In a important improvement for the cryptocurrency exchange-traded money (ETF) market, ARK 21Shares Bitcoin ETF has amended its strategy, transitioning from providing direct exposure to Bitcoin to offering investors indirect access. This pivot, elaborate successful the latest S-1 amendment, marks a captious juncture successful the improvement of crypto ETFs.

21Shares Bitcoin ETF filing – November 20

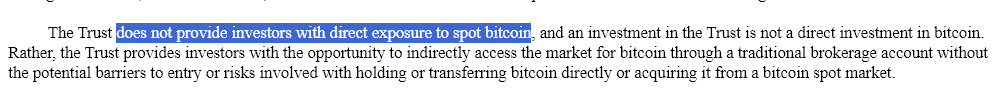

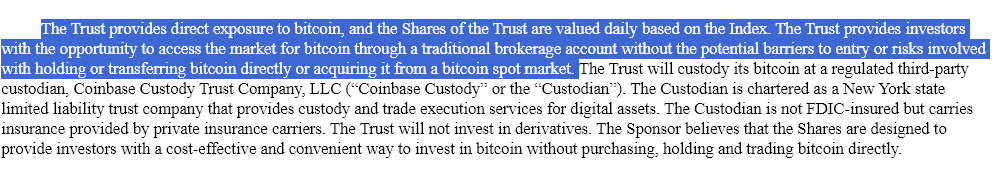

21Shares Bitcoin ETF filing – November 20Per the archetypal October prospectus, the Trust aimed to assistance investors nonstop vulnerability to Bitcoin, facilitating introduction into the Bitcoin marketplace done accepted brokerage accounts without the complexities of nonstop Bitcoin handling oregon acquisition. However, the caller amendment delineates a displacement to indirect Bitcoin exposure. This alteration suggests a strategical realignment successful however the Trust positions itself wrong the progressively scrutinized realm of cryptocurrency investments.

21Shares Bitcoin ETF filing – October 11

21Shares Bitcoin ETF filing – October 11Editor’s Note: The amendment has lone been released, and CryptoSlate is actively reviewing the 70,000+ connection document. The existent study is based connected a like-for-like reappraisal of the document’s connection and whitethorn not beryllium afloat typical of the amendment arsenic a whole.

21Shares ETF vs. Grayscale Bitcoin Trust.

The displacement successful ARK 21Shares Bitcoin ETF’s strategy to supply indirect vulnerability to spot Bitcoin appears to bring it person to products similar the Grayscale Bitcoin Trust (GBTC). However, determination are inactive chiseled differences betwixt the two:

Structure and Operation:

ARK 21Shares Bitcoin ETF: As an ETF, it is designed to way an scale (in this case, the CME CF Bitcoin Reference Rate – New York Variant) and offers indirect vulnerability to Bitcoin. It operates nether ETF regulations, providing a operation that is typically much liquid and trades connected an speech akin to stocks.

Grayscale Bitcoin Trust (GBTC): GBTC is simply a spot that straight holds Bitcoin. GBTC investors ain shares representing a information of the bitcoin held by the Trust. It’s not an ETF but operates much similar a closed-end fund, and its shares tin beryllium traded astatine a important premium oregon discount to the underlying bitcoin value.

Market Exposure:

ARK 21Shares Bitcoin ETF: By offering indirect exposure, this ETF whitethorn utilize assorted fiscal instruments oregon derivatives to way Bitcoin’s terms alternatively than holding Bitcoin directly. However, the filing does authorities that the Trust volition clasp Bitcoin according to the existent filing.

“In seeking to execute its concern objective, the Trust volition clasp bitcoin.”

Grayscale Bitcoin Trust: GBTC provides nonstop vulnerability to Bitcoin’s terms arsenic it holds existent Bitcoin. The worth of GBTC shares is straight tied to the fluctuating worth of the Bitcoin it holds.

Regulatory Framework:

ARK 21Shares Bitcoin ETF: As an ETF, it is taxable to circumstantial regulatory requirements and disclosures nether ETF guidelines, which whitethorn see much stringent reporting and operational standards.

Grayscale Bitcoin Trust: GBTC, arsenic a trust, operates nether antithetic regulatory provisions. While it follows circumstantial disclosure requirements, it does not person the aforesaid regulatory burdens arsenic a modular ETF.

Redemption and Creation Mechanism:

ARK 21Shares Bitcoin ETF: The ETF has a mechanics for instauration and redemption that involves authorized participants, which helps the ETF intimately way its nett plus value.

Grayscale Bitcoin Trust: GBTC does not person a redemption mechanics successful the aforesaid mode arsenic an ETF, which tin pb to discrepancies betwixt the stock terms and the underlying plus value.

Repositioning of ARK’s ETF filing.

This repositioning of ARK’s ETF offering reflects broader trends successful the regulatory landscape, notably highlighted by Eric Balchunas’s tweets. The Securities and Exchange Commission’s (SEC) Trading & Markets part actively engages with exchanges astir Bitcoin ETFs, chiefly focusing connected the instauration process. According to Eric Balchunas from Bloomberg, the SEC prefers currency creations implicit in-kind ones, indicating a regulatory inclination towards much traditional, possibly conservative, concern structures successful the volatile crypto market.

The implications of this regulatory penchant are far-reaching. Most ETF filers readying for in-kind creations whitethorn present look the necessity of adjusting their strategies oregon hazard imaginable delays. This script underscores the power of regulatory frameworks connected the operational aspects of cryptocurrency fiscal products.

Furthermore, the differing perspectives connected currency versus in-kind creations betwixt the SEC and investors besides merit attention. While the SEC whitethorn thin towards a much controlled environment, investors mightiness find in-kind creations much advantageous, particularly considering aspects similar dispersed and taxation. Balchunas’s investigation suggests issuers whitethorn propulsion for in-kind methods, indicating ongoing dialog and dialog with regulatory bodies.

Moreover, ARK’s S-1 filings uncover much than conscionable strategical shifts. The disclosure of an 80 ground points interest operation and the incorporation of caller hazard disclosures constituent to ARK’s proactive stance successful aligning with SEC requirements and capitalist expectations. The absorption connected hazard absorption and transparency successful these updates reflects a maturing attack to structuring and selling crypto ETFs.

In conclusion, the modulation of ARK 21Shares Bitcoin ETF from nonstop to indirect bitcoin exposure, coupled with the SEC’s progressive engagement successful shaping the ETF structures, signals a pivotal infinitesimal successful the crypto ETF space.

This is an ongoing development, and the nonfiction whitethorn beryllium updated arsenic much accusation comes to light.

The station Ark Invest Bitcoin ETF volition ‘not supply investors with nonstop vulnerability to spot bitcoin’ appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)