Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

As Asia begins its trading day, bitcoin BTC is trading supra $104,500 and, contempt a imaginable looming warfare successful the Middle East, has been comparatively level connected the time with negligible marketplace movement. Indeed, for the past afloat week, BTC is lone down 2%, according to CoinDesk marketplace data.

Analysts are debating whether the crypto market’s existent stillness is simply a motion of spot oregon if thing much precarious is afoot.

Three caller reports this week from CryptoQuant, Glassnode, and trading steadfast Flowdesk each constituent to the aforesaid aboveground conditions: debased volatility, choky terms action, and subdued on-chain activity. Additionally, retail information has waned, and organization players, from ETFs to whales, are present shaping the operation of flows.

But it’s CryptoQuant that’s flashing the astir urgent warning.

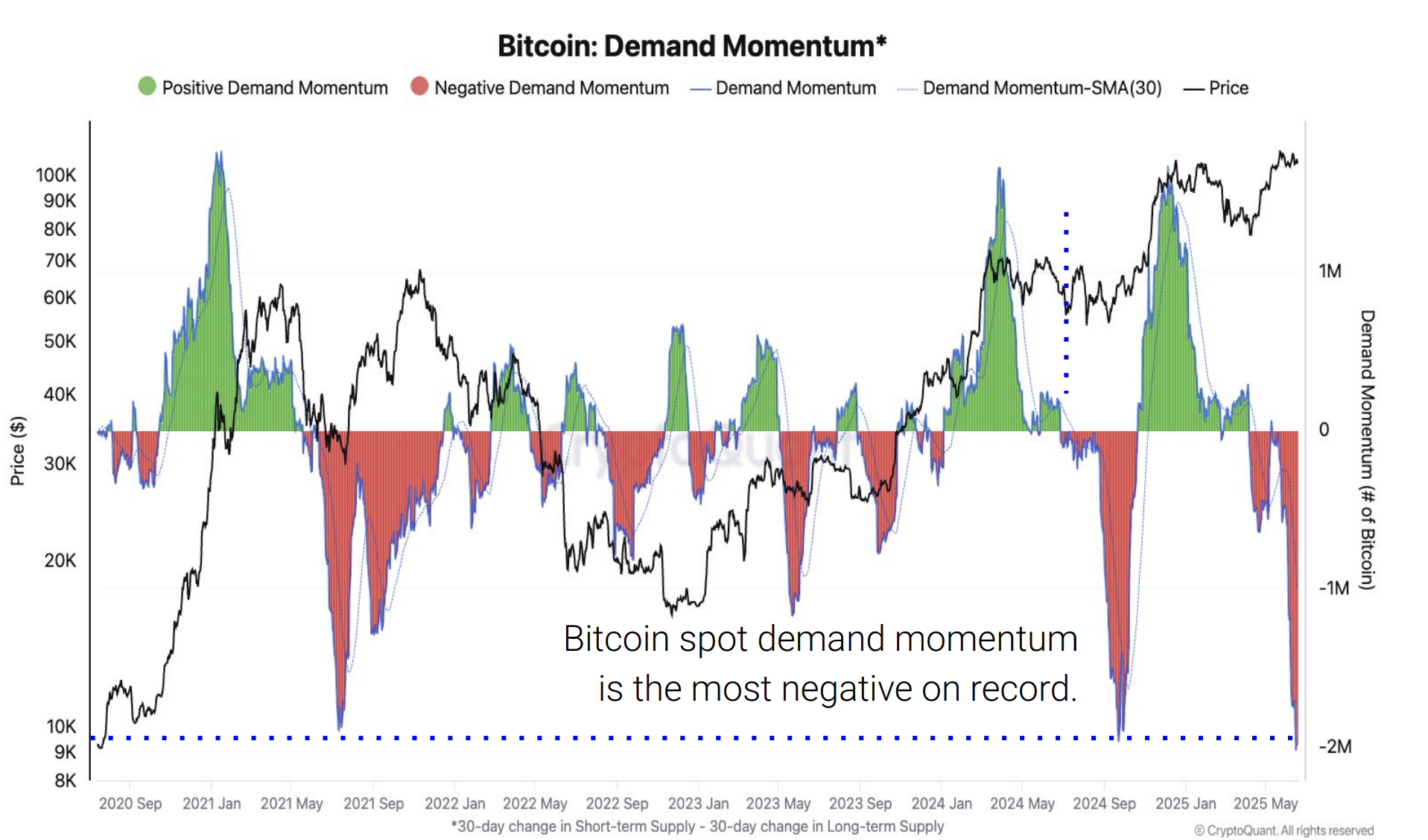

In its June 19 report, CryptoQuant argued that BTC could soon revisit $92,000 enactment oregon adjacent autumn arsenic debased arsenic $81,000 if request continues to deteriorate.

Spot request is inactive increasing, but good beneath trend. ETF flows person dropped by much than 60% since April, portion whale accumulation has halved. Short-term holders, who are usually newer marketplace participants, person shed astir 800,000 BTC since precocious May.

Their request momentum indicator, which tracks directional buying spot crossed cardinal cohorts, is present speechmaking antagonistic 2 cardinal BTC, the lowest successful CryptoQuant’s dataset.

Glassnode, however, sees the aforesaid signals and arrives astatine a acold little dire conclusion.

