Good Morning, Asia. Here's what's making quality successful the markets:

Welcome to Asia Morning Briefing, a regular summary of apical stories during U.S. hours and an overview of marketplace moves and analysis. For a elaborate overview of U.S. markets, spot CoinDesk's Crypto Daybook Americas.

BTC is pinned adjacent $111,000 with volatility compressed to multi-month lows, the benignant of calm that tends to precede decisive moves. Traders cognize what could interruption the lull: September’s U.S. ostentation information and the Fed’s complaint determination a week later.

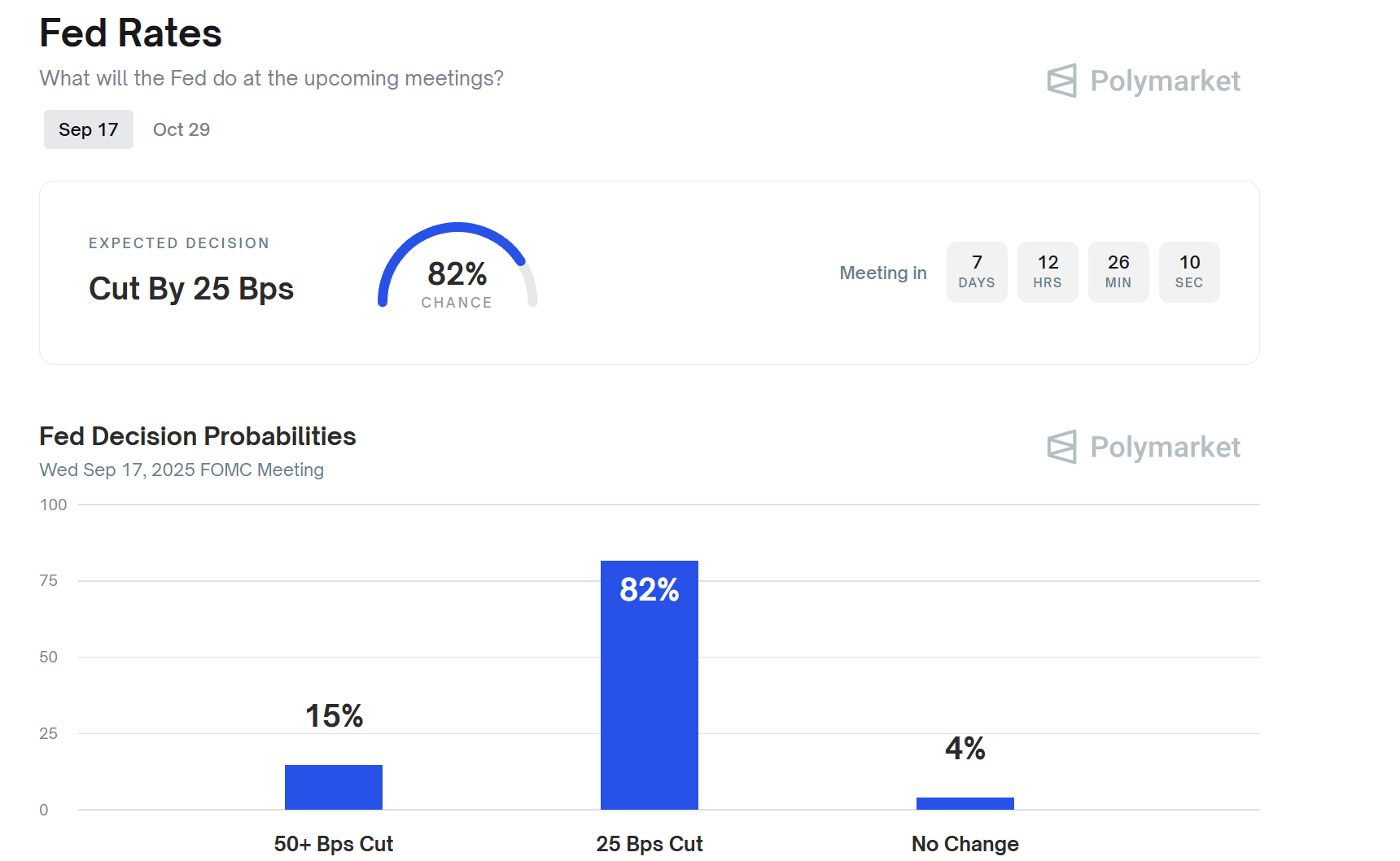

Prediction markets are leaning heavy toward easing. Polymarket bettors are assigning an 82% accidental of a 25-basis-point chopped connected Sept. 17, leaving lone slim likelihood for a deeper determination oregon nary change. Beyond that, October expectations are fractured, with astir adjacent probabilities for different chopped oregon a pause. That divergence explains wherefore volatility, though absent now, is improbable to enactment that way.

“Markets often look calm conscionable earlier they move. Bitcoin is trading successful 1 of its tightest ranges successful months, and volatility crossed crypto has compressed to multi-month lows,” said Gracie Lin, OKX Singapore CEO. “With U.S. ostentation information similar Core CPI retired connected Sept. 11 and the Fed’s much-anticipated complaint determination conscionable ahead, this quiescent play is mounting the signifier for the adjacent decisive move. Whether the catalyst is an upside ostentation astonishment oregon a dovish awesome from the Fed, what’s wide is that the lack of volatility is seldom imperishable successful integer assets; past shows the marketplace volition find its adjacent absorption soon enough.”

If a chopped pulls money-market returns lower, the accidental outgo of sitting successful currency rises, which is the pivot marketplace shaper Enflux says could nonstop flows toward crypto.

“The existent statement present is not if cuts come, but whether liquidity deployment shifts into BTC, ETH, and adjacent riskier assets,” the steadfast told CoinDesk.

In different words, the Fed’s chopped whitethorn drawback headlines, but the existent commercialized is whether sidelined currency rotates into integer assets — a displacement that could substance the instrumentality of volatility.

Market Movement

BTC: Bitcoin has dipped somewhat intraday, trading betwixt astir $110,812 and $113,237, reflecting short-term volatility amid shifting capitalist sentiment and broader crypto marketplace dynamics.

ETH: ETH is modestly up intraday, with a scope betwixt astir $4,279 and $4,379, signaling dependable request and immoderate renewed capitalist interest. Range, however, is constricted with humble ETF flows and traders awaiting the Fed's adjacent move.

Gold: Gold is rallying to grounds highs, fueled by mounting expectations of U.S. Federal Reserve involvement complaint cuts, a weakening U.S. dollar, and renewed safe-haven demand.

Nikkei 225: Asia-Pacific stocks opened mostly higher Wednesday, with Japan’s Nikkei 225 up 0.2%, arsenic investors awaited China’s August ostentation information showing an expected 0.2% CPI driblet and a smaller 2.9% PPI decline.

S&P 500: U.S. stocks closed astatine grounds highs Tuesday, with the S&P 500 up 0.27% to 6,512.61, arsenic investors looked past a grounds payroll revision that chopped 911,000 jobs from anterior figures.

1 month ago

1 month ago

English (US)

English (US)