In the weeks starring up to President Donald Trump’s inauguration, the crypto marketplace experienced important volatility. The Bitcoin market’s maturity means it’s affected by a analyzable operation of organization activity, macro events, terms movements, and derivatives.

The week earlier the inauguration was peculiarly volatile, with Bitcoin and the broader organization marketplace affected.

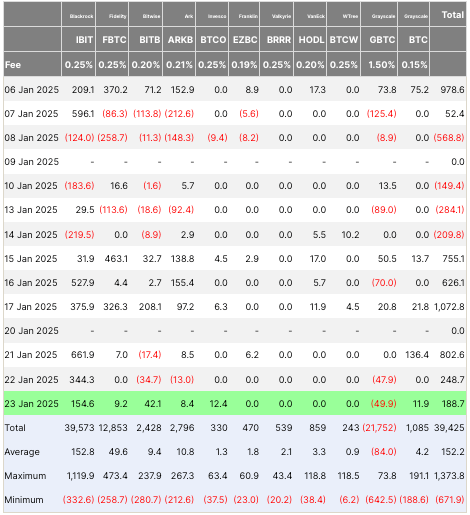

Spot Bitcoin ETF flows are presently 1 of the champion gauges of organization sentiment. Net inflows amusement institutions and nonrecreational investors are expanding their BTC exposure, portion outflows amusement a simplification successful holdings that usually bespeak either hazard aversion oregon profit-taking.

ETF flows showed a precise cautious marketplace during the archetypal fractional of January. Outflows dominated the amended portion of past week, with Jan. 14 seeing a peculiarly crisp diminution of 209.8 BTC. This driblet followed Bitcoin’s terms falling beneath $100,000, an important intelligence level that reflected the marketplace uncertainty up of the inauguration.

Table showing the nett flows for spot Bitcoin ETFs from Jan. 6 to Jan. 24, 2025 (Source: Farside Investors)

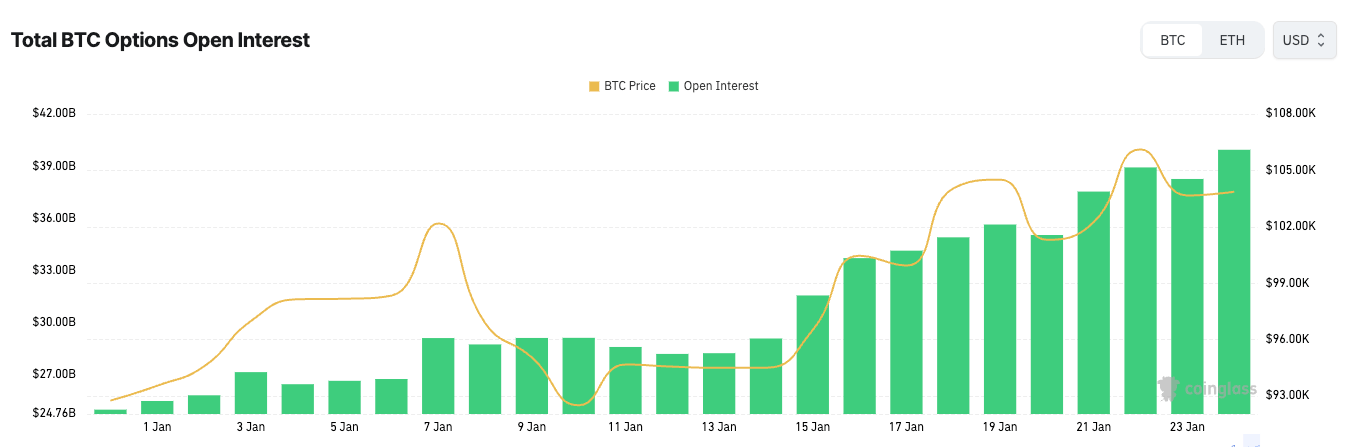

Table showing the nett flows for spot Bitcoin ETFs from Jan. 6 to Jan. 24, 2025 (Source: Farside Investors)While ETF flows showed hesitancy earlier the inauguration, unfastened involvement successful options steadily rose. Open involvement refers to the full fig of outstanding contracts successful the options market. A emergence successful OI mostly signals accrued information and involvement successful the marketplace arsenic traders and institutions presumption themselves for imaginable terms movements.

Between Jan. 13 and Jan. 16, OI grew from $30 cardinal to $33 billion, adjacent arsenic ETFs saw outflows. This divergence shows institutions were not exiting the marketplace wholly but were alternatively hedging their vulnerability to BTC done derivatives. By purchasing options that supply the close but not the work to bargain oregon merchantability Bitcoin astatine a predetermined price, institutions support themselves against downside risks.

Chart showing the unfastened involvement for Bitcoin options from Jan. 1 to Jan. 23, 2025 (Source: CoinGlass)

Chart showing the unfastened involvement for Bitcoin options from Jan. 1 to Jan. 23, 2025 (Source: CoinGlass)However, this sentiment shifted aft Jan. 16, and ETF flows turned affirmative the adjacent day, Jan. 17, with a important inflow of 1,072 BTC. This was accompanied by a continued emergence successful options OI, which climbed to implicit $35 cardinal by Jan. 19. Bitcoin’s terms besides showed signs of betterment during this period, reaching $102,000.

The summation successful ETF inflows indicates a willingness to adhd spot exposure, portion the emergence successful options OI reflects ongoing hazard management. The dual usage of ETFs and options shows however institutions navigate volatile markets by balancing directional vulnerability with strategical hedges.

Inauguration time brought backmost heightened volatility to Bitcoin. ETF flows turned antagonistic again, with a nett outflow of 284.7 BTC, signaling immoderate profit-taking oregon continued caution among organization investors.

However, options OI continued its dependable climb, nearing $37 billion. Bitcoin’s terms fluctuated importantly passim the time but yet settled astir $104,000. While immoderate investors reduced their spot exposure, others apt utilized the options marketplace to presumption themselves for imaginable volatility. The mixed ETF flows and rising OI bespeak that institutions remained engaged successful the market, adjacent arsenic they adopted a cautious approach.

The post-inauguration play saw a notable betterment successful ETF flows. By Jan. 23, nett inflows of 188.7 BTC suggested renewed optimism among organization investors. Bitcoin’s terms besides recovered, surpassing $105,000, portion options OI reached its highest level, approaching $40 billion. This alignment of ETF inflows, rising OI, and a recovering terms reflects a marketplace regaining confidence.

The dependable summation successful options OI passim this play highlights the relation of derivatives successful providing flexibility and hazard absorption for institutions. Even arsenic ETF flows fluctuated, the accordant maturation successful OI shows that institutions were astir apt not stepping distant from Bitcoin but were alternatively leveraging the options marketplace to navigate uncertainty.

Institutions are maturing successful their attack to Bitcoin, utilizing some ETFs and options to negociate their exposure. ETFs supply a straightforward mode to summation oregon trim Bitcoin exposure, portion options connection the flexibility to hedge hazard oregon instrumentality speculative positions. The rising OI, adjacent during periods of ETF outflows, suggests that institutions are not simply reacting to short-term terms changes but besides factoring successful broader macro conditions, specified arsenic governmental events and imaginable argumentation shifts.

The station As Bitcoin stirs, institutions hedge with ETFs and options appeared archetypal connected CryptoSlate.

8 months ago

8 months ago

English (US)

English (US)