In its play on-chain update, the steadfast acknowledges that the Bitcoin blockchain is “quiet," meaning transaction counts are down, fees are minimal, and miner gross is subdued.

However, this suggests that it whitethorn not beryllium a weakness, but alternatively a reflection of the network’s evolution. On-chain colony measurement remains high, but it’s concentrated successful large-value transfers, suggesting the concatenation is progressively being utilized by institutions and whales.

The derivatives market, Glassnode notes, present dwarfs on-chain activity, with futures and options volumes regularly exceeding spot by 7x–16x.

That displacement has brought much blase hedging, amended collateral practices, and a much mature, if little frenetic, marketplace structure.

France-based Flowdesk, a marketplace shaper and trading firm, has views that autumn determination successful between.

While noting thinning altcoin flows and level market-making volumes, its June 19 update describes the marketplace arsenic “coiled,” not cracking.

Flowdesk highlights a surge successful tokenized assets, specified arsenic Gold-backed XAUT (up 56% successful volume), stablecoin growth, and expanding RWA activity.

To them, debased volatility whitethorn simply beryllium the calm earlier a directional breakout, which is not needfully downwards.

But successful the end, nary 1 seems to clasp a reliable representation for what’s ahead.

Even Polymarket bettors aren't definite arsenic determination is a adjacent adjacent chance of BTC dropping to $90K successful June oregon moving up to $115K-120K.

One happening is for sure: the tug-of-war betwixt bullish organization activities and waning retail request perchance opens bitcoin up to melodramatic moves connected either broadside of the trade, which volition apt dictate the market’s adjacent chapter.

Presto Research Says Crypto Treasury Companies Have Less Risk Than You Think

A caller study from Presto Research argues that Crypto Treasury Companies (CTCs), specified arsenic Strategy and Metaplanet, are not conscionable leveraged bitcoin ETFs, but a caller signifier of fiscal engineering with little hazard than galore investors assume.

Strategy’s latest raise, which raised astir $1 cardinal via perpetual preferred shares, shows however BTC’s volatility tin beryllium utilized to an issuer’s advantage.

These securities, on with convertible bonds and at-the-market equity sales, let CTCs to money assertive crypto accumulation without triggering borderline risk.

Presto points retired that Strategy’s BTC is unpledged and Metaplanet’s bonds are unsecured, meaning collateral liquidation, the superior trigger successful past crypto blowups similar Celsius and Three Arrows, is mostly absent here. That does not destruct risk, but it changes the quality of it.

The existent challenge, Presto argues, is not crypto vulnerability itself but the subject to negociate dilution, currency flow, and superior timing.

Metaplanet’s “bitcoin yield” metric, which measures BTC per afloat diluted share, reflects that absorption connected shareholder value.

As agelong arsenic CTCs tin negociate the fiscal mechanics down their accumulation strategies, they volition gain NAV premiums conscionable similar high-growth companies successful accepted markets. But if they miscalculate, the aforesaid tools that substance their emergence could accelerate their fall.

Semler Scientific Maps Bold Plan to Hold 105,000 BTC by 2027

Semler Scientific (Nasdaq: SMLR) has unveiled 1 of the astir assertive bitcoin accumulation roadmaps successful firm history, announcing plans to clasp 10,000 BTC by the extremity of 2025, 42,000 by 2026, and a staggering 105,000 by the adjacent of 2027.

The California-based aesculapian instrumentality maker, which pivoted to a bitcoin treasury strategy past year, is efficaciously trying to summation its existent bitcoin stash of 4,449 coins by much than 2 fold implicit the adjacent 30 months.

It plans to bash truthful utilizing a premix of equity raises, indebtedness financing, and operational currency flow.

There aren't circumstantial details of however the institution plans to money the buy. Hwever, historically Semler’s superior mechanics for acquiring bitcoin was selling caller shares nether its at-the-market (ATM) program, which relies connected the institution trading astatine a premium to its nett plus worth (NAV).

According to information from Strategy-Tracker, Semler’s mNAV presently sits astatine 0.859x, meaning the marketplace values the firm’s equity little than its BTC holdings, which could beryllium cutting disconnected its quality to rise accretive capital.

How this dynamic plays out, would beryllium worthy watching arsenic the steadfast initiates much bitcoin buying. Even arsenic bitcoin has surged to all-time highs supra $100,000, Semler shares are down astir 40% connected the year.

Market Movements:

- BTC: Bitcoin remains stuck beneath $105K contempt beardown ETF inflows, with repeated absorption astatine $105,150 and signs of organization accumulation offset by short-term bearish momentum and macro volatility.

- ETH: Ethereum recovered enactment astatine $2,490 aft a high-volume selloff broke cardinal levels, with the terms consolidating successful a choky scope amid geopolitical tensions and macro uncertainty, signaling imaginable for a breakout if absorption astatine $2,510 is cleared.

- Gold: Gold hovered adjacent $3,366 connected Thursday, small changed arsenic escalating geopolitical tensions offset unit from the Fed’s hawkish stance, portion platinum retreated aft hitting a adjacent 10-year high; U.S. markets remained closed for Juneteenth.

- Nikkei 225: Japan’s Nikkei 225 opened 0.24% higher Friday arsenic Asia-Pacific markets mostly roseate up of China’s indebtedness premier complaint determination and amid ongoing Israel-Iran tensions.

4 months ago

4 months ago

English (US)

English (US)