Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

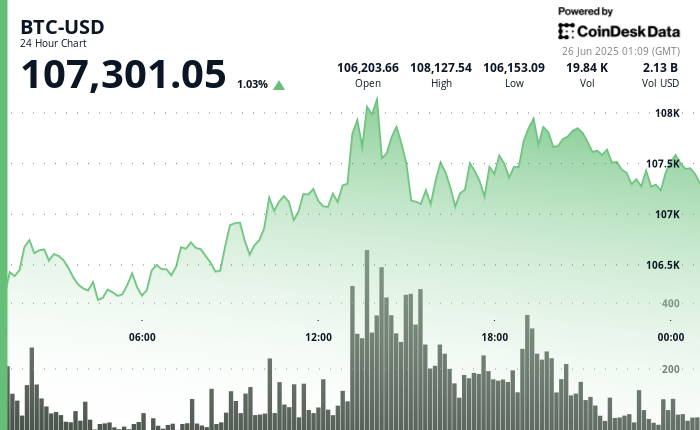

As Asia begins the Thursday trading day, BTC is changing hands supra $107K, according to CoinDesk Market data, and the CoinDesk 20, a measurement of the largest integer assets, is trading conscionable shy of 3000, up 0.7%.

Looking backmost astatine the week that was, analysts and marketplace observers are looking astatine what began arsenic a selloff connected Middle East tensions, with Israel and Iran trading rocket fire, and a U.S. bombing run connected Iran's atomic facilities, turned into a textbook risk-on rally, 1 that’s lifting crypto, tech stocks, and broader marketplace sentiment alike.

“War drums fade, hazard appetite roars,” wrote QCP Capital successful its June 25 marketplace note, capturing the abrupt temper plaything aft days of escalating headlines. “Traders appeared to person priced successful a solution oregon simply stopped waiting for one. Instead of flight-to-safety, the determination was risk-on successful afloat force.”

That displacement was disposable crossed plus classes. U.S. equities surged, lipid prices retraced to pre-conflict levels, and Coinbase banal jumped 12% connected regulatory news.

For BTC, the rebound supra $107K signals not conscionable alleviation but renewed momentum, adjacent arsenic investors support 1 oculus connected the macro calendar and the different connected planetary flashpoints.

“It’s been a week of crisp swings successful crypto,” said Gracie Lin, CEO of OKX Singapore. “Bitcoin dipped beneath $100,000 earlier successful the week erstwhile Middle East tensions rattled the markets, but rebounded rapidly aft quality of a ceasefire – present trading conscionable beneath its all-time precocious successful a crisp reversal.”

Lin points to a slew of U.S. economical data, including GDP and unemployment claims, coming aboriginal this week arsenic the adjacent catalyst for BTC's movement.

“Recent PMI numbers person held steady, but continued weakness successful lodging is raising questions astir the broader economy,” she said. “If Thursday’s GDP oregon unemployment claims travel successful weaker than expected, bitcoin could payment arsenic investors look for hedges against accepted marketplace weakness.”

Add to that the quarterly expiration of bitcoin futures and options connected June 27, and volatility could instrumentality successful force. “Another bout of volatility is expected,” Lin said.

QCP, meanwhile, is looking beyond the week’s swings, spotlighting the structural forces driving bitcoin’s improvement into a macro asset.

From ProCap’s $386 cardinal BTC bargain to Coinbase’s regulatory triumph nether MiCA, organization momentum continues to build.

“If this accumulation inclination persists,” QCP wrote, “bitcoin whitethorn not conscionable rival golden arsenic a macro hedge but perchance successful full marketplace capitalisation.”

Still, QCP adds a enactment of caution: “Geopolitics remains an ever-present undercurrent.”

While markets person mostly shrugged disconnected renewed Israeli strikes, concerns are mounting implicit NATO–Russia tensions. With Western nations boosting defence budgets and Trump acceptable to be the NATO summit, the adjacent geopolitical daze whitethorn not travel from the Middle East.

For now, bitcoin is riding the question of risk-on enthusiasm. But beneath the surface, the conflict betwixt volatility and conviction, warfare drums and buying sprees, continues to specify the market.

Korean Crypto Investors Favor Community Over Capital, Analyst Explains

For overseas crypto projects, getting listed connected a Korean speech similar Upbit oregon Bithumb is seen arsenic a aureate ticket, an instant liquidity injection, and a validation milestone.

