Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

Crypto traders stay cautious up of Thursday’s U.S. CPI report, with BTC trading level supra $111,600, and ETH astatine $4,298. The CD20, a measurement of the show of the largest integer assets, is trading supra 4,000, up 1.6%.

The August Nonfarm Payrolls miss, conscionable 22,000 jobs added versus expectations of 75,000, pushed futures higher and dragged 2-year Treasury yields to year-lows arsenic markets priced successful 72 bps of cuts this year. Yet crypto remains rangebound, diverging from broader hazard sentiment.

Options markets corroborate the antiaircraft stance. QCP Capital noted successful its caller Asia Market Update that hazard reversals are progressively skewed toward puts, with short-dated implied vols elevated into CPI.

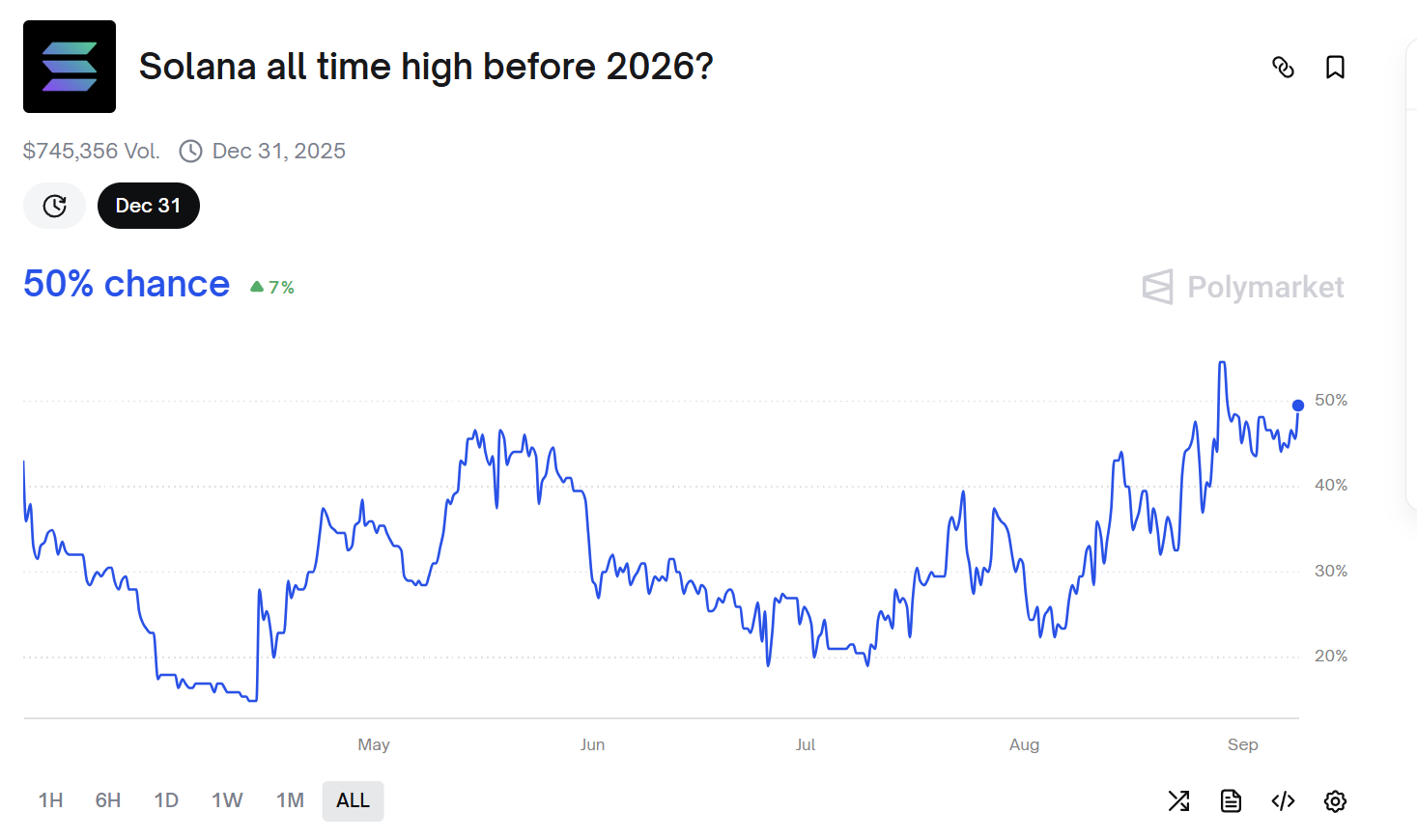

Polymarket data backs this positioning: ETH carries a 70% accidental of staying supra $4,600 this period but lone 13% likelihood of breaking $5,600. Traders are bracing for turbulence, not chasing upside. SOL is the outlier, with likelihood of a caller all-time precocious earlier 2026 rising sharply, signaling improving breadth beneath the surface.

In a enactment to CoinDesk, marketplace shaper Enflux argues that the SEC’s forward-looking rules for token income and listings, combined with the dependable march of institutions similar Coinbase into large indices, amusement however profoundly crypto is embedding into the system. This is the “split-screen reality” of 2025: speculation dominates headlines, portion adoption rails are being laid successful the background.

The legitimacy communicative besides played retired successful existent clip connected Friday. Michael Saylor’s Strategy was near retired of the S&P 500 contempt gathering each criteria, portion Robinhood was unexpectedly included instead, sending its banal up 7% and underscoring that crypto-adjacent firms with diversified concern lines whitethorn scope blue-chip presumption faster than axenic treasury plays.

WLFI’s turmoil illustrates the speculative broadside of the split-screen. The protocol froze implicit 270 wallets, including Justin Sun’s, to “protect users” aft phishing-related compromises.

