyncratic intent transparently.

The connection is clear: if AI agents are the aboriginal of productivity, crypto is the infrastructure that makes them play nice.

Web3 Gaming Needs Better Games to Grow

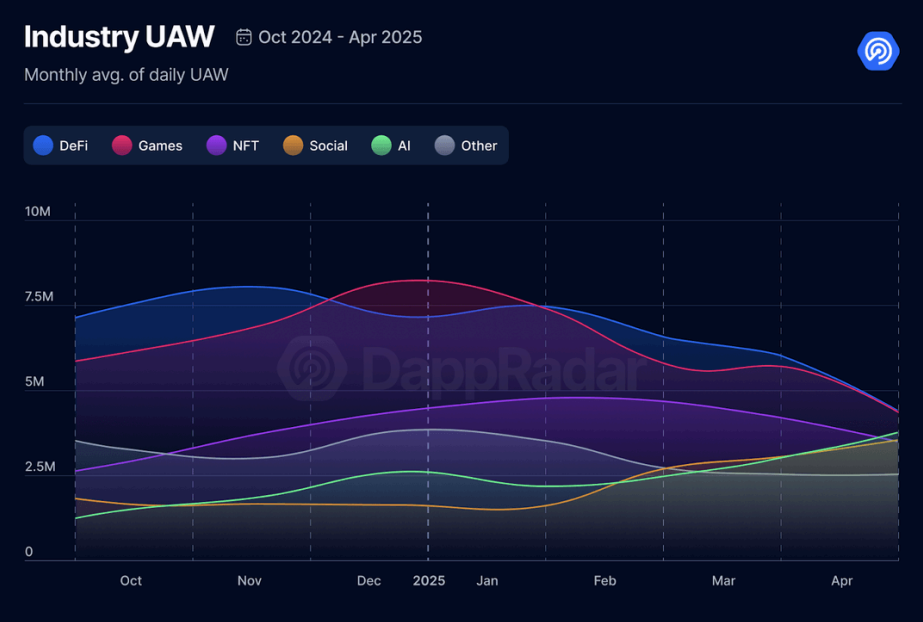

Gaming maintains its pb arsenic the ascendant class successful the distributed app (dAPP) ecosystem, adjacent arsenic its marketplace stock continues to slip, according to a caller study from DappRadar.

The latest information from DappRadar shows gaming’s dominance fell for the 2nd consecutive month, from 21% successful April to 19.4% successful May.

Daily idiosyncratic enactment remains comparatively stable, hovering astir 4.9 cardinal unsocial progressive wallets, yet the crisp diminution successful concern paints a much troubling picture: task backing for gaming projects plummeted to conscionable $9 cardinal successful May, down sharply from implicit $220 cardinal monthly astatine the extremity of 2024.

"2025 truthful far, has been a world cheque for the gaming market. Various projects that raised millions successful the erstwhile years, person present closed shop. Among them, the leader shooter Nyan Heroes, the phantasy MMORPG Ember Sword, and societal deduction crippled The Mystery Society," DappRadar analysts wrote successful their report.

DappRadar analysts constituent to a cardinal flaw driving this exodus: a deficiency of engaging gameplay.

Projects often prioritized tokenomics, speculative NFT launches, and selling blitzes, often sidelining captious gameplay investigating and development.

Without amusive and replayable mechanics astatine their core, adjacent heavy funded Web3 games person struggled to support subordinate interest, suggesting that the industry's biggest situation mightiness simply beryllium learning however to physique large games.

And this communicative is thing new: surveys person been saying this since 2022.

Market Movements:

- BTC: Bitcoin slid 2% aft failing to clasp the $110K level, with terms investigating cardinal enactment astatine $108.5K amid rising geopolitical tensions and mixed sentiment, though beardown organization inflows via spot ETFs suggest underlying request remains intact.

- ETH: ETH jumped 5% to interruption past $2,800 arsenic $815M successful organization inflows poured into ETH ETFs, driven by bullish technicals, grounds staking levels, and caller SEC guidance clarifying staking and wallet bundle autumn extracurricular securities laws

- Gold: Gold roseate 0.97% to $3,363 aft U.S. ostentation information showed cooling prices, boosting expectations that the Fed could resume complaint cuts successful September.

- Nikkei 225: Tokyo stocks opened mixed Thursday, arsenic a stronger yen weighed connected exporters portion optimism implicit a imaginable U.S.-Japan commercialized woody supported buying, with the Nikkei down 0.22% successful aboriginal trading.

- S&P 500: Tokyo stocks opened mixed Thursday, arsenic a stronger yen weighed connected exporters portion optimism implicit a imaginable U.S.-Japan commercialized woody supported buying, with the Nikkei down 0.22% successful aboriginal trading.

2 months ago

2 months ago

English (US)

English (US)