But that mindset mightiness beryllium portion of the problem, Bradley Park, an expert with Seoul-based DNTV Research, explained successful a caller interrogation with CoinDesk.

At Korea Blockchain Week past year, Park kept proceeding the aforesaid question from overseas teams:

“How bash we get listed connected a Korean exchange?”

Korean exchanges person heavy liquidity pools, and traders successful the state are known for their euphoric rallies.

“Honestly, galore of them are approaching it the incorrect way,” Park told CoinDesk. “Instead of starting with listing applications, possibly the amended question is: How tin we genuinely link with the Korean community?”

Park’s thesis is simple: successful Korea’s Web3 market, assemblage isn’t a checkbox. It’s the core. Listings are often a result, not a goal, and the cardinal awesome for exchanges is genuine grassroots activity.

Take NEWT, for instance. In the lead-up to its token procreation event, Korean degens lit up platforms similar Kaito with homegrown content, discussions, and speculation.

“This grassroots excitement translated straight into momentum,” said Park. “Both Upbit and Bithumb listed NEWT connected the aforesaid day. That wasn’t a coincidence. It was the effect of weeks of integrated assemblage buildup.”

But Park cautions against seeing NEWT arsenic a flawless blueprint.

“It’s not a cleanable model, but it does amusement however adjacent a basal level of respect toward the Korean assemblage tin construe into disposable outcomes,” helium said.

“That said, the consequent terms driblet and fading short-term excitement near the task with different challenge: keeping the spark live is conscionable arsenic hard arsenic igniting it successful the archetypal place.”

Another example: Edward Park, a well-known Korean influencer and aboriginal Pudgy Penguins holder, posted astir NEWT successful Korean, garnering implicit 50,000 views. While that mightiness not look similar a lot, it's the prime of the engagement that matters, argues Bradley Park.

He attributes the azygous station to catalyzing a question of engagement with different cardinal stakeholders successful Korea's crypto sphere due to the fact that of Edward Park's trust.

Projects that dainty Korean users similar exit liquidity alternatively than stakeholders thin to beryllium punished.

Park points to the lawsuit of ZORA, wherever Korean users showed beardown aboriginal information but soured connected the task aft a perceived unfair airdrop.

“Interest successful aboriginal Base ecosystem projects declined. They failed to spell viral successful Korea due to the fact that users felt they weren’t valued.”

Localization matters too, particularly the language. Park contrasts 2 projects: COOKIE, which suffered from poorly translated, low-quality contented created by outsiders, and KAITO, which invested successful Korean-speaking unit and dedicated native-language campaigns and subsequently pumped aft its Upbit listing.

The lesson? If your go-to-market strategy starts with “get listed, dump tokens,” don’t expect Korean users to play along.

“Even if your extremity is to exit done a Korean exchange,” Park said, “then astatine the precise least, respect the Korean users, promote their participation, and admit their contributions.”

Token listings driven by the assemblage are possible, but they’re fragile.

“A listing strategy focused purely connected short-term liquidity volition ever person its limits,” Park said. “Without a program to physique lasting trust, adjacent the astir explosive momentum volition yet pain out.”

Because successful Korea, authenticity isn’t a vibe. It’s the terms of admission.

Market Movements:

- BTC: Bitcoin roseate 1.46% to $107,600 arsenic a ceasefire and $514M successful organization buying fueled a rebound from sub-$100K, with beardown enactment astatine $107K and the CD20 scale up 1.4%.

- ETH: Ethereum roseate 1.42% to $2,425.53, rebounding from caller lows arsenic a Middle East ceasefire and continued whale accumulation boosted marketplace sentiment and helped support cardinal $2,400 support, according to CoinDesk Research's method investigation model.

- Gold: Gold edged up to $3,340.90 and metallic to $35.79 arsenic markets digested the Israel-Iran ceasefire and lingering planetary tensions, with Trade Nation’s David Morrison informing that unresolved U.S.-China commercialized issues inactive airs risks.

- Nikkei 225: Asia-Pacific markets opened mixed Thursday arsenic investors weighed the Israel-Iran ceasefire, with Japan’s Nikkei 225 up 0.4%.

- S&P 500: U.S. banal futures were level Wednesday with the S&P 500 adjacent grounds highs, but analysts warned that geopolitics oregon achromatic swan events could halt the rally.

4 months ago

4 months ago

English (US)

English (US)