Quick Take

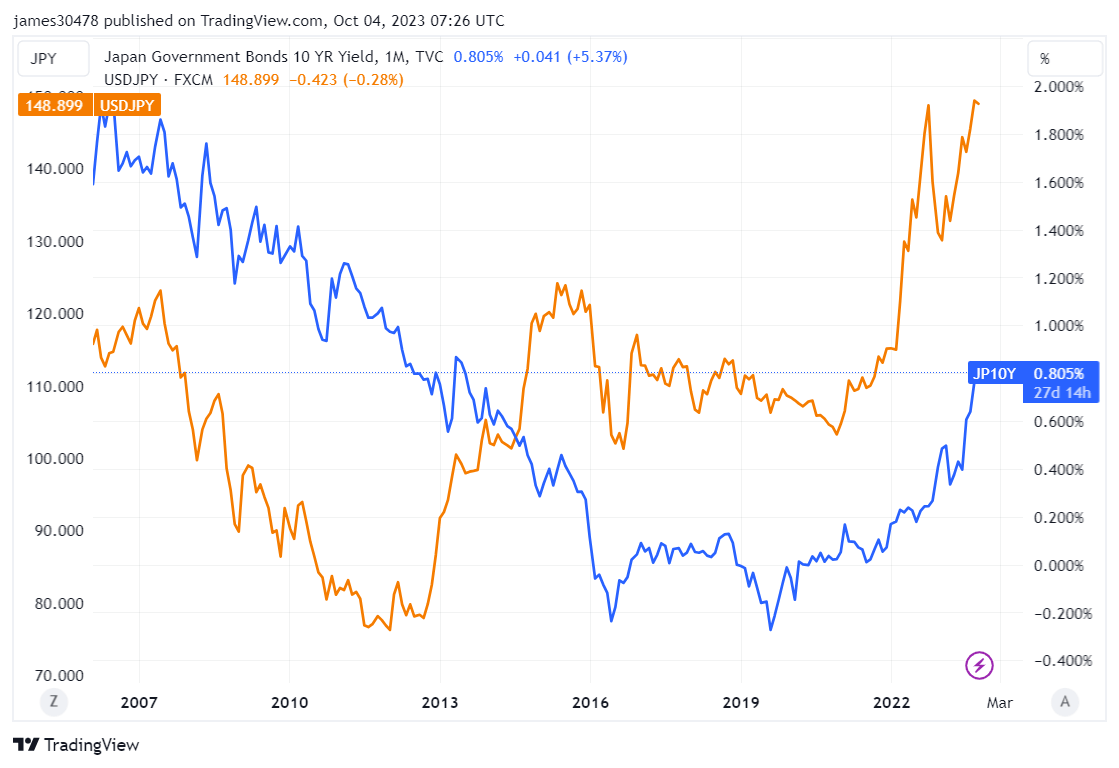

The Bank of Japan (BOJ) stands astatine a captious juncture, striving to support a delicate equilibrium amid a changing economical landscape. Recent information shows that the 10-year yield, which the BOJ has endeavored to support beneath 1%, has touched 0.8, a highest unseen since 2013. Simultaneously, the BOJ has labored not to fto the Yen weaken, yet it continues to beryllium pressured arsenic it drops further against the US dollar, crossing the 150 people for the archetypal clip successful implicit a year.

There is burgeoning speculation astir imaginable BOJ interventions successful these marketplace movements. As the cardinal slope continues to uphold antagonistic involvement rates, a displacement towards affirmative rates mightiness go inevitable successful the foreseeable future. It’s a precarious fulcrum of fiscal strategies that the BOJ is balancing on, with marketplace tempests stirring connected 1 broadside and the stableness of the nationalist currency connected the other.

This script highlights the intricate dynamics of monetary policies and the profound interaction they tin person connected some nationalist and planetary economies. A person look astatine the concern illuminates the complexities successful the BOJ’s argumentation decisions and the broader implications connected the fiscal landscape.

JPY: (Source: Trading View)

JPY: (Source: Trading View)The station As yen weakens and involvement peaks, Bank of Japan balances connected a argumentation precipice appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)