"On 1 side, speculative narratives similar WLFI hazard cannibalizing themselves done governance drama," Enflux wrote successful its note. "On the different hand, institutional-grade infrastructure and regularisation are solidifying astatine a gait that suggests the rails for mainstream adoption are being laid faster than astir expect."

Onchain information shows Sun’s transfers came hours aft WLFI’s crash, which was alternatively driven by shorting and dumping crossed exchanges. Yet the frost rattled whales and marketplace makers – shocked that the escaped marketplace of crypto could beryllium breached by protocol governance fiat – with insiders asking: “If they tin bash it to Sun, who’s next?”.

The takeaway: near-term volatility and governance play whitethorn headdress upside, but the deeper communicative is that crypto’s organization and regulatory foundations are hardening.

"Structural legitimacy, not speculation, remains the existent communicative of 2025," Enflux continued.

For traders, that means bracing for CPI noise; for investors, it means the legitimacy communicative continues to build.

Market Movement:

BTC: Bitcoin is holding dependable supra $111K, with enactment from consolidation adjacent cardinal absorption levels and coagulated on‑chain enactment zones. Analysts suggest this stableness could pave the mode for a breakout, though immoderate caution astir a imaginable pullback toward $100K exists

ETH: Ethereum’s terms has eased somewhat intraday, trading astir $4.3K. This question whitethorn bespeak broader crypto marketplace dynamics, including comparatively subdued request and positioning astir existent method levels.

Gold: Gold has surged to caller grounds highs, precocious hitting ~$3,636/oz, arsenic expectations of U.S. involvement complaint cuts emergence amid anemic labour data, a brushed U.S. dollar, geopolitical concerns, and continued cardinal slope demand.

Nikkei 225: Japan’s Nikkei 225 roseate 0.9% to a grounds precocious and the Topix gained 0.52% arsenic investors stake a caller LDP person could present caller fiscal stimulus pursuing Prime Minister Shigeru Ishiba’s resignation.

S&P 500: U.S. stocks edged higher Monday, with the S&P 500 up 0.2%, arsenic investors awaited ostentation information to gauge the likelihood of a jumbo Fed complaint chopped adjacent week.

1 month ago

1 month ago

English (US)

English (US)